Japan Die Casting Components Market Size, Share, Trends and Forecast by Component Type, Material Type, Process Type, Sales Channel, End Use Industry, and Region, 2026-2034

Japan Die Casting Components Market Summary:

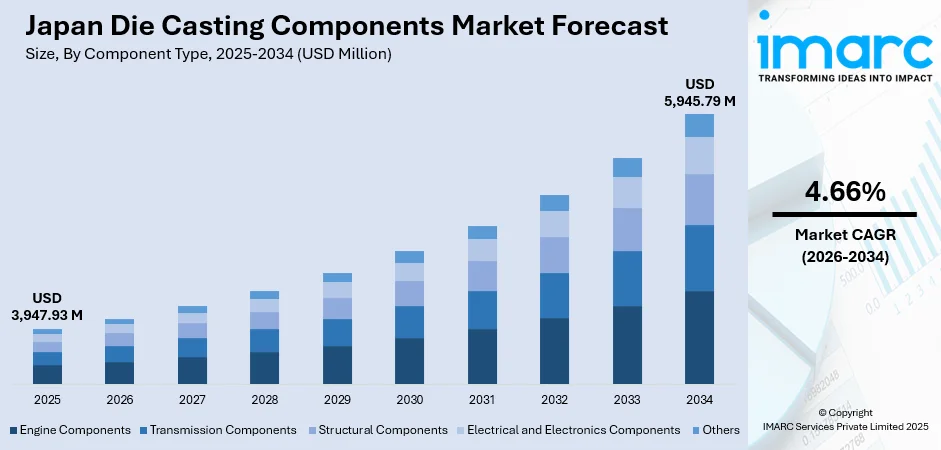

The Japan die casting components market size was valued at USD 3,947.93 Million in 2025 and is projected to reach USD 5,945.79 Million by 2034, growing at a compound annual growth rate of 4.66% from 2026-2034.

The Japan die casting components market is witnessing steady growth, driven by rising demand from the automotive industry for lightweight, fuel-efficient vehicles. Continuous advancements in die casting technologies are enhancing manufacturing precision, efficiency, and overall product quality. Simultaneously, increasing focus on sustainability is encouraging the adoption of eco-friendly casting methods and material recycling practices. These factors collectively support market expansion while aligning with the broader trend toward greener, more efficient automotive manufacturing.

Key Takeaways and Insights:

-

By Component Type: Engine components dominate the market with a share of 30.06% in 2025, driven by continuous demand for high-precision engine blocks, cylinder heads, and powertrain components requiring superior strength-to-weight ratios.

-

By Material Type: Aluminum die castings lead the market with a share of 50.05% in 2025, owing to aluminum's excellent lightweight properties, corrosion resistance, and thermal conductivity ideal for automotive and electronics applications.

-

By Process Type: High-Pressure Die Casting (HPDC) represents the largest segment with a market share of 55.07% in 2025, attributed to its capability for high-volume production of complex geometries with excellent dimensional accuracy.

-

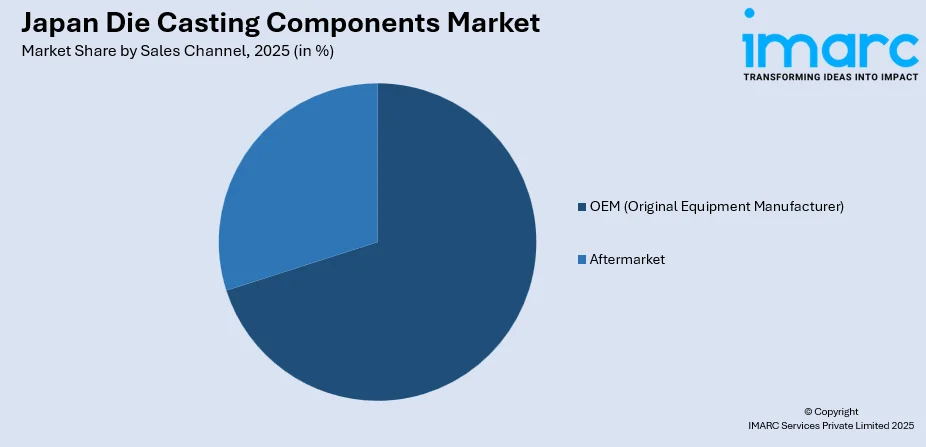

By Sales Channel: OEM (Original Equipment Manufacturer) exhibits clear dominance with a 70.21% share in 2025, reflecting strong relationships between die casting suppliers and major Japanese automotive and electronics manufacturers.

-

By End Use Industry: Automotive dominates the market with a share of 50.18% in 2025, driven by Japan's position as a global automotive manufacturing hub with leading OEMs demanding lightweight die-cast components.

-

Key Players: The Japan die casting components market features a competitive landscape comprising established domestic manufacturers, tier-one automotive suppliers, and specialized foundries competing through precision engineering capabilities, technological innovation, and integrated supply chain solutions.

To get more information on this market Request Sample

The Japan die casting components market is undergoing significant evolution, driven by the adoption of advanced technologies to meet the exacting quality standards of automotive, aerospace, and electronics sectors. Renowned for its expertise in precision engineering, Japan’s automotive industry pushes suppliers to implement high-accuracy die casting methods that deliver superior component quality. In November 2025, UBE Machinery’s development of a giga‑cast capable ultra‑large die casting machine, a breakthrough for EV structural modules, was recognized with the prestigious 41st Metalforming Industry Technology Award for its contribution to advancing die casting capabilities. Innovations such as vacuum die casting and squeeze casting are enhancing production efficiency, boosting component performance, and reducing defects. At the same time, a strong emphasis on environmental sustainability is encouraging the use of aluminum recycling and energy-efficient casting processes, helping manufacturers lower carbon footprints. These technological and sustainable practices collectively reinforce Japan’s position as a leader in high-quality die casting components.

Japan Die Casting Components Market Trends:

Lightweight Vehicle Development Accelerating Demand

Japanese automakers are increasingly adopting die-cast components to reduce vehicle weight and boost fuel efficiency. The shift toward electric and hybrid vehicles drives demand for lightweight aluminum and magnesium castings, enhancing battery range, performance, and handling. Nissan plans to introduce gigacast aluminum structural components in some EVs from fiscal 2027, cutting part count and weight while improving manufacturing efficiency. This trend offers growth opportunities for die casting suppliers as lightweight materials become essential for meeting emissions standards and consumer demand for efficient, eco-friendly vehicles.

Advanced Manufacturing Technologies Transforming Production

Japanese die casting manufacturers are increasingly leveraging advanced technologies, including computer-aided engineering, automated systems, and Industry 4.0 solutions, to enhance precision and efficiency. At the Japan Die Casting Congress & Exposition 2024, HACARUS showcased the AI-powered “HACARUS Check for iWRIST,” automating visual inspection of complex die-cast parts. Integrating robotics and AI enables production of intricate components with fewer defects and less material waste, streamlining operations, improving consistency, and boosting competitiveness to meet rising demand for high-quality, precision-engineered die-cast components.

Sustainability Initiatives Driving Green Manufacturing

Environmental sustainability is driving the Japanese die casting market, with manufacturers adopting eco-friendly practices like aluminum recycling and energy-efficient casting. Companies are optimizing processes to cut carbon emissions, reduce waste, and conserve energy. In 2025, Isuzu Motors developed a high-efficiency aluminum melting furnace for large die-cast parts, cutting energy use by nearly 50% and winning the METI Manufacturing Industry Director Award. Green technologies enhance regulatory compliance, corporate responsibility, and market reputation, meeting rising demand for sustainable practices in automotive, aerospace, and electronics sectors.

Market Outlook 2026-2034:

The Japan die casting components market outlook remains positive as automotive industry transformation and electric vehicle adoption create sustained demand for lightweight precision components. Technological advancements in casting processes and materials science are expected to enhance manufacturing capabilities and expand application possibilities. Japan's established position in advanced automotive engineering and precision manufacturing provides competitive advantages supporting continued market expansion. The market generated a revenue of USD 3,947.93 Million in 2025 and is projected to reach a revenue of USD 5,945.79 Million by 2034, growing at a compound annual growth rate of 4.66% from 2026-2034.

Japan Die Casting Components Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Component Type |

Engine Components |

30.06% |

|

Material Type |

Aluminum Die Castings |

50.05% |

|

Process Type |

High-Pressure Die Casting (HPDC) |

55.07% |

|

Sales Channel |

OEM (Original Equipment Manufacturer) |

70.21% |

|

End Use Industry |

Automotive |

50.18% |

Component Type Insights:

- Engine Components

- Transmission Components

- Structural Components

- Electrical and Electronics Components

- Others

The engine components dominate with a market share of 30.06% of the total Japan die casting components market in 2025.

The engine components segment maintains leadership driven by continuous automotive industry demand for high-precision engine blocks, cylinder heads, and powertrain components. Japanese automakers require die-cast engine parts offering superior strength-to-weight ratios and excellent dimensional accuracy to meet stringent performance and efficiency standards. In May 2025, Honda showcased a closed‑loop die‑casting aluminum recycling technology at the Automotive Engineering Exposition 2025 in Yokohama, developed with technical support from Honda Trading Group, enabling the use of die‑cast aluminum scrap in new castings and advancing sustainable production of high‑precision components such as engine housings.

Aluminum die-cast engine components are essential for lowering vehicle weight, enhancing fuel efficiency, and complying with strict emission regulations. Modern die-casting advancements enable the production of complex shapes with high structural strength and improved thermal management, supporting more efficient, high-performance powertrains. These technological improvements allow automakers to meet both environmental and performance goals, making aluminum die-cast parts a critical element in the design of contemporary engines.

Material Type Insights:

- Aluminum Die Castings

- Zinc Die Castings

- Magnesium Die Castings

- Others

The aluminum die castings leads with a share of 50.05% of the total Japan die casting components market in 2025.

Aluminum die castings are widely used in automotive and electronics industries due to their lightweight structure, high corrosion resistance, and excellent thermal conductivity. Japanese manufacturers increasingly favor aluminum to achieve vehicle weight reduction, enhance fuel efficiency, and lower emissions. Its strength and durability make it suitable for high-performance components, while recyclability aligns with sustainability initiatives. Continuous improvements in alloy design are enabling more complex shapes and superior functional performance.

The growing adoption of aluminum die castings in Japan is driven by technological innovations and stricter environmental regulations. Advanced alloy formulations offer improved mechanical properties, thermal management, and structural integrity, supporting demanding applications in engines, chassis, and electronic housings. Manufacturers benefit from both operational efficiency and compliance with sustainability standards. As research progresses, aluminum’s versatility is expanding, opening new opportunities in lightweight design, energy efficiency, and multi-sector industrial applications.

Process Type Insights:

- High-Pressure Die Casting (HPDC)

- Low-Pressure Die Casting (LPDC)

- Gravity Die Casting

- Others

The high-pressure die casting (HDPC) dominates with a market share of 55.07% of the total Japan die casting components market in 2025.

High-pressure die casting dominates process preferences due to its capability for high-volume production of complex geometries with excellent dimensional accuracy and surface finish. The technology enables rapid cycle times and consistent quality essential for automotive mass production requirements while supporting thin-wall casting applications increasingly demanded by lightweight vehicle designs. In March 2025, UBE Machinery’s 6500ton highpressure diecasting machine was installed at Ryobi’s die casting plant in Kikugawa, Japan, to produce integrated ultralarge automotive structural components, demonstrating the push by Japanese suppliers toward advanced HPDC equipment for large, highprecision parts.

In Japan, high-pressure die casting continues to dominate as the favored manufacturing method, thanks to its efficiency in producing complex components at scale. The process ensures precise dimensions and smooth surface finishes, making it ideal for the rigorous standards of automotive production. Its fast production cycles and reliable consistency allow manufacturers to maintain high throughput without sacrificing quality. Moreover, the technique facilitates thin-wall casting, a key factor in developing lighter vehicles, enabling weight reduction while preserving strength and overall performance.

Sales Channel Insights:

Access the comprehensive market breakdown Request Sample

- OEM (Original Equipment Manufacturer)

- Aftermarket

The OEM (original equipment manufacturer) leads with a share of 70.21% of the total Japan die casting components market in 2025.

OEM sales channels hold a dominant position in Japan’s die casting market, underscoring strong collaborations between suppliers and major automotive manufacturers. Tier-one and tier-two suppliers are required to meet stringent quality standards, precise design specifications, and just-in-time delivery requirements. Such partnerships allow for seamless integration into automotive supply chains, ensuring component reliability and enabling the production of high-performance vehicles that reflect the precision and technological advancement of Japan’s automotive industry.

The robustness of OEM relationships significantly enhances supplier competitiveness, as long-term contracts demand unwavering product quality and operational efficiency. By synchronizing production schedules with automakers’ timelines and enforcing rigorous quality control measures, die casting companies solidify their market standing. This strategy enables them to satisfy demanding performance benchmarks, maintain seamless supply chain integration, and support continuous innovation, driving technological advancements that sustain Japan’s leadership in the global automotive manufacturing landscape.

End Use Industry Insights:

- Automotive

- Aerospace and Defense

- Industrial Machinery

- Electrical and Electronics

- Consumer Goods

- Others

The automotive dominates with a market share of 50.18% of the total Japan die casting components market in 2025.

Japan’s automotive industry drives die-cast demand, as leading OEMs require lightweight components for engines, transmissions, and structures. Stringent environmental regulations and government incentives for green technology push automakers toward energy-efficient production. Under the Green Transformation (GX) strategy, part of the 7th Strategic Energy Plan, the Ministry of Economy, Trade and Industry promotes lowemission processes and energy-efficient investments, enabling the automotive and materials sectors to reduce CO₂ emissions, improve sustainability, and maintain global competitiveness in manufacturing.

The automotive sector remains the primary driver of die casting demand in Japan, fueled by the need for lightweight components in engine systems, transmission housings, and structural applications. Government incentives promoting green technologies, combined with strict environmental regulations, encourage automakers to adopt energy-efficient production methods. This focus on sustainability and efficiency continues to stimulate demand for advanced die casting solutions that meet performance, regulatory, and environmental requirements across the automotive value chain.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto Region dominates Japan’s die casting market, anchored by Tokyo and Yokohama as the nation’s industrial and economic hub. Advanced electronics, robotics, and precision manufacturing flourish here, supported by the Keihin Industrial Zone. Integrated die casting facilities, research centers, and efficient port logistics enable high-volume, export-oriented production, reinforcing Kanto’s central role in industrial innovation and supply chain efficiency.

The Kansai/Kinki Region represents a major industrial hub for die casting applications. The region excels in heavy machinery, chemicals, and industrial equipment manufacturing. Established die casting operations support diverse sectors, including electronics and consumer goods. Strong industrial clusters and skilled labor availability ensure Kansai remains a key contributor to Japan’s advanced manufacturing and supply chain ecosystem.

Central/Chubu Region shows a strong presence in the Japan’s automotive die casting demand, with Aichi Prefecture and Nagoya at its industrial core. Hosting Toyota headquarters and extensive tier-one supplier networks, the region excels in automotive and aerospace component production. Chubu’s manufacturing strength, high-volume shipments, and well-integrated supply chains position it as the nation’s primary hub for precision die casting in transportation and industrial sectors.

Kyushu-Okinawa Region shows growing die casting demand driven by semiconductor manufacturing and automotive assembly. Industrial centers like Fukuoka and Kitakyushu host steel production and heavy industries, generating requirements for precision die-cast components. The region also supports electronics and renewable energy sectors, with expanding infrastructure and industrial clusters enhancing local supply chains and regional competitiveness in high-tech and automotive manufacturing.

Tohoku Region offers emerging opportunities in die casting, supported by expanding automotive parts and electronics assembly. Post-disaster reconstruction has stimulated industrial development, attracting tier-two automotive suppliers and production facilities. The region’s growing manufacturing base, combined with improved infrastructure and investment incentives, positions Tohoku as a developing market for precision die casting and associated industrial applications in northern Japan.

Chugoku Region maintains stable die casting activity centered around Hiroshima, driven by shipbuilding, automobile production, and chemical industries. The region benefits from research and development in electronics and advanced materials, fostering innovation in die casting technologies. Well-established industrial clusters and specialized manufacturing operations support steady demand for precision components, ensuring Chugoku’s consistent role in Japan’s manufacturing landscape.

Hokkaido Region represents a smaller die casting market, with demand primarily from agricultural machinery and food processing equipment manufacturing. Limited heavy industrial presence restricts overall market size, but specialized component requirements create niche opportunities for suppliers. Emerging industrial initiatives and localized manufacturing clusters offer targeted potential for precision die casting applications in machinery and equipment essential to the region’s economy.

Shikoku Region contributes modest die casting demand, supporting shipbuilding, chemical production, and regional manufacturing operations. The island’s industrial base generates focused requirements for specialized components, while ongoing connectivity improvements with the mainland enhance supply chain integration. Shikoku’s market is characterized by smaller-scale, niche manufacturing activities that sustain steady demand for precision die casting in targeted industrial sectors.

Market Dynamics:

Growth Drivers:

Why is the Japan Die Casting Components Market Growing?

Automotive Industry Shift Toward Lightweight Vehicles

The rising demand for die casting components from the automobile industry progressively shifting toward lightweight and fuel-efficient vehicle models is significantly propelling market growth. Automotive manufacturers are increasingly applying die-cast parts to engine components, structural components, and transmission systems owing to their superior strength-to-weight ratio and excellent dimensional accuracy. In April 2025, Shibaura Machine Co., Ltd. announced receipt of an order for an ultra-large 12,000-ton die casting machine capable of producing large integrated aluminum structural components, highlighting how suppliers are scaling up equipment to meet the needs of next-generation electric and lightweight vehicles. Japan's position as a leader in sophisticated automotive engineering motivates tier-one and tier-two suppliers to implement high-precision die casting techniques to achieve demanding quality requirements.

Technological Advancements in Manufacturing Processes

Technological upgrades improving manufacturing efficiency, increasing accuracy, and minimizing operational costs are contributing substantially to market growth throughout Japan. Japanese manufacturers are embracing advanced casting methods including semi-solid die casting and vacuum-assisted die casting to enhance structural integrity and minimize porosity in components. In 2025, Techman Robot unveiled a high-speed AI inspection system at iREX 2025 that enables zero-downtime defect detection and quality control for complex parts, cutting inspection time by up to 50% and dramatically improving precision in automated production lines, underscoring how AI and robotics are reshaping manufacturing workflows in die casting and related processes. Integration of computer-aided engineering and automated die casting systems improves casting precision while reducing material waste and production cycle times.

Sustainability and Environmental Stewardship Focus

The Japanese die casting industry is increasingly driven by national emphasis on sustainability and environmental stewardship compelling manufacturers to adopt green practices. Companies are focusing on aluminum recycling and energy-saving casting techniques to minimize their carbon footprint while maintaining production quality and efficiency. Government regulations and corporate sustainability initiatives encourage investment in eco-friendly technologies and processes throughout the die casting value chain. The emphasis on circular economy principles and material recovery aligns with broader Japanese manufacturing sector commitments to environmental responsibility and resource optimization.

Market Restraints:

What Challenges the Japan Die Casting Components Market is Facing?

High Energy Costs Impacting Production Economics

Die casting requires significant energy for melting metals and operating machinery, making manufacturers vulnerable to electricity price fluctuations. In Japan, high energy costs raise production expenses, affecting competitiveness versus lower-cost regions. To manage costs and sustain operations, companies must optimize processes and implement energy-efficient technologies, ensuring economically viable and environmentally responsible die-casting production.

Skilled Labor Availability Constraints

Die casting requires specialized skills for equipment operation, quality assurance, and process optimization. Japan’s aging workforce and limited interest among younger generations create labor shortages, challenging manufacturers’ ability to maintain skilled teams. Workforce constraints hinder capacity expansion and innovation, making talent development and retention critical for sustaining long-term operational performance.

Global Competition Pressures

Japanese die casting faces growing competition from lower-cost regions, particularly Southeast Asia, pressuring pricing and market share. To remain competitive, manufacturers must invest in advanced technologies, process efficiencies, and quality improvements. Sustaining a technological edge while managing costs is essential for defending domestic and international market positions amid global competitive pressures.

Competitive Landscape:

The Japan die casting components market features a competitive landscape comprising established domestic manufacturers, specialized foundries, and integrated automotive suppliers serving diverse industrial sectors. Major players compete through technological innovation, precision engineering capabilities, and comprehensive quality management systems meeting stringent OEM requirements. Companies differentiate through investment in advanced manufacturing technologies, research and development activities, and expansion of production capacities to meet growing demand. Strategic partnerships between die casting suppliers, material providers, and automotive manufacturers strengthen supply chain integration while enabling collaborative product development initiatives.

Recent Developments:

-

In June 2025, Iwaki Die‑Casting Co., Ltd. inaugurated its second MIM (Metal Injection Molding) production facility in Kodaira, introducing advanced automation and unmanned sintering lines to boost high‑precision metal part output for electronics, medical devices, suspension parts and more in 2025.

Japan Die Casting Components Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Component Types Covered | Engine Components, Transmission Components, Structural Components, Electrical and Electronics Components, Others |

| Material Types Covered | Aluminum Die Castings, Zinc Die Castings, Magnesium Die Castings, Others |

| Process Types Covered | High-Pressure Die Casting (HPDC), Low-Pressure Die Casting (LPDC), Gravity Die Casting, Others |

| Sales Channels Covered | OEM (Original Equipment Manufacturer), Aftermarket |

| End Use Industries Covered | Automotive, Aerospace and Defense, Industrial Machinery, Electrical and Electronics, Consumer Goods, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan die casting components market size was valued at USD 3,947.93 Million in 2025.

The Japan die casting components market is expected to grow at a compound annual growth rate of 4.66% from 2026-2034 to reach USD 5,945.79 Million by 2034.

The engine components segment dominates with a 30.06% share, driven by continuous automotive demand for high-precision engine blocks and powertrain components requiring superior strength-to-weight ratios.

Key factors driving the Japan die casting components market include automotive industry shift toward lightweight vehicles, technological advancements in manufacturing processes, growing electric vehicle production, and increasing emphasis on sustainability and environmental stewardship.

Major challenges include high energy costs impacting production economics, skilled labor availability constraints amid aging demographics, global competition pressures from lower-cost manufacturing regions, and capital-intensive requirements for advanced manufacturing equipment upgrades.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)