Japan Engine Oils Market Size, Share, Trends and Forecast by Grade, Sales Channel, Engine Type, Vehicle Type, and Region, 2026-2034

Japan Engine Oils Market Summary:

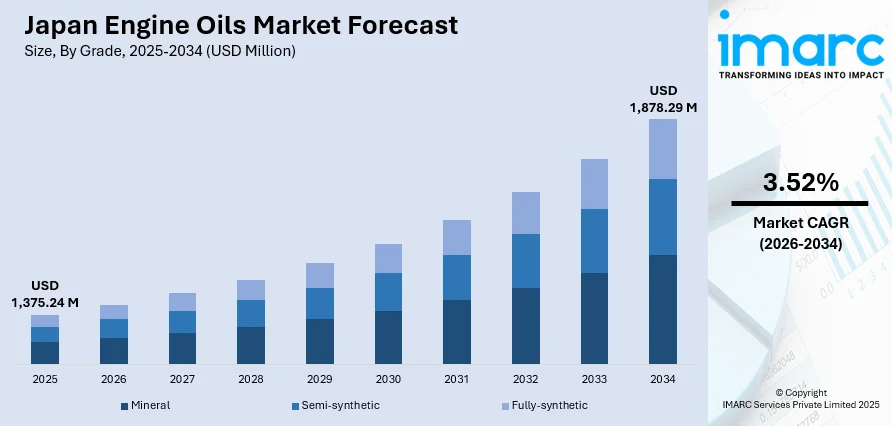

The Japan engine oils market size was valued at USD 1,375.24 Million in 2025 and is projected to reach USD 1,878.29 Million by 2034, growing at a compound annual growth rate of 3.52% from 2026-2034.

The market is driven by the growing automotive sector and rising vehicle ownership across urban and rural areas. Increasing consumer awareness about engine maintenance and longevity is driving demand for high-quality lubricants. A shift toward advanced formulations that provide improved fuel efficiency and cut down on emissions also supports market growth. Besides this, expanding aftermarket services and strict environmental regulations will further add value to the overall Japan engine oils market share.

Key Takeaways and Insights:

-

By Grade: Fully‑synthetic dominates the market with a share of 54% in 2025, driven by superior engine protection properties, extended drain intervals, and compatibility with modern high-performance engines requiring advanced lubrication solutions for optimal efficiency.

-

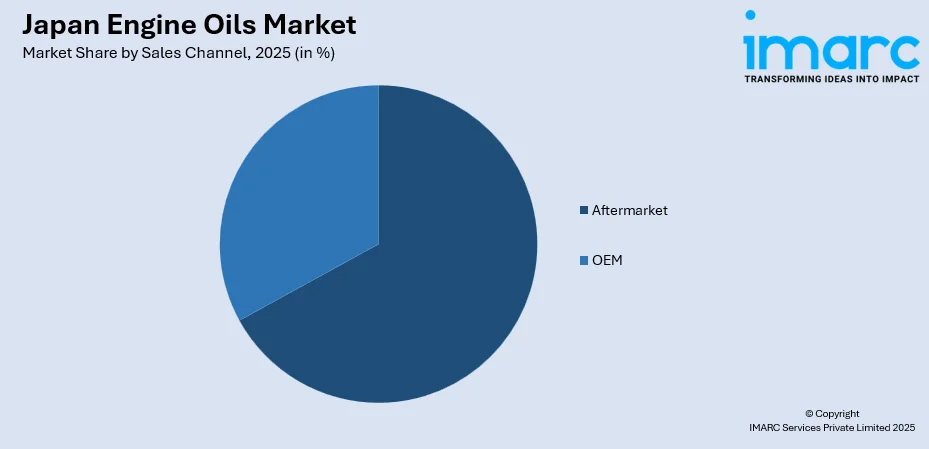

By Sales Channel: Aftermarket leads the market with a share of 67% in 2025, owing to the extensive network of service centers, quick-lube outlets, and automotive repair shops offering convenient oil change services across Japan.

-

By Engine Type: Gasoline represents the largest segment with a market share of 75% in 2025, driven by the predominance of gasoline-powered passenger vehicles in the Japanese automotive landscape and consumer preference for petrol engines.

-

By Vehicle Type: Passenger cars lead the market with a share of 69% in 2025, attributed to the high vehicle density in urban centers, frequent commuting patterns, and regular maintenance schedules followed by Japanese car owners.

-

By Region: Kanto region dominates the market with a share of 31% in 2025, driven by the concentration of automotive manufacturing hubs, higher population density, and extensive transportation networks in the Tokyo metropolitan area.

-

Key Players: The Japan engine oils market exhibits a well-established competitive landscape, with multinational lubricant manufacturers competing alongside domestic producers across premium and economy segments. Market participants focus on product differentiation through advanced formulations and strategic distribution partnerships.

To get more information on this market Request Sample

The Japan engine oils market is experiencing steady expansion driven by the country’s mature automotive ecosystem, high vehicle density, and strong consumer focus on long-term engine reliability. Increasing adoption of advanced powertrain technologies, including turbocharged and direct-injection engines, is accelerating the need for high-performance lubricant formulations capable of supporting greater thermal loads and precision engineering. Rising environmental awareness is also shaping purchasing preferences, with consumers and service providers shifting toward low-emission, fuel-efficient, and eco-certified engine oils. Additionally, the growth of Japan’s automotive aftermarket, supported by extensive service centers, dealership networks, and quick-service outlets, ensures convenient access to premium engine oils nationwide. These combined factors continue to reinforce sustained demand for technologically sophisticated and environmentally responsible lubrication solutions. As per sources, in March 2025, ENEOS announced plans to phase out lubricant production at its Yokohama Plant between January 2026 and March 2028 as part of a wider restructuring of its petroleum supply network.

Japan Engine Oils Market Trends:

Rising Adoption of Low-Viscosity Synthetic Formulations

The Japanese automotive industry is witnessing a significant shift toward low-viscosity synthetic engine oils designed to maximize fuel efficiency. These advanced formulations reduce internal friction within engine components, enabling smoother operation and improved energy conservation. Japanese consumers increasingly prefer these products due to their compatibility with modern engine designs that demand precise lubrication specifications. The development of ultra-thin oil films that maintain protective properties under extreme conditions represents a key innovation area. Manufacturers are investing heavily in research to create formulations that balance reduced viscosity with enhanced wear protection, addressing the evolving requirements of next-generation engines. As per sources, in May 2024, ENEOS announced it had successfully produced a low-carbon lubricant base oil from recycled used engine oil, confirming high-temperature oxidation stability equivalent to conventional crude-derived base oils.

Integration of Bio-Based and Sustainable Lubricant Solutions

Environmental sustainability is driving innovation in the Japanese engine oils sector, with growing interest in bio-based lubricant alternatives. These formulations incorporate renewable plant-derived base stocks that reduce dependence on petroleum resources while maintaining performance characteristics. In December 2024, ENEOS announced it had developed a 100% plant-derived 0W-20 engine oil certified to API SP/ILSAC GF-6, marking a major step toward carbon-neutral, bio-based lubricant solutions in Japan. Moreover, Japanese consumers demonstrate strong receptivity toward environmentally responsible products that align with national sustainability objectives. The development of biodegradable additives and recyclable packaging further supports this green transition. Industry participants are exploring novel extraction and refining processes to enhance the performance attributes of bio-based oils while ensuring cost competitiveness in the mainstream market.

Expansion of Extended-Drain Interval Products

Japanese engine oil manufacturers are increasingly focusing on extended-drain interval formulations that offer prolonged service life between oil changes. These products incorporate advanced additive packages that resist degradation, maintain viscosity stability, and provide sustained protection over extended periods. The convenience factor resonates strongly with Japanese consumers who value time efficiency and reduced maintenance frequency. These formulations also align with environmental objectives by minimizing waste oil generation and reducing resource consumption. The trend reflects broader market evolution toward value-added products that deliver superior performance while addressing practical consumer needs.

Market Outlook 2026-2034:

The Japan engine oils market is anticipated to demonstrate steady revenue growth throughout the forecast period, supported by the expanding vehicle parc and increasing maintenance consciousness among consumers. The ongoing technological advancements in lubricant formulations and the rising demand for specialized products compatible with hybrid and advanced engine systems will contribute to market expansion. Additionally, the strengthening aftermarket distribution networks and the growing preference for premium-grade lubricants are expected to drive revenue generation across various segments. The market generated a revenue of USD 1,375.24 Million in 2025 and is projected to reach a revenue of USD 1,878.29 Million by 2034, growing at a compound annual growth rate of 3.52% from 2026-2034.

Japan Engine Oils Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Grade |

Fully‑synthetic |

54% |

|

Sales Channel |

Aftermarket |

67% |

|

Engine Type |

Gasoline |

75% |

|

Vehicle Type |

Passenger Cars |

69% |

|

Region |

Kanto Region |

31% |

Grade Insights:

- Mineral

- Semi-synthetic

- Fully-synthetic

Fully‑synthetic dominates with a market share of 54% of the total Japan engine oils market in 2025.

Fully-synthetic dominates the Japan engine oils market, reflecting consumer preference for premium lubrication solutions that deliver superior engine protection. These formulations are engineered using chemically synthesized base stocks that offer exceptional thermal stability, oxidation resistance, and viscosity retention across extreme temperature ranges. For example, in March 2025, Kawasaki and Motul launched ‘Kawasaki Premium Oil by Motul,’ a sustainable, high-performance motorcycle oil using re-refined base oil and ester technology, demonstrating advanced lubrication innovation in Japan. Moreover, Japanese motorists increasingly recognize the long-term value proposition of synthetic oils, including extended drain intervals and reduced engine wear.

The strong performance of fully-synthetic in high-stress operating conditions makes them particularly suited for Japan's diverse driving environments, from congested urban traffic to mountainous terrain. The compatibility of these products with modern engine technologies, including variable valve timing and turbocharging systems, reinforces their market position. Consumer education initiatives and recommendations from vehicle manufacturers further support the adoption of fully-synthetic formulations.

Sales Channel Insights:

Access the comprehensive market breakdown Request Sample

- OEM

- Aftermarket

The aftermarket leads with a share of 67% of the total Japan engine oils market in 2025.

The aftermarket segment commands the largest share of Japan engine oils distribution, driven by the extensive network of automotive service providers operating across the country. Quick-lube centers, independent workshops, and automotive parts retailers offer convenient access points for consumers seeking oil change services and lubricant purchases. The strong service culture in Japan encourages regular maintenance adherence, supporting consistent aftermarket demand.

The proliferation of specialized automotive service chains and the expansion of e-commerce platforms have enhanced consumer accessibility to diverse engine oil products. For instance, in October 2025, Autobacs Seven Co., Ltd. reported a 3.0% increase in same-store sales and 4.1% total-store growth, driven by strong demand for maintenance services including engine oil changes. Further, Japanese consumers demonstrate loyalty toward trusted service providers who offer professional installation alongside product recommendations. The aftermarket channel's flexibility in accommodating various brands and formulations enables consumers to select products aligned with their specific requirements and budget considerations.

Engine Type Insights:

- Gasoline

- Diesel

The gasoline exhibits a clear dominance with a 75% share of the total Japan engine oils market in 2025.

Gasoline engines represent the dominant application segment within the Japan engine oils market, corresponding to the prevalence of petrol-powered vehicles in the national automotive fleet. The refined characteristics of Japanese gasoline engines, known for precision engineering and high-revving capabilities, require specialized lubricants that provide consistent protection under varying operating conditions. According to sources, in June 2025, Japan’s Ministry of Economy, Trade and Industry (METI) introduced an action plan to implement E10 and E20 gasoline, signaling potential adjustments in lubricant formulations for ethanol-blended fuels. Furthermore, consumer familiarity with gasoline technology sustains demand for compatible oil formulations.

The continued popularity of gasoline-powered vehicles, particularly compact cars and sedans favored by Japanese consumers, ensures sustained market relevance for this segment. Lubricant manufacturers develop targeted formulations addressing the specific requirements of Japanese gasoline engines, including enhanced deposit control and optimized friction modification. The established infrastructure for gasoline vehicle maintenance further supports consistent demand patterns.

Vehicle Type Insights:

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Two Wheelers

Passenger cars lead with a share of 69% of the total Japan engine oils market in 2025.

Passenger cars constitute the primary vehicle category driving Japan engine oils consumption, reflecting the nation's high personal vehicle ownership rates and established commuting patterns. The diverse passenger car market, encompassing compact vehicles, sedans, and crossovers, generates substantial lubricant demand across various formulation categories. Japanese consumers prioritize regular maintenance to preserve vehicle performance and resale value.

The concentration of passenger vehicles in urban metropolitan areas creates consistent demand for engine oil products and services. The well-organized automotive maintenance ecosystem in Japan, featuring authorized dealerships and independent service centers, facilitates convenient access to oil change services. Consumer awareness regarding the importance of appropriate lubricant selection for specific vehicle models supports the premium product segment.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

Kanto Region dominates with a market share of 31% of the total Japan engine oils market in 2025.

The Kanto region leads Japan engine oils market consumption, anchored by the Tokyo metropolitan area's massive vehicle population and concentrated economic activity. The region's extensive road networks and high traffic volumes generate substantial demand for lubricant products and maintenance services. The presence of major automotive industry stakeholders and distribution infrastructure strengthens market accessibility throughout the region.

The region's role as Japan's commercial and industrial heartland attracts significant commercial vehicle activity alongside passenger car traffic. The concentration of automotive retail outlets, service centers, and distribution facilities ensures comprehensive market coverage. Consumer sophistication and purchasing power in the region support demand for premium engine oil products and professional installation services.

Market Dynamics:

Growth Drivers:

Why is the Japan Engine Oils Market Growing?

Expanding Vehicle Parc and Rising Maintenance Awareness

The steady growth of Japan's vehicle population, encompassing both new registrations and the aging existing fleet, generates sustained demand for engine lubricants. As per sources, Japan had 78.74 Million vehicles in use, including 62.32 Million passenger cars, and 14.40 Million trucks, reflecting disciplined vehicle maintenance. Moreover, Japanese consumers exhibit strong maintenance consciousness, adhering to recommended service intervals and prioritizing quality products that protect their automotive investments. The cultural emphasis on preserving asset value encourages regular oil changes and careful lubricant selection. Educational campaigns by automotive associations and manufacturers further reinforce the importance of proper engine maintenance. The combination of growing vehicle numbers and disciplined maintenance practices creates a stable foundation for market expansion across all product segments and distribution channels.

Technological Advancements in Engine Design and Performance Requirements

The evolution of automotive engine technology in Japan drives corresponding innovation in lubricant formulations designed to meet increasingly demanding specifications. Modern engines featuring direct injection, turbocharging, and variable valve timing systems require advanced oils with specific performance characteristics. The trend toward engine downsizing while maintaining power output places additional stress on lubricants, necessitating enhanced thermal stability and wear protection. Japanese automakers' continuous pursuit of improved fuel efficiency and reduced emissions creates opportunities for specialty lubricant products. The symbiotic relationship between engine advancement and lubricant development propels ongoing market growth and product premiumization.

Strengthening Aftermarket Distribution Infrastructure

The robust expansion of automotive aftermarket channels across Japan enhances consumer access to engine oil products and professional installation services. The proliferation of quick-lube centers, automotive specialty retailers, and integrated service facilities creates convenient touchpoints for maintenance-conscious consumers. The development of sophisticated inventory management and logistics systems ensures product availability across diverse geographic locations. Digital platforms and e-commerce capabilities further extend market reach, enabling consumers to research products and schedule services conveniently. The comprehensive aftermarket ecosystem supports consistent market growth while accommodating evolving consumer preferences for service convenience and product variety.

Market Restraints:

What Challenges the Japan Engine Oils Market is Facing?

Extended Oil Change Intervals Reducing Replacement Frequency

The development of advanced long-life lubricant formulations enabling extended drain intervals impacts overall consumption volumes by reducing oil change frequency. Modern synthetic products designed for prolonged service life decrease the number of annual replacement occasions per vehicle. While these products command premium pricing, the reduced consumption volume partially offsets revenue gains from premiumization.

Growing Popularity of Electric Vehicles Displacing Conventional Lubricant Demand

The accelerating adoption of battery electric vehicles in Japan presents a structural challenge to traditional engine oil demand. Electric powertrains eliminate the need for conventional engine lubrication, reducing the addressable market as the vehicle parc composition shifts. Government incentives and infrastructure development supporting electrification accelerate this transition in key urban markets.

Price Sensitivity Among Budget-Conscious Consumer Segments

Economic considerations influence purchasing decisions among certain consumer segments who prioritize cost minimization over product performance attributes. Price competition from economy-grade products and promotional activities creates margin pressure across distribution channels. The availability of lower-cost alternatives constrains premiumization efforts in price-sensitive market segments.

Competitive Landscape:

The Japan engine oils market features a mature competitive environment characterized by established brand presence and well-developed distribution networks. Market participants compete across multiple dimensions, including product performance specifications, brand reputation, pricing strategies, and service integration. The emphasis on technological innovation drives continuous product development efforts aimed at meeting evolving engine requirements and environmental standards. Strategic partnerships between lubricant suppliers and automotive manufacturers facilitate original equipment specifications and recommended product status. Distribution excellence represents a critical competitive factor, with participants investing in extensive retail presence and service network relationships. Marketing initiatives focus on building consumer trust through quality assurance and technical expertise positioning. The market structure accommodates both premium and value-oriented competitors serving distinct consumer segments with differentiated product offerings.

Recent Developments:

-

In December 2024, Idemitsu Kosan introduced Idemitsu IFG Plantech Racing, the world’s first plant-based motor oil for racing cars, using over 80% plant-derived base oils. The product reduces the carbon footprint by 82% while delivering superior engine performance and protection, marking a major step toward sustainability in motorsports.

Japan Engine Oils Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Grades Covered | Mineral, Semi-synthetic, Fully-synthetic |

| Sales Channels Covered | OEM, Aftermarket |

| Engine Types Covered | Gasoline, Diesel |

| Vehicle Types Covered | Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles, Two Wheelers |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan engine oils market size was valued at USD 1,375.24 Million in 2025.

The Japan engine oils market is expected to grow at a compound annual growth rate of 3.52% from 2026-2034 to reach USD 1,878.29 Million by 2034.

Fully-synthetic held the largest market share, supported by its superior thermal stability, reduced friction, longer service intervals, and suitability for modern high-performance engines. Its ability to enhance fuel efficiency and protect components under extreme operating conditions drove widespread adoption across vehicle categories.

Key factors driving the Japan engine oils market include expanding vehicle population, rising maintenance awareness among consumers, technological advancements in engine design, strengthening aftermarket distribution infrastructure, and growing demand for premium synthetic formulations.

Major challenges include extended oil change intervals reducing replacement frequency, growing electric vehicle adoption displacing conventional lubricant demand, price sensitivity among budget-conscious consumers, fluctuating base oil costs, and intensifying competition across distribution channels.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)