Japan Exhaust Fan Market Size, Share, Trends and Forecast by Type, Application, and Region, 2026-2034

Japan Exhaust Fan Market Overview:

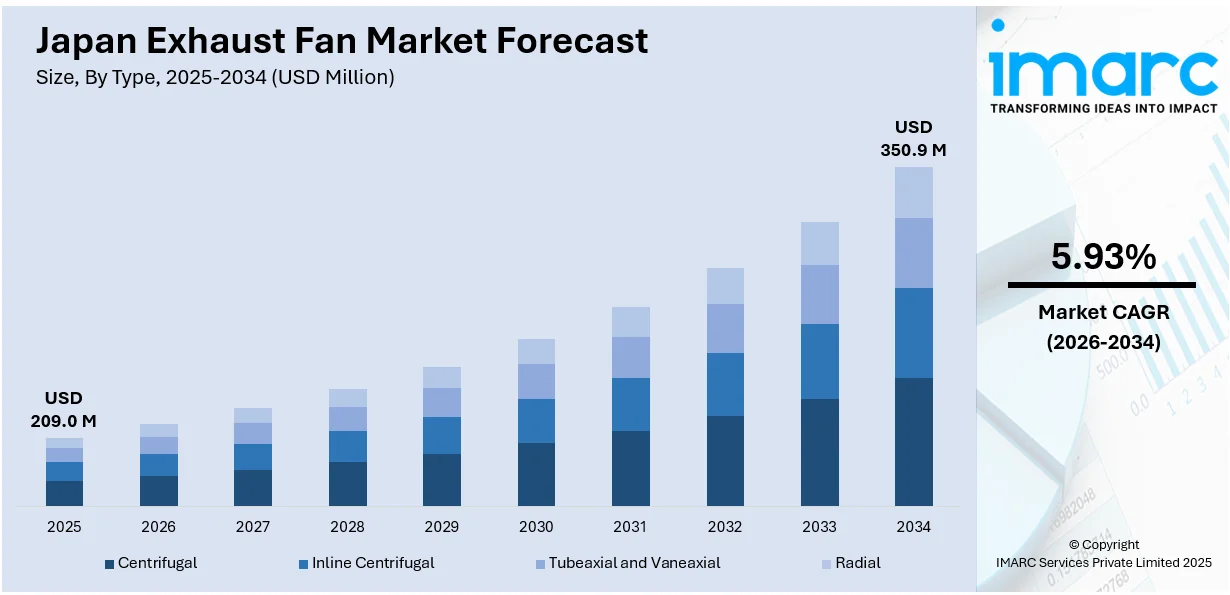

The Japan exhaust fan market size reached USD 209.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 350.9 Million by 2034, exhibiting a growth rate (CAGR) of 5.93% during 2026-2034. The market is driven by strict air quality regulations and the need for efficient ventilation in densely built residential zones. Commercial infrastructure modernization and energy compliance mandates are creating sustained demand for advanced, low-energy exhaust systems, thereby fueling the market. In parallel, Japan’s industrial sector increasingly requires smart, high-performance ventilation to meet safety and digital integration standards, further augmenting the Japan exhaust fan market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 209.0 Million |

| Market Forecast in 2034 | USD 350.9 Million |

| Market Growth Rate 2026-2034 | 5.93% |

Japan Exhaust Fan Market Trends:

Urban Residential Development and Indoor Air Quality Regulations

Japan's densely populated cities and vertical housing patterns have intensified the demand for proper ventilation systems in both new and existing residential buildings. The government’s stringent indoor air quality regulations, under the Building Standard Law and Ministry of Health guidelines, mandate sufficient airflow to mitigate health risks associated with humidity, mold, and airborne pollutants. This regulatory environment compels developers and homeowners to install exhaust fans as a compliance and health measure. Compact yet high-performance ventilation units are particularly favored for apartments and small homes where space optimization is essential. Moreover, growing consumer awareness around the adverse effects of indoor pollution is influencing renovation and refurbishment decisions to incorporate efficient ventilation solutions. Exhaust fans are also commonly installed in bathrooms, kitchens, and utility rooms to ensure consistent air turnover in moisture-prone areas. Demand is reinforced by Japan’s aging housing stock, prompting upgrades to meet current standards of safety and efficiency. This alignment of regulation, consumer health concerns, and construction activity is central to driving Japan exhaust fan market growth by necessitating widespread adoption of modern ventilation systems in both public and private housing sectors.

To get more information on this market Request Sample

Commercial Real Estate Modernization and Energy Efficiency Mandates

Commercial establishments in Japan, such as shopping malls, office towers, and hospitality venues, are undergoing rapid modernization, creating significant demand for effective HVAC and air circulation systems. Exhaust fans are integral to these systems, helping manage temperature, odor, and air quality in confined commercial environments. Regulatory mandates, including the Energy Conservation Law, now require commercial buildings to maintain minimum energy performance standards, incentivizing the use of energy-efficient exhaust solutions. Facility managers are replacing outdated fans with low-noise, high-efficiency models that offer better airflow control and reduced power consumption. Additionally, open-plan office layouts and multifunctional spaces demand flexible and powerful ventilation solutions to ensure uniform air distribution. High occupancy rates in commercial buildings further increase the need for reliable air extraction systems to mitigate carbon dioxide accumulation and maintain comfort. Building automation systems increasingly integrate exhaust fans to enable programmable control and optimize energy usage. These factors together make energy-efficient ventilation a priority for commercial infrastructure upgrades, reinforcing the consistent procurement of advanced exhaust systems throughout the sector.

Industrial Safety Standards and Smart Manufacturing Practices

Japan’s robust manufacturing sector, encompassing automotive, electronics, chemicals, and food processing, relies on controlled air environments to ensure safety, hygiene, and equipment longevity. Exhaust fans play a critical role in industrial ventilation by removing heat, fumes, dust, and volatile gases generated during production processes. Compliance with occupational safety standards enforced by the Ministry of Health, Labour and Welfare compels manufacturers to deploy adequate ventilation systems in line with workplace air quality norms. Factories and processing plants often require high-capacity exhaust systems engineered for continuous operation and corrosion resistance. Simultaneously, the rise of smart factories and Industry 4.0 practices is driving adoption of digitally monitored ventilation equipment capable of integrating with centralized control systems. This allows operators to monitor airflow, detect filter obstructions, and predict maintenance needs, minimizing downtime. Additionally, energy efficiency goals are prompting a transition from legacy systems to inverter-equipped or EC-motor-based exhaust fans. The synergy of regulatory compliance, operational efficiency, and digital integration is fostering a steady demand for modern ventilation technologies across industrial segments.

Japan Exhaust Fan Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type and application.

Type Insights:

- Centrifugal

- Inline Centrifugal

- Tubeaxial and Vaneaxial

- Radial

The report has provided a detailed breakup and analysis of the market based on the type. This includes centrifugal, inline centrifugal, tubeaxial and vaneaxial, and radial.

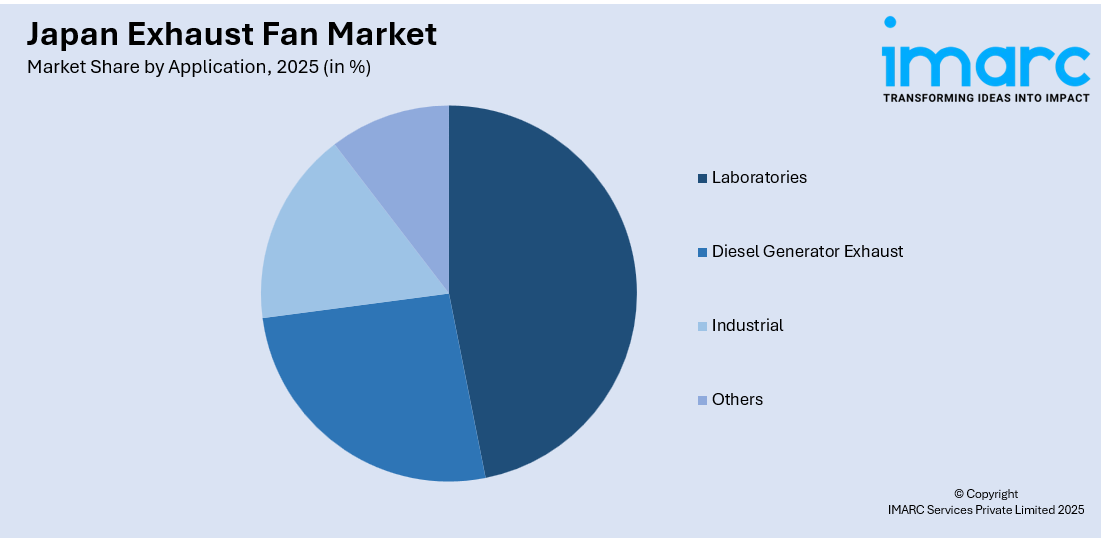

Application Insights:

Access the comprehensive market breakdown Request Sample

- Laboratories

- Diesel Generator Exhaust

- Industrial

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes laboratories, diesel generator exhaust, industrial applications, and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all major regional markets. This includes Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Exhaust Fan Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Centrifugal, Inline Centrifugal, Tubeaxial and Vaneaxial, Radial |

| Applications Covered | Laboratories, Diesel Generator Exhaust, Industrial, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan exhaust fan market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan exhaust fan market on the basis of type?

- What is the breakup of the Japan exhaust fan market on the basis of application?

- What is the breakup of the Japan exhaust fan market on the basis of region?

- What are the various stages in the value chain of the Japan exhaust fan market?

- What are the key driving factors and challenges in the Japan exhaust fan market?

- What is the structure of the Japan exhaust fan market and who are the key players?

- What is the degree of competition in the Japan exhaust fan market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan exhaust fan market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan exhaust fan market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan exhaust fan industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)