Japan Electric Bus Market Size, Share, Trends and Forecast by Propulsion Type, Battery Type, Length, Range, Battery Capacity, and Region, 2026-2034

Japan Electric Bus Market Overview:

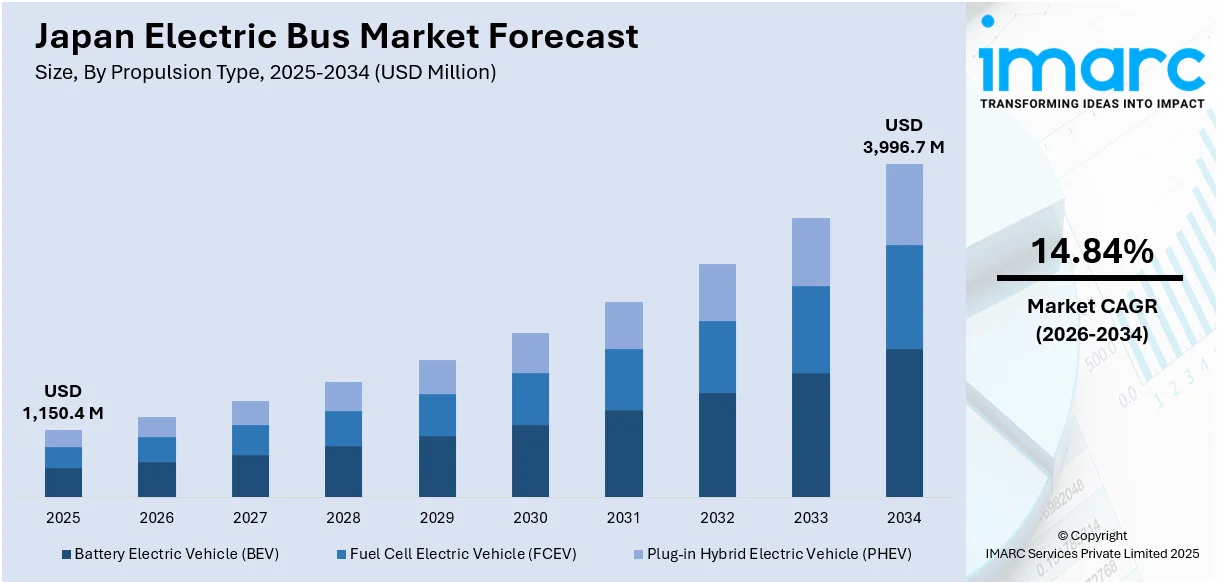

The Japan electric bus market size reached USD 1,150.4 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 3,996.7 Million by 2034, exhibiting a growth rate (CAGR) of 14.84% during 2026-2034. Advancements in battery technology, supportive policies, and focus on inclusive design are accelerating Japan's transition to electric buses. Improved energy efficiency, cost competitiveness, government subsidies, and accessibility features are enabling broader adoption, enhancing fleet performance, and consequently contributing to the growth of the Japan electric bus market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1,150.4 Million |

| Market Forecast in 2034 | USD 3,996.7 Million |

| Market Growth Rate 2026-2034 | 14.84% |

Japan Electric Bus Market Trends:

Advancements in Battery Technology and Bus Performance

Swift developments in battery technology and charging infrastructure are enhancing the feasibility of electric buses throughout Japan's densely populated urban areas. Improved energy density, thermal stability, and charging efficiency are alleviating range anxiety and allowing for more precise scheduling for operators. An important example is Toshiba’s collaboration with Rinko Bus and Drive Electro to introduce Japan’s first public electric bus in 2024, which utilized pantograph-based ultra-fast charging. Scheduled for launch in Kawasaki by November 2025, the project included Toshiba’s SCiB™ batteries that offer full charges in just 10 minutes. This advancement allowed buses to recharge during brief stops without disrupting operational flow, tackling a fundamental challenge in space-limited cities. Such advancements minimize downtime, enable more regular service, and permit transit agencies to expand electric fleets without enlarging depots. With battery prices decreasing and better integration with smart energy systems, the cost-effectiveness of e-buses is approaching that of diesel options, making the transition more appealing for fleet managers.

To get more information on this market Request Sample

Government Decarbonization Mandates and Subsidy Support

Japan's 2050 goal of achieving carbon neutrality is fostering policy coordination and financial backing for the implementation of electric buses, emphasizing effective, scalable solutions. Emission reduction mandates for public transport fleets, initiated by the governing body, are supported by incentives that reduce financial obstacles, featuring subsidies for acquiring new e-buses and retrofitting current diesel vehicles. For instance, in 2024, Sumitomo Corporation launched a retrofitted electric bus in Tokyo by converting a diesel bus to EV, reducing carbon dioxide (CO₂) emissions by 48% per vehicle. The bus had a 150 km range and was part of a broader effort to lower EV costs and promote reuse. This initiative supported Japan’s 2050 carbon neutrality goal. Furthermore, backing for these models via pilot approvals, aid for urban deployment, and co-financing, is making electrification feasible even for smaller operators. These combined policy and funding strategies remain essential to Japan's zero-emission shift in public transportation.

Focus on Accessibility and Long-Range Efficiency in Public Transit

Japan electric bus market growth is influenced by the demand to enhance public transportation's accessibility, efficiency, and technological sophistication. An increasing focus on universal design is encouraging manufacturers to incorporate accessible features, such as level surfaces, broader entrances, and designated areas for travelers with mobility difficulties. These design changes are backed by national policies that encourage inclusive urban infrastructure, especially considering Japan's aging demographic. Furthermore, the need for improved passenger safety and real-time connectivity is driving the incorporation of driver assistance systems, sensor-driven alerts, and telematics solutions. These characteristics enhance the rider experience while also simplifying fleet oversight and lowering the chances of accidents. The merging of accessibility guidelines with cutting-edge vehicle technologies is speeding up the shift to contemporary electric bus systems that not only reduce emissions but also provide smarter, safer, and more inclusive public transport options. In 2024, Isuzu launched Japan’s first battery electric vehicle (BEV) flat-floor route bus, the ERGA EV. This next-generation bus featured a barrier-free design, a 360 km range, and advanced safety and connectivity systems.

Japan Electric Bus Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on propulsion type, battery type, length, range, and battery capacity.

Propulsion Type Insights:

- Battery Electric Vehicle (BEV)

- Fuel Cell Electric Vehicle (FCEV)

- Plug-in Hybrid Electric Vehicle (PHEV)

The report has provided a detailed breakup and analysis of the market based on the propulsion type. This includes battery electric vehicle (BEV), fuel cell electric vehicle (FCEV), and plug-in hybrid electric vehicle (PHEV).

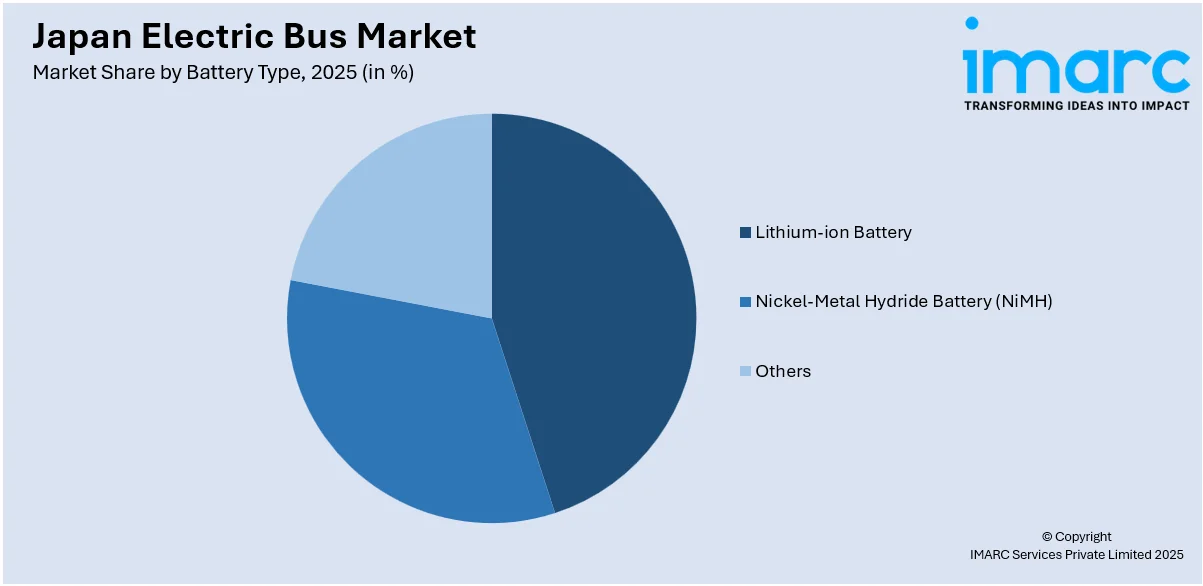

Battery Type Insights:

Access the comprehensive market breakdown Request Sample

- Lithium-ion Battery

- Nickel-Metal Hydride Battery (NiMH)

- Others

A detailed breakup and analysis of the market based on the battery type have also been provided in the report. This includes lithium-ion battery, nickel-metal hydride battery (NiMH), and others.

Length Insights:

- Less Than 9 Meters

- 9-14 Meters

- Above 14 Meters

A detailed breakup and analysis of the market based on the length have also been provided in the report. This includes less than 9 meters, 9-14 meters, and above 14 meters.

Range Insights:

- Less Than 200 Miles

- More Than 200 Miles

The report has provided a detailed breakup and analysis of the market based on the range. This includes less than 200 miles and more than 200 miles.

Battery Capacity Insights:

- Up To 400 kWh

- Above 400 kWh

A detailed breakup and analysis of the market based on the battery capacity have also been provided in the report. This includes up to 400 kWh and above 400 kW.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Electric Bus Market News:

- In April 2025, Hyundai Motor delivered ELEC CITY TOWN electric buses to Yakushima Island, Japan, supporting its zero-emission transport goals. The medium-sized, low-floor buses feature 145 kWh batteries and are tailored for the island’s mountainous terrain and humid climate. This initiative aligns with Yakushima’s carbon neutrality target by 2050.

- In March 2025, BYD, Keihan Bus, and Kansai Electric Power announced Japan’s first all-electric bus loop line in Kyoto, launched as a five-year demonstration project. The initial fleet includes four BYD J6 buses with a 150 km range and 3-hour charging time. This initiative supports Japan’s 2050 carbon neutrality goals and promotes green tourism in Kyoto.

Japan Electric Bus Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Propulsion Types Covered | Battery Electric Vehicle (BEV), Fuel Cell Electric Vehicle (FCEV), Plug-In Hybrid Electric Vehicle (PHEV) |

| Battery Types Covered | Lithium-Ion Battery, Nickel-Metal Hydride Battery (Nimh), Others |

| Lengths Covered | Less Than 9 Meters, 9-14 Meters, Above 14 Meters |

| Ranges Covered | Less Than 200 Miles, More Than 200 Miles |

| Battery Capacities Covered | Up To 400 kWh, Above 400 Kwh |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan electric bus market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan electric bus market on the basis of propulsion type?

- What is the breakup of the Japan electric bus market on the basis of battery type?

- What is the breakup of the Japan electric bus market on the basis of length?

- What is the breakup of the Japan electric bus market on the basis of range?

- What is the breakup of the Japan electric bus market on the basis of battery capacity?

- What is the breakup of the Japan electric bus market on the basis of region?

- What are the various stages in the value chain of the Japan electric bus market?

- What are the key driving factors and challenges in the Japan electric bus market?

- What is the structure of the Japan electric bus market and who are the key players?

- What is the degree of competition in the Japan electric bus market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan electric bus market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan electric bus market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan electric bus industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)