Japan Electric Welding Machine Market Size, Share, Trends and Forecast by Type, Application, and Region, 2026-2034

Japan Electric Welding Machine Market Overview:

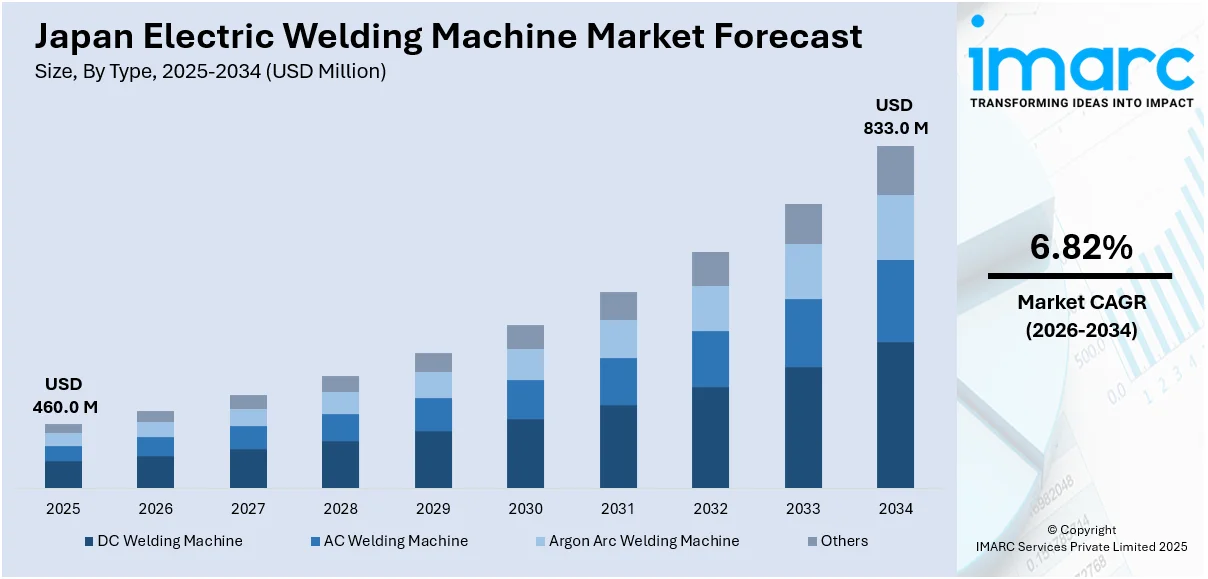

The Japan electric welding machine market size reached USD 460.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 833.0 Million by 2034, exhibiting a growth rate (CAGR) of 6.82% during 2026-2034. The market is driven by the rapid adoption of automation and robotics in welding, fueled by Japan’s aging workforce, demand for precision, and government-backed Industry 4.0 initiatives. Additionally, stringent environmental regulations and rising energy costs are accelerating the shift toward energy-efficient, inverter-based welding machines with reduced emissions. Growing demand from key sectors, including automotive and construction further reinforces these trends, further augmenting the Japan electric welding machine market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 460.0 Million |

| Market Forecast in 2034 | USD 833.0 Million |

| Market Growth Rate 2026-2034 | 6.82% |

Japan Electric Welding Machine Market Trends:

Increasing Adoption of Automation and Robotics in Welding

The market is witnessing a shift toward automation and robotics, driven by the need for precision, efficiency, and labor cost reduction. With Japan’s aging workforce and shrinking labor pool, manufacturers are increasingly investing in automated welding solutions to maintain productivity. Advanced robotic welding systems equipped with AI and IoT capabilities are gaining traction, enabling real-time monitoring, predictive maintenance, and improved weld quality. Industries such as automotive, shipbuilding, and construction are leading this trend, as automated welding ensures consistent output and reduces human error. Additionally, government initiatives promoting smart manufacturing and Industry 4.0 are accelerating the adoption of automated welding technologies. Japan's Society 5.0 vision, moving beyond Industry 4.0, embraces artificial intelligence, the Internet of Things, and robotics to transform key industries including transportation, healthcare, and infrastructure, supported by a JPY 4.2 trillion (USD 38 Billion) science, technology, and innovation budget in 2019. With smart infrastructure and automation at the center of this digital revolution, electric welding machine manufacturers are likely to see increased demand for intelligent, cyber-physical systems. This program also supports Japan's sustainability efforts and alignment with the Sustainable Development Goals, which will be strongly showcased at EXPO 2025 in Osaka. As a result, welding machine manufacturers are focusing on developing compact, energy-efficient, and high-performance robotic welding systems to cater to the growing demand for automation in Japan’s industrial sector.

To get more information on this market Request Sample

Rising Demand for Energy-Efficient and Eco-Friendly Welding Machines

Sustainability and energy efficiency are also significantly supporting the Japan electric welding machine market growth. With stringent environmental regulations and rising energy costs, manufacturers are prioritizing eco-friendly welding solutions that reduce carbon emissions and power consumption. In 2023, Japan witnessed its total energy consumption fall by 3.5%, at 391 Mtoe, with per capita electricity consumption at 7.3 MWh and energy self-reliance standing at only 16.5%, while it points towards continued dependence on imports and high energy costs. The industrial sector remains the largest electricity user, at 36%, as renewable sources powered the energy supply by 27.5%. These advances highlight the imperative need for energy-efficient welding machines to help Japanese manufacturers reduce operating expenses and carbon emissions. Inverter-based welding machines are gaining popularity due to their energy-saving capabilities, lightweight design, and improved arc stability. Additionally, there is a growing preference for welding technologies that minimize harmful fumes and spatter, aligning with Japan’s commitment to green manufacturing. The construction and automotive sectors, in particular, are adopting these advanced welding systems to comply with environmental standards while maintaining high productivity. As Japan continues to emphasize sustainable industrial practices, welding machine suppliers are expected to innovate further, offering more energy-efficient and environmentally friendly solutions to meet market demands.

Japan Electric Welding Machine Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type and application.

Type Insights:

- DC Welding Machine

- AC Welding Machine

- Argon Arc Welding Machine

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes DC welding machine, AC welding machine, argon arc welding machine, and others.

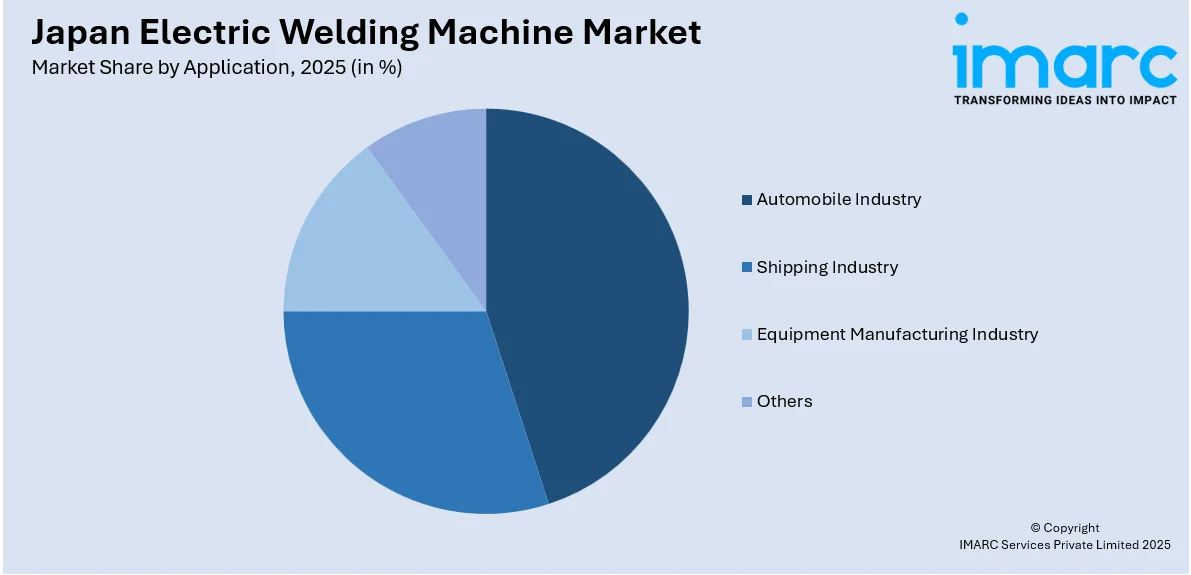

Application Insights:

Access the comprehensive market breakdown Request Sample

- Automobile Industry

- Shipping Industry

- Equipment Manufacturing Industry

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes automobile industry, shipping industry, equipment manufacturing industry, and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Electric Welding Machine Market News:

- April 16, 2025: Yaskawa Electric and Toyota developed a new arc welding process, Sequence Freezing Arc-Welding (SFA), which shortens roll cage manufacturing time from 2-3 weeks to only 2-3 days. The newer robotic technology increases welding accuracy, improves rigidity, and shortens production time by more than 80%. As Japan continues to expand the horizon in automation in the electric welding machine manufacturing process, SFA is an indicator of Japan's technical excellence in industrial robotics technology.

Japan Electric Welding Machine Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | DC Welding Machine, AC Welding Machine, Argon Arc Welding Machine, Others |

| Applications Covered | Automobile Industry, Shipping Industry, Equipment Manufacturing Industry, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan electric welding machine market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan electric welding machine market on the basis of type?

- What is the breakup of the Japan electric welding machine market on the basis of application?

- What is the breakup of the Japan electric welding machine market on the basis of region?

- What are the various stages in the value chain of the Japan electric welding machine market?

- What are the key driving factors and challenges in the Japan electric welding machine market?

- What is the structure of the Japan electric welding machine market and who are the key players?

- What is the degree of competition in the Japan electric welding machine market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan electric welding machine market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan electric welding machine market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan electric welding machine industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)