Japan E-Axle Market Size, Share, Trends and Forecast by Component Type, Vehicle Type, Drive Type, and Region, 2026-2034

Japan E-Axle Market Summary:

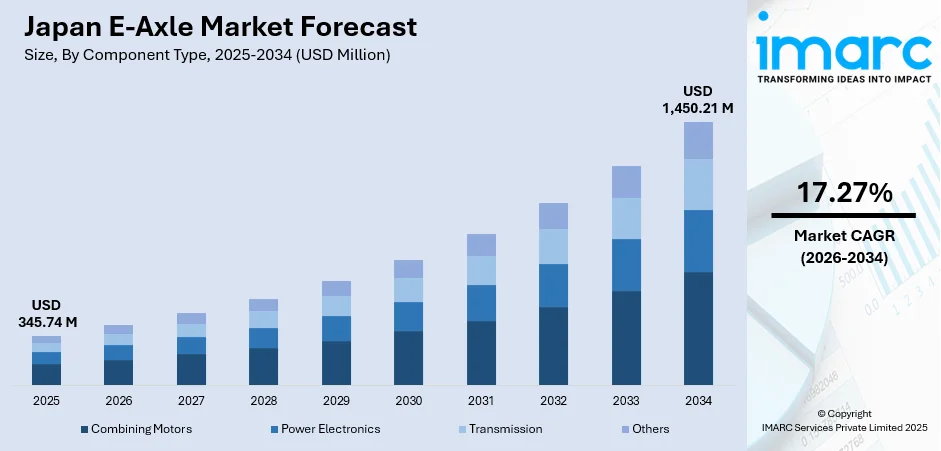

The Japan e-axle market size was valued at USD 345.74 Million in 2025 and is projected to reach USD 1,450.21 Million by 2034, growing at a compound annual growth rate of 17.27% from 2026-2034.

The Japan e-axle market is experiencing steady growth as the shift toward electric mobility accelerates across passenger and commercial vehicle segments. Rising EV production, strong government support for clean transportation, and advancements in integrated motor, inverter, and transmission systems are strengthening market demand. Increasing focus on energy efficiency, lightweight powertrains, and improved driving range further encourages widespread adoption, positioning e-axles as a critical component in Japan’s evolving electric vehicle ecosystem.

Key Takeaways and Insights:

- By Component Type: Transmission dominates the market with a share of 40% in 2025, as the critical component enabling torque multiplication and speed reduction in integrated e-axle systems, essential for optimizing vehicle performance and efficiency.

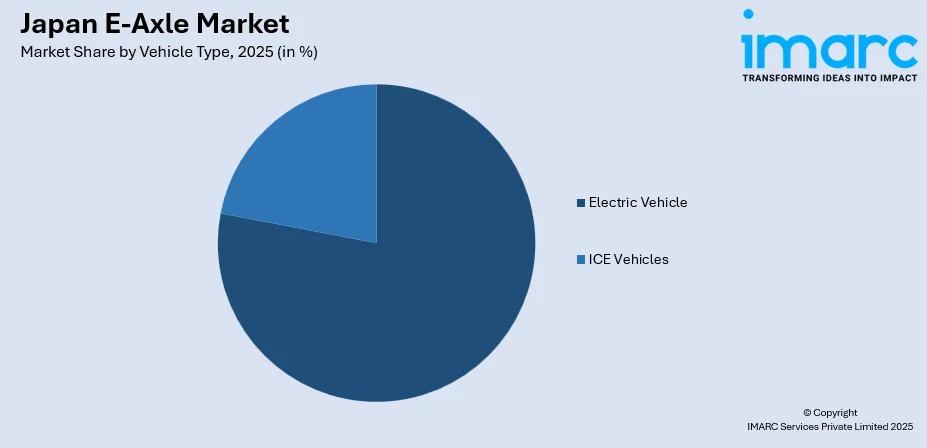

- By Vehicle Type: Electric vehicle leads the market with a share of 78% in 2025, driven by Japan's commitment to achieving carbon neutrality and the increasing adoption of battery electric vehicles supported by government incentives.

- By Drive Type: Forward wheel drive represents the largest segment with a market share of 45% in 2025, attributed to its cost-effectiveness, packaging efficiency, and dominance in passenger vehicles that comprise the majority of Japan's electric vehicle fleet.

- Key Players: The Japan e-axle market exhibits a moderately concentrated competitive structure, with established automotive component manufacturers and semiconductor companies driving innovation through strategic collaborations. Market participants focus on developing integrated multi-function e-axle systems, advancing silicon carbide power electronics, and forming partnerships to accelerate technological advancement and production scalability.

To get more information on this market Request Sample

The Japan e-axle market is expanding as the country accelerates its transition toward electric mobility, supported by technological innovation and strong policy commitments to carbon reduction. Automakers are increasingly integrating e-axles to achieve compact powertrain designs, higher energy efficiency, and improved vehicle performance in both battery electric and hybrid models. In August 2025, Isuzu launched its first battery-electric pickup, the D-MAX EV, featuring a jointly developed eAxle by BluE Nexus, AISIN, and DENSO. With a robust 4WD system, the D-MAX EV balances durability and low noise, targeting global markets while supporting a shift towards carbon neutrality in electric vehicle technologies. Advancements in motor technology, thermal management, and power electronics are enhancing system reliability, enabling smoother operation and longer driving ranges. Growing EV production capacity, supported by investment in domestic component manufacturing, is further reinforcing demand. The market also benefits from rising adoption of lightweight materials and integrated drivetrains, which help reduce overall vehicle weight and improve energy utilization. As consumer preference shifts toward cleaner transportation and OEMs prioritize scalable, modular electrification platforms, the Japan e-axle market is positioned for sustained, long term growth.

Japan E-Axle Market Trends:

Increasing Integration of Compact and Lightweight E-Axle Systems

Manufacturers in Japan are increasingly focusing on compact and lightweight e-axle systems to improve overall drivetrain efficiency and vehicle performance. In November 2024, Renesas Electronics introduced an 8-in-1 proof of concept for electric vehicle eAxle systems, developed with Nidec. This integration combines a drive motor, reduction gear, inverter, DC converter, and battery charger, streamlining components to reduce weight and costs while enhancing power management for faster market deployment. These modular architectures enable better energy utilization, reduced vehicle mass, and more efficient power delivery. As automakers develop flexible EV and hybrid platforms, compact e-axle layouts help optimize space, enhance battery placement, and improve engineering scalability, supporting the broader shift toward next generation electrified mobility.

Advancements in High Efficiency Motors and Power Electronics

Ongoing innovation in electric motors, inverters, and power electronics is significantly enhancing the capabilities of e-axle systems in Japan. Improved thermal management, higher voltage systems, and the adoption of advanced semiconductor technologies contribute to better torque output, longer driving range, and higher reliability. These advancements are enabling automakers to achieve superior drivetrain performance, reduce energy losses, and support the development of more efficient and durable electric and hybrid vehicles.

Rising Adoption Across Hybrid and Battery Electric Vehicle Platforms

Japan’s growing focus on hybrid and battery electric vehicle production is accelerating the adoption of e-axle systems across a broader range of models. Automakers are incorporating these integrated electric drivetrains to achieve smoother acceleration, quieter operation, and enhanced regenerative braking capability. In October 2025, BluE Nexus, AISIN, and DENSO jointly developed a compact eAxle, enhancing power performance and energy efficiency for Toyota's new bZ4X. The innovation features improved cooling technology and transmission efficiency, contributing to a better driving experience and supporting Toyota's carbon neutrality goals across various electric vehicle models. The rising demand for cleaner mobility, combined with improvements in e-axle efficiency and design, is strengthening their role as a core component in Japan’s expanding EV ecosystem.

Market Outlook 2026-2034:

The Japan e-axle market outlook remains strong as the country accelerates its transition toward electrified mobility across passenger and commercial vehicle segments. Growing investments in EV production, stricter emission norms, and advancements in lightweight drivetrains are driving broader adoption of integrated e-axle systems. Continuous improvements in power electronics, thermal management, and compact motor designs are further enhancing system efficiency and performance. With rising demand for hybrid and battery electric vehicles, Japan is positioned for steady, long term growth in e-axle deployment. The market generated a revenue of USD 345.74 Million in 2025 and is projected to reach a revenue of USD 1,450.21 Million by 2034, growing at a compound annual growth rate of 17.27% from 2026-2034.

Japan E-Axle Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Component Type | Transmission | 40% |

| Vehicle Type | Electric Vehicle | 78% |

| Drive Type | Forward Wheel Drive | 45% |

Component Type Insights:

- Combining Motors

- Power Electronics

- Transmission

- Others

The transmission dominates with a market share of 40% of the total Japan e-axle market in 2025.

The transmission segment holds a dominant position as Japan’s e-axle systems increasingly require advanced gearing solutions that enhance torque delivery, efficiency, and drivetrain responsiveness. E-axle transmissions are engineered to manage high rotational speeds, support compact system integration, and ensure smoother vehicle acceleration. Growing EV and hybrid production is reinforcing demand for durable, lightweight, and precision engineered transmission components tailored for electrified drivetrains.

Japan’s strong expertise in high performance automotive engineering is further supporting innovation in e-axle transmission technologies. Manufacturers are prioritizing reduced mechanical losses, optimized gear ratios, and improved thermal stability to meet evolving EV efficiency standards. Continuous R&D toward compact gear assemblies, enhanced lubrication systems, and noise reduction features is strengthening the segment’s relevance. As electrified mobility accelerates, transmissions remain essential for improving range, drivability, and long term system reliability.

Vehicle Type Insights:

Access the comprehensive market breakdown Request Sample

- ICE Vehicles

- Passenger Vehicle

- Commercial Vehicle

- Electric Vehicle

The electric vehicle leads with a share of 78% of the total Japan e-axle market in 2025.

Electric vehicles lead the market as Japan intensifies its shift toward zero-emission mobility, supported by strong regulatory targets and expanding charging infrastructure. The Japan electric car market size was valued at USD 43.22 Billion in 2024 and is projected to reach USD 179.35 Billion by 2033, reinforcing rapid electrification. EV manufacturers rely heavily on integrated e-axle systems to achieve compact packaging, quiet operation, and improved drivetrain efficiency. Rising demand for high performance and long-range EVs continues to accelerate the adoption of advanced e-axle designs.

The segment benefits from Japan’s growing investment in battery technology, power electronics, and lightweight vehicle platforms. E-axles enable seamless power delivery and enhanced regenerative braking performance, making them central to modern EV engineering. As more automakers adopt unified motor-inverter-axle assemblies to streamline production, reliance on sophisticated e-axle systems is set to strengthen further, solidifying this segment’s leadership across Japan’s evolving electric vehicle landscape.

Drive Type Insights:

- Forward Wheel Drive

- Rear Wheel Drive

- All Wheel Drive

The forward wheel drive exhibits a clear dominance with a 45% share of the total Japan e-axle market in 2025.

Forward wheel drive e-axle systems dominate the market as Japanese automakers prioritize compact, efficient, and cost-effective drivetrain layouts suitable for small and mid sized EV platforms. FWD configurations support simpler integration, reduced mechanical complexity, and enhanced energy efficiency, making them ideal for urban mobility vehicles.

The segment also benefits from widespread adoption of FWD architectures in Japan’s mainstream passenger cars. E-axles designed for front wheel drive applications offer improved traction control, better packaging flexibility, and lower production costs, enabling manufacturers to scale EV output efficiently. As electrification expands across mass market vehicle categories, the demand for reliable and high torque FWD e-axles is expected to continue rising, reinforcing their market leadership.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto region shows steady demand for e-axle systems, supported by concentrated automotive production, strong EV adoption, and ongoing electrification initiatives. Growing investments in advanced mobility technologies and rising deployment of charging infrastructure continue to strengthen the region’s role in Japan’s electrified drivetrain ecosystem.

The Kansai/Kinki region demonstrates consistent growth in e-axle consumption driven by its diversified manufacturing base, expanding EV component production, and rising R&D activity. Strong industrial capabilities and supportive regional policies are encouraging wider integration of electrified drivetrains across automotive supply chains.

The Central/Chubu region benefits from its position as Japan’s core automotive manufacturing hub, generating strong demand for e-axle systems used in EV and hybrid models. High production capacity, advanced engineering expertise, and supplier concentration continue to support steady market expansion.

The Kyushu-Okinawa region is witnessing increasing uptake of e-axle technologies, supported by growing automotive manufacturing activity and regional initiatives promoting clean mobility. Expanding EV assembly operations and rising investments in energy efficient drivetrain components are contributing to sustained market development.

The Tohoku region shows gradual growth in e-axle adoption as the region strengthens its automotive parts production capabilities. Rising focus on electrification, improved industrial infrastructure, and expanding supplier networks are encouraging higher integration of e-axle systems in component manufacturing.

The Chugoku region is experiencing steady demand for e-axles driven by its industrial clusters and evolving automotive supply chain. Growing emphasis on energy efficient technologies and increased participation in EV component manufacturing are supporting the region’s market presence.

The Hokkaido region reflects modest but increasing demand, supported by expanding clean mobility programs and broader EV adoption. Investments in charging networks and interest in efficient drivetrain technologies are gradually enhancing the region’s participation in the e-axle market.

The Shikoku region shows slow but stable growth in e-axle usage, supported by its emerging automotive parts manufacturing activities and rising focus on sustainable mobility solutions. Gradual electrification efforts and improving industrial capabilities are contributing to market expansion.

Market Dynamics:

Growth Drivers:

Why is the Japan E-Axle Market Growing?

Supportive Government Policies and Electrification Incentives

Supportive regulatory measures promoting lower emissions, higher fuel efficiency, and rapid EV adoption are accelerating investments in electrified drivetrains across Japan’s automotive sector. Subsidies for electric vehicles, tax benefits, and incentives for local manufacturing of EV components are encouraging OEMs to scale up production of efficient propulsion systems. In September 2024, Japan announced its plans to invest USD 2.4 Billion in subsidies to enhance electric vehicle battery production, boosting projects by Toyota, Nissan, and Panasonic. The initiative aims to increase annual battery capacity by 50% and reduce dependence on foreign suppliers, solidifying Japan's position in the growing global EV market. These policies are also motivating suppliers to develop advanced, integrated e-axle solutions that meet national sustainability targets while enhancing drivetrain performance, reliability, and long term cost competitiveness.

Growing Focus on Cost Efficient Drivetrain Integration

Automakers are increasingly adopting cost efficient drivetrain architectures that streamline assembly, reduce mechanical complexity, and improve vehicle performance. E-axle systems combine motors, power electronics, and transmission components into a unified module, helping manufacturers lower production costs and accelerate platform development. This integrated approach enhances power delivery, reduces maintenance requirements, and supports scalable EV designs. As OEMs seek to balance performance with affordability, demand for compact, modular, and economically viable e-axle solutions continues to strengthen.

Expansion of EV Charging Infrastructure Nationwide

Japan’s rapid rollout of fast charging stations, smart charging networks, and standardized charging protocols is reinforcing consumer confidence in electric mobility. In July 2025, PowerX and Mercedes-Benz unveiled their first high-power EV charging hub in Chiba Park, Japan, featuring a maximum output of 150 kW and 24/7 accessibility for all EV owners. Amenities include a cafe and gym. Additional hubs are planned for Kashiwa City and Komazawa, Tokyo. Improved charging accessibility is boosting adoption of EVs across urban and regional areas, driving higher demand for efficient and high-performance e-axle systems. As more consumers shift toward battery electric and hybrid vehicles, manufacturers are expanding production of advanced e-axles to support smoother acceleration, greater energy efficiency, and enhanced overall driving experience.

Market Restraints:

What Challenges the Japan E-Axle Market is Facing?

High Production Costs and Complex Component Requirements

E-axle manufacturing involves advanced motors, precision power electronics, thermal management systems, and high grade materials, resulting in elevated production costs. Smaller suppliers often face challenges in scaling technology due to expensive R&D and specialized equipment needs. These cost pressures can slow widespread adoption, particularly in budget sensitive vehicle segments, and may limit OEM flexibility in offering competitively priced electric models across diverse consumer categories.

Thermal Management and Reliability Challenges in High Power Applications

As e-axle systems become more compact and powerful, maintaining optimal thermal performance is increasingly difficult. Heat buildup can affect motor efficiency, inverter performance, and component life span, requiring advanced cooling solutions that add complexity and cost. Ensuring long term durability under high torque and continuous load conditions remains a constraint, prompting manufacturers to invest heavily in testing, simulation, and material innovation to meet reliability expectations.

Supply Chain Constraints for Semiconductors and Critical Materials

The Japan e-axle market is sensitive to fluctuations in semiconductor availability and sourcing of rare earth materials used in motors and power electronics. Global supply disruptions, geopolitical uncertainties, and price volatility can delay production timelines and increase input costs. These constraints make it challenging for OEMs and component manufacturers to maintain stable output, manage inventory efficiently, and meet growing EV demand without operational disruptions.

Competitive Landscape:

The Japan e-axle market features a competitive landscape shaped by strong participation from automotive OEMs, drivetrain specialists, and electronics manufacturers that are rapidly advancing electrification capabilities. Companies are focusing on integrated motor inverter units, higher efficiency designs, and improved thermal management to differentiate performance. Competition is also intensifying around modular architectures that reduce vehicle platform complexity and manufacturing costs. Strategic collaborations between automakers, motor producers, and semiconductor suppliers are becoming more common to accelerate innovation and secure stable component availability. Continuous R&D in lightweight materials and high voltage systems further defines the competitive momentum in the market.

Recent Developments:

- In December 2024, Japanese company Musashi Auto Parts announced its expansion into electric vehicle components, focusing on India's growing two- and three-wheeler market. The firm has initiated e-axle production in Bengaluru and plans to increase capacity significantly by 2030, collaborating with local startups to enhance its EV product portfolio and systems supply.

- In October 2024, Yamaha Motor partnered with UK's Caterham EVo Limited to develop 'Project V,' an electric sports coupe. Yamaha will provide an e-axle and vehicle motion control technologies for the prototype, targeting mid-2025 for completion. This collaboration aligns with Yamaha's commitment to sustainability and carbon neutrality goals by 2050.

Japan E-Axle Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Component Types Covered | Combining Motors, Power Electronics, Transmission, Others |

| Vehicle Types Covered |

|

| Drive Types Covered | Forward Wheel Drive, Rear Wheel Drive, All Wheel Drive |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan e-axle market size was valued at USD 345.74 Million in 2025.

The Japan e-axle market is expected to grow at a compound annual growth rate of 17.27% from 2026-2034 to reach USD 1,450.21 Million by 2034.

Transmission held the largest Japan e-axle market share, supported by their critical role in ensuring efficient torque transfer, optimized power delivery, and smooth drivetrain operation, making them essential for both hybrid and fully electric vehicle architectures.

Key factors driving the Japan e-axle market include rising EV production, advancements in integrated motor and inverter technologies, supportive electrification policies, expanding charging infrastructure, and strong OEM focus on improving drivetrain efficiency, compactness, and performance across electric mobility platforms.

Major challenges in the market include high development and integration costs, complex thermal management requirements, reliance on advanced semiconductor components, and supply chain pressures that can affect production timelines, overall manufacturing efficiency, and system affordability.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)