Japan Dialysis Equipment Market Size, Share, Trends and Forecast by Type, End User, and Region, 2026-2034

Japan Dialysis Equipment Market Overview:

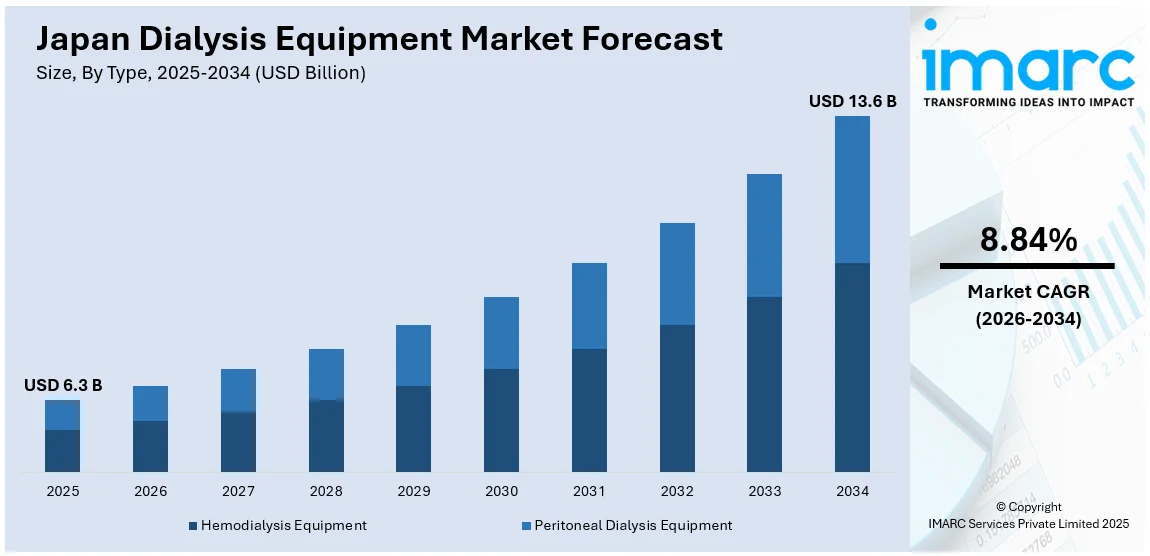

The Japan dialysis equipment market size reached USD 6.3 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 13.6 Billion by 2034, exhibiting a growth rate (CAGR) of 8.84% during 2026-2034. The market is driven by an aging population, high prevalence of chronic kidney disease, and a strong healthcare infrastructure. Technological innovations and government support for renal care also enhance treatment accessibility and quality. Leading global and domestic companies are further contributing to a competitive environment, shaping the landscape of the Japan dialysis equipment market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 6.3 Billion |

| Market Forecast in 2034 | USD 13.6 Billion |

| Market Growth Rate 2026-2034 | 8.84% |

Japan Dialysis Equipment Market Trends:

Aging Population and Rising CKD Prevalence

Japan has one of the world’s oldest populations, with a significant portion over the age of 65. As people age, they become more likely to develop diabetes and hypertension, which are among the top contributors to CKD. Since the rate of CKD is growing, more elderly patients are receiving dialysis as regular renal support is needed for them. The healthcare system in Japan handles the demand well, although the increasing number of patients causes strain, so dialysis services are being modernized. As a result of this aging population, there is continuous growth in the dialysis equipment market because caregivers need to provide more and better services to patients.

To get more information on this market Request Sample

Expansion of Home-Based Dialysis Treatments

The Japan dialysis equipment market growth is also driven by the gradual but steady shift toward home-based dialysis solutions, particularly peritoneal dialysis and home hemodialysis. It is mainly caused by more people desiring easier access and more control, a wish to relieve hospitals, and initiatives by the government aiming to spread health support. New portable buildings for dialysis and online monitoring have made it safer and more convenient for people to perform dialysis at home. Additionally, by delivering care at home, Japan reduces the need for elderly patients to be hospitalized and makes their lives easier. Home-based therapy is increasing the demand for easy-to-use small equipment and training aids, which is boosting growth and advancements in the dialysis equipment industry.

Government Support and Healthcare Infrastructure

Japan’s universal healthcare system provides comprehensive coverage for dialysis treatments, significantly reducing the financial burden on patients. This strong public support ensures that individuals with chronic kidney disease have consistent access to high-quality care, regardless of income level. The government also actively promotes innovations in renal therapy, funds specialized treatment centers, and regulates quality standards for dialysis equipment. These policies have created a stable environment for investment and expansion in the dialysis sector. Furthermore, collaboration between public institutions and private manufacturers fosters the development and adoption of next-generation dialysis technologies. This solid infrastructure and policy framework are crucial enablers of market growth, ensuring consistent demand and encouraging the development of more efficient and patient-focused equipment.

Japan Dialysis Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type and end user.

Type Insights:

- Hemodialysis Equipment

- Hemodialysis Machines

- n-Center Hemodialysis Machines

- Home Based Hemodialysis Machines

- Hemodialysis Consumables

- Dialyzers

- Dialysate

- Access Products

- Others

- Hemodialysis Machines

- Peritoneal Dialysis Equipment

- Peritoneal Dialysis Equipment Type

- Continuous Ambulatory Peritoneal Dialysis (CAPD)

- Automated Peritoneal Dialysis (APD)

- Peritoneal Dialysis Product

- Cyclers

- Fluids

- Others

- Peritoneal Dialysis Equipment Type

The report has provided a detailed breakup and analysis of the market based on the type. This includes hemodialysis equipment [hemodialysis machines (n-center hemodialysis machines, and home-based hemodialysis machines) and hemodialysis consumables (dialyzers, dialysate, access products, and others)] and peritoneal dialysis equipment [peritoneal dialysis equipment type (continuous ambulatory peritoneal dialysis (CAPD) and automated peritoneal dialysis (APD)] and peritoneal dialysis product (cyclers, fluids, and others).

End User Insights:

Access the comprehensive market breakdown Request Sample

- Dialysis Centers and Hospitals

- Home Healthcare

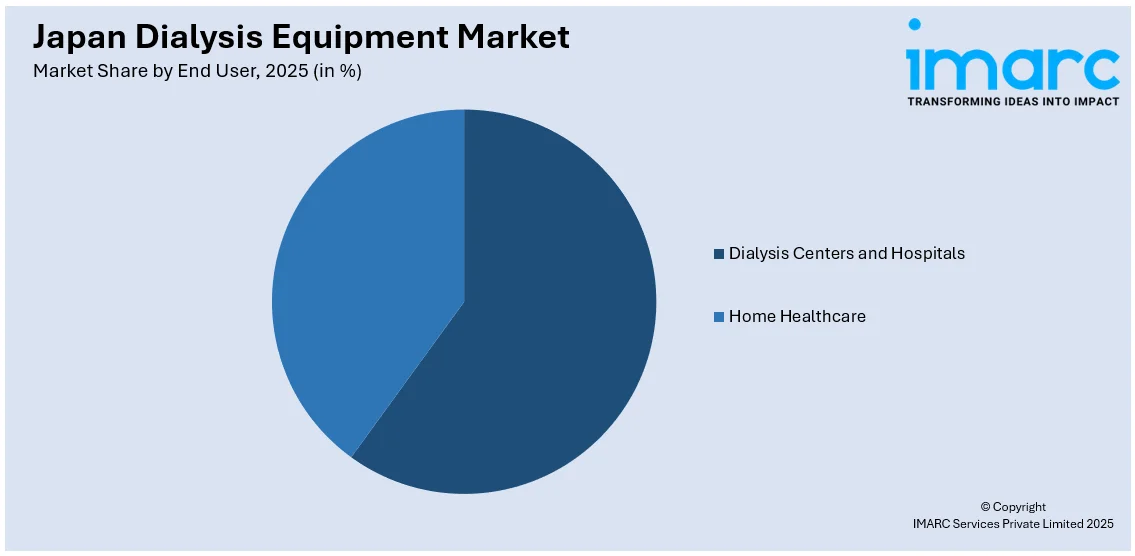

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes dialysis centers and hospitals and home healthcare.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include the Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Dialysis Equipment Market News:

- In December 2023, Maruishi Pharmaceutical Co., Ltd. and Kissei Pharmaceutical Co., Ltd. announced that the KORSUVA® IV Injection Syringe for Dialysis 17.5μg, 25.0μg, and 35.0μg will be introduced in Japan.

Japan Dialysis Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| End Users Covered | Dialysis Centers and Hospitals, Home Healthcare |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan dialysis equipment market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan dialysis equipment market on the basis of type?

- What is the breakup of the Japan dialysis equipment market on the basis of end user?

- What is the breakup of the Japan dialysis equipment market on the basis of region?

- What are the various stages in the value chain of the Japan dialysis equipment market?

- What are the key driving factors and challenges in the Japan dialysis equipment market?

- What is the structure of the Japan dialysis equipment market and who are the key players?

- What is the degree of competition in the Japan dialysis equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan dialysis equipment market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan dialysis equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan dialysis equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)