Japan Cryptocurrency Exchange Market Size, Share, Trends and Forecast by Exchange Type, Cryptocurrency Type, User Type, Revenue Model, Trading Service, and Region, 2026-2034

Japan Cryptocurrency Exchange Market Overview:

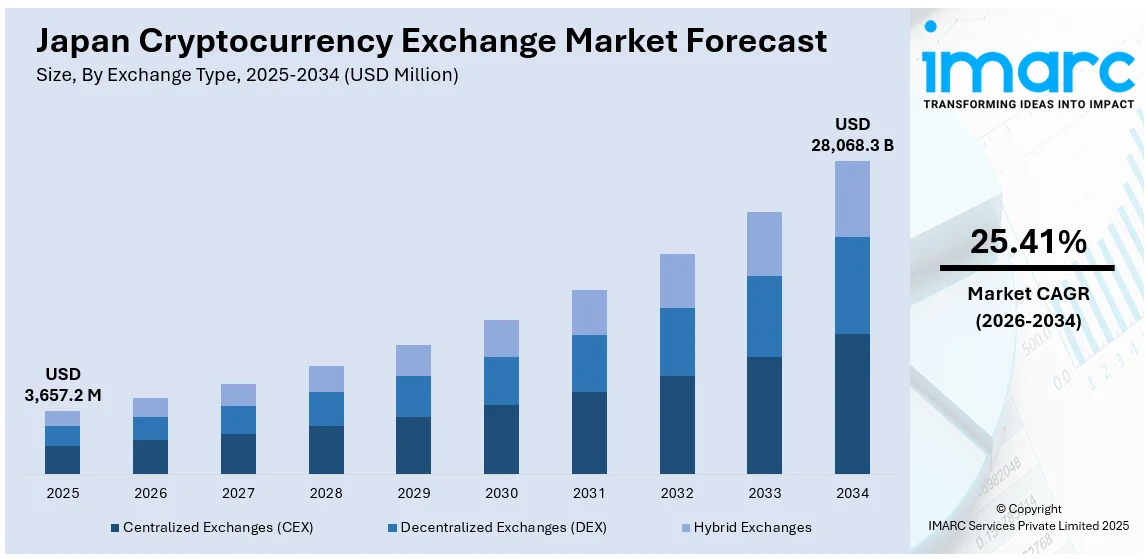

The Japan cryptocurrency exchange market size reached USD 3,657.2 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 28,068.3 Million by 2034, exhibiting a growth rate (CAGR) of 25.41% during 2026-2034. The Japanese government's clear regulatory framework, including licensing and stringent security protocols, is creating a transparent and trustworthy environment for cryptocurrency exchanges. Increased institutional adoption is fostering innovation and contributing to the expansion of the Japan cryptocurrency exchange market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 3,657.2 Million |

| Market Forecast in 2034 | USD 28,068.3 Million |

| Market Growth Rate 2026-2034 | 25.41% |

Japan Cryptocurrency Exchange Market Trends:

Regulatory Clarity and Government Support

The governing authority in Japan is playing a critical role in creating a strong regulatory framework for cryptocurrency exchanges, providing a secure and transparent setting for businesses and investors alike. The governing body is legitimizing the market by implementing licensing requirements via the Financial Services Agency (FSA), promoting engagement from both domestic and foreign participants. These rules require exchanges to follow stringent security procedures, anti-money laundering (AML) regulations, and user safety protocols. The proactive approach to implementing clear, organized policies is establishing a basis of trust, drawing in diverse market participants. For example, in February 2025, the FSA announced initiatives to cut cryptocurrency tax rates from 55% to 20% and consider the approval of Bitcoin spot exchange-traded funds (ETFs) by the middle of 2025. These changes seek to reclassify crypto assets as financial products, simplifying regulatory processes and improving market transparency. With the development of the regulatory framework, it is vital in reducing risks associated with market fluctuations, fraud, and unregulated trading practices. These adjustments not only enhance investor trust but also foster the development of cryptocurrency-related services, enabling exchanges to innovate and broaden their offerings. Furthermore, these changes aim to create a more stable market setting, promote increased participation, and draw a varied array of investors, including retail traders and institutional participants.

To get more information on this market Request Sample

Growing Institutional Adoption and Investment

Rising interest from institutional investors is a major factor supporting the Japan cryptocurrency exchange market growth. Banks, asset managers, and various financial institutions are starting to accept cryptocurrencies as a valid asset category, integrating them into their investment portfolios. Cryptocurrency exchanges are essential in fulfilling the growing demand from these institutions by providing services customized to their requirements, including large trades, sophisticated trading platforms, and secure custody solutions. The movement towards institutional adoption indicates wider acceptance of cryptocurrencies and increased market stability, which consequently boosts the legitimacy of exchanges. An ongoing increase in institutional investment drives the overall progress and evolution of Japan's crypto market, creating novel avenues for innovation and expansion. For instance, in 2025, SBI VC Trade became the inaugural Japanese company authorized as an "Electronic Payment Instruments Exchange Service Provider." This authorization enabled SBI VC Trade to introduce USDC stablecoin services in Japan, representing a notable achievement for the regulated application of stablecoins in the nation’s financial industry. A beta launch of this service was scheduled within ten days of the announcement, further illustrating the increasing institutional interest in cryptocurrency. These advancements highlight the growing participation of key financial entities in the crypto arena.

Japan Cryptocurrency Exchange Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on exchange type, cryptocurrency type, user type, revenue model, and trading service.

Exchange Type Insights:

- Centralized Exchanges (CEX)

- Decentralized Exchanges (DEX)

- Hybrid Exchanges

The report has provided a detailed breakup and analysis of the market based on the exchange type. This includes centralized exchanges (CEX), decentralized exchanges (DEX), and hybrid exchanges.

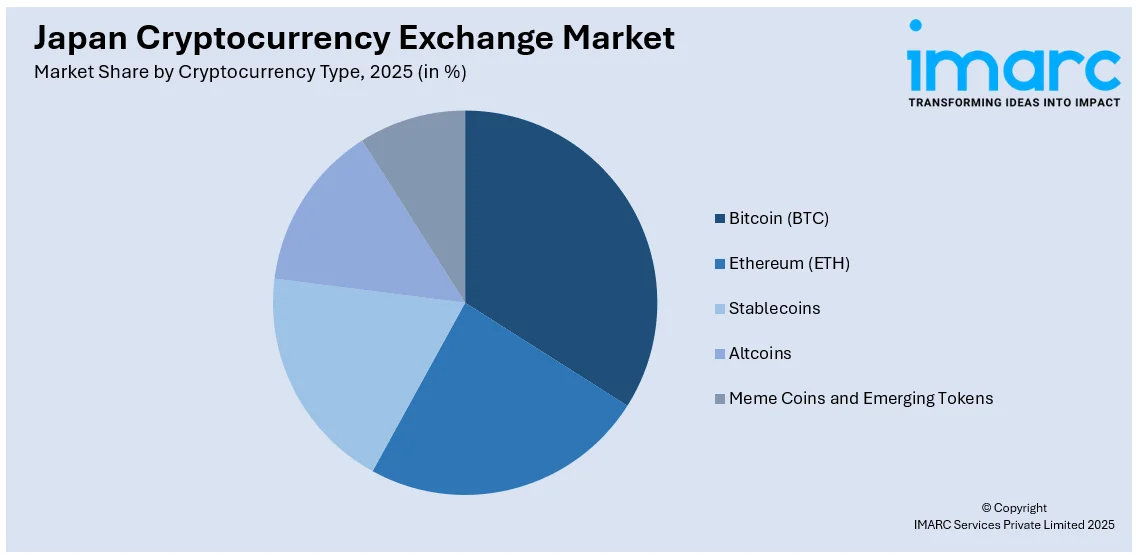

Cryptocurrency Type Insights:

Access the comprehensive market breakdown Request Sample

- Bitcoin (BTC)

- Ethereum (ETH)

- Stablecoins

- Altcoins

- Meme Coins and Emerging Tokens

A detailed breakup and analysis of the market based on the cryptocurrency type have also been provided in the report. This includes bitcoin (BTC), Ethereum (ETH), stablecoins, altcoins, and meme coins and emerging tokens.

User Type Insights:

- Retail Traders

- Institutional Investors

- High-Frequency Traders

The report has provided a detailed breakup and analysis of the market based on the user type. This includes retail traders, institutional investors, and high-frequency traders.

Revenue Model Insights:

- Transaction Fees

- Subscription-Based Models

- Listing Fees

- Staking and Yield Farming Services

A detailed breakup and analysis of the market based on the revenue model have also been provided in the report. This includes transaction fees, subscription-based models, listing fees, and staking and yield farming services.

Trading Service Insights:

- Spot Trading

- Futures and Derivatives Trading

- Margin Trading

- Peer-to-Peer (P2P) Trading

A detailed breakup and analysis of the market based on the trading service have also been provided in the report. This includes spot trading, futures and derivatives trading, margin trading, and peer-to-peer (P2P) trading.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Cryptocurrency Exchange Market News:

- In March 2025, UPCX announced that its token (UPC) will launch on Japanese crypto exchange BitTrade on March 27, 2025. BitTrade, licensed by Japan’s Financial Services Agency, approved UPCX after a thorough compliance review. This marks a major milestone in UPCX’s global expansion strategy.

- In February 2025, Japan’s FSA announced it is exploring enhanced disclosure rules for crypto assets, aiming to align them with securities to boost investor confidence. This proactive step could pave the way for future crypto ETFs and strengthen market transparency.

Japan Cryptocurrency Exchange Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Exchange Types Covered | Centralized Exchanges (CEX), Decentralized Exchanges (DEX), Hybrid Exchanges |

| Cryptocurrency Types Covered | Bitcoin (BTC), Ethereum (ETH), Stablecoins, Altcoins, Meme Coins and Emerging Tokens |

| User Types Covered | Retail Traders, Institutional Investors, High-Frequency Traders |

| Revenue Models Covered | Transaction Fees, Subscription-Based Models, Listing Fees, Staking and Yield Farming Services |

| Trading Services Covered | Spot Trading, Futures and Derivatives Trading, Margin Trading, Peer-to-Peer (P2P) Trading |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan cryptocurrency exchange market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan cryptocurrency exchange market on the basis of exchange type?

- What is the breakup of the Japan cryptocurrency exchange market on the basis of cryptocurrency type?

- What is the breakup of the Japan cryptocurrency exchange market on the basis of user type?

- What is the breakup of the Japan cryptocurrency exchange market on the basis of revenue model?

- What is the breakup of the Japan cryptocurrency exchange market on the basis of trading service?

- What is the breakup of the Japan cryptocurrency exchange market on the basis of region?

- What are the various stages in the value chain of the Japan cryptocurrency exchange market?

- What are the key driving factors and challenges in the Japan cryptocurrency exchange market?

- What is the structure of the Japan cryptocurrency exchange market and who are the key players?

- What is the degree of competition in the Japan cryptocurrency exchange market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan cryptocurrency exchange market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan cryptocurrency exchange market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan cryptocurrency exchange industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)