Japan Elderly Care Products Market Size, Share, Trends and Forecast by Product, Usage, End User, and Region, 2026-2034

Japan Elderly Care Products Market Overview:

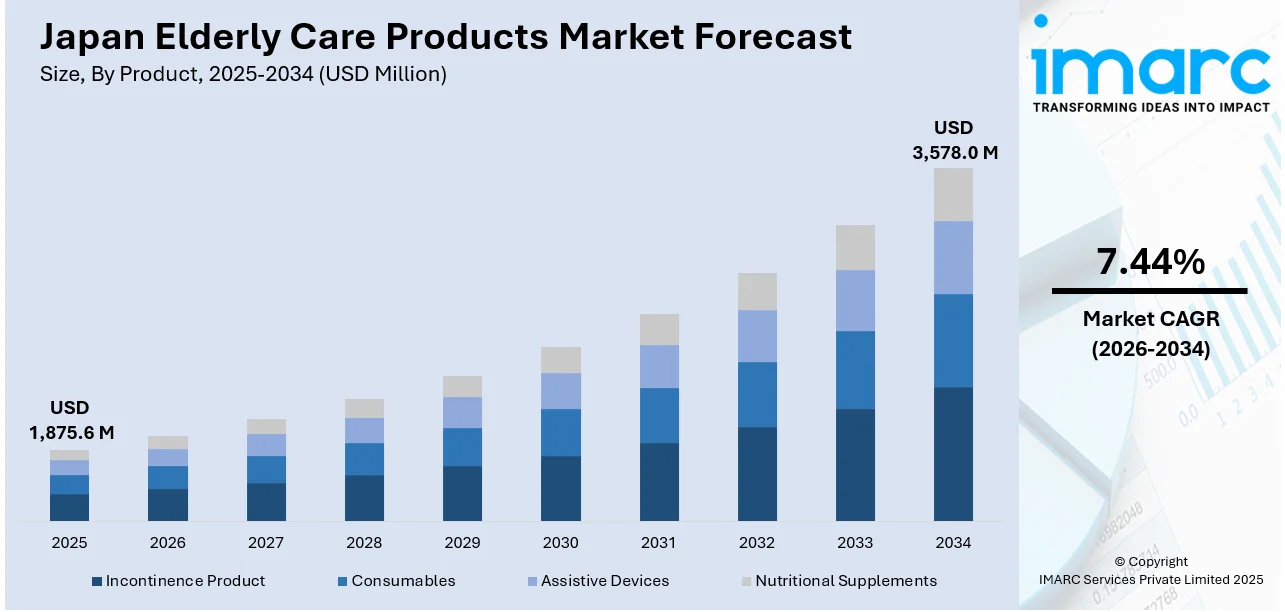

The Japan elderly care products market size reached USD 1,875.6 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 3,578.0 Million by 2034, exhibiting a growth rate (CAGR) of 7.44% during 2026-2034. At present, with the rise in the senior citizen population, there is an increasing need for products that aid in their daily living, mobility, and health management. Besides this, the growing preferences for home-based care, which aid in reducing the burden on healthcare facilities, are contributing to the expansion of the Japan elderly care products market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1,875.6 Million |

| Market Forecast in 2034 | USD 3,578.0 Million |

| Market Growth Rate 2026-2034 | 7.44% |

Japan Elderly Care Products Market Trends:

Increasing aging population

The rising aging population is positively influencing the market in Japan. Government figures indicated that the elderly population in Japan increased by 20,000, reaching 36.25 Million in September 2024, representing an all-time high of 29.3% of the total population. The demand for goods that assist senior adults in managing their health, mobility, and everyday lives is increasing along with the population of these individuals. Japan has one of the longest life expectancies in the world, and as a result of a sizable section of its population growing older, there is a rising emphasis on making sure senior citizens are comfortable, safe, and independent. Products like walking assistance, adult diapers, home healthcare equipment, and assistive furniture are high in demand. In order to help senior citizens retain their quality of life, families are actively looking for trustworthy alternatives. To further encourage the utilization of elderly care products at home, the government is supporting aging-in-place policies. Quality product purchases are being bolstered by older persons' and their families' increasing disposable incomes. As the aging population continues to rise, manufacturers are innovating to meet the evolving physical and emotional needs of this demographic.

To get more information on this market Request Sample

Growing home care trends

Rising home care trends are impelling the Japan elderly care products market growth. As more elderly individuals prefer to age in the comfort of their homes rather than in institutional settings, the demand for products that support independent living is increasing. Families and caregivers are looking for solutions that ensure safety, hygiene, and convenience for seniors at home. This shift is encouraging the adoption of products, such as adjustable beds, mobility aids, bathing equipment, and home monitoring systems. The growing preferences for home-based care reduce the burden on healthcare facilities and allow personalized attention, further driving the demand for elderly care products. Additionally, healthcare professionals are recommending home care as a cost-effective and emotionally supportive option for aging populations. The expansion of e-commerce platforms plays a vital role by making a wide assortment of elderly care products easily accessible to families across Japan. According to the PCMI, the total e-commerce revenue in Japan for 2024 reached USD 380 Billion. Online availability, doorstep delivery, and product comparisons help caregivers make informed decisions. Moreover, smart technologies are being integrated into home care products, making them more user-friendly and efficient. The government is also supporting home care through various policies and subsidies, encouraging people to adopt supportive products.

Japan Elderly Care Products Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product, usage, and end user.

Product Insights:

- Incontinence Product

- Consumables

- Assistive Devices

- Nutritional Supplements

The report has provided a detailed breakup and analysis of the market based on the product. This includes incontinence product, consumables, assistive devices, and nutritional supplements.

Usage Insights:

- Home Care

- Chronic Illness Care

A detailed breakup and analysis of the market based on the usage have also been provided in the report. This includes home care and chronic illness care.

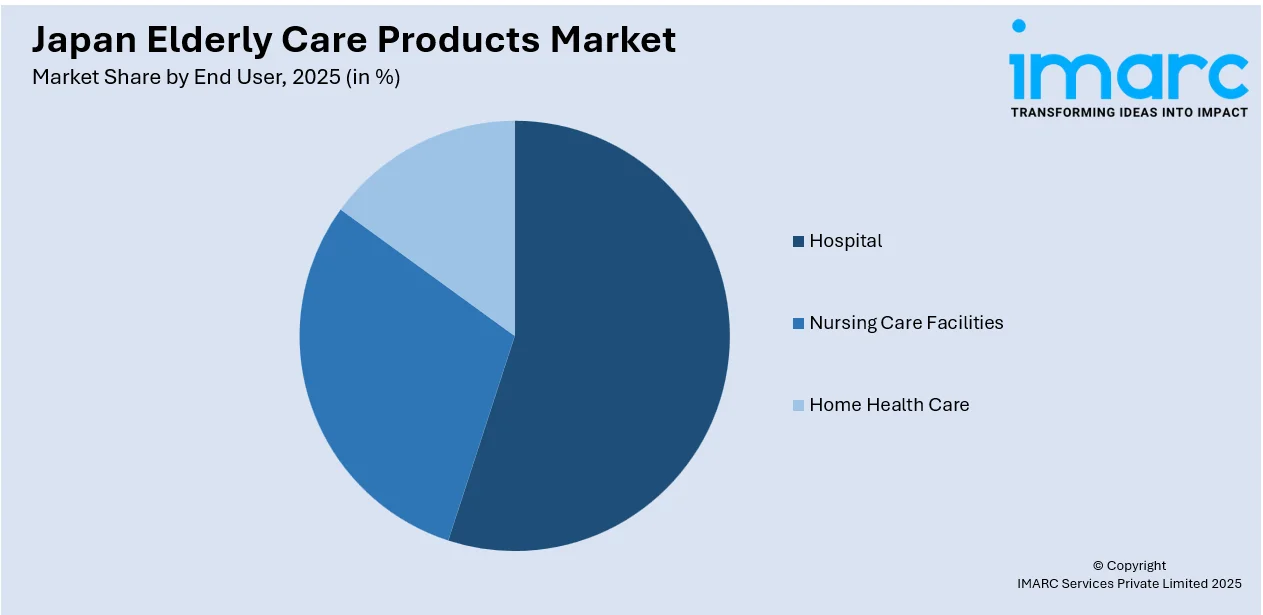

End User Insights:

Access the comprehensive market breakdown Request Sample

- Hospital

- Nursing Care Facilities

- Home Health Care

The report has provided a detailed breakup and analysis of the market based on the end user. This includes hospital, nursing care facilities, and home health care.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Elderly Care Products Market News:

- In March 2025, Medical Japan 2025 Osaka was set to be held at INTEX Osaka, uniting industry leaders to present innovations and promote progress in the medical and healthcare sectors. It was to be conducted from March 5-7, 2025. It broadened its range by featuring seven specialized expos. Six expos would showcase the newest advancements in hospital and clinic apparatus, pharmaceutical solutions, elderly care, infection control, and health and wellness technologies.

- In October 2024, Canon Marketing Japan Inc. put money into LacuS, which focused on creating and selling comprehensive nutritional food products for seniors, via Canon Marketing Japan MIRAI Fund. With this investment, the firm sought to generate new value based on the idea of promoting health and allowing older individuals to enjoy fulfilling lives through nutrition.

Japan Elderly Care Products Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Incontinence Product, Consumables, Assistive Devices, Nutritional Supplements |

| Usages Covered | Home Care, Chronic Illness Care |

| End Users Covered | Hospital, Nursing Care Facilities, Home Health Care |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan elderly care products market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan elderly care products market on the basis of product?

- What is the breakup of the Japan elderly care products market on the basis of usage?

- What is the breakup of the Japan elderly care products market on the basis of end user?

- What is the breakup of the Japan elderly care products market on the basis of region?

- What are the various stages in the value chain of the Japan elderly care products market?

- What are the key driving factors and challenges in the Japan elderly care products market?

- What is the structure of the Japan elderly care products market and who are the key players?

- What is the degree of competition in the Japan elderly care products market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan elderly care products market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan elderly care products market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan elderly care products industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)