Japan Energy Efficient Transformers Market Size, Share, Trends and Forecast by Type, Cooling Type, Efficiency Level, Application, and Region, 2026-2034

Japan Energy Efficient Transformers Market Overview:

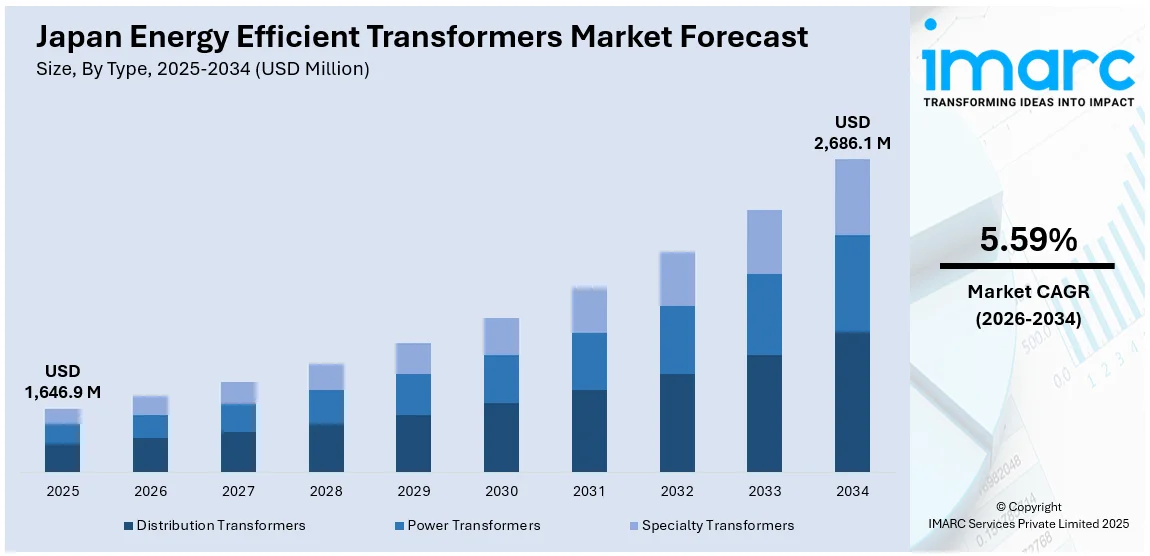

The Japan energy efficient transformers market size reached USD 1,646.9 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 2,686.1 Million by 2034, exhibiting a growth rate (CAGR) of 5.59% during 2026-2034. The market is driven by stringent national energy regulations and the government’s long-term vision to modernize aging grid infrastructure with efficient technologies. Growth in renewable energy projects and localized grids necessitates low-loss transformers capable of stable performance under fluctuating loads, thereby fueling the market. Concurrently, rising industrial automation and EV infrastructure expansion are creating steady deployment avenues in high-performance sectors, further augmenting the Japan energy efficient transformers market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1,646.9 Million |

| Market Forecast in 2034 | USD 2,686.1 Million |

| Market Growth Rate 2026-2034 | 5.59% |

Japan Energy Efficient Transformers Market Trends:

National Energy Strategy and Regulatory Compliance

Japan’s energy policy has increasingly emphasized efficiency, resilience, and sustainability in the face of constrained domestic resources and heightened climate commitments. Following the Fukushima disaster and the consequent restructuring of its energy mix, Japan has enacted stricter efficiency norms across transmission and distribution infrastructure. Regulatory frameworks such as the Top Runner Program and energy conservation laws mandate the adoption of transformers with minimal energy loss. Utilities and grid operators are now replacing outdated equipment with energy-efficient alternatives that align with both performance and environmental metrics. On May 19, 2025, Hitachi Energy successfully tested the world’s first 765 kV/400 kV, 250 MVA natural ester-filled transformer. This ultra-high-voltage AC transformer, featuring a biodegradable ester fluid with a flash point twice that of mineral oil and Hitachi’s rupture-resistant TXpand™ technology, significantly enhances safety and environmental performance. The development supports Japan’s grid modernization goals by offering a sustainable, high-capacity solution amid rising electricity demand and stricter environmental standards. The Ministry of Economy, Trade and Industry (METI) plays a critical role by issuing technical guidelines and offering incentives for compliant installations. These initiatives are particularly prominent in densely populated urban areas where power quality and land constraints necessitate compact, high-performance transformer systems. Moreover, the gradual liberalization of the power sector has encouraged private players to invest in advanced infrastructure as a means of differentiation and reliability assurance. Retrofit projects in existing substations and planned capacity additions across renewables integration further reinforce demand for low-loss equipment. These multifaceted government-led initiatives are now central to driving Japan energy efficient transformers market growth.

To get more information on this market Request Sample

Industrial Automation and Electrification of Transportation

Japan’s highly industrialized economy is experiencing a strong transition toward electrified operations, digital manufacturing, and low-emission mobility—all of which require stable and efficient power delivery systems. In automotive, railways, and semiconductor manufacturing, reliable transformers are essential to protect sensitive equipment and maintain voltage precision under variable loads. The expansion of electric vehicle (EV) infrastructure, including fast-charging stations and dedicated substations, has created new deployment opportunities for high-efficiency transformers with rapid load response capabilities. Meanwhile, industrial automation—supported by initiatives such as Society 5.0, is driving up demand for digitally integrated power equipment that communicates with broader energy management systems. On October 27, 2023, Japan’s Ministry of Economy, Trade and Industry (METI) promulgated new energy efficiency standards for transformers used in buildings and factories, targeting fiscal year 2026 for enforcement. These standards apply to transformers with rated primary voltages from 600 V to 7,000 V in AC circuits and are divided into 24 categories based on type, phases, frequency, capacity, and specifications. The new efficiency standards aim to reduce energy losses, as transformers consume 2–3% of total transmitted energy, by approximately 11.4% compared to 2019 levels, helping Japan improve energy conservation in line with the Act on the Rational Use of Energy. Energy-efficient transformers play a pivotal role in achieving power savings and reducing downtime in such high-tech manufacturing settings. In railway electrification projects, particularly in urban transit networks, low-loss transformers are favored for their compactness, operational stability, and compliance with EMI standards. Additionally, the integration of battery energy storage systems (BESS) in industrial and commercial complexes is another use case where efficient transformers serve as a bridge between high-voltage grids and consumer-side assets. This transformation in industrial energy architecture continues to create a robust pipeline for advanced transformer deployment.

Japan Energy Efficient Transformers Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type, cooling type, efficiency level, and application.

Type Insights:

- Distribution Transformers

- Power Transformers

- Specialty Transformers

The report has provided a detailed breakup and analysis of the market based on the type. This includes distribution transformers, power transformers, and specialty transformers.

Cooling Type Insights:

- Oil-Cooled Transformers

- Dry-Type Transformers

The report has provided a detailed breakup and analysis of the market based on the cooling type. This includes oil-cooled transformers and dry-type transformers.

Efficiency Level Insights:

- Low-Efficiency Transformers

- High-Efficiency Transformers

- Ultra-High-Efficiency Transformers

The report has provided a detailed breakup and analysis of the market based on the efficiency level. This includes low-efficiency transformers, high-efficiency transformers, and ultra-high-efficiency transformers.

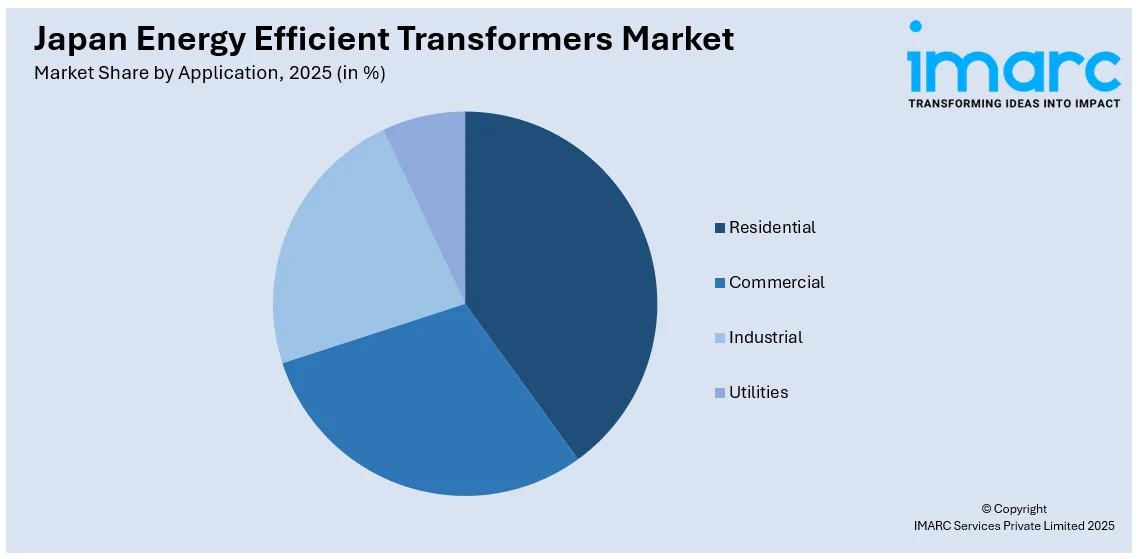

Application Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial

- Industrial

- Utilities

The report has provided a detailed breakup and analysis of the market based on the application. This includes residential, commercial, industrial, and utilities.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all major regional markets. This includes Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Energy Efficient Transformers Market News:

- On April 5, 2024, Mitsubishi Electric announced it will transfer its distribution transformer business from the Nagoya Works to Hitachi Industrial Equipment Systems, with full integration expected by April 1, 2026. The move aims to expand Hitachi's portfolio of highly energy-efficient as well as eco-friendly transformers, reinforcing its focus on advanced grid edge solutions.

Japan Energy Efficient Transformers Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Distribution Transformers, Power Transformers, Specialty Transformers |

| Cooling Types Covered | Oil-Cooled Transformers, Dry-Type Transformers |

| Efficiency Levels Covered | Low-Efficiency Transformers, High-Efficiency Transformers, Ultra-High-Efficiency Transformers |

| Applications Covered | Residential, Commercial, Industrial, Utilities |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan energy efficient transformers market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan energy efficient transformers market on the basis of type?

- What is the breakup of the Japan energy efficient transformers market on the basis of cooling type?

- What is the breakup of the Japan energy efficient transformers market on the basis of efficiency level?

- What is the breakup of the Japan energy efficient transformers market on the basis of application?

- What is the breakup of the Japan energy efficient transformers market on the basis of region?

- What are the various stages in the value chain of the Japan energy efficient transformers market?

- What are the key driving factors and challenges in the Japan energy efficient transformers market?

- What is the structure of the Japan energy efficient transformers market and who are the key players?

- What is the degree of competition in the Japan energy efficient transformers market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan energy efficient transformers market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan energy efficient transformers market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan energy efficient transformers industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)