Japan Connected Vehicles Market Size, Share, Trends and Forecast by Technology, Application, Connectivity, Vehicle Connectivity, Vehicle, and Region, 2026-2034

Japan Connected Vehicles Market Summary:

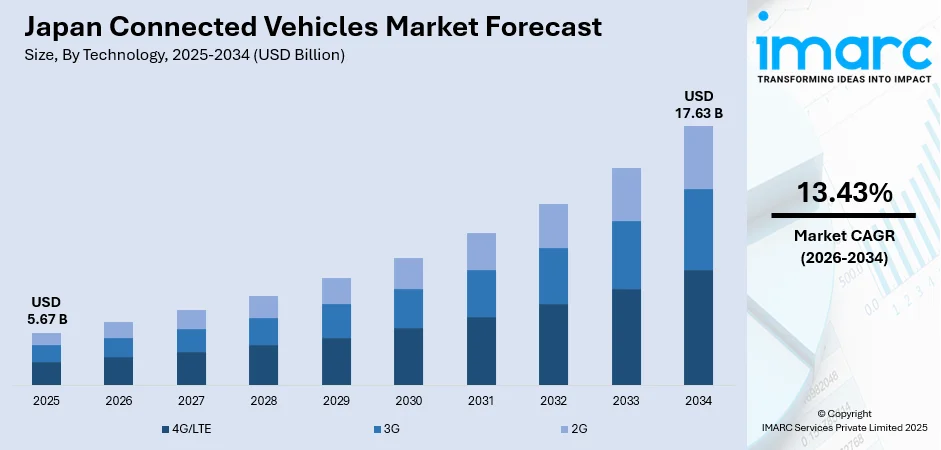

The Japan connected vehicles market size was valued at USD 5.67 Billion in 2025 and is projected to reach USD 17.63 Billion by 2034, growing at a compound annual growth rate of 13.43% from 2026-2034.

The market is primarily driven by the growing integration of telematics systems across passenger and commercial vehicles, enabling real-time tracking, remote diagnostics, and efficient fleet management capabilities. Additionally, supportive government policies aimed at enhancing road safety and reducing traffic fatalities are accelerating the adoption of connected technologies. The increasing collaboration between major automakers and technology firms to develop advanced platforms for infotainment, data analytics, and autonomous driving functionalities is further propelling the Japan connected vehicles market share.

Key Takeaways and Insights:

- By Technology: 4G/LTE dominated the market with approximately 75.7% revenue share in 2025, driven by its widespread network infrastructure availability across urban and rural areas, enabling reliable connectivity for telematics, navigation, and safety applications in modern vehicles.

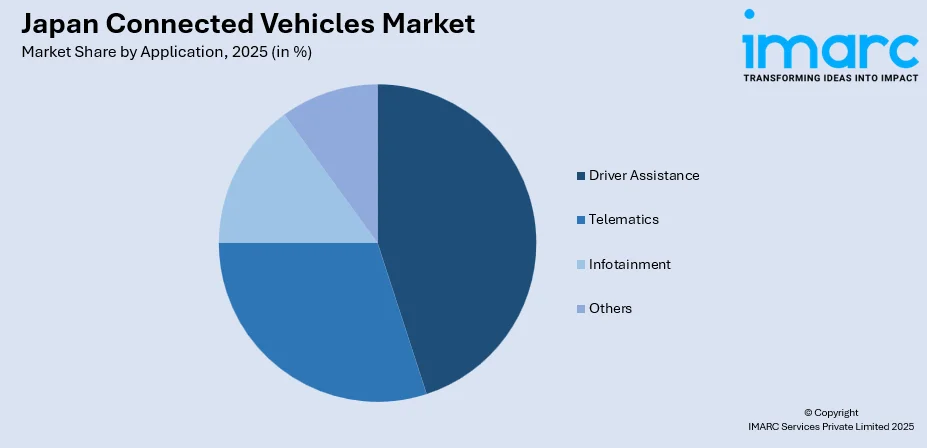

- By Application: Driver Assistance segment led the market with a revenue share of 43.9% in 2025, owing to the increasing implementation of advanced safety features including adaptive cruise control, lane departure warning, and collision avoidance systems mandated by regulatory standards.

- By Connectivity: Embedded connectivity accounted for the largest revenue share of approximately 54.3% in 2025. This dominance is driven by automakers integrating built-in connectivity modules directly into vehicles, providing seamless access to telematics and infotainment services.

- By Vehicle Connectivity: Vehicle to Vehicle (V2V) segment dominated the market with approximately 45.8% share in 2025, supported by government initiatives promoting cooperative intelligent transport systems to enhance road safety and traffic efficiency.

- By Vehicle: Passenger Cars segment held the largest share of 85% in 2025, reflecting the high consumer demand for connected features and the integration of advanced connectivity technologies in personal vehicles.

- By Region: Kanto region represented the largest segment with a market share of 33.7% in 2025, attributed to the concentration of automotive manufacturers, technology companies, and advanced testing infrastructure in the Tokyo metropolitan area.

- Key Players: The Japan connected vehicles market exhibits moderate to high competitive intensity, with domestic automotive manufacturers competing alongside global technology providers and telecommunications companies across various connected vehicle segments.

To get more information on this market Request Sample

The Japan connected vehicles market is experiencing robust growth as the nation continues to prioritize smart mobility solutions to address challenges related to its aging population and driver shortages. The integration of telematics systems has become a cornerstone for both consumer and commercial applications, enabling real-time vehicle tracking, predictive maintenance, and enhanced driver safety. In fact, sales of connected vehicles in Japan jumped 34 % year-on-year in Q1 2025, driven by a surge in demand for in-car digital features and automakers embedding connectivity as a standard across their portfolios. Major automakers are embedding connectivity as a standard feature rather than a premium option, democratizing access to digital mobility services. The market is further supported by collaborative licensing arrangements for essential patents, facilitating the deployment of next-generation communication technologies across vehicle platforms.

Japan Connected Vehicles Market Trends:

Growing Integration of Advanced Telematics Systems

The integration of sophisticated telematics platforms represents a significant trend shaping the market landscape. Automakers are developing proprietary connected services that offer comprehensive functionality including real-time emergency support, always-updated navigation, remote vehicle control capabilities, and proactive maintenance alerts. In a sign of growing ecosystem support, Wireless Car, a global connected‑car services specialist, opened a dedicated Japan branch in late 2024, pledging to deepen partnerships with Japanese OEMs and accelerate the rollout of cloud‑based telematics and mobility services across local fleets. These platforms enable seamless data exchange between vehicles and cloud-based infrastructure, enhancing overall driving experience and vehicle lifecycle management.

Expansion of Vehicle-to-Everything Communication Infrastructure

The development of vehicle-to-everything communication networks is gaining substantial momentum as cities deploy smart traffic management systems. Pilot programs across major metropolitan areas are testing connected traffic signals that adapt in real time to vehicle and pedestrian movements, digital signboards alerting drivers about road hazards, and optimized routes to reduce congestion. In 2024, a consortium including Kyocera Corporation, Toyota Tsusho Corporation, Panasonic System Networks R&D Lab. and Nippon Signal Co., Ltd. formed a new collaborative initiative called Smart Mobility Infrastructure Collaborative Innovation Partnership (SMICIP) to develop “Smart Mobility Infrastructure” that uses V2X radio‑equipment in vehicles and infrastructure to share danger and traffic‑flow information among vehicles, pedestrians, and roads. These initiatives align with broader smart city objectives and create foundations for future autonomous mobility services.

Adoption of Artificial Intelligence for Enhanced User Experience

The incorporation of artificial intelligence into connected vehicle systems is transforming user interactions and driving safety outcomes. For instance, in March 2024 SoundHound AI announced that its “Chat AI Automotive,” effectively a generative‑AI voice assistant, was being adopted for DS Automobiles cars in Japan, marking the first in‑vehicle generative‑AI assistant deployment in the country. Intelligent voice recognition systems are enabling hands-free control over navigation, media, and vehicle settings through advanced natural language processing. Additionally, predictive analytics powered by machine learning algorithms are being utilized to anticipate traffic conditions, optimize driving routes, and provide personalized recommendations based on driver behavior patterns.

Market Outlook 2026-2034:

The Japan connected vehicles market is poised for significant transformation as domestic automakers accelerate the rollout of advanced connectivity features across their vehicle portfolios. The gradual deployment of fifth-generation network connectivity by major manufacturers will enable deeper integration with smart city systems and real-time cloud-based services. Rising consumer demand for in-car digital features and continuous investments by automakers to embed cellular connectivity as a core value proposition are expected to sustain strong growth momentum. The market generated a revenue of USD 5.67 Billion in 2025 and is projected to reach a revenue of USD 17.63 Billion by 2034, growing at a compound annual growth rate of 13.43% from 2026-2034.

Japan Connected Vehicles Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Technology | 4G/LTE | 75.7% |

| Application | Driver Assistance | 43.9% |

| Connectivity | Embedded | 54.3% |

| Vehicle Connectivity | Vehicle to Vehicle (V2V) | 45.8% |

| Vehicle | Passenger Cars | 85% |

| Region | Kanto | 33.7% |

Technology Insights:

- 4G/LTE

- 3G

- 2G

The 4G/LTE dominates with a market share of 75.7% of the total Japan connected vehicles market in 2025.

The strong dominance of fourth-generation long-term evolution technology stems from the mature network infrastructure established across the country, providing reliable coverage in both urban centers and suburban regions. For instance, Rakuten Mobile achieved a 4G population coverage of 98.4 percent in Japan by 2023. This technology enables high-speed data transmission essential for telematics applications, real-time navigation updates, and streaming infotainment services. Automakers have standardized their connected vehicle platforms around this technology due to its proven reliability and widespread network availability.

The technology supports bandwidth requirements for over-the-air software updates, remote diagnostics, and emergency communication services that have become standard features in modern connected vehicles. Additionally, the existing infrastructure allows for cost-effective implementation compared to newer generation networks, making it accessible for integration across various vehicle segments from entry-level to premium models.

Application Insights:

Access the Comprehensive Market Breakdown Request Sample

- Driver Assistance

- Telematics

- Infotainment

- Others

The driver assistance leads with a share of 43.9% of the total Japan connected vehicles market in 2025.

The prominence of driver assistance applications reflects the regulatory emphasis on vehicle safety and the nation's commitment to reducing traffic accidents and fatalities. Advanced driver assistance systems leverage connected vehicle infrastructure to enable features including adaptive cruise control, forward collision warning, automatic emergency braking, and lane departure warning systems. In 2025, Nissan began testing a new driver-assistance system on Japanese roads in collaboration with UK startup Wayve, using cameras, radars, and lidar to provide Level 2 driving support in complex urban environments, with plans to bring the system to market by 2027. These applications utilize real-time data from onboard sensors combined with connectivity to cloud-based services for enhanced situational awareness.

The government's initiatives under traffic safety programs have encouraged automakers to integrate these systems as standard equipment rather than optional features. Insurance providers also offer premium discounts for vehicles equipped with advanced safety technologies, creating additional incentives for consumer adoption and driving the segment's continued expansion across all vehicle categories.

Connectivity Insights:

- Integrated

- Embedded

- Tethered

The embedded dominates with a market share of 54.3% of the total Japan connected vehicles market in 2025.

Embedded connectivity has emerged as the preferred solution as automakers integrate dedicated communication modules directly into vehicle architecture during manufacturing. This approach ensures seamless connectivity from the moment of vehicle purchase without requiring customers to pair external devices or manage separate subscriptions. The built-in modules enable direct communication with manufacturer cloud platforms for telematics services, software updates, and emergency assistance.

The shift toward software-defined vehicles has further strengthened the case for embedded connectivity, as these systems require constant network access for feature updates and personalization services. Automakers view embedded solutions as essential for maintaining direct customer relationships and generating recurring revenue through connected service subscriptions throughout the vehicle lifecycle.

Vehicle Connectivity Insights:

- Vehicle to Vehicle (V2V)

- Vehicle to Infrastructure (V2I)

- Vehicle to Pedestrian (V2P)

The vehicle to vehicle (V2V) leads with a share of 45.8% of the total Japan connected vehicles market in 2025.

Vehicle-to-vehicle communication technology enables direct data exchange between nearby vehicles, sharing critical information including position, speed, direction, and potential hazards without relying on cellular network infrastructure. This peer-to-peer communication allows vehicles to detect and respond to situations beyond the range of onboard sensors, providing advance warning of approaching vehicles at intersections or hazards around corners. In 2024, the establishment of the Smart Mobility Infrastructure Technology Research Partnership (SMICIP), which was formed by a consortium of Japanese industry players, marked a major step forward in promoting V2X-based infrastructure coordination. The partnership aims to deploy “Smart Mobility Infrastructure” that uses V2X radio equipment, such as ITS Connect, installed in vehicles and roadside infrastructure to notify vehicles, bicycles, and pedestrians of danger detected by the system.

Government-led programs promoting cooperative intelligent transport systems have accelerated the adoption of standardized vehicle-to-vehicle protocols among domestic automakers. The technology is considered foundational for future autonomous mobility services, as it enables cooperative maneuvering between multiple vehicles and enhances the overall reliability of automated driving systems in complex traffic environments.

Vehicle Insights:

- Passenger Cars

- Commercial Vehicles

The passenger cars dominate with a market share of 85% of the total Japan connected vehicles market in 2025.

The overwhelming dominance of passenger cars reflects the large installed base of personal vehicles and high consumer expectations for connected features in daily transportation. Automakers have responded to these expectations by making connectivity standard across their vehicle lineups, from compact models to luxury sedans. Connected services platforms offer features including real-time emergency support, always-updated navigation, remote vehicle control, and proactive maintenance alerts.

The democratization of connected features across price segments has expanded market penetration beyond premium vehicles to mass-market offerings. Consumers increasingly view connected capabilities as essential rather than optional, driving automakers to embed these technologies as core differentiators. The integration of smartphone mirroring platforms and native infotainment applications further enhances the appeal of connected passenger vehicles.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto region exhibits a clear dominance with a 33.7% share of the total Japan connected vehicles market in 2025.

The Kanto region's leadership position stems from its concentration of major automotive manufacturers, electronics companies, and technology firms that drive innovation in connected vehicle systems. The Tokyo metropolitan area serves as the primary testing ground for smart mobility initiatives, with pilot programs deploying vehicle-to-infrastructure communication at intersections and implementing advanced traffic management systems. In fact, in early 2025, TIER IV completed pilot tests of a robotaxi service in Tokyo (in Odaiba and Nishi‑Shinjuku during Nov–Dec 2024), demonstrating the region’s readiness to experiment with next‑generation mobility solutions under real urban traffic conditions. The region's dense urban environment creates ideal conditions for demonstrating the safety and efficiency benefits of connected technologies.

The presence of world-class research institutions and collaborative development facilities supports continuous advancement in connectivity solutions. Additionally, the high population density and traffic volumes in the Kanto region generate strong demand for technologies that improve commuting efficiency and reduce accident risks, making it the natural epicenter for connected vehicle adoption and innovation.

Market Dynamics:

Growth Drivers:

Why is the Japan Connected Vehicles Market Growing?

Accelerating Integration of Advanced Telematics Infrastructure

The increasing adoption of comprehensive telematics systems represents a primary catalyst for market expansion across the Japanese automotive sector. These sophisticated platforms enable real-time vehicle tracking, remote diagnostics, and efficient fleet management capabilities that deliver substantial value for both individual consumers and commercial fleet operators. The systems facilitate predictive maintenance by analyzing vehicle health data and alerting owners to potential issues before they escalate into costly repairs. Additionally, telematics integration supports the development of usage-based insurance products that reward safe driving behavior with reduced premiums, creating compelling incentives for consumer adoption. The convergence of telecommunications infrastructure with automotive engineering has enabled automakers to offer always-connected experiences that enhance vehicle ownership throughout its lifecycle.

Supportive Government Policies and Safety Initiatives

Government regulatory frameworks and safety initiatives are providing significant impetus for connected vehicle technology adoption across the nation. The national traffic safety vision establishes ambitious targets for reducing traffic fatalities and injuries, driving regulatory requirements for advanced safety technologies in new vehicles. In 2025, the Ministry of Land, Infrastructure, Transport and Tourism (MLIT) partnered with Mitsubishi Heavy Industries to deploy a “Merging Support Information System” on the Shin-Tomei Expressway, supporting the first nationwide trial of autonomous trucks and demonstrating how infrastructure-level systems enable connected and autonomous driving solutions. Assessment programs evaluate and rate vehicles based on their safety performance including connected features, encouraging automakers to integrate these technologies to achieve higher ratings and competitive positioning. Legislative amendments have established legal frameworks for automated driving systems, creating clarity for manufacturers developing connected and autonomous capabilities. Furthermore, government-led demonstration projects are testing autonomous mobility services in various regions to address driver shortages resulting from demographic changes, showcasing practical applications of connected technologies.

Strategic Collaborations Between Automakers and Technology Firms

The proliferation of strategic partnerships between automotive manufacturers, software providers, telecommunications operators, and technology startups is accelerating innovation cycles and expanding connected vehicle capabilities. These collaborations enable co-development of platforms for infotainment, data analytics, cybersecurity, and autonomous driving functionalities that would be challenging for individual companies to develop independently. In October 2024, Toyota Motor Corporation and Nippon Telegraph and Telephone Corporation (NTT) agreed to jointly develop a “Mobility AI Platform,” aiming to combine AI, communications and cloud‑computing infrastructure to support connected and autonomous mobility with the long‑term goal of realizing a "zero traffic accidents" society. Joint ventures and research alliances facilitate access to cutting-edge technologies including fifth-generation connectivity, cloud-based vehicle management, and over-the-air update capabilities. The partnerships also help share development costs and reduce time-to-market for new features, allowing automakers to respond quickly to evolving consumer expectations. By integrating diverse technological expertise with automotive manufacturing knowledge, these collaborative efforts are positioning the nation as a global leader in intelligent transportation solutions.

Market Restraints:

What Challenges the Japan Connected Vehicles Market is Facing?

Infrastructure Investment Requirements for Rural Coverage

Expanding advanced network coverage to rural and mountainous regions presents significant infrastructure investment challenges that constrain market growth potential. While urban centers enjoy comprehensive connectivity, remote areas often lack the network density required for reliable connected vehicle services. The geographical terrain and population distribution make infrastructure deployment economically challenging, creating coverage gaps that limit the utility of connected features for vehicles operating outside metropolitan zones.

Cybersecurity Vulnerabilities and Data Protection Concerns

The increasing connectivity of vehicles introduces cybersecurity vulnerabilities that pose risks to both vehicle operations and personal data. Protecting connected vehicles from malicious attacks and data breaches requires continuous investment in security protocols and encryption technologies. Consumers express concerns about the collection, storage, and potential misuse of driving behavior data and personal information gathered by connected systems. These security and privacy considerations create hesitancy among some consumers regarding full adoption of connected features.

Interoperability and Standardization Complexities

Aligning domestic connected vehicle systems with international standards for global deployment presents ongoing technical and regulatory challenges. The coexistence of multiple communication protocols and competing technology standards creates interoperability issues between different vehicle manufacturers and infrastructure providers. Achieving consensus on unified standards requires extensive coordination among automakers, telecommunications companies, and regulatory authorities, slowing the pace of ecosystem-wide integration and limiting network effects.

Competitive Landscape:

The Japan connected vehicles market features a diverse competitive landscape comprising domestic automotive manufacturers, international technology providers, and telecommunications companies. Leading automakers are developing proprietary connected platforms while simultaneously forming strategic alliances with software developers and telecommunications operators to enhance their capabilities. Competition centers on the depth and quality of connected services offerings, integration with broader mobility ecosystems, and the ability to deliver seamless over-the-air updates and new feature deployments. Tier-one automotive suppliers are expanding their portfolios to include connectivity hardware and software solutions, intensifying competition across the value chain. The market is witnessing increased participation from technology companies seeking to establish positions in the automotive connectivity space through partnerships and platform development initiatives.

Recent Developments:

- In June 2025, DIMO established DIMO Japan, a joint venture with HAKUHODO KEY3 to enhance car connectivity for Japanese automakers. The initiative aims to provide robust data infrastructure for real-time diagnostics, usage-based insurance, and location-based services, lowering barriers for automakers and third-party developers.

Japan Connected Vehicles Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | 4G/LTE, 3G, 2G |

| Applications Covered | Driver Assistance, Telematics, Infotainment, Others |

| Connectivity Covered | Integrated, Embedded, Tethered |

| Vehicle Connectivity Covered | Vehicle to Vehicle (V2V), Vehicle to Infrastructure (V2I), Vehicle to Pedestrian (V2P) |

| Vehicles Covered | Passenger Cars, Commercial Vehicles |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan connected vehicles market size was valued at USD 5.67 Billion in 2025.

The Japan connected vehicles market is expected to grow at a compound annual growth rate of 13.43% from 2026-2034 to reach USD 17.63 Billion by 2034.

4G/LTE technology dominated the market with approximately 75.7% revenue share, driven by its widespread network infrastructure availability and proven reliability for telematics, navigation, and safety applications.

Key factors driving the Japan connected vehicles market include the growing integration of advanced telematics systems, supportive government safety policies and regulations, strategic collaborations between automakers and technology firms, and increasing consumer demand for connected mobility features.

Major challenges include infrastructure investment requirements for expanding network coverage in rural areas, cybersecurity vulnerabilities and data protection concerns, interoperability complexities between competing technology standards, and the need for coordinated standardization across multiple stakeholders.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)