Japan Diaper Market Report by Product Type (Baby Diaper, Adult Diaper), Distribution Channel (Supermarkets and Hypermarkets, Pharmacies, Convenience Stores, Online Stores, and Others), and Region 2026-2034

Japan Diaper Market:

Japan diaper market size reached USD 2.65 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 4.03 Billion by 2034, exhibiting a growth rate (CAGR) of 4.75% during 2026-2034. The market is being driven by high personal hygiene awareness, a growing trend towards organic and hypoallergenic materials and the focus on quality diaper solutions for adults and infants.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 2.65 Billion |

|

Market Forecast in 2034

|

USD 4.03 Billion |

| Market Growth Rate 2026-2034 | 4.75% |

Access the full market insights report Request Sample

Japan Diaper Market Analysis:

- Major Market Drivers: The growing awareness among individuals towards personal hygiene is driving the market. Additionally, the increasing number of working women is escalating the demand for disposable diapers for their children, which is also acting as another significant growth-inducing factor.

- Key Market Trends: The development of product variants that are produced by using organic or hypoallergenic materials is gaining traction across the country. Moreover, the rising emphasis of key players on creating quality diapering solutions for both adults and infants is further bolstering the market.

- Competitive Landscape: Some of the prominent companies in the market across Japan include Kao Corporation, LiveDo CORPORATION, Oji Holdings Corporation, and Unicharm Corporation, among many others.

- Challenges and Opportunities: The declining birth rate across the country represents one of the primary challenges hampering the market. However, continuous product innovations, including the introduction of environmentally friendly and bio-based diaper options, will continue to fuel the overall market in the coming years.

Japan Diaper Market Trends:

Rising Adult Population

The shifting preferences from regular nappies towards adult diapers, owing to declining birth rates and the increasing aging population across the country, are primarily augmenting the market. According to the report published by BBC, the number of babies born in Japan in 2023 was approximately down by 5.1% from 2022. However, the expanding geriatric population has led to significant demand for adult diapers. As per the latest data updated by the World Economic Forum in September 2023, more than one in 10 individuals in Japan are aged 80 or older. Moreover, according to the article published by the Guardian in February 2024, the population across Japan, accounting for about 125 million is expected to fall by about 30% to 87 million by 2070. This demographic shift has prompted companies to innovate and cater to the needs of elderly consumers, which is stimulating the market. As per IMARC, the Japan adult diaper market size reached US$ 2.6 Billion in 2023. Looking forward, IMARC Group projects the market to reach US$ 5.0 Billion by 2032, exhibiting a growth rate (CAGR) of 7.5% during 2024-2032. The increasing popularity of quality diapering solutions among adults is anticipated to fuel the Japan diaper market growth across the country over the forecasted period. For instance, in March 2024, Oji Holdings announced its inclination towards the production of adult diapers, amid a rise in the aging population in Japan.

Increasing Eco-Friendly Options

More than two million metric tons of used disposable diapers are discarded as trash each year in Japan, most of which generally comprise between 4%-6% of burnable trash. As a result, the growing consumer environmental awareness is escalating the adoption of recycling techniques, thereby stimulating the market across the country. For instance, in February 2023, Kao Corporation and Kyoto University successfully completed the verification testing of the used disposable diaper carbonization recycling system in collaboration with Saito City, Japan. Additionally, various innovations in diaper production, setting high safety and quality standards, are also elevating the Japan diaper market revenue. For example, some of the prominent corporations in Japan, like Lec Inc., Pigeon Corporation, KAO, and Unicharm, are integrating biodegradable and recycled materials into their designs. Apart from this, the development of diaper options that produce low to zero volatile organic compounds (VOCs) is fueling the market. For instance, in April 2024, Unicharm launched the world’s first disposable diapers via horizontal recycling in stores across South Japan. This method allows limited resources to be reused, thereby minimizing the demand for wood pulp and petroleum-based materials. Moreover, the increasing waste generation is elevating the need for broader sustainability goals. For example, in June 2023, a team of researchers from the University of Kitakyushu in Japan introduced a type of concrete that can replace up to 40% of sand with shredded diapers. Consequently, the rise in environmentally conscious consumer behavior is expected to augment the Japan diaper market outlook over the forecasted period.

Popularity of Smart Diapers

The increasing prevalence of urinary tract infections is escalating the popularity of smart product variants that report and monitor health metrics, thereby providing real-time data to caregivers. For instance, in March 2024, Japan-based Toray Industries launched a diaper-embedded urination sensor using semiconductive carbon nanotubes. In line with this, the company also tested the capabilities of automatic urine-detecting diapers worn by patients at nursing homes. It was intended to further evaluate performance with larger groups of individuals, with a view to commercializing the sensor during the fiscal year ending March 2026. Besides this, key players are focusing on adopting cutting-edge materials and design methodologies to reduce bulkiness, increase absorption capabilities, enhance user comfort, etc., which is one of the Japan diaper market's recent opportunities. For example, in April 2023, JoeCo launched diapers with a super thin 2mm Japanese absorption core technology that contains one million premium SAP particles for rapid and extensive absorption, thereby preventing shifting and securely locking in fluids. Additionally, the smart moisture indicator strip signals the optimal diaper-changing time for mothers. Apart from this, the increasing usage of these diapers in skilled nursing facilities and other healthcare settings is driving the market across the country. For instance, in September 2021, a team of researchers at the Tokyo University of Science (TUS) in Japan developed a diaper that detects blood glucose levels in individuals. The glucose-testing diaper is equipped with a self-powered sensor that utilizes a biofuel cell to detect the presence of urine, measure its glucose concentration, and then wirelessly transmit that information to patients and medical personnel. These innovations will continue to bolster the Japan diaper market share in the coming years.

Japan Diaper Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with the Japan diaper market forecast at the country and regional levels for 2026-2034. Our report has categorized the market based on the product type and distribution channel.

Breakup by Product Type:

To get detailed segment analysis of this market Request Sample

- Baby Diaper

- Disposable Diapers

- Training Diapers

- Cloth Diapers

- Swim Pants

- Biodegradable Diapers

- Adult Diaper

- Pad Type

- Flat Type

- Pant Type

The report has provided a detailed breakup and analysis of the market based on the product type. This includes baby diaper (disposable diapers, training diapers, cloth diapers, swim pants, and biodegradable diapers), and adult diaper (pad type, flat type, and pant type).

The widespread usage of disposable diapers that provide convenience to babies is catalyzing the market across the country. For example, Pampers, one of the most popular brands in Japan, offers disposable diapers with super absorption and a highly functional design. Moreover, training diapers are designed to help children transition from diapers to regular underwear. Besides this, they are equipped with indicators that change color to signal when it's time for a change, aiding both parents and children during the toilet training phase. Furthermore, according to the Japan diaper market overview, the growing need for minimizing the risk of rashes is acting as another significant growth-inducing factor. For instance, the Merries diaper brand by Kao Corporation created a line of diapers with a three-layer, breathable design that keeps the baby's skin dry. Apart from this, pad type diapers are designed for light incontinence, offering discreet protection that can be easily attached to regular underwear. As a result, they are ideal for active seniors who require minimal assistance. In addition, flat type diapers provide more substantial coverage. They are suited for moderate to heavy incontinence, often used by individuals with limited mobility or those receiving care in nursing homes. Pant type diapers, resembling regular underwear, offer maximum comfort and convenience, allowing users to maintain their dignity and independence while managing incontinence. These pants are popular among active adults who prefer a secure fit and ease of use. They ensure comprehensive care and support for the elderly, addressing different levels of incontinence and enhancing the quality of life for users. This, in turn, is elevating the Japan diaper market's recent price.

Breakup by Distribution Channel:

- Supermarkets and Hypermarkets

- Pharmacies

- Convenience Stores

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, pharmacies, convenience stores, online stores, and others.

Supermarkets and hypermarkets constitute a significant portion, offering a wide variety of diaper brands and types, attracting customers with convenience and competitive pricing. Pharmacies are also key players, providing both baby and adult diapers, often emphasizing medical-grade products and personalized advice for incontinence management. Convenience stores cater to immediate needs, stocking essential diaper products for quick and easy access, especially in urban areas, which is escalating the Japan diaper market demand. The rise of online stores offers a vast selection of diapers with the added benefits of home delivery, subscription services, and often lower prices. Other channels include specialty baby stores and healthcare facilities, which provide niche products and professional guidance. This multi-channel distribution strategy ensures that consumers have access to a wide range of products suited to their specific needs and preferences. For example, Moony, one of the brands under Unicharm, offers a subscription service that delivers diapers directly to consumers' homes regularly. This service ensures that parents never run out of diapers and saves time on regular shopping trips.

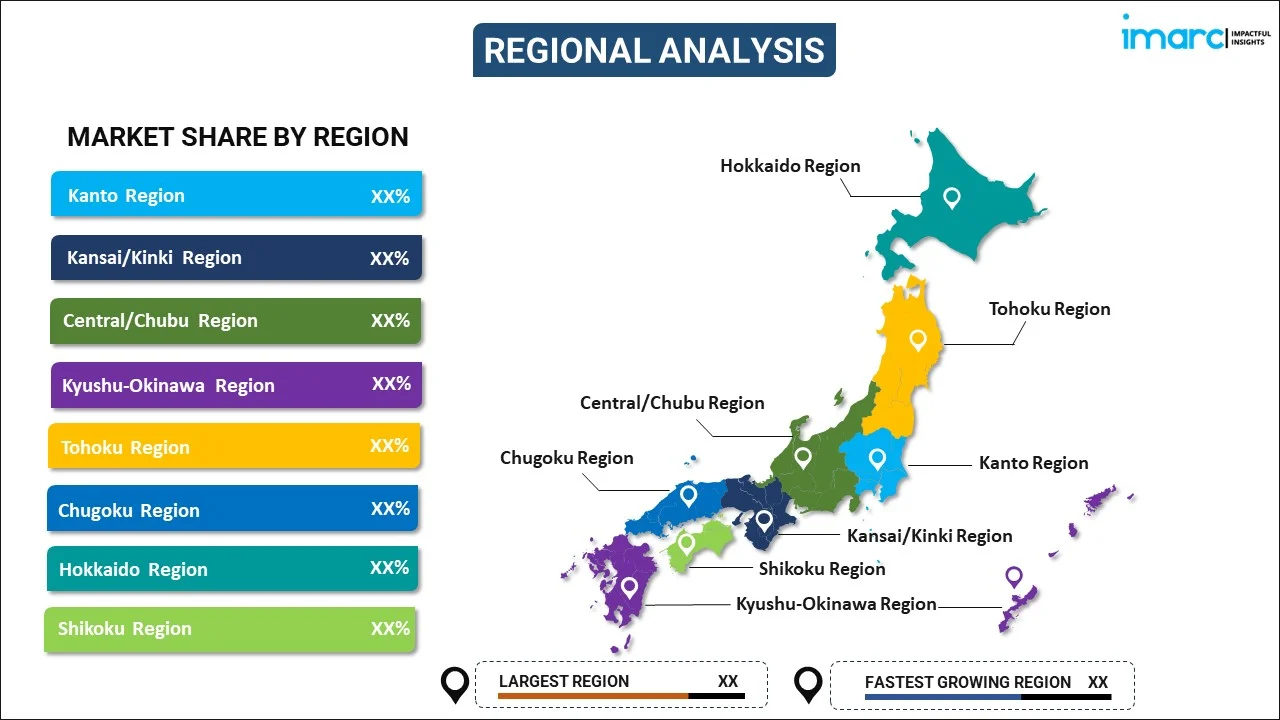

Breakup by Region:

To get detailed regional analysis of this market Request Sample

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include the Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

As per the Japan diaper market statistics, demographic trends and changing consumer preferences across the country's diverse regions are propelling the growth in this segment. In the Kanto Region, which includes Tokyo, the high population density is driving the demand for both baby and adult diapers. Moreover, companies like Unicharm have a significant presence here, offering a wide range of products, including their popular MamyPoko baby diapers. Besides this, the Kansai/Kinki Region, with cities like Osaka and Kyoto, also shows robust market activity, with a focus on convenience store sales due to the busy urban lifestyles. In the Central/Chubu Region, known for its manufacturing hubs, there is a steady demand for diapers, with local brands gaining traction in supermarkets and hypermarkets.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major Japan diaper market companies have been provided. Some of the key players include:

- Kao Corporation

- LiveDo CORPORATION

- Oji Holdings Corporation

- Unicharm Corporation

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Japan Diaper Market Recent Developments:

- April 2024: Unicharm, one of the firms based in Kagoshima, Japan, launched the world's first horizontally recycled diapers.

- March 2024: Japan-based Toray Industries introduced a diaper-embedded urination sensor by utilizing semiconductive carbon nanotubes.

- March 2024: Oji Holdings, one of the companies in Japan, announced its plan to halt the production of baby diapers to manufacture more diapers for adults, owing to the declining birth rates across the country.

Japan Diaper Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered |

|

| Distribution Channels Covered | Supermarkets and Hypermarkets, Pharmacies, Convenience Stores, Online Stores, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Companies Covered | Kao Corporation, LiveDo CORPORATION, Oji Holdings Corporation, Unicharm Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan diaper market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Japan diaper market?

- What is the breakup of the Japan diaper market on the basis of product type?

- What is the breakup of the Japan diaper market on the basis of distribution channel?

- What are the various stages in the value chain of the Japan diaper market?

- What are the key driving factors and challenges in the Japan diaper?

- What is the structure of the Japan diaper market and who are the key players?

- What is the degree of competition in the Japan diaper market?

Key Benefits for Stakeholders:

- IMARC's industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan diaper market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan diaper market.

- The study maps the leading, as well as the fastest-growing, markets. It further enables stakeholders to identify the key country-level markets within the region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan diaper industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)