Japan E-KYC Market Size, Share, Trends and Forecast by Product, Deployment Mode, End User, and Region, 2026-2034

Japan E-KYC Market Overview:

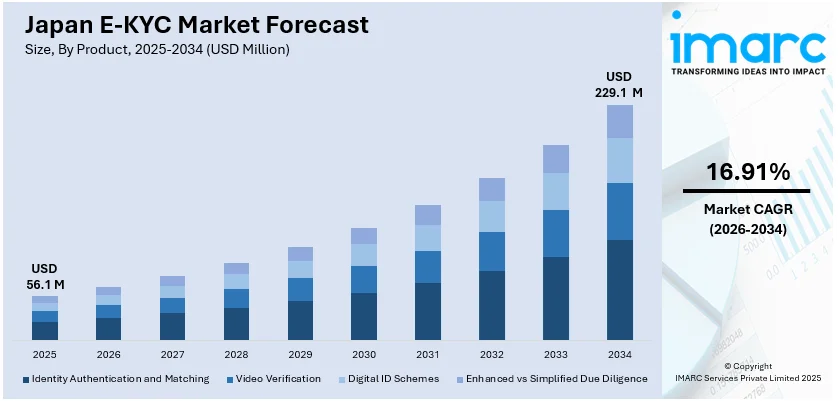

The Japan e-KYC market size reached USD 56.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 229.1 Million by 2034, exhibiting a growth rate (CAGR) of 16.91% during 2026-2034. The market is rapidly growing, driven by the increasing adoption of biometric authentication and digital verification solutions. Moreover, the integration of real-time e-KYC for mobile services and secure electronic contracts boosts security, convenience, and trust across various digital platforms, enhancing Japan's e-KYC market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 56.1 Million |

| Market Forecast in 2034 | USD 229.1 Million |

| Market Growth Rate 2026-2034 | 16.91% |

Japan E-KYC Market Trends:

Rising Integration of Biometric Solutions in Japan’s E-KYC Market

Japan's e-KYC market is experiencing exponential growth as biometric authentication becomes a growing part of digital platforms. The transition is being spurred on by the demands for greater security, efficiency, and ease in identity verification practices across industries such as finance, telecommunications, and e-commerce. One of the biggest steps towards that came in June 2024 when KDDI Digital Life, which is a part of KDDI, bolstered its povo platform with real-time e-KYC customer authentication. It targeted particularly the young, technophile Generation Z, which is known to cherish digital-first experiences, security, and convenience. With biometric solutions in place, customers could now easily and safely authenticate their identity without having to provide physical documents or undergo traditional face-to-face verification processes. This action not only improved the user experience but also helped to extend the market through enhanced attractiveness of the platform to digital natives. The adoption of biometric technology ensures that identity verification is both quick and reliable, which is essential for enhancing trust and promoting wider usage of mobile services. KDDI’s push for e-KYC adoption aligns with broader trends in Japan’s mobile-first and security-driven digital services, cementing the platform’s role in the country’s digital transformation and driving Japan's e-KYC market growth.

To get more information on this market Request Sample

Strengthening Trust in Digital Transactions with E-KYC

Trust and security are becoming pivotal drivers of Japan’s e-KYC market, especially in sectors like finance and legal services that require a high degree of verification. In October 2024, Liquid, Inc. partnered with DocuSign to integrate its “LIQUID e-KYC” online identity verification service, marking a crucial advancement in the security of digital transactions. This integration introduced biometric authentication for electronic contract signing, allowing users to verify their identity with facial recognition via a smartphone. This invention simplified users to securely execute transactions without giving up the comfort of digital mediums. As transactions grow online, making it vital for people to be able to sign contracts confidently becomes even more so. With enabling an easy and secure way to verify identity, this collaboration bolsters the level of confidence for users in relying on platforms to perform sensitive, high-risk transactions such as banking agreements or judicial contracts. Liquid's e-KYC service leverages state-of-the-art biometric and image recognition capabilities to provide a seamless, low-error process without the need for complicated steps. The DocuSign partnership reinforces Liquid's market leadership in Japan's expanding e-KYC market. It boosts the use of biometric technology across industries requiring high levels of identity verification. This action not only increases security but also further fuels Japan's digitalization.

Japan E-KYC Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on product, deployment mode, and end user.

Product Insights:

- Identity Authentication and Matching

- Video Verification

- Digital ID Schemes

- Enhanced vs Simplified Due Diligence

The report has provided a detailed breakup and analysis of the market based on the product. This includes identity authentication and matching, video verification, digital id schemes, and enhanced vs simplified due diligence.

Deployment Mode Insights:

- Cloud-based

- On-premises

A detailed breakup and analysis of the market based on the deployment mode have also been provided in the report. This includes cloud-based and on-premises.

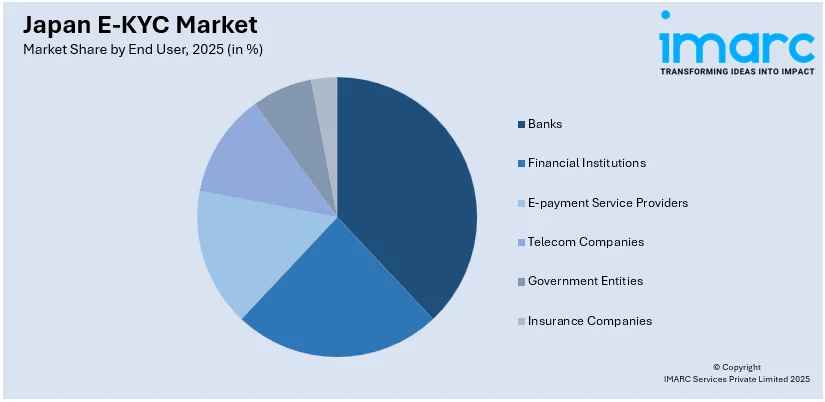

End User Insights:

Access the comprehensive market breakdown Request Sample

- Banks

- Financial Institutions

- E-payment Service Providers

- Telecom Companies

- Government Entities

- Insurance Companies

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes banks, financial institutions, e-payment service providers, telecom companies, government entities, and insurance companies.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan E-KYC Market News:

- February 2025: Seven Bank launched Face Cash, a facial recognition ATM service, enabling cashless deposits and withdrawals without physical cards or smartphones. This development advanced biometric authentication in Japan's banking sector, enhancing customer convenience and security while driving further adoption of e-KYC solutions in financial services.

- January 2025: Daon expanded its presence in Japan through a deal with Elements Inc., following the latter’s acquisition of Polarify. This collaboration strengthened Elements’ position as the No.1 player in Japan’s e-KYC market, boosting identity authentication services for over 550 organizations.

Japan E-KYC Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Authentication and Matching, Video Verification, Digital ID Schemes, Enhanced vs Simplified Due Diligence |

| Deployment Modes Covered | Cloud-based, On-Premises |

| End Users Covered | Banks, Financial Institutions, E-Payment Service Providers, Telecom Companies, Government Entities, Insurance Companies |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan e-KYC market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan e-KYC market on the basis of product?

- What is the breakup of the Japan e-KYC market on the basis of deployment mode?

- What is the breakup of the Japan e-KYC market on the basis of end user?

- What is the breakup of the Japan e-KYC market on the basis of region?

- What are the various stages in the value chain of the Japan e-KYC market?

- What are the key driving factors and challenges in the Japan e-KYC market?

- What is the structure of the Japan e-KYC market and who are the key players?

- What is the degree of competition in the Japan e-KYC market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan e-KYC market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan e-KYC market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan e-KYC industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)