Japan Construction Aggregates Market Size, Share, Trends and Forecast by Type, Application, and Region, 2026-2034

Japan Construction Aggregates Market Summary:

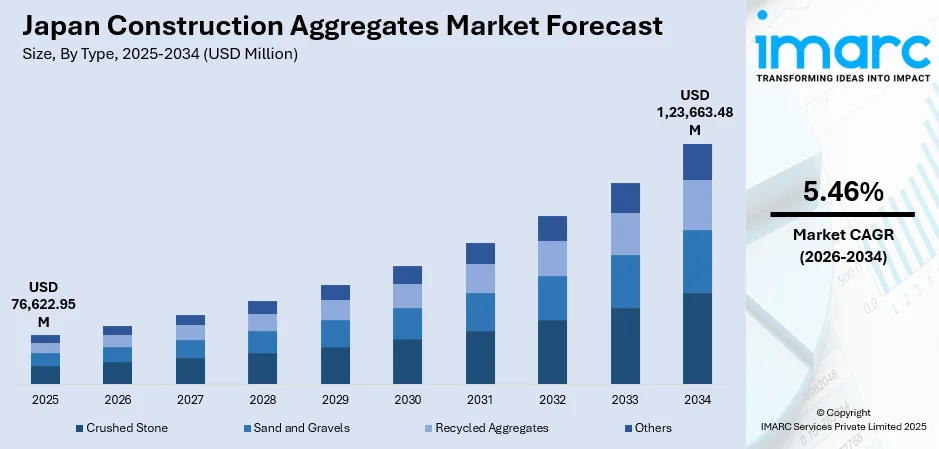

The Japan construction aggregates market size was valued at USD 76,622.95 Million in 2025 and is projected to reach USD 1,23,663.48 Million by 2034, expanding at a compound annual growth rate of 5.46% from 2026-2034.

The Japanese construction aggregates sector continues to benefit from substantial government investments in disaster-resilient infrastructure and urban redevelopment initiatives. The nation's commitment to earthquake-resistant construction standards is driving consistent demand for high-quality crushed stone and specialty aggregates across residential and commercial projects. Accelerating preparations for major national events, combined with ongoing transportation network modernization and aging infrastructure replacement programs, sustain robust consumption patterns.

Key Takeaways and Insights:

- By Type: Crushed stone dominates the market with a share of 47.9% in 2025, driven by its essential role in concrete production for earthquake-resistant structures, road construction, and foundation works across Japan's seismically active terrain.

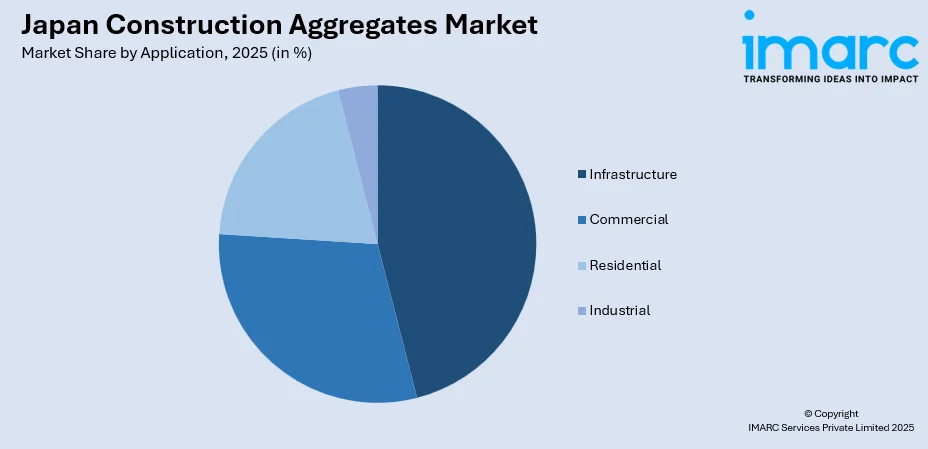

- By Application: Infrastructure leads the market with a share of 46.0% in 2025. This dominance stems from sustained government investment in transportation networks, seismic retrofitting programs, and public facilities modernization under national resilience plans.

- By Region: Kanto Region represents the largest region with a market share of 33.2% in 2025, fueled by Tokyo's urban redevelopment megaprojects, metro system expansions, high-rise developments, and data corridor construction initiatives.

- Key Players: The Japan construction aggregates market demonstrates moderate competitive intensity, with established cement corporations and regional quarry operators serving diverse customer segments across metropolitan and rural geographies.

To get more information on this market Request Sample

The Japan construction aggregates industry operates within a mature yet evolving market, characterized by stringent quality standards and sophisticated supply chain networks. The sector benefits from robust institutional frameworks governing material specifications for seismic-resistant construction, ensuring consistent demand for premium aggregate products. Increasing investments in construction activities are fueling the market expansion. As per IMARC Group, the Japan construction market size reached USD 652.7 Billion in 2025. Market participants increasingly focus on technological advancements, with automated quarrying systems and digital logistics optimization gaining prominence among leading producers seeking operational efficiency improvements.

Japan Construction Aggregates Market Trends:

Expansion of Specialty Aggregate Applications

Market evolution increasingly favors engineered aggregates designed for specific performance requirements, particularly seismic resistance and environmental sustainability. Japanese researchers developed calcium carbonate concrete in October 2024 that absorbs more carbon dioxide (CO2) than conventional concrete emits during production. Producers are expanding portfolios to include lightweight variants, permeable aggregates for stormwater management, and high-strength products supporting advanced construction methodologies in earthquake-prone regions.

Integration of Digital Technologies in Quarrying Operations

Japanese aggregate producers are embracing digital transformation through artificial intelligence (AI)-powered production optimization and automated quality control systems. As per IMARC Group, the Japan AI market size was valued at USD 6.6 Billion in 2024. Major producers have implemented predictive analytics across quarry operations, significantly reducing equipment downtime and enhancing yield efficiency. These technological investments address workforce constraints while improving operational consistency, enabling producers to maintain competitive positioning amid rising labor costs and skilled worker shortages throughout the industry.

Accelerating Adoption of Recycled Construction Materials

The Japanese market demonstrates growing momentum towards recycled aggregate utilization as sustainability regulations intensify. Manufacturers are expanding processing capacity for construction and demolition waste, developing innovative crushing technologies that produce aggregates meeting stringent quality specifications. This transformation aligns with broader circular economy initiatives and supports carbon reduction objectives.

Market Outlook 2026-2034:

The market growth will be anchored by continued infrastructure investments under national resilience programs, particularly seismic retrofitting of aging transportation assets and disaster prevention initiatives. The market generated a revenue of USD 76,622.95 Million in 2025 and is projected to reach a revenue of USD 1,23,663.48 Million by 2034, growing at a compound annual growth rate of 5.46% from 2026-2034. Urban redevelopment projects across major metropolitan areas, combined with commercial construction supporting logistics facilities and data centers, will generate substantial aggregate demand. The ongoing shift towards sustainable construction practices will drive recycled aggregate adoption, while technological advancements in production processes will enhance operational efficiency across the supply chain.

Japan Construction Aggregates Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Crushed Stone | 47.9% |

| Application | Infrastructure | 46.0% |

| Region | Kanto Region | 33.2% |

Type Insights:

- Crushed Stone

- Sand and Gravels

- Recycled Aggregates

- Others

Crushed stone dominates with a market share of 47.9% of the total Japan construction aggregates market in 2025.

Crushed stone maintains its preeminent market position through indispensable applications in concrete production, road base construction, and foundation works. Japanese construction standards mandate specific aggregate gradations for earthquake-resistant structures, creating sustained demand for precisely processed crushed stone meeting rigorous quality specifications. The material's superior load-bearing characteristics and consistent availability from domestic quarry operations ensure its foundational role across residential, commercial, and infrastructure projects. Major cement and construction materials corporations operate extensive quarrying networks throughout the country, ensuring reliable supply chains serving metropolitan construction demand.

The segment continues to benefit from Japan's focus on disaster-resilient infrastructure development, where high-quality crushed stone provides essential structural integrity. Advanced processing technologies enable producers to optimize particle distribution and shape characteristics, meeting increasingly sophisticated engineering requirements for modern construction methodologies. Market participants invest in automation and digital quality management systems to maintain production consistency while addressing workforce constraints throughout quarrying operations.

Application Insights:

Access the Comprehensive Market Breakdown Request Sample

- Commercial

- Residential

- Industrial

- Infrastructure

Infrastructure leads with a share of 46.0% of the total Japan construction aggregates market in 2025.

Infrastructure applications command the largest aggregate consumption driven by Japan's sustained commitment to transportation network modernization and disaster prevention investments. The government's infrastructure development priorities encompass highway construction, railway system upgrades, port facilities expansion, and municipal utility networks requiring substantial aggregate volumes. Japan's road network featured numerous bridges and tunnels, with annual investments in public roads maintaining consistent aggregate demand. Seismic retrofitting programs targeting aging structures create additional infrastructure-related consumption.

The segment benefits from major project pipelines, including high-speed rail expansions, urban transit system developments, and airport modernization initiatives across the country. Government budget allocations for fiscal year 2025-26 outline spending of JPY 115.54 Trillion (approximately USD 730 Billion), reflecting continued commitment to infrastructure enhancement. These investments ensure sustained aggregate demand throughout the forecast period, as Japan prioritizes connectivity improvements and resilience against natural disasters.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

Kanto Region exhibits a clear dominance with a 33.2% share of the total Japan construction aggregates market in 2025.

The Kanto region encompasses Japan's economic heartland centered on the Tokyo metropolitan area, generating dominant aggregate consumption through unprecedented construction activity. The region's supremacy reflects concentration of high-rise development projects, commercial real estate expansion, and transportation infrastructure modernization serving the world's largest metropolitan economy. Tokyo remains the hub of construction activity with projects modernizing transportation networks and commercial districts while accommodating population growth and tourist influx. Major developments include the Torch Tower project set for completion in 2028, becoming Japan's tallest skyscraper and exemplifying ongoing vertical expansion.

Kanto benefits from early adoption of Building Information Modeling (BIM) and net-zero building codes, positioning the region as Japan's construction innovation leader. Government infrastructure outlays target seismic retrofits of expressways, municipal shelters, and metro system expansions throughout the region. These converging development patterns sustain robust aggregate demand while establishing technology adoption precedents influencing national construction practices. Strong industrial presence, including manufacturing and logistics hubs, also fuels warehouse and factory construction. In addition, better logistics connectivity and proximity to ports ensure easier raw material sourcing and faster distribution, giving suppliers a cost and delivery advantage over less developed or remote regions across the country.

Market Dynamics:

Growth Drivers:

Why is the Japan Construction Aggregates Market Growing?

Sustained Government Investment in Disaster-Resilient Infrastructure

Japan's vulnerability to seismic events is driving substantial aggregate demand through continuous investments in earthquake-resistant construction and infrastructure retrofitting programs. The national building code framework mandates particular aggregate specifications ensuring structural integrity during seismic events. The January 2024 Noto Peninsula earthquake measuring magnitude 7.6 caused approximately USD 17.6 Billion in infrastructure damage, reinforcing national commitment to resilient construction. Government initiatives channel extensive funding towards bridge renewals, flood-control systems, and quake-proof utility networks requiring substantial high-quality aggregate volumes. These disaster prevention investments provide structural support for aggregate demand independent of economic cycles.

Urban Redevelopment and Vertical Expansion in Metropolitan Areas

Japanese metropolitan centers are witnessing unprecedented redevelopment activities, as aging commercial districts undergo comprehensive transformation into modern mixed-use developments. Tokyo is undergoing what developers describe as ‘once-in-a-century’ redevelopment aimed at restoring aging buildings and enhancing earthquake preparedness throughout central districts. Major projects in Shibuya, including eight significant developments scheduled for completion between 2023 and 2029, generate substantial aggregate requirements for foundation works and structural concrete. Redevelopment of old neighborhoods and waterfront zones further boosts demand for road base materials and ready-mix concrete. In addition, earthquake-resistant building codes require stronger foundations and higher concreting standards, raising aggregates usage per square meter.

Transportation Network Modernization and Expansion

Japan's commitment to world-class transportation infrastructure generates consistent aggregate demand through highway construction, railway system upgrades, and airport modernization initiatives. The Tokyo Outer Ring Road (Gaikan Expressway) expansion represented the largest infrastructure project in 2024, improving regional connectivity while reducing urban congestion and supporting environmental objectives. High-speed rail developments require extensive aggregate consumption for tunneling operations and station construction. Port facility expansions, airport capacity improvements, and urban transit system extensions complement road network investments, ensuring diversified transportation-related aggregate demand. These transportation investments support economic connectivity while creating sustained market opportunities throughout the forecast period.

Market Restraints:

What Challenges the Japan Construction Aggregates Market is Facing?

Severe Labor Shortages and Aging Workforce

Severe labor shortages and an aging workforce are constraining the growth of the market in Japan by slowing project execution and raising operating costs. With fewer young workers entering construction and quarrying, production efficiency at aggregate plants and mining sites is declining. Companies are forced to rely on overtime, mechanization, and subcontracting, which increases costs and affects supply stability. Delays in infrastructure and real estate projects reduce aggregate demand in the short term.

Rising Material Costs and Supply Chain Pressures

Construction material price escalation strains project economics and affects aggregate demand patterns across Japanese markets. Geopolitical tensions and international sanctions have disrupted global supply chains, elevating resource costs and affecting construction feasibility assessments. Currency fluctuations compound import cost pressures while domestic production capacity limitations constrain response flexibility. These financial pressures affect project pipeline progression and aggregate consumption patterns.

Declining Domestic Cement Market and Population Pressures

A declining domestic cement market and population pressures are weakening the growth of the market by reducing overall construction activity. Shrinking population lowers demand for new housing, schools, and urban infrastructure, which directly cuts aggregate consumption. At the same time, reduced cement usage signals slower commercial and civil construction, further limiting bulk material demand. Local governments also scale back public works in depopulating regions, hurting regional aggregates sales.

Competitive Landscape:

The Japan construction aggregates market features established cement corporations and regional quarry operators competing across product quality, geographic coverage, and service capabilities. Major industry participants leverage integrated supply chains combining quarry operations, processing facilities, and distribution networks serving diverse customer segments. Competition intensifies around premium aggregate specifications meeting stringent construction standards, with technology investment differentiating leading producers. Regional operators maintain competitive positioning through localized service excellence and specialized product offerings addressing specific project requirements. Sustainability credentials increasingly influence competitive dynamics, as green building standards are expanding, driving investments in recycled aggregate processing capabilities. Strategic partnerships between aggregate suppliers and construction companies enhance supply chain integration while acquisition activity consolidates market positioning among leading participants.

Recent Developments:

- In July 2025, BMT hosted KINKI DORO SHIZAI Co., Ltd., a prominent Japanese firm specializing in construction material recycling, to visit and collaborate at its headquarters. This visit created opportunities for collaboration in technology regarding concrete recycling, particularly with the use of Recycled Aggregate Type M (JIS A 5022), a recycled material following Japanese standards that attracted worldwide interest as a sustainable and circular solution for the construction sector.

- In January 2025, ITOCHU Corporation signed a collaboration memorandum with Mitsubishi UBE Cement and MCi Carbon Pty Ltd to manufacture carbon-embodied products using mineral carbonation technology that could capture CO2 and reuse waste materials like concrete and steel slag for cement alternatives.

Japan Construction Aggregates Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Crushed Stone, Sand and Gravels, Recycled Aggregates, Others |

| Applications Covered | Commercial, Residential, Industrial, Infrastructure |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan construction aggregates market size was valued at USD 76,622.95 Million in 2025.

The Japan construction aggregates market is expected to grow at a compound annual growth rate of 5.46% from 2026-2034 to reach USD 1,23,663.48 Million by 2034.

Crushed stone dominates the market with 47.9% share, driven by its essential applications in concrete production, road construction, and foundation works meeting earthquake-resistant building standards across Japan's construction sector.

Key factors driving the Japan construction aggregates market include sustained government investment in disaster-resilient infrastructure and seismic retrofitting programs, extensive urban redevelopment initiatives across metropolitan areas, transportation network modernization projects, and growing adoption of sustainable construction materials aligned with carbon neutrality objectives.

Major challenges include severe labor shortages, rising material costs driven by supply chain disruptions, declining domestic cement demand reflecting population pressures, regulatory complexity affecting project timelines, and increasing operational costs constraining profit margins across the industry.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)