Japan Electrical Wires and Cables Market Size, Share, Trends and Forecast by Type, End User, and Region, 2026-2034

Japan Electrical Wires and Cables Market Summary:

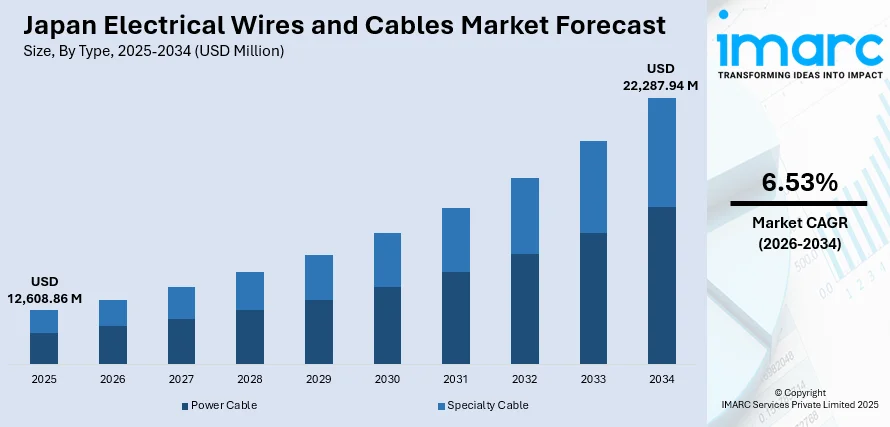

The Japan electrical wires and cables market size was valued at USD 12,608.86 Million in 2025 and is projected to reach USD 22,287.94 Million by 2034, growing at a compound annual growth rate of 6.53% from 2026-2034.

The Japan electrical wires and cables market is experiencing robust growth driven by the nation's ambitious infrastructure modernization initiatives, accelerating renewable energy integration, and expanding digital connectivity requirements. The government's Green Transformation policy framework and substantial investments in smart grid technologies are creating sustained demand for high-performance power transmission and distribution cables. Additionally, the surge in data center construction and semiconductor manufacturing facilities across metropolitan regions is generating significant requirements for specialized cabling solutions, further strengthening Japan electrical wires and cables market share.

Key Takeaways and Insights:

- By Type: Power cable dominates the market with a share of 67% in 2025, driven by extensive grid modernization programs and renewable energy transmission infrastructure expansion across the nation.

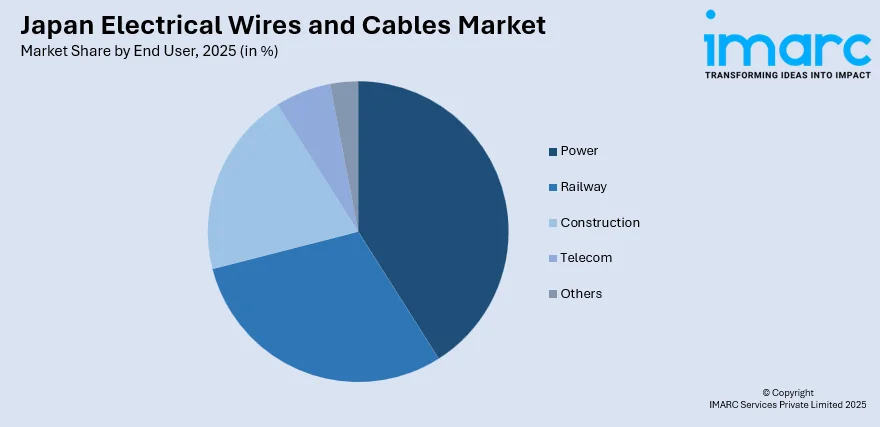

- By End User: Power leads the market with a share of 41% in 2025, supported by cross-regional interconnection projects and utility investments in decarbonized power transmission networks.

- Key Players: The Japan electrical wires and cables market exhibits moderate to high competitive intensity, characterized by established domestic manufacturers with vertically integrated operations competing alongside international cable specialists. Market participants focus on technological innovation, sustainable manufacturing practices, and strategic partnerships with utility operators to strengthen their market positioning.

To get more information on this market Request Sample

Japan's electrical wires and cables market is undergoing significant transformation driven by the country's commitment to achieving carbon neutrality. The government's commitment to achieving carbon neutrality is spurring substantial investments in power grid enhancement, cross-regional transmission network development, and renewable energy integration infrastructure. The country's strategic focus on economic security has elevated domestic cable manufacturing capabilities, particularly for critical submarine cable systems supporting digital connectivity. Rising demand from data centers, semiconductor manufacturing facilities, and telecommunications infrastructure is further propelling market expansion across metropolitan regions. Additionally, Japanese manufacturers continue to demonstrate technological leadership in high-voltage transmission systems, specialty cables, and environmentally sustainable product innovations, strengthening the nation's competitive position in both domestic and international markets.

Japan Electrical Wires and Cables Market Trends:

Expansion of Submarine Cable Infrastructure for Digital Connectivity

Japan is witnessing unprecedented investment in submarine cable systems to support surging data transmission demands driven by artificial intelligence applications and cloud computing services. The country serves as a critical telecommunications hub connecting Asia and North America, with numerous international submarine cable landing stations and multiple active or announced cable systems spanning transpacific and intra-Asia routes. This strategic positioning reinforces Japan's role as a vital node in global digital connectivity infrastructure.

Smart Grid Technology Integration and Grid Modernization

The Japanese power grid sector is experiencing a fundamental shift toward smart grid technologies incorporating advanced communication, automation, and data analytics capabilities. These technologies enable superior energy management, improved grid stability, and enhanced demand-response mechanisms essential for integrating variable renewable energy sources such as solar and wind power. Utility operators are increasingly deploying intelligent monitoring systems and predictive maintenance solutions to optimize energy distribution, reduce grid congestion, and enhance overall power supply reliability across the nation's transmission and distribution networks.

Eco-Friendly Cable Solutions and Sustainable Manufacturing

Environmental sustainability concerns are driving a growing trend toward eco-wires and eco-cables developed with environmentally friendly materials that minimize environmental impact. Japanese cable manufacturers are increasingly focusing on developing halogen-free, flame-retardant cables and implementing circular economy principles in production processes. In December 2024, Hitachi Energy announced the supply of Japan's first SF₆-free 300 kV circuit-breakers to Chubu Electric Power Grid, eliminating 99.3% of CO2-equivalent emissions and marking a significant advancement in sustainable power grid infrastructure development.

Market Outlook 2026-2034:

The Japan electrical wires and cables market is positioned for sustained growth through the forecast period, underpinned by strategic government initiatives promoting renewable energy integration, digital infrastructure expansion, and grid resilience enhancement. The convergence of power infrastructure and communication networks under initiatives such as the Watt-Bit Coordination framework, proposed by TEPCO Power Grid during the GX2040 Leaders Panel, is creating new opportunities for integrated cable solutions. This strategic approach recognizes that co-locating decarbonized power sources with data centers optimizes infrastructure development costs while accelerating deployment timelines across the nation. The market generated a revenue of USD 12,608.86 Million in 2025 and is projected to reach a revenue of USD 22,287.94 Million by 2034, growing at a compound annual growth rate of 6.53% from 2026-2034.

Japan Electrical Wires and Cables Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Power Cable | 67% |

| End User | Power | 41% |

Type Insights:

- Power Cable

- Specialty Cable

The power cable dominates with a market share of 67% of the total Japan electrical wires and cables market in 2025.

The power cable commanding market position reflects Japan's extensive transmission and distribution network requirements driven by grid modernization initiatives and renewable energy integration programs. The government's master plan for cross-regional interconnection network development emphasizes significant infrastructure investments including major transmission line projects connecting renewable energy-rich regions with high-demand urban centers. These large-scale developments necessitate high-capacity power cables capable of efficient long-distance electricity transmission while meeting stringent safety and performance standards.

Power cable demand is further accelerated by high-voltage direct current submarine cable construction connecting renewable energy generation sites with urban consumption centers. Japan's strategic focus on developing offshore wind capacity in Hokkaido, Honshu, and Kyushu regions requires substantial underwater cable infrastructure investments. In July 2025, Sumitomo Electric commenced installation of its 525 kV XLPE HVDC underground cable for Germany's A-Nord corridor project, demonstrating Japanese manufacturers' technological leadership in high-voltage cable systems. Power cable demand is further accelerated by the construction of high-voltage direct current submarine cables connecting renewable energy generation sites with urban consumption centers.

End User Insights:

Access the comprehensive market breakdown Request Sample

- Railway

- Power

- Construction

- Telecom

- Others

The power leads with a share of 41% of the total Japan electrical wires and cables market in 2025.

The power sector's market leadership stems from Japan's comprehensive grid enhancement programs addressing both renewable energy integration and infrastructure resilience requirements. The country's transmission and distribution network operators, represented by the Grid Council comprising ten companies, are implementing substantial capital investments to support the nation's carbon neutrality objectives. The cross-regional network master plan encompasses multiple strategic projects including the Chugoku-Kyushu enhancement and the Kyushu-Shikoku new build, driving sustained demand for high-capacity power cables across the national grid infrastructure.

Rising electricity demand from data centers and semiconductor manufacturing facilities is driving additional power infrastructure investments across Japan. The Organization for Cross-regional Coordination of Transmission Operators projects that electricity demand from data centers and semiconductor factories nationwide will surge dramatically over the coming decade, representing a substantial increase from current levels. This anticipated growth is prompting utility operators to accelerate substation construction and transmission line upgrades, particularly in metropolitan regions where digital infrastructure concentration is highest, creating robust long-term demand for electrical wires and cables.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto Region dominates Japan's electrical wires and cables market, driven by Tokyo's position as the nation's economic, digital, and financial hub with the highest concentration of data centers, semiconductor facilities, and commercial infrastructure requiring extensive cabling solutions.

The Kansai/Kinki Region represents a significant market driven by Osaka's industrial base and ongoing infrastructure investments, with Kansai Transmission and Distribution enhancing four substations and transmission lines to support expanding digital infrastructure demands.

The Central/Chubu Region maintains steady demand supported by its manufacturing sector concentration and automotive industry presence, with Chubu Electric Power Grid leading sustainability initiatives including Japan's first SF₆-free high-voltage circuit breaker deployment.

The Kyushu-Okinawa Region is emerging as a strategic hub for digital infrastructure diversification, with Fukuoka Prefecture selected for new submarine cable landing stations to complement and substitute existing infrastructure in metropolitan areas.

The Tohoku Region presents growth opportunities driven by renewable energy development and grid interconnection projects linking northern power generation capacity with southern consumption centers through enhanced transmission infrastructure.

The Chugoku Region benefits from planned grid enhancement investments for the Chugoku-Kyushu interconnection project, strengthening cross-regional power transmission capabilities and driving sustained cable demand.

Hokkaido Region represents substantial growth potential as Japan's primary renewable energy source region, with the Hokkaido-Tokyo transmission line project driving significant demand for high-capacity submarine and land-based cables.

The Shikoku Region is experiencing infrastructure development through the planned Kyushu-Shikoku new build transmission project and Shikoku-Kansai enhancement initiatives connecting the island to broader national grid networks.

Market Dynamics:

Growth Drivers:

Why is the Japan Electrical Wires and Cables Market Growing?

Government-Led Renewable Energy Integration and Grid Modernization

Japan's commitment to achieving carbon neutrality by 2050 is driving unprecedented investments in power grid infrastructure to accommodate expanding renewable energy capacity. The government's Sixth Strategic Energy Plan emphasizes maximizing renewable energy utilization while enhancing grid resilience through comprehensive transmission network development. For instance, the Organization for Cross-regional Coordination of Transmission Operators has outlined investment requirements ranging from JPY 6 Trillion to JPY 7.9 Trillion for transmission and distribution network development through 2050, creating sustained long-term demand for power cables.

Surging Data Center and Digital Infrastructure Demand

The exponential growth of artificial intelligence applications, cloud computing services, and digital transformation initiatives is driving substantial expansion of data center facilities across Japan, creating significant demand for specialized electrical cabling solutions. The rise of artificial intelligence and Japan's drive for digital transformation is forecasted to boost power demand from data centers by twelve-fold over the next ten years, necessitating major infrastructure investments. In August 2024, TEPCO announced plans to invest USD 3.2 Billion in power grid infrastructure by 2030, including the construction of new large-scale substations nationwide with forty percent concentrated in the Tokyo metropolitan area to support data center and semiconductor manufacturing expansion.

Strategic Economic Security and Domestic Production Enhancement

Japan's increasing focus on economic security and supply chain resilience is driving initiatives to enhance domestic cable manufacturing capabilities, particularly for critical infrastructure applications. The government's classification of undersea cables as critical supplies under economic security policy reflects the strategic importance placed on maintaining robust domestic production capacity. In April 2025, Japan's Ministry of Economy, Trade and Industry (METI) announced plans to bring subsea cables under its purview as part of economic security policy, aiming to expand domestic capability to lay undersea cables and strengthen Japan's position in the global supply chain for electrical cables and supporting infrastructure.

Market Restraints:

What Challenges the Japan Electrical Wires and Cables Market is Facing?

High Infrastructure Development Costs and Land Constraints

Building transmission capacity in Japan faces significant cost challenges due to land ownership regulations and limited available space, making offshore and submarine cable solutions comparatively more attractive despite their higher initial investment requirements. The substantial capital requirements for grid enhancement projects can strain financing capacities and extend implementation timelines.

Regional Grid Frequency Incompatibility Limitations

Japan's unique dual-frequency grid system, with eastern regions operating at 50 Hz and western regions at 60 Hz, creates bottlenecks for electricity transfer between networks. The limited capacity of frequency converter stations restricts cross-regional power flow, requiring additional investments in converter infrastructure alongside transmission line development.

Aging Infrastructure and Maintenance Requirements

Japan's existing electrical infrastructure includes substantial aging assets requiring replacement and upgrading to accommodate changing power generation mix and increasing climate-related disaster resilience requirements. The need for concurrent maintenance of legacy systems while implementing new infrastructure can create resource allocation challenges for market participants.

Competitive Landscape:

The Japan electrical wires and cables market demonstrates a moderately consolidated competitive structure characterized by established domestic manufacturers with comprehensive product portfolios and vertically integrated operations. Market participants compete through technological innovation, manufacturing efficiency, sustainability initiatives, and strategic partnerships with utility operators and infrastructure developers. Japanese manufacturers maintain strong positions in specialty cable segments including submarine cables, high-voltage transmission systems, and automotive wiring harnesses, leveraging decades of accumulated expertise and continuous research and development investments. The competitive landscape is increasingly influenced by sustainability requirements, with manufacturers differentiating through environmentally friendly product offerings and reduced carbon footprint manufacturing processes.

Japan Electrical Wires and Cables Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Power Cable, Specialty Cable |

| End Users Covered | Railway, Power, Construction, Telecom, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan electrical wires and cables market size was valued at USD 12,608.86 Million in 2025.

The Japan electrical wires and cables market is expected to grow at a compound annual growth rate of 6.53% from 2026-2034 to reach USD 22,287.94 Million by 2034.

The power cable dominated the Japan electrical wires and cables market with a 67% share in 2025, driven by extensive grid modernization programs, cross-regional interconnection projects, and renewable energy transmission infrastructure investments across the nation.

Key factors driving the Japan electrical wires and cables market include government-led renewable energy integration initiatives, surging data center and digital infrastructure demand, smart grid technology adoption, and strategic economic security policies promoting domestic production capabilities.

Major challenges include high infrastructure development costs and land constraints, regional grid frequency incompatibility between eastern and western Japan requiring converter stations, aging infrastructure maintenance requirements, and supply chain considerations for raw materials including copper and aluminum.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)