Japan Copper Alloys Market Size, Share, Trends and Forecast by Type, End Use, and Region, 2026-2034

Japan Copper Alloys Market Overview:

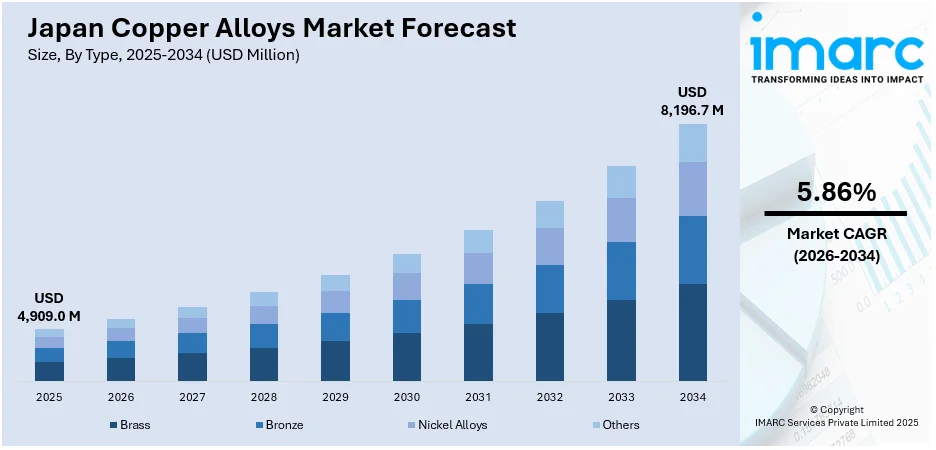

The Japan copper alloys market size reached USD 4,909.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 8,196.7 Million by 2034, exhibiting a growth rate (CAGR) of 5.86% during 2026-2034. Rising demand from electronics and automotive sectors, especially for connectors and heat exchangers, is one of the factors contributing to Japan copper alloys market share. Industrial miniaturization, renewable energy expansion, and construction applications also support growth due to copper alloys’ conductivity, strength, and corrosion resistance.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 4,909.0 Million |

| Market Forecast in 2034 | USD 8,196.7 Million |

| Market Growth Rate 2026-2034 | 5.86% |

Japan Copper Alloys Market Trends:

Shift toward Sustainable High-Performance Copper Alloys

The Japan copper alloys market is experiencing increased adoption of environmentally friendly, high-conductivity materials in response to rising demand for sustainable manufacturing. New formulations without lead or beryllium are gaining popularity, particularly in sectors like consumer electronics, smart devices, and sanitary hardware, where both performance and compliance with global safety standards are essential. These advanced copper alloys offer improved electrical and thermal efficiency while aligning with global directives such as RoHS and FDA standards. This reflects a broader push within Japan’s industrial base to adopt materials that balance performance, reliability, and environmental responsibility. As manufacturers prioritize miniaturization, durability, and green credentials, such alloys are becoming central to applications across smart homes, medical devices, and next-generation electronic systems. These factors are intensifying the Japan copper alloys market growth. For example, in October 2024, at METAL JAPAN in Chiba, Tokyo, bedra Vietnam Alloy Material Co., Ltd. introduced lead-free, high-conductivity copper alloys tailored to Japan’s demand for sustainable and efficient materials. Its eco-friendly series, compliant with global standards, targets electronics, smart devices, and sanitary hardware, reinforcing Japan’s copper alloy market shift toward green innovation and high performance.

To get more information on this market Request Sample

Rising Focus on Recycled High-Performance Alloys

The market in Japan is increasingly turning toward materials made entirely from recycled sources, driven by the push for sustainability and circular manufacturing. High-performance copper titanium and Corson alloys are now being developed using advanced recycling and purification techniques, offering reliable performance without reliance on virgin raw materials. These alloys are finding expanded use in electronics, electric vehicles, data infrastructure, and robotics, where durability, conductivity, and environmental compliance are critical. The adoption of such materials reflects a broader commitment to reducing industrial waste and supporting decarbonization goals. As demand for eco-conscious components rises across next-generation applications, the shift toward fully recycled, high-reliability copper alloys is becoming a defining feature of Japan’s evolving approach to materials innovation. For instance, in January 2025, JX Advanced Metals launched high-performance copper titanium and Corson alloys made entirely from recycled materials under its "Cu again" initiative. Verified by UL Solutions, these alloys are tailored for use in smartphones, EVs, AI data centers, and robotics. By leveraging proprietary recycling and purification technologies, the company aims to meet Japan’s growing demand for sustainable copper alloy solutions while supporting decarbonization and next-gen electronics innovation.

Japan Copper Alloys Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type and end use.

Type Insights:

- Brass

- Bronze

- Nickel Alloys

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes brass, bronze, nickel alloys, and others.

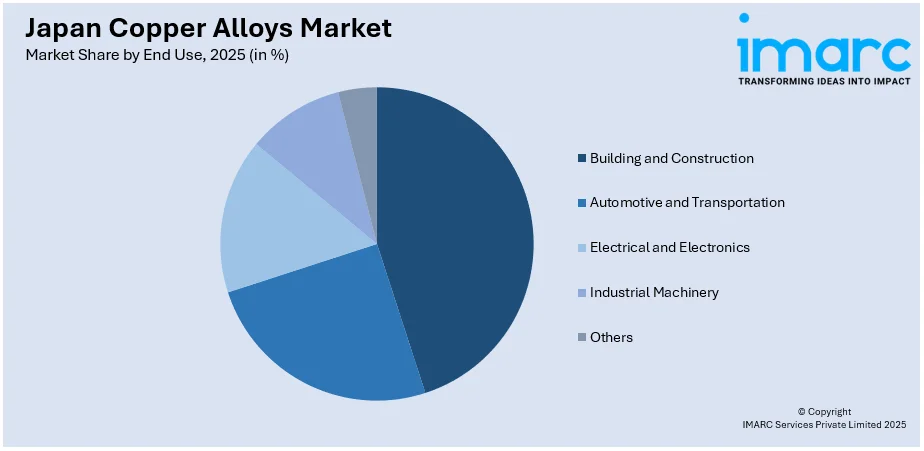

End Use Insights:

Access the comprehensive market breakdown Request Sample

- Building and Construction

- Automotive and Transportation

- Electrical and Electronics

- Industrial Machinery

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes building and construction, automotive and transportation, electrical and electronics, industrial machinery, and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Copper Alloys Market News:

- In February 2025, Japanese copper processor Mitsui Kinzoku expanded overseas, establishing a US base to reduce reliance on Chinese demand amid trade tensions. This strategic move supports Japan’s copper alloys market by securing stable international outlets and responding to geopolitical risks. With rising global interest in high-performance copper materials, Japan’s manufacturers are positioning themselves to maintain competitiveness and ensure supply chain resilience in key sectors like electronics and automotive.

Japan Copper Alloys Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Brass, Bronze, Nickel Alloys, Others |

| End Uses Covered | Building and Construction, Automotive and Transportation, Electrical and Electronics, Industrial Machinery, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan copper alloys market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan copper alloys market on the basis of types?

- What is the breakup of the Japan copper alloys market on the basis of end uses?

- What is the breakup of the Japan copper alloys market on the basis of region?

- What are the various stages in the value chain of the Japan copper alloys market?

- What are the key driving factors and challenges in the Japan copper alloys market?

- What is the structure of the Japan copper alloys market and who are the key players?

- What is the degree of competition in the Japan copper alloys market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan copper alloys market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan copper alloys market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan copper alloys industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)