Japan Construction Safety Equipment Market Size, Share, Trends and Forecast by Equipment Type, Construction Type, Application, and Region, 2026-2034

Japan Construction Safety Equipment Market Overview:

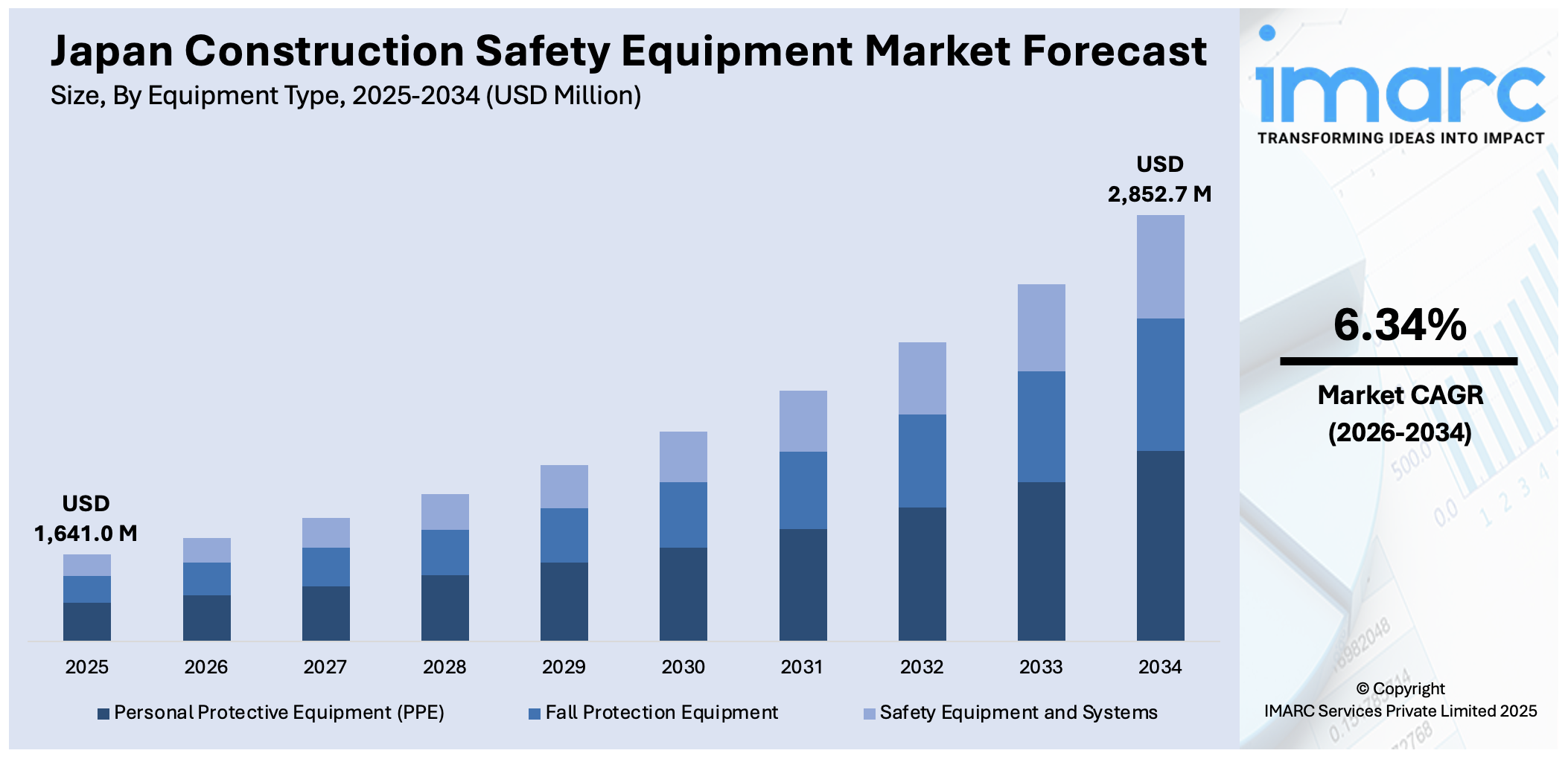

The Japan construction safety equipment market size reached USD 1,641.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 2,852.7 Million by 2034, exhibiting a growth rate (CAGR) of 6.34% during 2026-2034. The market is embracing intelligent safety technology, ergonomic personal protective gear, and sophisticated fall prevention systems in a bid to enhance the safety and efficiency of workers. Wearable sensors, adaptive PPE, and advanced fall arrest equipment are becoming commonplace, particularly to accommodate an aging labor pool and high-rise construction projects. These innovations are revolutionizing reactive to proactive management of safety, promoting regulatory compliance, and improving the well-being of workers. These trends are among the major drivers of growth in the Japan construction safety equipment market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1,641.0 Million |

| Market Forecast in 2034 | USD 2,852.7 Million |

| Market Growth Rate 2026-2034 | 6.34% |

Japan Construction Safety Equipment Market Trends:

Development of Smart Safety Technologies

Japan's construction sector is increasingly adopting smart safety technologies to improve worker safety and operational efficiency. Some of the technologies involved are wearable equipment with sensors integrated into them that track important signs, sense dangerous environmental situations, and monitor the whereabouts of workers in real time. The connectivity of these devices to central digital platforms enables speedy response to probable safety incidents, curtailing accidents drastically and facilitating safety regulation compliance. Data analysis has a critical function as it enables predictive risk analysis and proactive safety, changing the conventional reactive manner. Such adoption of technology is particularly relevant in Japan, with an aging workforce necessitating novel safety solutions. The implementation of these modern safety tools is a key driver of the continued expansion of Japan construction safety equipment, as the industry continues to harness digital innovations for better worker welfare and productivity. For instance, in September 2023, Japanese construction equipment company, Kobelco, officially introduced two new Short Radius excavators—SK230SRLC-7 and SK270SR(N)LC-7—improving construction safety through compact, accurate machines custom-made for urban and residential locations.

To get more information on this market Request Sample

Focus on Ergonomic Personal Protective Equipment (PPE)

There is increased emphasis in Japan on ergonomic and modular personal protective equipment aimed at maximizing worker comfort and protection over longer periods of usage. Today's PPE includes features that are adjustable, light in weight, and ventilated to be able to minimize fatigue and fit different body types, which is crucial due to Japan's aging construction workforce. Modular designs enable the workers to be able to personalize protection based on specific job needs, enhance efficiency, and compliance with safety measures. This is a sign of a larger trend for making protective gear more aligned with worker health, which leads to greater on-site productivity and safety. The focus on ergonomic PPE is a key driver of the steady increase in the Japan construction safety equipment market, as users seek more user-friendly and flexible safety solutions that are responsive to changing labor force requirements. As per the sources, in April 2024, the construction safety equipment industry in Japan is increasing fast due to intelligent PPE technologies such as wearable sensors, intelligent helmets, GPS, environment monitoring, and exoskeletons to improve laborers' safety and efficiency.

Advanced Fall Protection Systems

Fall protection continues to be a critical safety issue within Japan's construction industry, especially considering the high-rise urban development projects that are common. Widespread use of high-tech fall protection systems like self-retracting lifelines, shock-absorbing lanyards, and full-body harnesses designed to rapidly and efficiently stop falls is found. Physical equipment is augmented by digital assets that are used for routine fall protection equipment inspection and verification of regulatory compliance. Personalized fall prevention measures are enabled by detailed risk assessments tailored to site-specific conditions, while extensive training programs for workers reinforce safety culture at construction sites. These collective actions highlight the industry's determination in minimizing fall injury. The emphasis on sophisticated fall protection systems is a driving factor behind Japan construction safety equipment market growth, as the sector emphasizes holistic solutions to protect workers and comply with high levels of safety measures.

Japan Construction Safety Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on equipment type, construction type, and application.

Equipment Type Insights:

- Personal Protective Equipment (PPE)

- Head Protection

- Eye and Face Protection

- Respiratory Protection

- Hand and Arm Protection

- Protective Clothing

- Foot Protection

- Hearing Protection

- Fall Protection Equipment

- Harnesses

- Lanyards

- Lifelines

- Anchors

- Safety Equipment and Systems

- Fire Safety Equipment

- Safe Access Equipment

- Gas Detection Systems

The report has provided a detailed breakup and analysis of the market based on the equipment type. This includes personal protective equipment PPE (head protection, eye and face protection, respiratory protection, hand and arm protection, protective clothing, foot protection, and hearing protection), fall protection equipment (harnesses, lanyards, lifelines, and anchors), and safety equipment and systems (fire safety equipment, safe access equipment, and gas detection systems).

Construction Type Insights:

- Residential Construction

- Commercial Construction

- Industrial Construction

A detailed breakup and analysis of the market based on the construction type have also been provided in the report. This includes residential construction, commercial construction, and industrial construction.

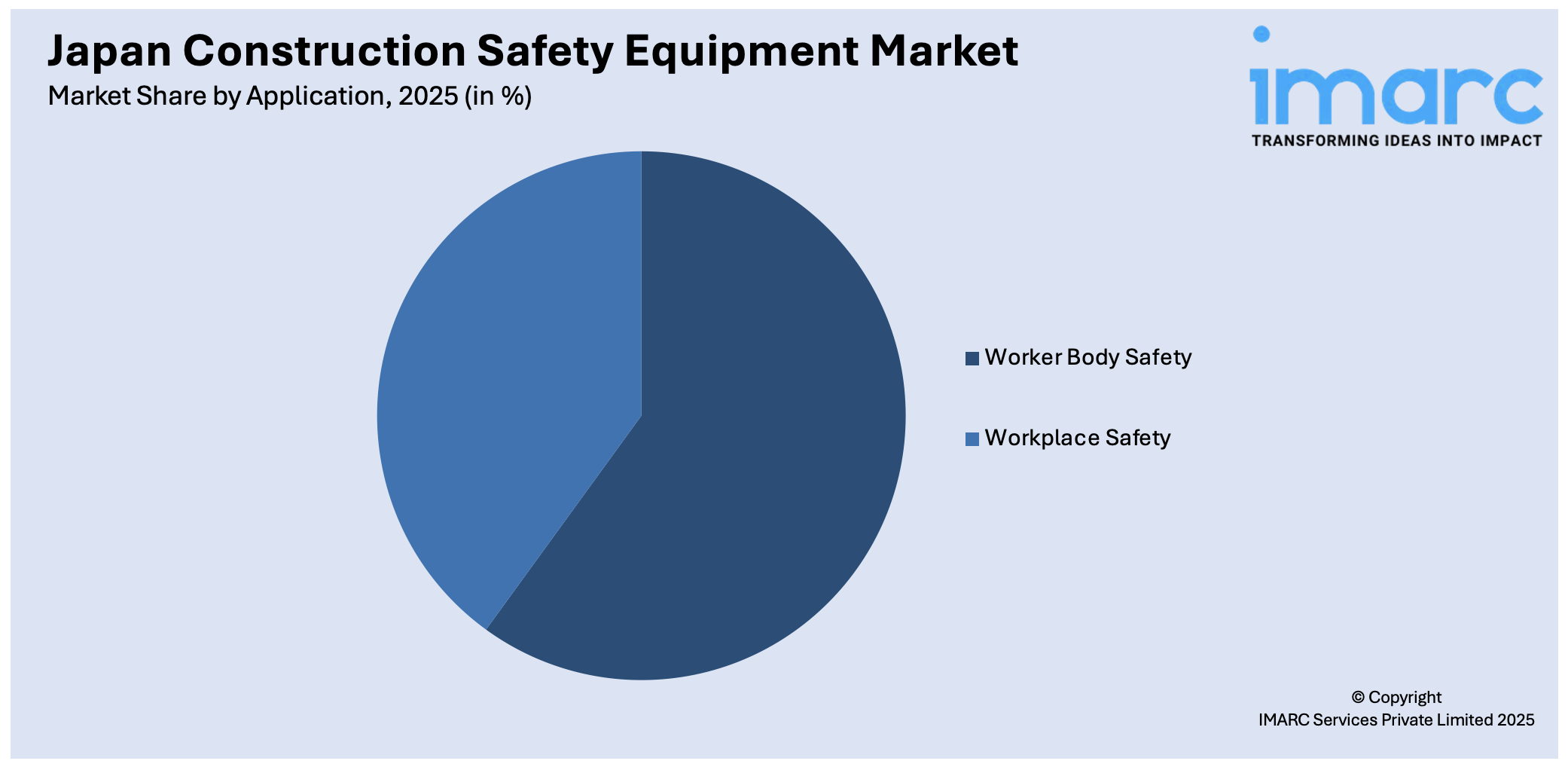

Application Insights:

Access the comprehensive market breakdown Request Sample

- Worker Body Safety

- Workplace Safety

The report has provided a detailed breakup and analysis of the market based on the application. This includes worker body safety and workplace safety.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto region, Kansai/Kinki region, Central/Chubu region, Kyushu-Okinawa region, Tohoku region, Chugoku region, Hokkaido region, and Shikoku region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Construction Safety Equipment Market News:

- In November 2024, SGS introduces expanded testing services for helmets of PPE, extending from industrial and construction safety. Accredited for prominent markets such as Japan, Australia, the EU, UK, and US, the service supports manufacturers in meeting compliance requirements while improving wearer protection in varied applications.

Japan Construction Safety Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Equipment Types Covered |

|

| Construction Types Covered | Residential Construction, Commercial Construction, Industrial Construction |

| Applications Covered | Worker Body Safety, Workplace Safety |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan construction safety equipment market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan construction safety equipment market on the basis of equipment type?

- What is the breakup of the Japan construction safety equipment market on the basis of construction type?

- What is the breakup of the Japan construction safety equipment market on the basis of application?

- What is the breakup of the Japan construction safety equipment market on the basis of region?

- What are the various stages in the value chain of the Japan construction safety equipment market?

- What are the key driving factors and challenges in the Japan construction safety equipment?

- What is the structure of the Japan construction safety equipment market and who are the key players?

- What is the degree of competition in the Japan construction safety equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan construction safety equipment market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan construction safety equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan construction safety equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)