Japan EV Battery Components Market Size, Share, Trends and Forecast by Component Type, Battery Type, Vehicle Type, Propulsion Type, End User, and Region, 2026-2034

Japan EV Battery Components Market Summary:

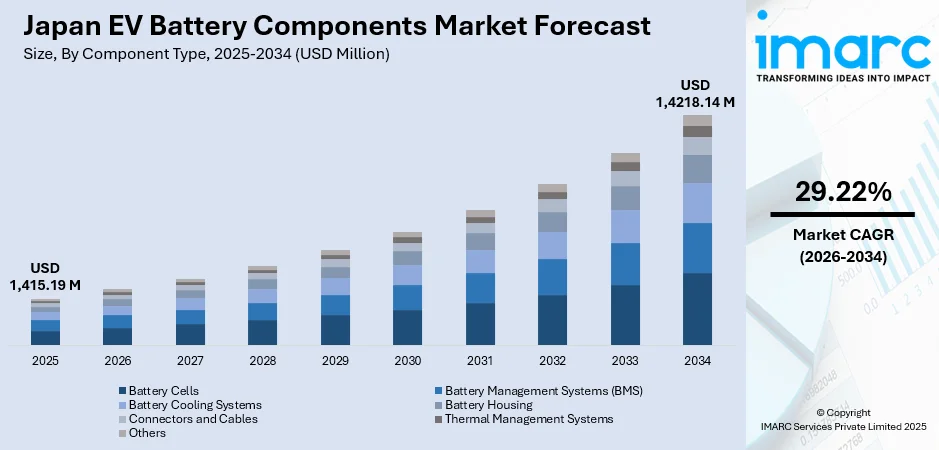

The Japan EV battery components market size was valued at USD 1,415.19 Million in 2025 and is projected to reach USD 1,4218.14 Million by 2034, growing at a compound annual growth rate of 29.22% from 2026-2034.

The market is driven by rapid advancements in solid-state battery technology, increasing demand for high-performance battery management systems, and the growing adoption of lightweight materials for enhanced energy efficiency. Government initiatives promoting electric mobility, coupled with strong investments in research and development by domestic manufacturers, are accelerating innovation across the value chain. Rising environmental consciousness among consumers and stringent emission regulations further support expansion, contributing to the Japan EV battery components market share.

Key Takeaways and Insights:

-

By Component Type: Battery cells dominate the market with a share of 45% in 2025, driven by strong domestic manufacturing capacity and advanced cell technologies enabling higher energy density.

-

By Battery Type: Lithium-ion batteries lead the market with a share of 81% in 2025, owing to reliable performance, mature supply chains, and superior energy-to-weight efficiency.

-

By Vehicle Type: Passenger vehicles dominate the market with a share of 68% in 2025, driven by rising personal EV adoption, supportive incentives, and expanding urban charging networks.

-

By Propulsion Type: Battery electric vehicles (BEVs) represent the largest segment with a market share of 54% in 2025, owing to zero-emission performance aligned with national goals and consumer preference for fully electric models.

-

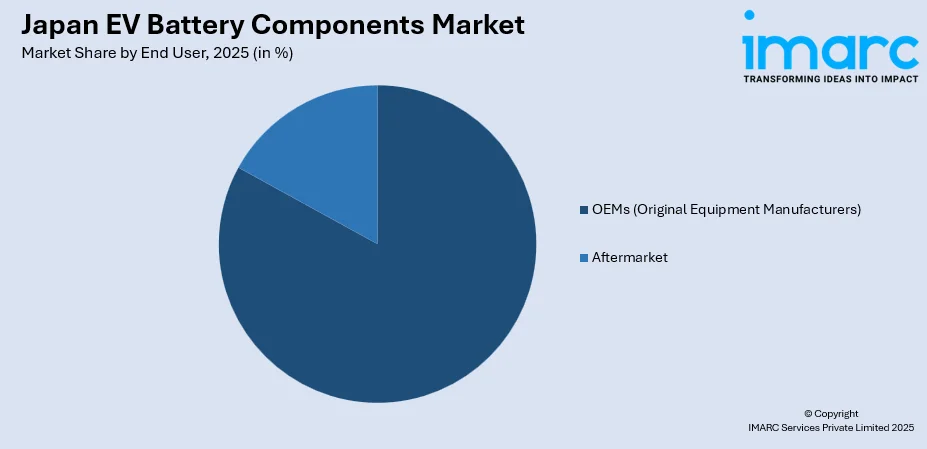

By End User: OEMs (original equipment manufacturers) lead the market with a share of 83% in 2025, driven by integrated supplier partnerships and in-house battery development strategies enhancing cost and quality.

-

By Region: Kanto region dominates the market with a share of 31% in 2025, owing to major automotive headquarters, strong logistics infrastructure, and proximity to leading research hubs.

-

Key Players: The Japan EV battery components market exhibits a consolidated competitive structure, with established domestic conglomerates leveraging decades of technological expertise competing alongside specialized component manufacturers. Strategic partnerships and vertical integration characterize the competitive dynamics, as market participants focus on proprietary technologies and intellectual property development.

To get more information on this market Request Sample

The Japan EV battery components market is experiencing robust expansion driven by the nation's commitment to achieving carbon neutrality and reducing dependence on fossil fuels. Government policies promoting electric vehicle (EV) adoption through purchase incentives and infrastructure development have created a favorable ecosystem for battery component manufacturers. As per sources, Japan announced up to USD 2.4 Billion in subsidies to boost domestic EV battery production, supporting projects by Toyota and Nissan, to strengthen national capacity and supply chain competitiveness. Moreover, the automotive industry's strategic pivot toward electrification has intensified demand for high-quality battery cells, advanced management systems, and thermal regulation solutions. Japan's established expertise in precision manufacturing and materials science positions domestic suppliers advantageously in the global supply chain. Consumer awareness regarding environmental sustainability continues rising, accelerating the transition from conventional vehicles to electric alternatives. The convergence of technological innovation, regulatory support, and shifting consumer preferences collectively propels market expansion across all component categories and vehicle segments.

Japan EV Battery Components Market Trends:

Emergence of Next-Generation Solid-State Battery Technologies

Japan maintains global leadership in solid-state battery development, representing a transformative shift in EV energy storage solutions. Research institutions and manufacturers are advancing solid electrolyte materials that eliminate flammability risks associated with liquid-based alternatives while enabling substantially higher energy densities. In July 2024, SoftBank and Enpower Japan announced an all-solid-state lithium-metal battery achieving 350 Wh/kg specific energy, marking a major advancement in next-generation high-energy-density battery technology. These innovations promise extended driving ranges and reduced charging durations, addressing key consumer concerns regarding EV practicality. The transition toward solid-state architecture requires fundamental redesigns of battery housing, thermal management systems, and cell configurations. Manufacturing processes are being refined to achieve scalable production while maintaining stringent quality standards essential for automotive applications. This technological evolution is reshaping component specifications and creating opportunities for specialized material suppliers throughout the value chain.

Integration of Artificial Intelligence in Battery Management Systems

Battery management systems are undergoing sophisticated evolution through artificial intelligence (AI) integration, enabling predictive analytics and real-time optimization capabilities. In February 2025, Infineon and Eatron expanded their partnership to deliver AI-powered battery management solutions, integrating machine-learning-based diagnostics and optimization to enhance performance, safety, and reliability across automotive, industrial, and consumer battery applications. Moreover, advanced algorithms process vast datasets from multiple sensors to anticipate potential failures, optimize charging cycles, and extend overall battery longevity. Machine learning (ML) models continuously enhance accuracy by analysing operational patterns across various driving conditions and environmental factors. These intelligent systems facilitate adaptive thermal balancing, ensuring consistent performance regardless of external temperature variations. The incorporation of Internet of Things (IoT) connectivity enables remote diagnostics and over-the-air software updates that enhance functionality throughout the vehicle lifecycle. This technological advancement addresses consumer demands for reliability while reducing warranty-related concerns for manufacturers.

Development of Sustainable and Recyclable Battery Materials

Environmental sustainability considerations are driving significant innovation in battery material development and end-of-life management strategies. Manufacturers are prioritizing cathode and anode formulations that reduce reliance on scarce minerals while maintaining or improving performance characteristics. Research efforts focus on developing closed-loop recycling systems that recover valuable materials from spent batteries for reintegration into new production cycles. As per sources, in March 2025, Panasonic Energy and Sumitomo Metal Mining launched a closed-loop nickel recycling initiative for lithium-ion battery cathodes, reusing end-of-life materials to advance sustainable, circular battery production in Japan. Furthermore, biodegradable housing materials and environmentally friendly electrolyte solutions are gaining attention as manufacturers address lifecycle environmental impacts. Supply chain transparency initiatives ensure ethical sourcing practices for raw materials, responding to growing consumer and regulatory expectations. These sustainability-focused innovations align with Japan's broader environmental objectives while creating differentiation opportunities for forward-thinking manufacturers.

Market Outlook 2026-2034:

The Japan EV battery components market is set for strong revenue growth, supported by rising EV adoption and steady technological progress. Government incentives promoting domestic production and research will reinforce Japan’s global competitiveness. Advancements toward solid-state technologies will generate high-value opportunities for innovative suppliers. Expanding charging networks and improving consumer confidence will sustain demand across vehicle segments. Strategic partnerships between automakers and component specialists will enhance efficiency, reduce costs, and further stimulate long-term market expansion.The market generated a revenue of USD 1,415.19 Million in 2025 and is projected to reach a revenue of USD 1,4218.14 Million by 2034, growing at a compound annual growth rate of 29.22% from 2026-2034.

Japan EV Battery Components Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Component Type |

Battery Cells |

45% |

|

Battery Type |

Lithium-Ion Batteries |

81% |

|

Vehicle Type |

Passenger Vehicles |

68% |

|

Propulsion Type |

Battery Electric Vehicles (BEVs) |

54% |

|

End User |

OEMs (Original Equipment Manufacturers) |

83% |

|

Region |

Kanto Region |

31% |

Component Type Insights:

- Battery Cells

- Battery Management Systems (BMS)

- Battery Cooling Systems

- Battery Housing

- Connectors and Cables

- Thermal Management Systems

- Others

Battery cells dominate with a market share of 45% of the total Japan EV battery components market in 2025.

Battery cells represent the fundamental building blocks of EV energy storage systems, converting chemical energy into electrical power that drives propulsion motors. Japan's battery cell manufacturing ecosystem benefits from decades of accumulated expertise in electrochemistry, precision engineering, and quality control methodologies that ensure consistent performance across millions of production units. Advanced cell designs incorporate proprietary electrode formulations and separator technologies that maximize energy density while maintaining thermal stability under demanding operating conditions. The integration of sophisticated manufacturing automation enables high-volume production with minimal defect rates, addressing automotive industry requirements for reliability and consistency.

The production of battery cell facilities continues expanding capacity to meet growing demand from vehicle manufacturers pursuing ambitious electrification targets. According to sources, in October 2025, Prime Planet Energy & Solutions began mass production of a new prismatic lithium-ion battery at its Himeji Plant, enhancing capacity and energy density for Toyota, Lexus, and Subaru BEVs. Research initiatives focus on improving charge-discharge cycle durability, reducing degradation rates, and enhancing cold-weather performance characteristics critical for consumer satisfaction. Cell architecture innovations include larger format designs that simplify pack assembly while improving volumetric efficiency within vehicle platforms. The strategic importance of battery cells within the overall value chain has prompted significant investments in production technology and workforce development across major manufacturing regions.

Battery Type Insights:

- Lithium-Ion Batteries

- Nickel-Metal Hydride Batteries

- Solid-State Batteries

- Lead-Acid Batteries

Lithium-ion batteries lead with a share of 81% of the total Japan EV battery components market in 2025.

Lithium-ion batteries dominate the Japan EV battery components market owing to their proven track record, established manufacturing infrastructure, and favorable performance characteristics for automotive applications. These batteries deliver optimal energy-to-weight ratios essential for achieving competitive driving ranges without excessive vehicle mass that would compromise efficiency and handling dynamics. Continuous refinements in cathode chemistry, including variations utilizing nickel, manganese, and cobalt combinations, enable customization for specific performance requirements and cost constraints across different vehicle segments.

The mature supply chain supporting lithium-ion battery production ensures reliable component availability and predictable pricing, facilitating production planning for vehicle manufacturers. As per sources, in September 2024, Subaru and Panasonic Energy announced plans to establish a new lithium-ion battery factory in Gunma, Japan, expanding domestic production and supplying next-generation batteries for Subaru’s future BEVs. Additionally, quality assurance protocols developed over decades of commercial deployment provide confidence in battery longevity and safety performance throughout expected operational lifespans. Manufacturing processes benefit from accumulated learning curve effects that progressively reduce production costs while improving consistency and reliability. The extensive real-world operational data from millions of deployed lithium-ion batteries informs ongoing optimization efforts targeting enhanced durability and performance retention characteristics.

Vehicle Type Insights:

- Passenger Vehicles

- Commercial Vehicles

- Two-Wheelers

- Three-Wheelers

Passenger vehicles exhibit a clear dominance with a 68% share of the total Japan EV battery components market in 2025.

Passenger vehicles represent the primary demand driver for EV battery components in Japan, reflecting strong consumer interest in personal electric mobility solutions for daily commuting and lifestyle transportation needs. Urban consumers increasingly recognize EVs as practical alternatives to conventional automobiles, attracted by lower operating costs, reduced maintenance requirements, and environmental benefits. Government incentive programs specifically targeting individual purchasers have successfully stimulated demand across various passenger vehicle categories, from compact commuter cars to premium sedans and crossover utility vehicles. According to sources, Japan upgraded its Clean Energy Vehicle (CEV) subsidies for EVs, PHEVs, and FCVs, encouraging passenger vehicle electrification and supporting net-zero GHG goals for the automotive sector.

The passenger vehicle segment demands battery components optimized for diverse usage patterns, including frequent short-distance urban driving combined with occasional longer highway journeys. Battery management systems must accommodate varied charging behaviors, from regular overnight home charging to opportunistic fast charging during travel. Thermal management solutions address the performance requirements of vehicles operating across Japan's diverse climate zones, from subtropical southern regions to cold northern territories. Component specifications balance performance optimization with cost considerations appropriate for mass-market consumer price expectations.

Propulsion Type Insights:

- Battery Electric Vehicles (BEVs)

- Plug-in Hybrid Electric Vehicles (PHEVs)

- Hybrid Electric Vehicles (HEVs)

Battery electric vehicles (BEVs) lead with a share of 54% of the total Japan EV battery components market in 2025.

Battery electric vehicles (BEVs) lead propulsion type segmentation, reflecting growing consumer confidence in pure electric powertrains and expanding charging infrastructure supporting practical daily usage. According to sources, in October 2025, Japan’s EV market share recovered to 2.7%, with 5,858 units BEVs and 3,004 units PHEVs sold, reflecting renewed consumer interest and expanded domestic BEV launches. These vehicles rely exclusively on battery-stored energy for propulsion, eliminating internal combustion components entirely and maximizing the efficiency benefits of electric drivetrains. The simplicity of battery electric powertrains reduces mechanical complexity compared to hybrid alternatives, potentially improving long-term reliability and reducing maintenance requirements.

Consumer acceptance of Battery electric vehicles (BEVs) continues expanding as driving range capabilities improve and charging network density increases across urban and suburban areas. The environmental credentials of zero tailpipe emissions align with consumer values and regulatory requirements promoting cleaner transportation alternatives. Battery component specifications for pure electric applications prioritize maximum energy storage capacity and rapid charging capability to address range anxiety concerns. The growing battery EV segment drives demand for larger battery packs requiring greater quantities of cells, management systems, and thermal components per vehicle.

End User Insights:

Access the comprehensive market breakdown Request Sample

- OEMs (Original Equipment Manufacturers)

- Aftermarket

OEMs (original equipment manufacturers) exhibit a clear dominance with 83% share of the total Japan EV battery components market in 2025.

OEMs (original equipment manufacturers) represent the dominant end-user segment for EV battery components, integrating these critical systems into new vehicle production at manufacturing facilities across Japan. OEM purchasing strategies emphasize long-term supply agreements with qualified component suppliers meeting stringent automotive quality standards and delivery reliability requirements. The automotive industry's established supplier qualification processes create substantial barriers for component manufacturers seeking OEM business relationships, favoring established suppliers with proven track records.

This battery component procurement increasingly involves collaborative development partnerships where vehicle manufacturers and component suppliers jointly optimize specifications for specific vehicle platforms. In March 2024, Panasonic Energy and Mazda signed an agreement to supply cylindrical automotive lithiumion batteries, strengthening long-term partnerships and supporting sustainability and local talent development in Japan. These partnerships enable customized solutions that maximize integration efficiency and performance within particular vehicle architectures. Supply chain visibility and risk management have gained prominence following global disruption events, prompting OEMs to pursue supply diversification and regional manufacturing strategies. The concentration of purchasing authority within OEM organizations creates significant negotiating leverage that influences component pricing and supply terms throughout the market.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

Kanto region leads with a share of 31% of the total Japan EV battery components market in 2025.

Kanto region encompasses Tokyo and surrounding prefectures, representing Japan's primary center for automotive industry headquarters, research facilities, and advanced manufacturing operations. This geographic concentration creates natural advantages for battery component suppliers seeking proximity to major customer decision-makers and collaborative development opportunities. The region's extensive transportation infrastructure facilitates efficient logistics connecting component suppliers with vehicle assembly facilities distributed throughout Japan and export terminals serving international markets.

Educational institutions and research centers concentrated in the Kanto region provide access to engineering talent and collaborative research partnerships advancing battery technology development. The regional innovation ecosystem supports startup companies developing novel battery materials and manufacturing processes alongside established industry participants. Real estate costs and labor market competition present challenges for manufacturers considering Kanto region facility expansions, prompting some production capacity investments in alternative locations while maintaining regional research and administrative functions.

Market Dynamics:

Growth Drivers:

Why is the Japan EV Battery Components Market Growing?

Government Policy Support and Regulatory Framework

National and regional government initiatives provide substantial support for EV adoption and domestic battery component manufacturing development. Comprehensive policy frameworks establish clear electrification targets that create predictable demand trajectories enabling long-term investment planning by component manufacturers. Purchase incentives reduce consumer acquisition costs, accelerating EV adoption rates and corresponding component demand growth. Infrastructure development programs expand public charging networks, addressing practical usage concerns that previously limited consumer consideration of electric alternatives. As per sources, in 2025, Japan’s Ministry of Economy, Trade and Industry announced a 50 Billion Yen FY2025 supplementary budget to expand EV charging infrastructure, supporting apartment complexes, commercial use, and accelerating nationwide EV adoption. Further, regulatory requirements progressively tightening vehicle emission standards create compliance imperatives driving automotive manufacturers toward electrification strategies. Tax advantages and preferential treatment for EV manufacturers and component suppliers enhance investment returns and competitive positioning. These coordinated policy measures establish favorable market conditions that support sustained growth throughout the forecast period.

Technological Innovation and Research Investment

Sustained investment in battery technology research drives continuous performance improvements that expand EV capabilities and consumer appeal. Academic institutions, government laboratories, and corporate research centers collaborate on fundamental science advancing understanding of electrochemical processes and material properties. Applied research translates scientific discoveries into practical manufacturing improvements and product performance enhancements benefiting commercial applications. Innovation efforts address key consumer concerns including driving range limitations, charging duration requirements, and total cost of ownership considerations. Intellectual property development creates competitive advantages for innovative manufacturers while establishing barriers protecting market positions from competitive threats. The innovation-driven improvement trajectory maintains consumer interest by delivering progressively enhanced products that compare favorably against conventional alternatives. Research investments targeting next-generation technologies including solid-state batteries position Japanese manufacturers advantageously for future market evolution. As per sources, in 2025, QuantumScape hosted its second annual Solid-State Battery Symposium in Kyoto, Japan, showcasing collaborations with Japanese OEMs and METI to advance next-generation solid-state battery technology.

Expanding Electric Vehicle Adoption and Market Penetration

Growing consumer acceptance of EVs creates expanding demand for battery components across all categories and specifications. According to sources, in 2025, Hyundai premiered the All-New NEXO hydrogen SUV, and Kia debuted its PV5 electric van in Japan, marking their expanded green vehicle lineup and market re-entry. Moreover, early adopter enthusiasm has transitioned toward mainstream consumer consideration as practical concerns regarding range and charging convenience diminish. Generational shifts in consumer attitudes favor environmentally conscious transportation choices, creating favorable demographic trends supporting continued market expansion. Corporate fleet electrification initiatives add commercial demand complementing individual consumer purchases. International market growth creates export opportunities for Japanese battery component manufacturers leveraging domestic technological advantages. The expanding installed base of EVs creates aftermarket service opportunities and replacement demand supporting long-term market sustainability. Network effects from growing EV prevalence improve charging infrastructure economics, further accelerating adoption cycles through positive feedback mechanisms.

Market Restraints:

What Challenges the Japan EV Battery Components Market is Facing?

High Initial Cost Barriers for Consumers

Elevated vehicle purchase prices compared to conventional alternatives create affordability challenges limiting EV adoption among price-sensitive consumer segments. Battery components represent substantial portions of total vehicle manufacturing costs, directly impacting retail pricing and consumer accessibility. Economic uncertainty and household budget constraints reduce discretionary spending capacity available for vehicle purchases, particularly affecting premium-priced electric alternatives. Financing terms and total cost of ownership calculations remain unfamiliar to many consumers, hindering informed purchase decisions. Used vehicle market development remains nascent, limiting lower-cost entry points for budget-conscious consumers interested in electric mobility.

Infrastructure Development and Charging Accessibility Limitations

Uneven geographic distribution of charging infrastructure creates practical usage limitations affecting consumer confidence in EV viability. Rural and suburban areas frequently lack convenient charging options, restricting EV consideration to urban residents with reliable home charging capabilities. Public charging station availability varies significantly across regions, creating inconsistent user experiences that generate consumer uncertainty. Charging duration requirements exceed conventional refueling times, requiring lifestyle adjustments that some consumers find inconvenient or impractical. Residential charging installation requires upfront investment and may present challenges for apartment dwellers lacking dedicated parking facilities.

Supply Chain Vulnerabilities and Material Sourcing Concerns

Dependence on internationally sourced raw materials exposes battery component manufacturers to supply disruption risks and price volatility affecting production planning. Concentrated mining operations for critical minerals create geopolitical vulnerabilities that could impact material availability and costs. Competition for limited material supplies from global battery manufacturing expansion may constrain production capacity growth. Processing and refining capacity constraints create potential bottlenecks even when raw material extraction meets demand requirements. Establishing alternative supply sources requires substantial time and investment, limiting short-term flexibility in responding to disruption events.

Competitive Landscape:

The Japan EV battery components market demonstrates a consolidated competitive structure characterized by established domestic manufacturers with extensive automotive industry relationships and technological capabilities. Market participants leverage accumulated expertise in precision manufacturing, quality control systems, and supply chain management developed through decades of automotive component production experience. Vertical integration strategies enable leading competitors to control critical production processes and protect proprietary technologies from competitive replication. Strategic partnerships between battery component specialists and vehicle manufacturers create collaborative ecosystems that strengthen competitive positions while addressing customer-specific requirements. Research and development investments remain essential for maintaining technological leadership as performance expectations continue advancing. Geographic expansion initiatives target international growth opportunities while preserving domestic market positions against potential foreign entrants.

Recent Developments:

-

In January 2025, Mazda announced plans to build a module pack plant in Iwakuni City, Yamaguchi Prefecture, producing cylindrical lithium-ion battery packs from Panasonic Energy for its first dedicated battery-electric vehicle, supporting local employment, advancing EV technology adoption, and contributing to Japan’s 2030 electrification and sustainability objectives.

Japan EV Battery Components Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Component Types Covered | Battery Cells, Battery Management Systems (BMS), Battery Cooling Systems, Battery Housing, Connectors and Cables, Thermal Management Systems, Others |

| Battery Types Covered | Lithium-Ion Batteries, Nickel-Metal Hydride Batteries, Solid-State Batteries, Lead-Acid Batteries |

| Vehicle Types Covered | Passenger Vehicles, Commercial Vehicles, Two-Wheelers, Three-Wheelers |

| Propulsion Types Covered | Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), Hybrid Electric Vehicles (HEVs) |

| End Users Covered | OEMs (Original Equipment Manufacturers), Aftermarket |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan EV battery components market size was valued at USD 1,415.19 Million in 2025.

The Japan EV battery components market is expected to grow at a compound annual growth rate of 29.22% from 2026-2034 to reach USD 1,4218.14 Million by 2034.

Battery cells held the largest market share, driven by robust domestic manufacturing capabilities, advanced production technologies, and their critical role in enhancing energy density, efficiency, and overall performance, making them essential for next-generation EV applications.

Key factors driving the Japan EV battery components market include government policy support promoting electric mobility, technological advancements in solid-state batteries and battery management systems, expanding charging infrastructure, and growing consumer environmental awareness.

Major challenges include high upfront vehicle costs, limited charging infrastructure in remote areas, inconsistent government incentives, long battery replacement times, supply chain constraints, and low consumer awareness about electric mobility benefits.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)