Japan Construction Demolition Waste Recycling Market Size, Share, Trends and Forecast by Material, Source, Service, and Region, 2025-2033

Japan Construction Demolition Waste Recycling Market Overview:

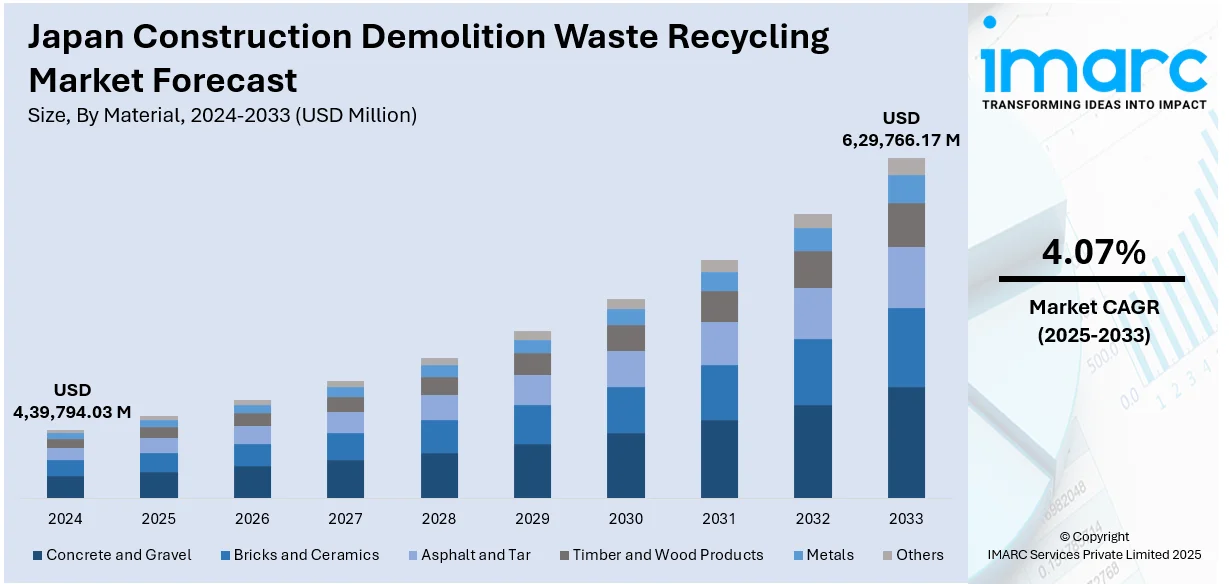

The Japan construction demolition waste recycling market size reached USD 4,39,794.03 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 6,29,766.17 Million by 2033, exhibiting a growth rate (CAGR) of 4.07% during 2025-2033. The market is driven by strict regulatory enforcement mandating material separation and reuse, innovations in recovery technologies increasing efficiency and output value, and ongoing urban redevelopment creating high volumes of recyclable input. These drivers together are expected to further augment the Japan construction demolition waste recycling market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4,39,794.03 Million |

| Market Forecast in 2033 | USD 6,29,766.17 Million |

| Market Growth Rate 2025-2033 | 4.07% |

Japan Construction Demolition Waste Recycling Market Trends:

Regulatory Enforcement and Policy Reforms

Japan has enforced increasingly strict regulations targeting construction and demolition waste, prompted by limited landfill capacity and environmental risks. The Waste Management and Public Cleansing Act, amended several times since its introduction, sets detailed obligations on waste generators, with severe penalties for non-compliance. These regulatory pressures are coupled with the Construction Material Recycling Law, which mandates the separation and reuse of materials such as concrete, wood, and asphalt. Public works contractors must submit detailed recycling plans before projects begin, creating an operational environment where recycling becomes non-optional. Municipal and prefectural governments further strengthen this direction through localized waste management targets. These include designated recycling quotas, disposal fee structures, and licensing requirements for contractors and transporters. Through such layered governance, the cost of non-compliance becomes significant, redirecting investment into compliant recycling processes and technologies. On April 4, 2025, Transition Asia reported that Japan can meet growing scrap demand tied to electric arc furnace (EAF) expansion, countering concerns about a domestic shortage of recycled steel. The Japan Iron and Steel Federation has set a target to boost domestic scrap circulation by 6.9 million metric tons by 2030, with measures proposed to improve obsolete scrap collection and processing. Ferrous scrap recovery from CDEW streams can help reduce pressure on exports and raw material imports. Enforcement is also rigorous, with increasing surveillance of job sites and traceability protocols for waste transport, forcing stakeholders across the value chain to align with legal expectations. In this tightly regulated climate, recycling operations are no longer an auxiliary function but an integral part of the construction cycle. This shift toward embedded recycling compliance is a primary catalyst behind Japan construction demolition waste recycling market growth.

Urban Redevelopment and Infrastructure Renewal Projects

Japan is experiencing a sustained cycle of urban regeneration, particularly in major metropolitan areas such as Tokyo, Osaka, and Nagoya. As older commercial and residential buildings reach the end of their lifecycle, large-scale demolition projects are being launched to clear space for modern infrastructure. Many of these structures were built during the post-war construction boom and no longer meet current safety, efficiency, or zoning standards. Their replacement is often linked to urban planning goals aimed at disaster resilience, energy performance, and population redistribution. At the same time, infrastructure renewal efforts are accelerating across transport, utilities, and public spaces. Projects under Japan’s national infrastructure strategy emphasize sustainability and waste minimization. Contractors are under pressure to ensure that demolition activities generate materials that can be reintegrated into construction cycles. The volume of concrete, steel, and other structural components being dismantled creates a large supply of recyclable input. By embedding recycling into redevelopment workflows, the construction ecosystem becomes a closed loop. Major contractors are now investing in integrated demolition-recycling capabilities to secure regulatory approvals and align with client expectations for sustainable project delivery. Notably, Japan-based Kayama Kogyo reported recently that it recycles 80% of its incoming material, including industrial and construction waste, using high-efficiency shredding systems from SSI Inc. The company processes a mix of copper wire, scrap wood, plastics, and C&D byproducts, producing marketable recyclables and refuse-derived fuel, while aiming to reach a 100% landfill diversion rate.

Japan Construction Demolition Waste Recycling Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on material, source, and service.

Material Insights:

- Concrete and Gravel

- Bricks and Ceramics

- Asphalt and Tar

- Timber and Wood Products

- Metals

- Others

The report has provided a detailed breakup and analysis of the market based on the material. This includes concrete and gravel, bricks and ceramics, asphalt and tar, timber and wood products, metals, and others.

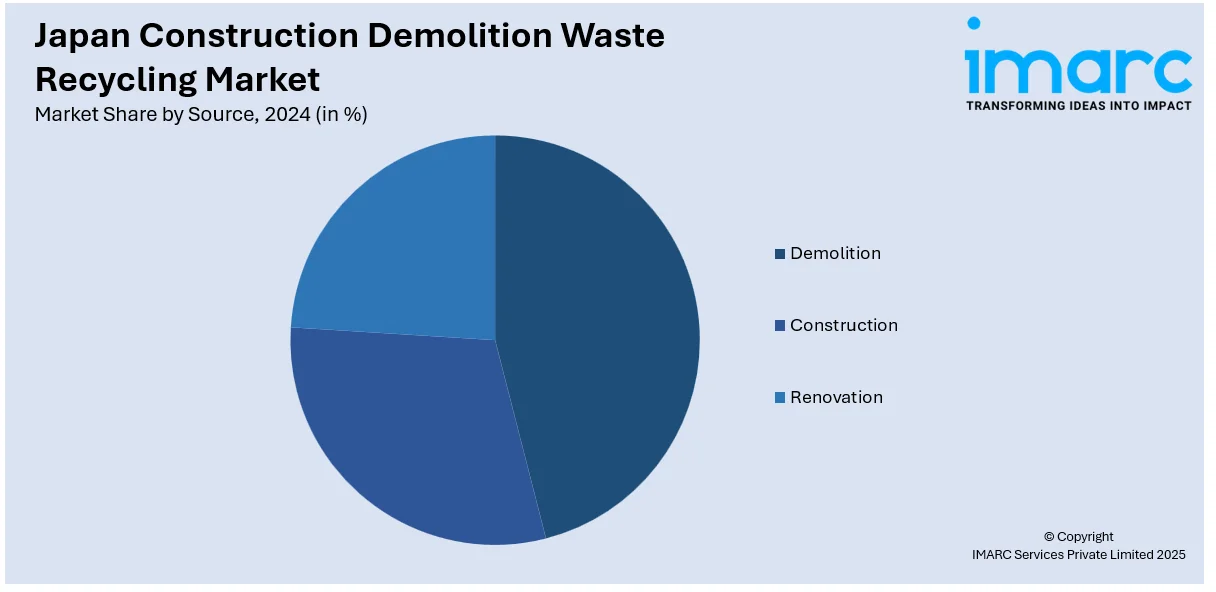

Source Insights:

- Demolition

- Construction

- Renovation

The report has provided a detailed breakup and analysis of the market based on the source. This includes demolition, construction, and renovation.

Service Insights:

- Disposal

- Collection

The report has provided a detailed breakup and analysis of the market based on the service. This includes disposal and collection.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all major regional markets. This includes Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Construction Demolition Waste Recycling Market News:

- On September 18, 2024, NYK and Oono Development signed an MoU to develop a ship recycling business in Japan, using a 39-hectare dry dock capable of dismantling two large ocean-going vessels at once. Over 90% of the steel recovered from dismantled ships is reused or recycled—primarily into construction materials highlighting the high potential recovery rate for ferrous components within the construction, demolition, and excavation waste (CDEW) stream.

Japan Construction Demolition Waste Recycling Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Concrete and Gravel, Bricks and Ceramics, Asphalt and Tar, Timber and Wood Products, Metals, Others |

| Sources Covered | Demolition, Construction, Renovation |

| Services Covered | Disposal, Collection |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan construction demolition waste recycling market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan construction demolition waste recycling market on the basis of material?

- What is the breakup of the Japan construction demolition waste recycling market on the basis of source?

- What is the breakup of the Japan construction demolition waste recycling market on the basis of service?

- What is the breakup of the Japan construction demolition waste recycling market on the basis of region?

- What are the various stages in the value chain of the Japan construction demolition waste recycling market?

- What are the key driving factors and challenges in the Japan construction demolition waste recycling market?

- What is the structure of the Japan construction demolition waste recycling market and who are the key players?

- What is the degree of competition in the Japan construction demolition waste recycling market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan construction demolition waste recycling market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan construction demolition waste recycling market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan construction demolition waste recycling industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)