Japan Diesel Power Plant Market Size, Share, Trends and Forecast by Component, Capacity Range, Application, and Region, 2026-2034

Japan Diesel Power Plant Market Summary:

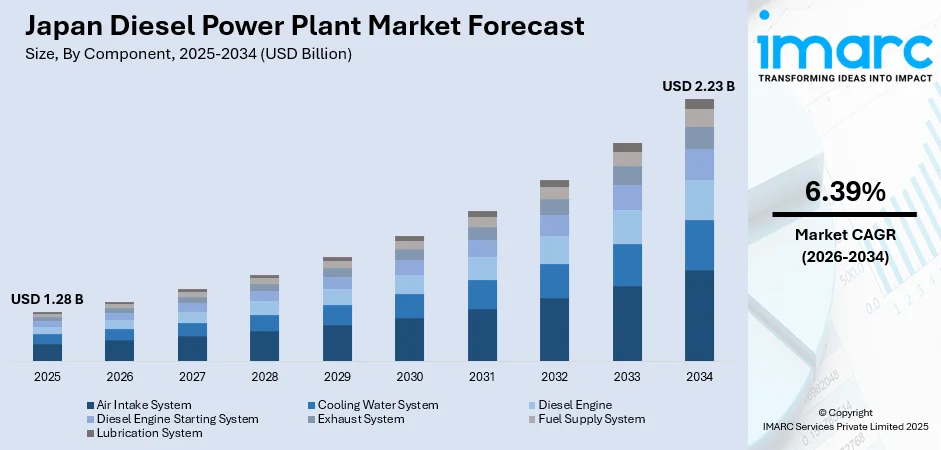

The Japan diesel power plant market size was valued at USD 1.28 Billion in 2025 and is projected to reach USD 2.23 Billion by 2034, growing at a compound annual growth rate of 6.39% from 2026-2034.

The Japan diesel power plant market is experiencing robust growth driven by the nation's increasing demand for reliable backup power solutions across industrial, commercial, and critical infrastructure applications. Diesel power plants will also play a critical role in a consistent supply of energy in regions with limited grid connectivity and emergency power demand. The market environment is shifting as the incorporation of hybrid systems involving diesel generators and renewable energy sources is transforming the market environment, and the strictness of emission regulations is driving the market towards the implementation of new emission control technologies.

Key Takeaways and Insights:

-

By Component: Diesel engine dominates the market with a share of 46% in 2025, driven by its central role in power generation efficiency and reliability across applications.

-

By Capacity Range: Medium scale leads the market with a share of 42% in 2025, owing to its versatile deployment across industrial facilities and commercial establishments.

-

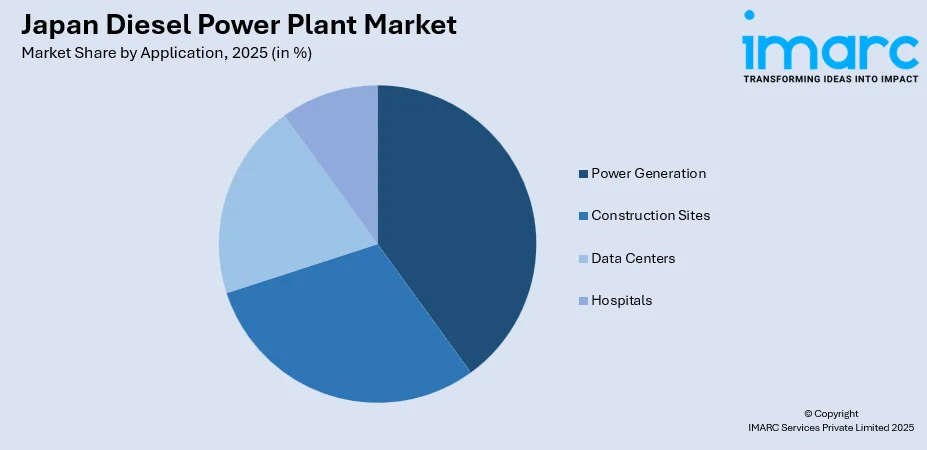

By Application: Power generation represents the largest segment with a market share of 39% in 2025, reflecting Japan's critical need for backup and primary power solutions.

-

By Region: Kanto Region dominates with a share of 34% in 2025, attributed to the high concentration of industrial activities and critical infrastructure in Tokyo metropolitan area.

-

Key Players: The Japan diesel power plant market exhibits a competitive landscape characterized by the presence of established domestic manufacturers alongside international players. Market participants focus on technological innovation, emission compliance, and after-sales service excellence to maintain competitive positioning.

To get more information on this market Request Sample

The Japan diesel power plant market continues to evolve as the nation balances its energy security requirements with environmental sustainability goals. In manufacturing, petrochemical, and heavy industries, industrial plants depend largely on the power plants that produce diesel to ensure that operations are not affected at all, especially in areas where natural disasters are a common occurrence and grid reliability is a point of concern. The energy environment that emerged after Fukushima has contributed to the significance of the distributed power generation model, where diesel generation can be used as a source of backup power in hospitals, data centers, and telecommunication infrastructure. The developed manufacturing industry in Japan requires quality, dependable power generation equipment, which is leading to the creation of efficient engines and emission minimization technology. The government's push for disaster resilience has prompted increased investments in backup power infrastructure across public facilities and emergency response centers.

Japan Diesel Power Plant Market Trends:

Hybrid Power System Integration

The integration of diesel generators with renewable energy sources is transforming Japan's power generation landscape. The Japan diesel generator market size reached USD 1,109.2 Million in 2024. Looking forward, the market is expected to reach USD 2,202.4 Million by 2033, exhibiting a growth rate (CAGR) of 7.1% during 2025-2033. Hybrid systems combining diesel plants with solar photovoltaic arrays and wind turbines are gaining prominence, particularly in remote islands and industrial zones seeking energy cost optimization. These configurations enable seamless power transition during renewable intermittency while reducing overall fuel consumption. Japanese utilities are increasingly deploying hybrid microgrids in island communities, such as those in Okinawa Prefecture, where grid connectivity limitations necessitate innovative power solutions that balance reliability with environmental considerations.

Advanced Emission Control Technologies

Japan's stringent environmental regulations are driving widespread adoption of sophisticated emission control systems in diesel power plants. Selective catalytic reduction systems and diesel particulate filters are becoming standard equipment, enabling facilities to meet increasingly strict nitrogen oxide and particulate matter emission limits. The transition toward ultra-low sulfur diesel fuels further supports cleaner operations. Major industrial complexes in Kawasaki and Yokohama have pioneered the implementation of comprehensive emission monitoring and control systems, establishing benchmarks for environmentally responsible diesel power generation.

Digital Monitoring and Predictive Maintenance

Digital transformation is reshaping diesel power plant operations across Japan through the integration of advanced monitoring systems and predictive maintenance capabilities. The Japan digital transformation market size was valued at USD 57.9 Billion in 2024. Looking forward, the market is expected to reach USD 304.8 Billion by 2033, exhibiting a CAGR of 20.3% from 2025-2033. Internet of Things sensors and artificial intelligence-driven analytics enable real-time performance optimization and early fault detection, minimizing unplanned downtime and extending equipment lifespan. Cloud-based monitoring platforms allow centralized management of distributed diesel generator fleets across multiple locations. Leading data center operators in Tokyo have implemented sophisticated digital twin technologies to simulate power plant performance scenarios and optimize maintenance scheduling.

Market Outlook 2026-2034:

The Japan diesel power plant market is positioned for sustained growth as the nation continues to prioritize energy resilience and industrial competitiveness. Investments in critical infrastructure backup power systems, data center expansion, and disaster preparedness initiatives are expected to drive demand across all market segments. The evolution of emission control technologies and hybrid integration capabilities will enable diesel power plants to maintain relevance within Japan's increasingly sustainability-focused energy landscape. The market generated a revenue of USD 1.28 Billion in 2025 and is projected to reach a revenue of USD 2.23 Billion by 2034, growing at a compound annual growth rate of 6.39% from 2026-2034.

Japan Diesel Power Plant Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Component |

Diesel Engine |

46% |

|

Capacity Range |

Medium Scale |

42% |

|

Application |

Power Generation |

39% |

|

Region |

Kanto Region |

34% |

Component Insights:

- Air Intake System

- Cooling Water System

- Diesel Engine

- Diesel Engine Starting System

- Exhaust System

- Fuel Supply System

- Lubrication System

The diesel engine dominates with a market share of 46% of the total Japan diesel power plant market in 2025.

The diesel engine segment maintains its dominant position within the Japan diesel power plant market, serving as the core power generation unit that determines overall plant efficiency and output capacity. Japanese manufacturers have developed highly refined diesel engine technologies optimized for the demanding operational requirements of industrial and critical infrastructure applications. These engines feature advanced fuel injection systems, turbocharging technologies, and electronic control units that maximize power output while minimizing fuel consumption. The segment benefits from Japan's extensive engineering expertise in internal combustion engine development.

Engine manufacturers continue to invest in research and development (R&D) focused on improving thermal efficiency and reducing emissions across their product portfolios. The trend toward modular engine designs enables flexible capacity scaling to meet diverse power requirements, from small commercial installations to large industrial complexes. Ongoing advancements in metallurgy and precision manufacturing support the production of engines capable of extended operation under demanding conditions, with improved mean time between failures that reduce lifecycle ownership costs for end users.

Capacity Range Insights:

- Large Scale

- Medium Scale

- Small Scale

The medium scale leads with a share of 42% of the total Japan diesel power plant market in 2025.

Medium scale diesel power plants have emerged as the preferred choice across Japan's diverse industrial and commercial sectors, offering an optimal balance between power output capability and capital investment requirements. These installations typically serve manufacturing facilities, commercial complexes, and institutional buildings requiring reliable backup power without the infrastructure demands of large-scale installations. The segment's growth reflects the Japanese market's preference for right-sized power solutions that deliver operational flexibility while maintaining cost efficiency across the equipment lifecycle.

The medium scale segment benefits from standardized equipment configurations that streamline installation, commissioning, and ongoing maintenance activities. Manufacturers have developed containerized and modular solutions within this capacity range that enable rapid deployment and simplified logistics for end users. These configurations prove particularly valuable for disaster recovery applications where speed of installation directly impacts business continuity outcomes. The segment also attracts demand from data center operators seeking scalable power infrastructure that can grow alongside facility expansion plans.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Construction Sites

- Data Centers

- Hospitals

- Power Generation

The power generation exhibits a clear dominance with a 39% share of the total Japan diesel power plant market in 2025.

The power generation application segment leads the Japan diesel power plant market, reflecting the critical importance of a reliable electricity supply across the nation's industrial and infrastructure landscape. Diesel power plants serve both primary generation roles in remote areas with limited grid connectivity and backup generation functions for facilities requiring an uninterrupted power supply. Japan's geographic characteristics, including numerous islands and mountainous terrain, create ongoing demand for distributed generation solutions where centralized grid infrastructure proves impractical or uneconomical.

Industrial complexes and manufacturing facilities represent significant demand sources within this application segment, requiring reliable power for continuous production processes where interruptions result in substantial economic losses. The segment also encompasses peak shaving applications where diesel generators supplement grid power during periods of high demand, helping facilities manage electricity costs and avoid penalties associated with demand charges. Grid support applications continue to grow as utilities seek distributed resources capable of rapid response to system emergencies.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto region dominates with a share of 34% of the total Japan diesel power plant market in 2025.

The Kanto region’s diesel power plant market is supported by rising demand for resilient backup generation across densely populated urban and industrial areas. Frequent grid strain during extreme weather, combined with the need for rapid-response power for hospitals, data centers, and transport infrastructure, increases reliance on diesel systems. Their quick start-up capability and flexible deployment make them essential for ensuring energy stability in a region with high consumption and limited land availability.

The growth is further driven by modernization initiatives that replace aging units with cleaner, high-efficiency diesel technologies that meet Japan’s strict emissions standards. Industries in Kanto continue to adopt hybrid systems integrating diesel with renewables to maintain reliability during variable solar output. Additionally, emergency preparedness policies encourage municipalities and critical facilities to maintain dependable diesel capacity, reinforcing the technology’s role as a secure, dispatchable power source amid evolving regional energy transition goals.

Market Dynamics:

Growth Drivers:

Why is the Japan Diesel Power Plant Market Growing?

Expanding Data Center Infrastructure

Japan's rapidly expanding data center industry represents a significant growth catalyst for the diesel power plant market, as these facilities require highly reliable backup power systems to protect critical computing infrastructure and ensure service availability. The Japan data center market size reached 1.4 GW in 2025. Looking forward, the market is expected to reach 2.2 GW by 2034, exhibiting a growth rate (CAGR) of 4.74% during 2026-2034. The increasing adoption of cloud computing, artificial intelligence, and digital transformation initiatives across Japanese enterprises is driving substantial investments in data center capacity, particularly within the Kanto and Kansai regions. Each new data center development typically incorporates multiple diesel generators configured in redundant arrangements to meet stringent uptime requirements and service level agreements. The hyperscale data center trend, characterized by facilities exceeding certain megawatt power capacities, creates demand for large-scale diesel power plant installations capable of supporting entire campus operations during grid outages.

Enhanced Disaster Preparedness Requirements

Japan's ongoing commitment to disaster preparedness and resilience continues to drive investments in backup power infrastructure across public facilities, emergency response centers, and critical services. The nation's experience with earthquakes, typhoons, and other natural disasters has reinforced the importance of maintaining reliable power generation capabilities independent of vulnerable grid infrastructure. Government initiatives promoting business continuity planning and infrastructure hardening have encouraged organizations across all sectors to upgrade their emergency power systems. Healthcare facilities, telecommunications networks, and transportation infrastructure are prioritizing diesel power plant installations as essential components of comprehensive disaster response strategies.

Industrial Sector Modernization

Japan's industrial sector modernization efforts are generating sustained demand for reliable power generation equipment as manufacturers upgrade aging facilities and implement advanced production technologies. The shift toward automated manufacturing systems, precision equipment, and sensitive electronic controls increases the consequences of power quality issues and supply interruptions. Industrial facilities are increasingly investing in diesel power plants that can provide both backup power and power quality conditioning to protect valuable production equipment. The trend toward reshoring manufacturing activities and supply chain resilience is supporting new industrial development projects that incorporate comprehensive power infrastructure from initial design stages.

Market Restraints:

What Challenges is the Japan Diesel Power Plant Market Facing?

Stringent Environmental Regulations

Japan's increasingly strict environmental regulations impose significant compliance requirements on diesel power plant operators, necessitating substantial investments in emission control technologies and ongoing monitoring systems. The tightening of nitrogen oxide and particulate matter emission limits requires installation of advanced after-treatment equipment that increases both capital and operational costs.

Competition from Alternative Technologies

The diesel power plant market faces increasing competition from alternative backup power technologies, including natural gas generators, battery energy storage systems, and fuel cell solutions. These alternatives offer potential advantages in emissions profile and operational flexibility that appeal to environmentally conscious organizations seeking to reduce their carbon footprint.

Fuel Price Volatility

Fluctuations in diesel fuel prices create uncertainty for power plant operators regarding long-term operational costs and return on investment calculations. Japan's dependence on imported petroleum products exposes the diesel power generation sector to global commodity market dynamics and currency exchange rate movements that complicate financial planning.

Competitive Landscape:

The Japan diesel power plant market exhibits a moderately competitive landscape characterized by the presence of established domestic manufacturers with deep market knowledge alongside international players leveraging global technology platforms. Market participants compete across multiple dimensions, including product reliability, fuel efficiency, emission compliance capabilities, and after-sales service quality. Distribution networks and established customer relationships represent significant competitive advantages, particularly in industrial segments where long-term service agreements and spare parts availability influence purchasing decisions. The market has witnessed increasing emphasis on value-added services, including remote monitoring, predictive maintenance, and turnkey project delivery capabilities. Technology partnerships and strategic alliances enable participants to offer comprehensive solutions addressing evolving customer requirements for hybrid systems and emission control integration.

Japan Diesel Power Plant Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Air Intake System, Cooling Water System, Diesel Engine, Diesel Engine Starting System, Exhaust System, Fuel Supply System, Lubrication System |

| Capacity Ranges Covered | Large Scale, Medium Scale, Small Scale |

| Applications Covered | Construction Sites, Data Centers, Hospitals, Power Generation |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan diesel power plant market size was valued at USD 1.28 Billion in 2025.

The Japan diesel power plant market is expected to grow at a compound annual growth rate of 6.39% from 2026-2034 to reach USD 2.23 Billion by 2034.

The diesel engine segment dominated the market with a share of 46% in 2025, driven by its fundamental role in power generation and continuous technological advancements in efficiency and emissions control.

Key factors driving the Japan diesel power plant market include expanding data center infrastructure requirements, enhanced disaster preparedness initiatives, industrial sector modernization efforts, and the need for reliable backup power across critical facilities.

Major challenges include stringent environmental regulations requiring advanced emission control investments, competition from alternative technologies such as battery storage and fuel cells, and fuel price volatility affecting operational cost projections.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)