Japan False Ceiling Market Size, Share, Trends and Forecast by Material, Cost Range, Installation, Application, and Region, 2026-2034

Japan False Ceiling Market Summary:

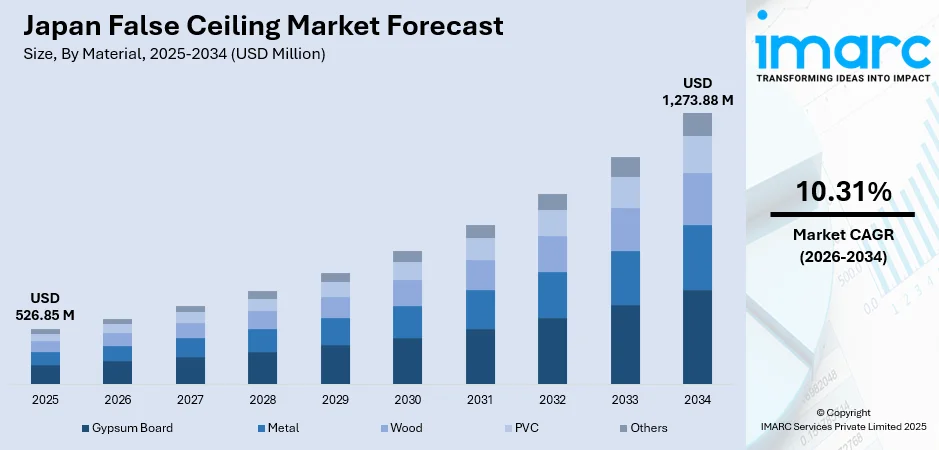

The Japan false ceiling market size was valued at USD 526.85 Million in 2025 and is projected to reach USD 1,273.88 Million by 2034, growing at a compound annual growth rate of 10.31% from 2026-2034.

The Japan false ceiling market is experiencing substantial growth driven by increasing number of large-scale commercial construction projects and rising investments in sustainable building infrastructure. Government initiatives promoting energy-efficient construction and green building certifications are driving the demand for advanced ceiling solutions. The growing emphasis on acoustic performance, fire safety compliance, and aesthetic design in commercial and residential spaces is reshaping market dynamics. Technological advancements in modular ceiling systems, smart building integration, and sustainable material innovation are creating substantial opportunities for market participants, positioning Japan as a leading adopter of next-generation false ceiling solutions.

Key Takeaways and Insights:

-

By Material: Gypsum board dominates the market with a share of 45% in 2025, driven by its superior fire resistance, sound insulation properties, ease of installation, and cost-effectiveness that align with Japan's stringent building safety regulations and sustainable construction practices.

-

By Cost Range: Medium-cost leads the market with a share of 44% in 2025, reflecting the preference of commercial and residential developers for balanced quality-to-price ratios that meet performance requirements while maintaining budget efficiency across diverse construction projects.

-

By Installation: Suspended represents the largest segment with a market share of 56% in 2025, owing to its versatility in concealing mechanical systems, superior acoustic control capabilities, and ease of maintenance access that make it essential for modern commercial and institutional building designs.

-

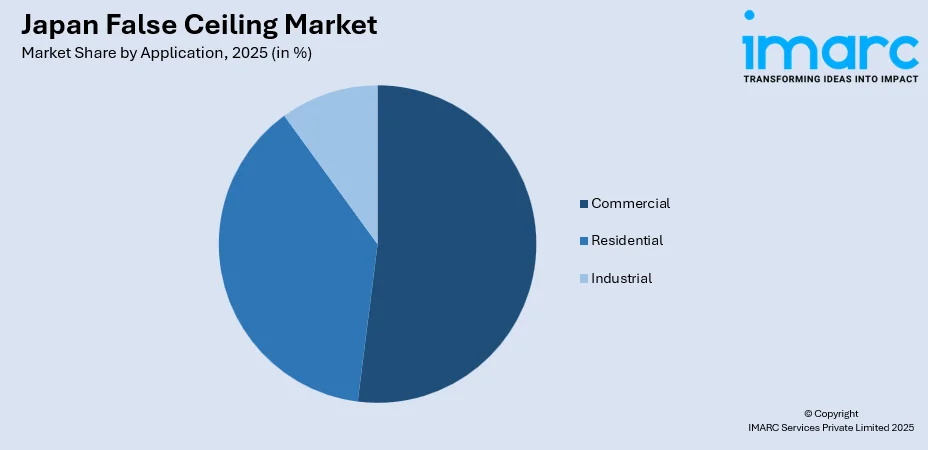

By Application: Commercial dominates the market with a share of 52% in 2025, due to robust office construction activity in metropolitan areas, retail space modernization, and hospitality sector expansion supporting tourism infrastructure development.

-

By Region: Kanto Region represents the largest segment with a market share of 32% in 2025, influenced by concentrated construction activity in Tokyo's central business districts, ongoing urban redevelopment megaprojects, and superior infrastructure development supporting the region's economic prominence.

-

Key Players: The Japan false ceiling market experiences moderate competitive intensity, with established domestic manufacturers competing alongside multinational construction material corporations. These players differentiate themselves across premium, mid-range, and value segments through product innovation, sustainability initiatives, and strategic distribution partnerships to capture diverse market demands.

To get more information on this market Request Sample

The Japan false ceiling market is driven by the continuous demand for enhanced aesthetic and functional designs across both residential and commercial construction sectors. The rextensive infrastructure expansion in major cities like Tokyo necessitates cost-effective solutions for integrating improved acoustics, lighting, and utilities. Additionally, the market benefits from the growing emphasis on energy efficiency and sustainable building practices, with false ceilings playing a crucial role in enhancing insulation and reducing energy usage. This trend is further supported by substantial governmental investments in housing, exemplified by the Tokyo Metropolitan Government’s 2025 initiative, where four operators were selected to manage public-private funds worth approximately 20 billion yen for affordable housing projects. This significant funding directly drives the demand for building materials, including versatile and efficient false ceiling systems. Furthermore, technological advancements in fire-resistant and durable materials ensure that these solutions meet stringent safety standards while addressing contemporary design requirements, thereby strengthening the market growth.

Japan False Ceiling Market Trends:

Increasing Construction and Infrastructure Development

The accelerated pace of residential and commercial construction across Japan is influencing the market, driven by the demand for cost-effective solutions that enhance aesthetics, sound insulation, and integrated lighting. As infrastructure development intensifies, particularly in major metropolitan centers like Tokyo and Osaka, the need for versatile ceiling systems in new builds and renovations is rising. This growth is exemplified by the completion of the ONE DOJIMA PROJECT in 2024 by Tokyo Tatemono Co. Ltd., a 195-meter, 49-story ultra-high-rise mixed-use building in Osaka. Featuring Japan's first Four Seasons Hotel and luxury residences, the project's high-end finishes and functional requirements necessitate extensive use of advanced false ceiling technology.

Technological Advancements in Ceiling Materials

Innovations in material science are leading to the development of products that offer improved durability, ease of installation, and customization. The availability of fire-resistant, lightweight, and easy-to-maintain materials, such as gypsum, mineral fiber, and metal are making false ceilings increasingly popular. Technological improvements, including integrated lighting systems and soundproofing solutions, provide additional functionality, making these systems appealing to both residential and commercial sectors. A notable example of innovation occurred in 2025 when Architect Developer Inc. (ADI) adopted the world’s first 100% recycled gypsum plasterboard, the "Chiyoda Circular Gypsum Board," for its new residential projects.

Adoption of Luxury and High-end Designs

The Japan false ceiling market is significantly influenced by the nation's affluent population, which is driving the demand for high-end residential and commercial developments. These luxury projects require premium materials and sophisticated designs, with a focus on aesthetics and exclusivity, often achieved through high-quality false ceilings. This growing purchasing power is reflected in the Statistics Bureau of Japan’s data, which shows that the average monthly income per household reached 599,845 yen in 2025. This financial growth fosters ongoing demand for luxury properties and high-end corporate spaces, where tailored false ceiling solutions are crucial for fulfilling sophisticated interior and design requirements.

Market Outlook 2026-2034:

The Japan false ceiling market is poised for strong growth during the forecast period, driven by ongoing investments in commercial construction and changing architectural design trends. The market generated a revenue of USD 526.85 Million in 2025 and is projected to reach a revenue of USD 1,273.88 Million by 2034, growing at a compound annual growth rate of 10.31% from 2026-2034. This growth is supported by increased demand for aesthetic and functional ceiling solutions in modern building projects.

Japan False Ceiling Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Material | Gypsum Board | 45% |

| Cost Range | Medium-Cost | 44% |

| Installation | Suspended | 56% |

| Application | Commercial | 52% |

| Region | Kanto Region | 32% |

Material Insights:

- Gypsum Board

- Metal

- Wood

- PVC

- Others

Gypsum board dominates with a market share of 45% of the total Japan false ceiling market in 2025.

Gypsum board holds the biggest market share, supported by its versatile properties, including fire resistance, soundproofing, and ease of installation. These features make it a popular choice for both residential and commercial spaces, offering durability and aesthetic appeal.

Gypsum board’s affordability and wide availability in Japan contribute to its market leadership. It is well-suited for the country’s building standards, meeting both regulatory requirements and individual preferences, further solidifying its position as the material of choice for false ceilings.

Cost Range Insights:

- Low-Cost

- Medium-Cost

- High-Cost

Medium-cost leads with a market share of 44% of the total Japan false ceiling market in 2025.

Medium-cost dominates the market, as it provides a balance between affordability and quality. The material in this segment offers sufficient durability, aesthetic appeal, and performance, making it an attractive option for both residential and commercial projects, where cost-effectiveness is crucial.

Furthermore, the demand for medium-cost false ceiling is driven by budget-conscious individuals and developers. The material in this price range provide an ideal choice for projects aiming to meet design standards without exceeding budget constraints, making it widely popular across various sectors in Japan's construction industry.

Installation Insights:

- Drywall

- Suspended

- Stretch Ceilings

- Others

Suspended exhibits a clear dominance with a 56% share of the total Japan false ceiling market in 2025.

Suspended leads the market because of its ease of installation and flexibility. It allows for quick setup, with the ability to hide wiring, pipes, and other utilities, making it a preferred choice for both residential and commercial projects.

Suspended ceiling also offers excellent sound insulation and fire resistance, meeting the high standards required in Japan’s construction sector. Its versatility in design and ability to accommodate changing building needs contribute to its widespread popularity in the market.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Commercial

- Residential

- Industrial

Commercial dominates with a market share of 52% of the total Japan false ceiling market in 2025.

Commercial holds the biggest market share owing to the increasing demand for aesthetically pleasing and functional spaces in offices, retail stores, and public buildings. False ceilings help enhance the look of commercial interiors while providing practical benefits like acoustic insulation.

The continued growth of the commercial sector, particularly the development of new office buildings, is exemplified by major projects like Toyota's announcement in 2025 regarding the start of construction for its new Tokyo Head Office at Shinagawa Station. Such projects require high-performance false ceilings to improve the overall aesthetic of these spaces.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

Kanto Region leads with a market share of 32% of the total Japan false ceiling market in 2025.

Kanto Region represents the largest segment due to its status as the country’s economic and commercial hub. The substantial demand for false ceilings in major cities like Tokyo and Yokohama, driven by both residential and commercial development, is clearly illustrated by significant new projects, such as the "Minami-Aoyama 3-Chome Project" in Tokyo, a luxury rental apartment complex integrated with commercial facilities announced by GI Capital Management Ltd. in 2025.

Moreover, the Kanto Region benefits from advanced infrastructure, a large user base, and significant investment in commercial development. These factors drive the need for aesthetic, functional, and efficient building solutions, positioning the region as the leading market for false ceilings in Japan.

Market Dynamics:

Growth Drivers:

Why is the Japan False Ceiling Market Growing?

Rising Employment in Hospitality Sector

The robust hospitality sector in Japan, driven by international tourism and continuous development of hotels and resorts, is a crucial factor impelling the growth of the market. The Japan National Tourism Organization reported that 3,377,800 visitors arrived in Japan in June 2025, a 7.6% increase compared to the same period in 2024. This rise in tourism underscores the demand for new and renovated hospitality spaces. False ceilings play a crucial role in achieving both functional and aesthetic goals, such as acoustic management, ambient lighting, and modern interior design, essential for creating premium guest experiences.

Expanding Urban Redevelopment Projects

The Japan false ceiling market is increasingly driven by comprehensive urban redevelopment initiatives focused on modernizing outdated or damaged areas. A prime example of this trend is the Miyamasaka District Urban Redevelopment Project in Shibuya, announced in 2025. This significant project will revitalize the aging area through mixed-use developments featuring super-high-rise and mid-rise buildings. Slated for construction beginning in 2027, the redevelopment will integrate modern infrastructure with enhanced safety and accessibility standards. These projects necessitate the refurbishment of aging buildings, demanding new and highly efficient interior systems. False ceilings play a crucial role in enhancing functionality and aesthetics, ensuring compliance with contemporary building codes and design requirements.

Resilience Against Natural Disasters

Japan is prone to natural disasters, such as earthquakes and tsunamis, leading to an increased focus on building designs that offer resilience and safety. For instance, in 2025, Japan issued tsunami warnings after a magnitude 7.6 earthquake struck off its northeast coast, triggering waves up to 3 meters in some areas. False ceilings contribute to seismic safety by allowing for flexible ceiling systems that can withstand vibrations during earthquakes. Additionally, certain false ceiling materials are designed to reduce the impact of structural shifts, enhancing overall building stability. The growing demand for disaster-resistant construction solutions is accelerating the adoption of false ceilings, particularly in high-risk areas where safety and resilience are paramount in building design.

Market Restraints:

What Challenges the Japan False Ceiling Market is Facing?

Labor Shortages and Skilled Workforce Constraints

Japan's construction industry faces persistent labor shortages, creating significant installation capacity challenges in the false ceiling market. The lack of skilled workers impacts project completion timelines, slowing down market growth. With fewer tradespeople available, installation delays disrupt material demand patterns and hinder the timely execution of construction projects, affecting the overall growth and efficiency of the false ceiling sector.

Raw Material Price Volatility and Supply Chain Disruptions

Raw material price fluctuations and ongoing supply chain disruptions present major challenges for false ceiling manufacturers and contractors in Japan. Increasing costs of essential materials such as timber, cement, steel, and gypsum raise construction expenses, complicating budget planning. These price hikes influence material selection, affecting both commercial and residential projects, while squeezing profit margins and creating financial strain for market participants.

Stringent Building Code Compliance Requirements

Japan's strict building regulations impose substantial compliance requirements on false ceiling manufacturers, increasing development costs and extending certification timelines. Stringent fire resistance, seismic performance, and environmental standards demand thorough testing and documentation, which delays market entry and product innovation. These regulatory demands present barriers for companies seeking to introduce new ceiling technologies, slowing the pace of innovation and adoption within the industry.

Competitive Landscape:

The Japan false ceiling market exhibits moderate competitive intensity characterized by the presence of established domestic manufacturers alongside multinational construction material corporations competing across material types and price segments. Market dynamics reflect strategic positioning, ranging from premium, innovation-driven offerings emphasizing advanced acoustic performance and sustainability certifications to value-oriented products targeting cost-conscious developers. The competitive landscape is increasingly shaped by product innovation focusing on modular installation systems, sustainable material compositions, and integrated smart building technologies. Manufacturers are investing in research and development (R&D) to create lightweight, fire-resistant, and eco-friendly ceiling solutions that meet evolving user demands and regulatory requirements. Strategic partnerships between ceiling system suppliers and major construction companies are enhancing distribution capabilities and project delivery capacity across Japan's key construction markets.

Japan False Ceiling Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Gypsum Board, Metal, Wood, PVC, Others |

| Cost Ranges Covered | Low-Cost, Medium-Cost, High-Cost |

| Installations Covered | Drywall, Suspended, Stretch Ceilings, Others |

| Applications Covered | Commercial, Residential, Industrial |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan false ceiling market size was valued at USD 526.85 Million in 2025.

The Japan false ceiling market is expected to grow at a compound annual growth rate of 10.31% from 2026-2034 to reach USD 1,273.88 Million by 2034.

Gypsum board dominates the market with a 45% revenue share in 2025, driven by its superior fire resistance, sound insulation properties, ease of installation, and alignment with Japan's stringent building safety regulations and sustainable construction practices.

Key factors driving the Japan false ceiling market include the nation's affluent population, which drives the demand for high-end residential and commercial developments. With an average household income of 599,845 yen in 2025, there is sustained growth in luxury real estate and premium false ceiling solutions.

Major challenges include labor shortages and skilled workforce constraints affecting installation capacity, raw material price volatility and supply chain disruptions impacting production costs, stringent building code compliance requirements creating certification barriers, and competition from alternative ceiling materials in specific applications.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)