Japan Electric Switches and Sockets Market Size, Share, Trends and Forecast by Product Type, Material, Application, and Region, 2026-2034

Japan Electric Switches and Sockets Market Summary:

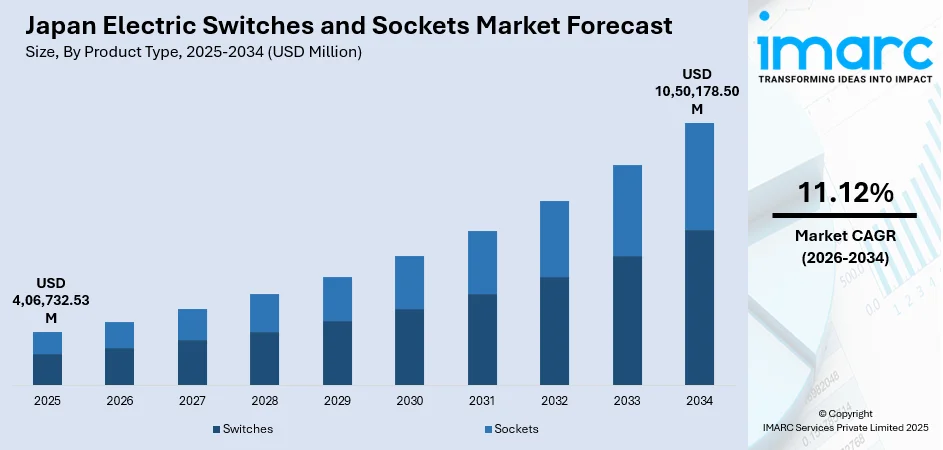

The Japan electric switches and sockets market size was valued at USD 4,06,732.53 Million in 2025 and is projected to reach USD 10,50,178.50 Million by 2034, growing at a compound annual growth rate of 11.12% from 2026-2034.

The market is driven by the rising adoption of smart home technologies and IoT-enabled solutions, with consumers prioritizing voice-controlled switches for enhanced convenience and energy efficiency. Government initiatives promoting sustainable energy use and stricter efficiency regulations are accelerating demand for eco-friendly electrical fittings. Japan's rapidly aging population is fueling demand for home automation technologies, including smart switches and outlets that support independent living and eldercare. Additionally, commercial sectors are increasingly integrating automated and energy-saving solutions to meet corporate sustainability targets, further augmenting the Japan electric switches and sockets market share.

Key Takeaways and Insights:

- By Product Type: Switches dominate the market with a share of 58.7% in 2025, driven by the rising demand for advanced switching solutions including dimmer switches, motor starters, and smart switches that offer scheduling, motion detection, and energy monitoring features in urban residential and commercial environments.

- By Material: Plastic leads the market with a share of 69.8% in 2025, owing to its cost-effectiveness, lightweight properties, durability, and design flexibility that enables manufacturers to produce aesthetically appealing switches and sockets suitable for modern interiors.

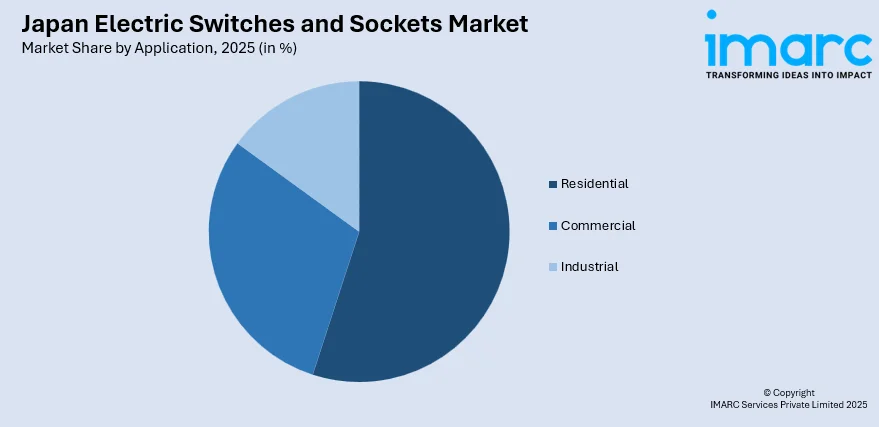

- By Application: Residential represents the largest segment with a market share of 55.8% in 2025, propelled by increasing home automation adoption, renovation activities in existing housing stock, and government incentives promoting energy-efficient electrical installations in households.

- By Region: Kanto Region dominates the market with a share of 34.2% in 2025, driven by the concentration of population in metropolitan Tokyo, higher disposable incomes, premium real estate developments, and extensive commercial infrastructure requiring advanced electrical solutions.

- Key Players: The market shows moderate competitive intensity, with strong domestic manufacturers competing alongside multinational players across residential, commercial, and industrial segments, driving continual product innovation, technology upgrades, and differentiation in safety, design, and smart functionality.

To get more information on this market Request Sample

The Japan electric switches and sockets market is witnessing robust growth driven by multiple converging factors. The country's demographic transformation, with a significant portion of the population projected to be elderly within the coming decades, is creating unprecedented demand for smart home technologies that facilitate independent living for senior residents. Government investment in digital technologies has established Japan as a leader in smart home technology adoption. Local government programs actively promote energy-efficient appliances and electrical installations through substantial incentives, encouraging residents to upgrade their electrical infrastructure with advanced products that offer both convenience and environmental benefits. As per sources, in September 2025, Japan launched the Home Energy Conservation 2025 Campaign, offering subsidies for newly built energy-efficient homes and installation of energy-saving equipment.

Japan Electric Switches and Sockets Market Trends:

Rising Integration of Smart Home and IoT Technologies

The market is experiencing transformative growth through the integration of Internet of Things (IoT) capabilities and smart home ecosystems. In April 2025, Panasonic Solutions launched its first new switch and socket series in five years at Architect’25, featuring advanced design, energy-saving functions, and improved safety for residential and commercial use. Moreover, consumers are increasingly seeking energy-efficient solutions that can be managed via mobile devices or voice-activated systems for enhanced convenience and security. The popularity of smart switches is rising due to their scheduling, motion detection, and energy monitoring features, particularly in urban environments where smart home technology adoption is becoming prevalent. Manufacturers are responding by introducing products with enhanced connectivity, design attributes, and safety features that integrate seamlessly with home automation platforms and provide real-time energy consumption data.

Emphasis on Energy Efficiency and Sustainable Products

Environmental consciousness is reshaping product development in the electric switches and sockets market as both consumers and businesses prioritize sustainability. Rising electricity prices and climate change concerns are driving demand for electrical products offering energy-saving features such as automated shut-off and low-power standby modes. Manufacturers are increasingly incorporating recycled and biodegradable materials into their product designs to reduce environmental impact while meeting stringent government energy regulations. In January 2025, Panasonic and Mitsubishi Materials launched a PMP loop to recycle metals from discarded home appliances, reusing gold, silver, and copper in new products, reinforcing circular economy practices and sustainable manufacturing. Moreover, the commercial sector, including offices and hospitality establishments, is actively adopting energy-efficient electrical fixtures to meet corporate social responsibility standards and sustainability targets.

Demand Surge from Geriatric Population and Assisted Living Requirements

Japan's demographic shift is creating substantial opportunities for the electric switches and sockets market as home automation becomes essential for eldercare solutions. Smart electrical devices are increasingly being integrated with assisted living technologies to address labor shortages, lower healthcare costs, and improve safety for elderly residents living independently. The ambient-assisted living segment is witnessing remarkable growth as sensors for fall detection, emergency alerts, and health monitoring are being integrated into residential settings. In June 2025, Fujitsu launched its Millimeter-Wave Monitoring System in Japan, enabling 24/7 privacy-conscious fall and health anomaly detection in assisted living, enhancing safety for geriatric residents. Further, this demographic-driven demand is prompting manufacturers to develop user-friendly electrical products with accessibility features, motion-sensing capabilities, and remote-control functionalities tailored for geriatric consumers.

Market Outlook 2026-2034:

The Japan electric switches and sockets market is set for steady revenue expansion driven by rapid urban growth, continuous infrastructure upgrades, and nationwide smart city programs. Rising adoption of advanced electrical systems in residential renovations, commercial developments, and new housing projects further strengthens market momentum. Policy incentives supporting energy-efficient materials encourage broader uptake of sustainable switchgear. Japan’s long-term carbon-neutrality ambitions and its push toward net-zero energy buildings reinforce demand for intelligent, eco-friendly electrical fittings, ensuring solid revenue performance throughout the forecast period. The market generated a revenue of USD 4,06,732.53 Million in 2025 and is projected to reach a revenue of USD 10,50,178.50 Million by 2034, growing at a compound annual growth rate of 11.12% from 2026-2034.

Japan Electric Switches and Sockets Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Switches | 42% |

| Material | Plastic | 60% |

| Application | Residential | 75% |

| Region | Kanto Region | 70% |

Product Type Insights:

- Switches

- 1-Way Switch

- 2-Way Switch

- Push Bell Switch

- Dimmer/Regulator Switch

- Motor Starter Switch

- Others

- Sockets

- Power Sockets

- USB Sockets

- Combination Sockets

- Smart Sockets

The switches dominate with a market share of 58.7% of the total Japan electric switches and sockets market in 2025.

Switches dominate the product type category, serving as critical components in residential, commercial, and industrial electrical systems. Rising demand is driven by modern construction, interior renovation projects, and the growing adoption of smart home technologies. Advanced switch designs featuring dimmers, touch controls, and IoT connectivity are increasingly preferred for their convenience, energy management capabilities, and integration with home automation systems, allowing users to control lighting, appliances, and security functions efficiently and remotely. In February 2025, Nature and Panasonic announced the IoT-enabled "Nature EV Switch," launching in May 2025 for Panasonic’s Home EV Charging Service, with app compatibility.

The switches segment benefits from material innovations and manufacturing flexibility, with plastic-based switches remaining popular due to their insulation properties, cost efficiency, and design adaptability. Consumers increasingly seek stylish, durable switches that complement interior aesthetics while meeting performance standards. Additionally, rising awareness of energy efficiency and safety regulations encourages adoption of smart and automated switches, further expanding the segment’s relevance across modern residences and commercial establishments, ensuring steady growth in product demand.

Material Insights:

- Plastic

- Metal

- Others

The plastic leads with a share of 69.8% of the total Japan electric switches and sockets market in 2025.

Plastic remains the leading material in the market due to its excellent electrical insulation, durability, and cost-effectiveness. Its versatility allows manufacturers to produce a wide range of switch designs, from basic functional units to advanced, aesthetically appealing smart switches, meeting diverse consumer preferences and safety standards. Plastic’s lightweight nature also simplifies installation and reduces transportation costs, making it a practical choice for residential, commercial, and industrial electrical applications across the country.

The widespread use of plastic supports innovation in form, color, and texture, enabling switches that complement modern interior design trends while maintaining regulatory compliance. Its resistance to wear, heat, and impact ensures long-term reliability, particularly in high-usage environments. Additionally, plastic facilitates integration of advanced features such as touch controls, motion sensors, and IoT connectivity, reinforcing the material’s dominance in enabling energy-efficient, technologically sophisticated, and user-friendly electrical solutions throughout Japan.

Application Insights:

Access the Comprehensive Market Breakdown Request Sample

- Residential

- Commercial

- Industrial

The residential exhibits a clear dominance with a 55.8% share of the total Japan electric switches and sockets market in 2025.

The residential segment dominates the market, propelled by rising demand for modern, safe, and energy-efficient electrical fittings in homes. Growing urbanization, housing renovations, and new construction projects are fueling adoption, with consumers prioritizing convenient, reliable, and user-friendly switches and sockets for daily household use. Residential applications increasingly incorporate smart features, including remote control, automation, and energy monitoring, reflecting evolving lifestyle preferences and the integration of connected home technologies across Japanese households. In September 2024, Prime Star Co., Ltd. launched JUNG outlets in Japan, featuring PSE certification, KNX compatibility, customizable installation, and vibrant Le Corbusier colors, enhancing the country’s switches and sockets market.

Homeowners also seek products that combine functionality with aesthetic appeal, ensuring switches and sockets complement interior décor while meeting performance and safety standards. Rising awareness of energy efficiency and sustainability encourages adoption of eco-friendly materials and devices with reduced power consumption. The focus on enhancing comfort, convenience, and security in living spaces strengthens the residential segment’s growth, making it the primary driver of market expansion within the Japan electric switches and sockets industry.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto Region commands with a market share of 34.2% of the total Japan electric switches and sockets market in 2025.

The Kanto Region held the market, driven by its dense population, extensive urban infrastructure, and concentration of residential, commercial, and industrial developments. High construction activity, ongoing renovations, and the rapid adoption of smart home technologies contribute to strong demand for advanced electrical fittings throughout the region. Manufacturers strategically locate production and distribution facilities in Kanto to ensure efficient supply chains, reduce logistics costs, and meet the needs of this economically significant and technology-driven market.

Consumer preferences in Kanto emphasize convenience, energy efficiency, and integration with connected home systems, encouraging widespread adoption of smart switches and sockets. The region’s focus on modern living standards, sustainability initiatives, and digital infrastructure supports investment in innovative products that enhance safety, control, and energy management. Consequently, Kanto remains a central hub for market growth, technological advancement, and the introduction of high-performance, user-friendly electrical solutions.

Market Dynamics:

Growth Drivers:

Why is the Japan Electric Switches and Sockets Market Growing?

Accelerating Smart Home Technology Adoption and IoT Integration

The Japan electric switches and sockets market is experiencing robust growth driven by the accelerating adoption of smart home technologies and Internet of Things integration across residential and commercial sectors. As per sources, in July 2025, X-HEMISTRY reported that Japan’s smart home penetration remains below 10%, highlighting strong growth potential as Matter-compatible devices simplify IoT integration and boost consumer adoption. Moreover, Japanese consumers are increasingly prioritizing intelligent and interconnected solutions that can be controlled remotely through mobile devices or voice-activated systems for enhanced convenience, security, and energy management. The government has invested substantially in digital technologies, establishing Japan as a global leader in smart home innovation. Manufacturers are responding to this demand by introducing switches and sockets with enhanced connectivity features, scheduling capabilities, motion detection, and energy monitoring functionalities that integrate seamlessly with popular home automation ecosystems.

Demographic Transformation and Geriatric Population Requirements

Japan's rapidly geriatric population is creating unprecedented demand for home automation technologies, including smart electrical switches and outlets that support independent living for elderly residents. With a significant portion of the population projected to be aged over sixty-five within the coming decades, there is growing emphasis on assisted living technologies that address labor shortages and improve eldercare outcomes. As of September 2025, Japan’s elderly population reached 36.19 million, accounting for a record 29.4% of the total population, highlighting growing demand for smart home solutions for independent living. Furthermore, smart home devices with voice control, motion sensing, and remote monitoring capabilities enable elderly individuals to manage their living environments safely and independently. This demographic shift is driving innovation in electrical products designed with accessibility features, simplified interfaces, and integration with health monitoring systems.

Government Initiatives Promoting Energy Efficiency and Sustainability

The Japan electric switches and sockets market is benefiting substantially from government initiatives promoting energy efficiency and sustainable infrastructure development. In March 2025, Japan promoted ZEB (Net Zero Energy Building) initiatives, encouraging energy-efficient construction and smart electrical systems installation, supporting sustainable infrastructure and advanced switches and sockets adoption. Moreover, the Ministry of Economy, Trade and Industry's Top-Runner Program mandates stringent energy efficiency standards for new commercial buildings, spurring innovation in smart electrical systems and LED lighting controls. Local government programs provide financial incentives for residents to upgrade their electrical installations with energy-efficient products. These regulatory frameworks and subsidy programs are accelerating the replacement of conventional electrical fittings with advanced, energy-saving alternatives across both new construction and renovation projects.

Market Restraints:

What Challenges the Japan Electric Switches and Sockets Market is Facing?

High Installation and Retrofit Costs for Smart Electrical Systems

The initial investment required for advanced smart switches and integrated electrical systems presents a significant barrier to widespread market adoption, particularly among price-sensitive residential consumers and small commercial establishments. Smart electrical products command premium pricing compared to conventional alternatives, and installation often requires specialized technicians familiar with IoT connectivity and home automation protocols. This cost sensitivity is particularly pronounced in regions where household incomes trail the national median, creating uneven adoption patterns across different prefectures.

Integration Challenges with Legacy Building Infrastructure

A substantial portion of Japan's existing housing stock and commercial buildings predates the era of smart infrastructure, creating significant challenges for integrating modern electrical products with legacy wiring systems and analog controls. Retrofitting older buildings with advanced switches and sockets often requires extensive modifications to existing electrical infrastructure, increasing project complexity and costs. The fragmented nature of HVAC and electrical contractor markets in Japan further complicates integration efforts, sometimes resulting in suboptimal system performance and compatibility issues.

Limited Consumer Awareness and Technical Complexity

Despite growing interest in smart home technologies, many consumers remain unfamiliar with the full capabilities and benefits of advanced electrical products, limiting adoption rates particularly among older demographics. The technical complexity associated with configuring and operating IoT-enabled switches and sockets can deter potential buyers who prefer straightforward, conventional solutions. Additionally, concerns regarding data privacy, cybersecurity vulnerabilities, and the reliability of connected devices create hesitation among certain consumer segments considering smart electrical upgrades.

Competitive Landscape:

The Japan electric switches and sockets market features a moderately consolidated competitive environment characterized by domestic electrical equipment manufacturers competing alongside established multinational corporations. Market participants employ diverse strategies including product innovation, premium branding, distribution network expansion, and strategic partnerships to strengthen their competitive positions. Leading companies are investing substantially in research and development to introduce smart switches and sockets with enhanced IoT connectivity, energy efficiency features, and contemporary designs that appeal to modern consumers. The competitive landscape is further intensified by the growing emphasis on sustainability, prompting manufacturers to develop eco-friendly products incorporating recycled materials and energy-saving technologies. Companies are also focusing on expanding service networks and providing comprehensive after-sales support to enhance customer satisfaction and loyalty across residential, commercial, and industrial segments.

Recent Developments:

- In September 2025, Panasonic launched a new series of full 2-wire remote control switches (Advanced type) for non-residential use in Japan. Available in matte white, gray, and black, the switches are compatible with smart devices, allowing smartphone control, dimming functions, and energy-efficient lighting management, enhancing convenience and design in modern buildings.

Japan Electric Switches and Sockets Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Materials Covered | Plastic, Metal, Others |

| Applications Covered | Residential, Commercial, Industrial |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan electric switches and sockets market size was valued at USD 4,06,732.53 Million in 2025.

The Japan electric switches and sockets market is expected to grow at a compound annual growth rate of 11.12% from 2026-2034 to reach USD 10,50,178.50 Million by 2034.

Switches dominated the market with a leading share, supported by rising demand for advanced switching solutions such as dimmer switches, smart switches, and IoT-enabled motor starters that enhance control, efficiency, and convenience across residential, commercial, and industrial electrical installations.

Key factors driving the Japan electric switches and sockets market include expanding smart home adoption, strong government support for energy-efficient installations, rising geriatric demand for assisted living technologies, and increasing commercial building automation, collectively fueling sustained upgrades in modern electrical infrastructure nationwide.

Major challenges include high installation and retrofit costs for smart electrical systems, integration difficulties with legacy building infrastructure, limited consumer awareness about advanced product capabilities, and competition from lower-priced alternatives.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)