Japan Contract Lifecycle Management Software Market Size, Share, Trends and Forecast by Deployment Model, CLM Offerings, Enterprise Size, Industry, and Region, 2026-2034

Japan Contract Lifecycle Management Software Market Overview:

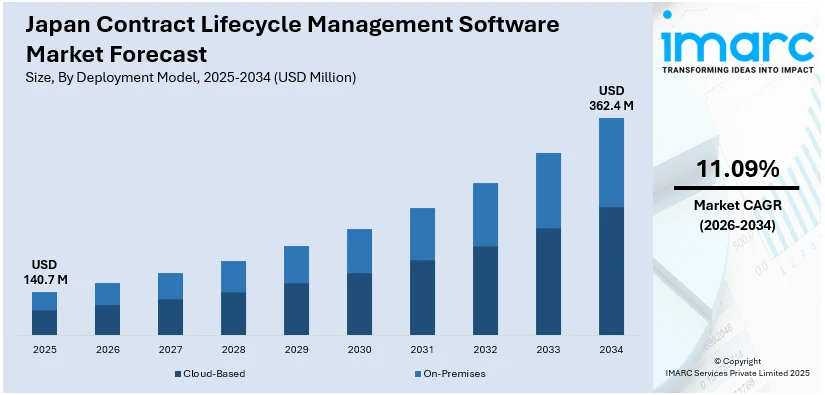

The Japan contract lifecycle management software market size reached USD 140.7 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 362.4 Million by 2034, exhibiting a growth rate (CAGR) of 11.09% during 2026-2034. The increasing demand for digital transformation, compliance requirements, improved contract efficiency, risk management, automation, and enhanced data security are some of the factors propelling the growth of the market. Adoption across industries like finance, healthcare, and manufacturing also contributes to market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 140.7 Million |

| Market Forecast in 2034 | USD 362.4 Million |

| Market Growth Rate 2026-2034 | 11.09% |

Japan Contract Lifecycle Management Software Market Trends:

AI-Driven Contract Management Adoption

The Japan contract lifecycle management (CLM) industry is shifting toward AI-powered solutions that streamline contract management operations. Companies are increasingly using technologies that automate contract development, approval procedures, and post-signature administration, which reduces manual involvement and increases productivity. These AI-powered technologies are intended to improve risk mitigation, increase compliance, and expedite contract execution. As organizations in Japan appreciate the need for optimal contract management, more are looking for solutions that incorporate AI, advanced analytics, and contract intelligence. This transition not only improves operational efficiency but also ensures that firms can handle contracts more efficiently and in accordance with changing legislation, making it a critical priority for enterprises in Japan's expanding legal tech landscape. For example, in August 2024, Sirion partnered with Deloitte India to implement its contract lifecycle management platform across the APAC region, enhancing contract management efficiency for clients, including those in Japan.

To get more information on this market Request Sample

Digital Transformation in Contract Management

The market in Japan continues to move toward more integrated and automated contract management systems to boost productivity. These solutions let legal teams handle contracts throughout their lifespan, from development and negotiation to execution and post-signature administration. Businesses are increasingly using these solutions to optimize operations, decrease manual duties, and remain compliant with growing requirements. The transition to digital contract management enables Japanese firms to better manage complicated contracts, improve operational efficiency, and reduce risks. With more law firms and enterprises pursuing digital solutions, the Japanese CLM software market is expected to expand significantly as organizations seek more efficient and technologically advanced contract management systems. For instance, in April 2024, LegalOn Technologies launched its AI-powered LegalOn Cloud service in Japan, designed to assist legal personnel with tasks ranging from contract creation to post-signature management, as well as legal consultations and research. The service marks a significant step in digital contract management. The company also announced a strategic partnership with the Mori Hamada & Matsumoto law firm, further enhancing its offering in the Japanese legal tech market.

Japan Contract Lifecycle Management Software Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on deployment model, CLM offerings, enterprise size, and industry.

Deployment Model Insights:

- Cloud-Based

- On-Premises

The report has provided a detailed breakup and analysis of the market based on the deployment model. This includes cloud-based and on-premises.

CLM Offerings Insights:

- Licensing and Subscription

- Services

A detailed breakup and analysis of the market based on the CLM offerings have also been provided in the report. This includes licensing and subscription and services.

Enterprise Size Insights:

- Large Enterprise

- Small and Medium Enterprise

The report has provided a detailed breakup and analysis of the market based on the enterprise size. This includes large enterprise and small and medium enterprise.

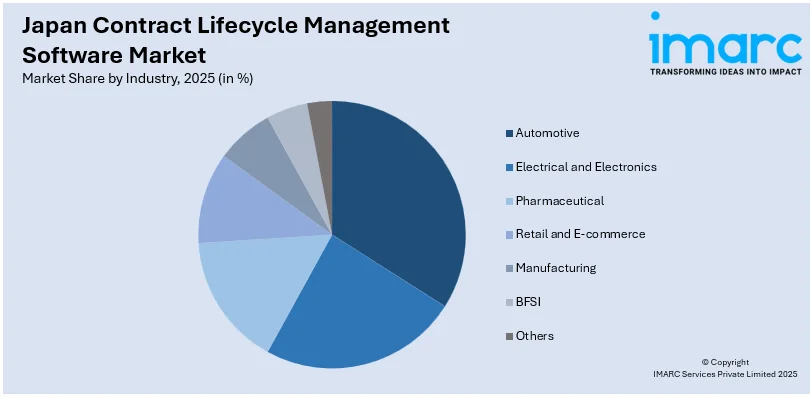

Industry Insights:

Access the comprehensive market breakdown Request Sample

- Automotive

- Electrical and Electronics

- Pharmaceutical

- Retail and E-commerce

- Manufacturing

- BFSI

- Others

A detailed breakup and analysis of the market based on the industry have also been provided in the report. This includes automotive, electrical and electronics, pharmaceutical, retail and e-commerce, manufacturing, BFSI, and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto region, Kansai/Kinki region, Central/Chubu region, Kyushu-Okinawa region, Tohoku region, Chugoku region, Hokkaido region, and Shikoku region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Contract Lifecycle Management Software Market News:

- In October 2024, Deloitte streamlined global contracting processes for Astellas, a Japanese pharmaceutical company, harmonizing contract templates and processes across 70 countries, resulting in a 20% faster signing process.

Japan Contract Lifecycle Management Software Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Deployment Models Covered | Cloud-Based, On-Premises |

| CLM Offerings Covered | Licensing and Subscription, Services |

| Enterprise Sizes Covered | Large Enterprise, Small and Medium Enterprise |

| Industries Covered | Automotive, Electrical and Electronics, Pharmaceutical, Retail and E-commerce, Manufacturing, BFSI, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan contract lifecycle management software market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan contract lifecycle management software market on the basis of deployment model?

- What is the breakup of the Japan contract lifecycle management software market on the basis of CLM offerings?

- What is the breakup of the Japan contract lifecycle management software market on the basis of enterprise size?

- What is the breakup of the Japan contract lifecycle management software market on the basis of industry?

- What are the various stages in the value chain of the Japan contract lifecycle management software market?

- What are the key driving factors and challenges in the Japan contract lifecycle management software market?

- What is the structure of the Japan contract lifecycle management software market and who are the key players?

- What is the degree of competition in the Japan contract lifecycle management software market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan contract lifecycle management software market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan contract lifecycle management software market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan contract lifecycle management software industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)