Japan Diagnostic Testing Market Size, Share, Trends and Forecast by Test Type, Technology, Sample Type, Mode of Testing, Application End User, and Region, 2026-2034

Japan Diagnostic Testing Market Overview:

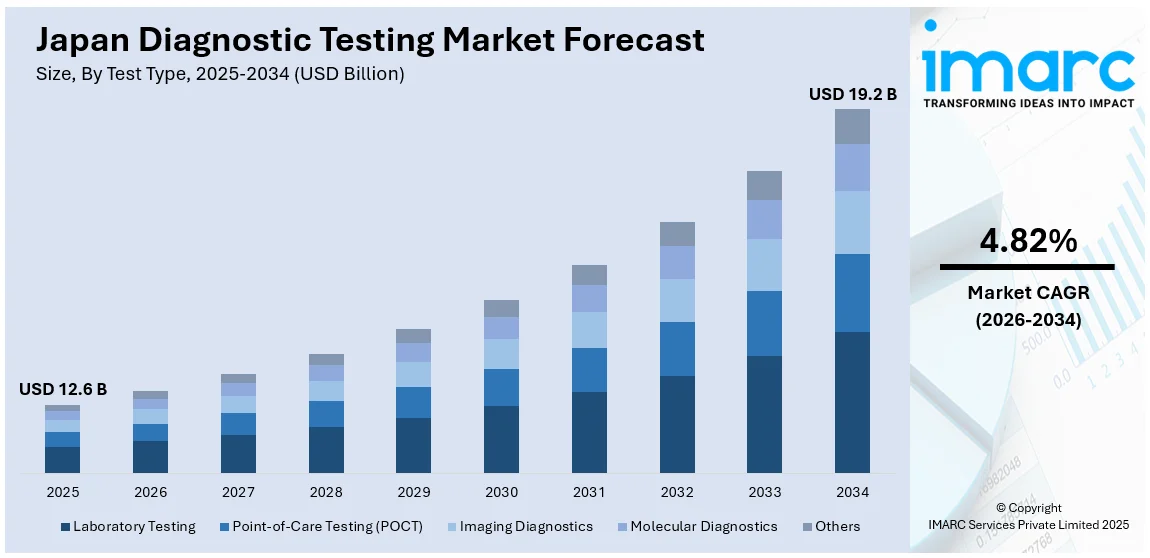

The Japan diagnostic testing market size reached USD 12.6 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 19.2 Billion by 2034, exhibiting a growth rate (CAGR) of 4.82% during 2026-2034. The market is witnessing significant growth driven by advances in medical technologies, increasing healthcare awareness, and rising prevalence of chronic diseases. Innovations in molecular diagnostics, imaging, and point-of-care testing are expanding market opportunities. With a strong healthcare infrastructure and demand for early diagnosis, the market is poised for significant developments, further solidifying Japan diagnostic testing market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 12.6 Billion |

| Market Forecast in 2034 | USD 19.2 Billion |

| Market Growth Rate 2026-2034 | 4.82% |

Japan Diagnostic Testing Market Trends:

Growing Demand of Point-of-Care Testing

Point-of-care (POC) testing is increasingly popular in Japan because it offers quicker, more convenient diagnostic results directly at the patient's site. The instruments prove especially useful in emergency rooms, clinics, and home care situations, providing speedy and accurate results that support immediate decision-making. Japan's population growth and increasing aging rate also fuel demand for POC testing, where early diagnosis and treatment are essential. With advances in technologies like instant blood glucose testing, pregnancy tests, and infection detection, the waits for patients and healthcare professionals are minimized and care efficiency increased. Additionally, the convenience offered by POC tests relieves healthcare facilities from the workload, and resource utilization is enhanced. For instance, in June 2023, Sysmex Corporation announced the launch of the world's first point-of-care testing system that detects antimicrobial susceptibility within 30 minutes. Designed for urinary tract infections, the system utilizes innovative microfluidic technology to provide rapid results, enhancing antimicrobial use and addressing the urgent global threat of antimicrobial resistance (AMR). As Japan focuses on improving healthcare accessibility and reducing hospital overcrowding, the POC diagnostic tools market is expected to expand rapidly, becoming a key part of the nation's healthcare infrastructure.

To get more information on this market Request Sample

Integration of Artificial Intelligence

Artificial Intelligence (AI) is transforming the Japan diagnostic testing market by enhancing accuracy, speed, and efficiency in test result interpretation. AI algorithms are now being integrated into diagnostic devices, enabling them to analyze complex data more effectively than traditional methods. This is particularly beneficial in areas such as imaging, pathology, and molecular diagnostics, where AI can quickly identify patterns and anomalies that may be overlooked by human clinicians. AI also reduces the chances of human error, ensuring more reliable diagnoses and improving patient outcomes. For instance, in January 2025, Monitor Corporation announced the launch of its AI lung cancer diagnosis tool, MONCAD CTLN, in Japan through a partnership with Doctor-NET. The software aids radiologists in detecting lung cancer via CT scans. With Japan's radiologist shortage, this collaboration aims to enhance AI-assisted diagnostics in the healthcare sector. Moreover, AI-driven tools assist in personalized medicine by analyzing genetic data to recommend tailored treatment plans. With growing investment in AI technologies, Japan’s healthcare system is becoming more proactive and precise in managing diseases. The continued integration of AI is expected to contribute significantly to the Japan diagnostic testing market growth, driving innovation and increasing demand for AI-powered diagnostic solutions.

Japan Diagnostic Testing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on test type, technology, sample type, mode of testing, application, and end user.

Test Type Insights:

- Laboratory Testing

- Point-of-Care Testing (POCT)

- Imaging Diagnostics

- Molecular Diagnostics

- Others

The report has provided a detailed breakup and analysis of the market based on the test type. This includes laboratory testing, point-of-care testing (POCT), imaging diagnostics, molecular diagnostics, and others.

Technology Insights:

- Immunoassay-Based

- PCR-Based

- Next Gen Sequencing

- Spectroscopy-Based

- Chromatography-Based

- Microfluidics

- Others

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes immunoassay-based, PCR-based, next gen sequencing, spectroscopy-based, chromatography-based, microfluidics, and others.

Sample Type Insights:

- Blood

- Urine

- Saliva

- Sweat

- Hair

- Others

A detailed breakup and analysis of the market based on the sample type have also been provided in the report. This includes blood, urine, saliva, sweat, hair, and others.

Mode of Testing Insights:

- Prescription Based Testing

- OTC Testing

A detailed breakup and analysis of the market based on the mode of testing have also been provided in the report. This includes prescription based testing and OTC testing.

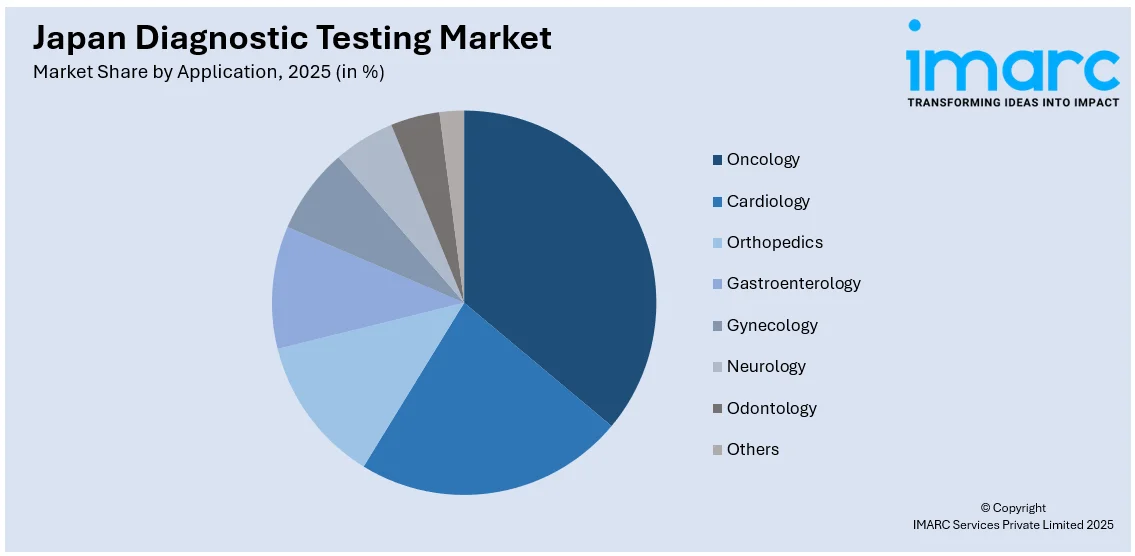

Application Insights:

Access the comprehensive market breakdown Request Sample

- Oncology

- Cardiology

- Orthopedics

- Gastroenterology

- Gynecology

- Neurology

- Odontology

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes oncology, cardiology, orthopedics, gastroenterology, gynecology, neurology, odontology, and others.

End User Insights:

- Hospitals

- Diagnostic Centers

- Ambulatory Surgical Centers (ASCs)

- Specialty Clinics

- Homecare

- Blood Banks

- Research Labs and Institutes

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals, diagnostic centers, ambulatory surgical centers (ASCs), specialty clinics, homecare, blood banks, research labs and institutes, and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Diagnostic Testing Market News:

- In August 2024, Hitachi High-Tech and Gencurix announced their partnership to enhance cancer molecular diagnostics, combining Hitachi's expertise in diagnostic products with Gencurix's biomarker discovery technology. Their collaboration aims to develop reliable testing services in Japan, promoting personalized medicine and improving cancer diagnosis through advanced digital solutions and innovative testing methodologies.

- In April 2024, C2N Diagnostics announced its partnership with Mediford Corporation to expand its Alzheimer’s disease blood testing services in Japan. This collaboration enhances access to advanced biomarker testing, addressing the country’s high prevalence of Alzheimer’s. C2N aims to support clinical research and improve early diagnosis and treatment monitoring for neurological diseases in Japan.

Japan Diagnostic Testing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Test Types Covered | Laboratory Testing, Point-of-Care Testing (POCT), Imaging Diagnostics, Molecular Diagnostics, Others |

| Technologies Covered | Immunoassay-Based, PCR-Based, Next Gen Sequencing, Spectroscopy-Based, Chromatography-Based, Microfluidics, Others |

| Sample Types Covered | Blood, Urine, Saliva, Sweat, Hair, Others |

| Modes of Testing Covered | Prescription Based Testing, OTC Testing |

| Applications Covered | Oncology, Cardiology, Orthopedics, Gastroenterology, Gynecology, Neurology, Odontology, Others |

| End Users Covered | Hospitals, Diagnostic Centers, Ambulatory Surgical Centers (ASCs), Specialty Clinics, Homecare, Blood Banks, Research Labs and Institutes, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan diagnostic testing market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan diagnostic testing market on the basis of test type?

- What is the breakup of the Japan diagnostic testing market on the basis of technology?

- What is the breakup of the Japan diagnostic testing market on the basis of sample type?

- What is the breakup of the Japan diagnostic testing market on the basis of mode of testing?

- What is the breakup of the Japan diagnostic testing market on the basis of application?

- What is the breakup of the Japan diagnostic testing market on the basis of end user?

- What is the breakup of the Japan diagnostic testing market on the basis of region?

- What are the various stages in the value chain of the Japan diagnostic testing market?

- What are the key driving factors and challenges in the Japan diagnostic testing market?

- What is the structure of the Japan diagnostic testing market and who are the key players?

- What is the degree of competition in the Japan diagnostic testing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan diagnostic testing market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan diagnostic testing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan diagnostic testing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)