Japan Fermented Food and Beverage Market Size, Share, Trends and Forecast by Type, Distribution Channel, and Region, 2026-2034

Japan Fermented Food and Beverage Market Overview:

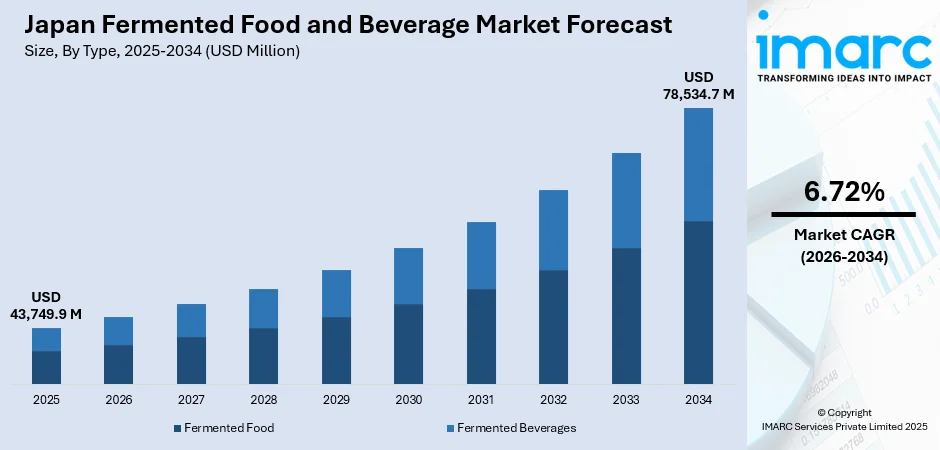

The Japan fermented food and beverage market size reached USD 43,749.9 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 78,534.7 Million by 2034, exhibiting a growth rate (CAGR) of 6.72% during 2026-2034. The market is driven by strong cultural integration and daily consumption of traditional fermented staples across generations. An aging population is accelerating demand for probiotic-rich functional foods that support digestive and immune health, thereby fueling the market. Rapid innovation in fermentation processes and product diversification is enhancing appeal among health-conscious and export-oriented consumers, further augmenting the Japan fermented food and beverage market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 43,749.9 Million |

| Market Forecast in 2034 | USD 78,534.7 Million |

| Market Growth Rate 2026-2034 | 6.72% |

Japan Fermented Food and Beverage Market Trends:

Cultural Integration and Domestic Consumption Patterns

Fermented products are deeply embedded in Japanese cuisine, serving as both staple ingredients and daily dietary components. Traditional items such as miso, natto, soy sauce, and pickled vegetables are consumed across demographics, making fermentation a culturally entrenched food preservation method. This strong culinary heritage sustains a stable domestic demand, particularly as consumers view these foods as beneficial for digestion, flavor, and dietary balance. Regional producers continue to craft specialty fermented items using localized techniques, which enhances product diversity and cultural appeal. Simultaneously, modern reinterpretations of traditional fermented products are entering convenience store shelves, helping younger consumers engage with heritage flavors in accessible formats. Additionally, fermentation aligns with Japan’s preference for umami-rich foods, enhancing palatability without added sugars or preservatives. The enduring role of fermented foods in both traditional and modern eating habits is a foundational force behind Japan fermented food and beverage market growth, as it sustains a loyal consumer base and encourages continuous innovation rooted in cultural relevance. For example, the market size of Amazake, a fermented rice beverage, grew from JPY 11.9 billion in 2009 to JPY 24.6 billion in 2017. With 20% glucose content after fermentation, koji amazake has been shown to improve bowel movements and skin hydration when consumed daily for 3-8 weeks. Nutritionally, sakekasu amazake offers 102 kcal/100g and 13.8g of sucrose, while also positively affecting skin texture and sebum content.

To get more information on this market Request Sample

Innovation in Fermentation Technology and Product Expansion

Japan’s advanced food processing and biotechnology sectors are driving innovation across fermentation techniques, resulting in new textures, flavors, and nutritional profiles. Startups and established players are investing in controlled microbial fermentation to create customized enzymes, enhanced flavor profiles, and improved safety in fermented beverages and foods. Plant-based and vegan variations of traditionally animal-derived fermented items are being developed to meet demand from flexitarian consumers. Additionally, the expansion of fermented beverages, such as craft kombucha and rice-based probiotic drinks, is tapping into premium health-conscious markets. Innovative packaging and distribution models, such as chilled ready-to-drink formats and subscription services, are broadening access to previously niche products. A 2023 industry report highlights the growing global interest in fermentation, with 149% more fermented options on restaurant menus in 2020. Japan faces significant sustainability challenges, with over 60% of its calories imported and 8 million metric tons of food wasted in 2021, equating to 64 kilograms per person. This underscores the potential for fermentation to help reduce food waste and lower the country's carbon footprint. As technological development enhances production scalability and precision, manufacturers are able to balance tradition with modern consumer expectations, sustaining relevance in an increasingly competitive food and beverage landscape. These advancements also cater to export potential, enabling Japanese producers to compete in global wellness and specialty food markets.

Japan Fermented Food and Beverage Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type and distribution channel.

Type Insights:

- Fermented Food

- Yogurt

- Tofu

- Tempeh

- Sauerkraut/Fermented Veggies and Pickles

- Cheese

- Others

- Fermented Beverages

- Yogurt Drinks/Smoothies

- Kombucha

- Kefir

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes fermented food (yogurt, tofu, tempeh, sauerkraut/fermented veggies and pickles, cheese, and others) and fermented beverages (yogurt drinks/smoothies, kombucha, kefir, and others).

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarket/Hypermarket

- Convenience Store

- Online Retail Stores

- Others

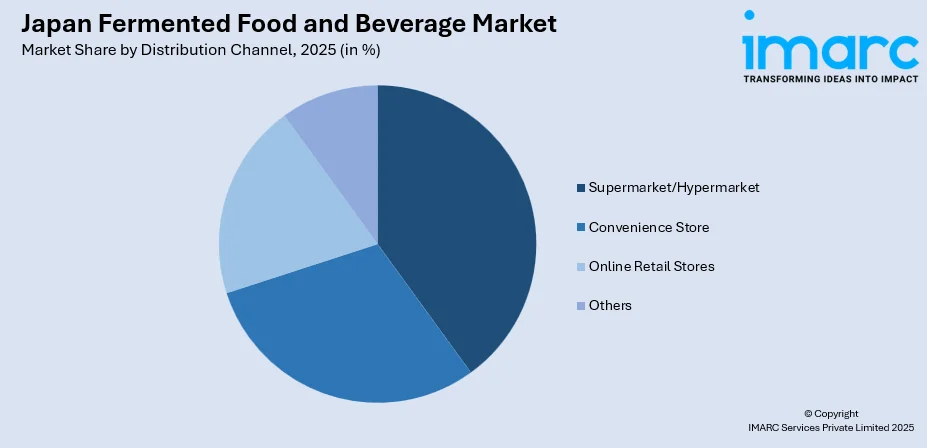

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarket/hypermarket, convenience store, online retail stores, and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all major regional markets. This includes Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Fermented Food and Beverage Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Distribution Channels Covered | Supermarket/Hypermarket, Convenience Store, Online Retail Stores, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan fermented food and beverage market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan fermented food and beverage market on the basis of type?

- What is the breakup of the Japan fermented food and beverage market on the basis of distribution channel?

- What is the breakup of the Japan fermented food and beverage market on the basis of region?

- What are the various stages in the value chain of the Japan fermented food and beverage market?

- What are the key driving factors and challenges in the Japan fermented food and beverage market?

- What is the structure of the Japan fermented food and beverage market and who are the key players?

- What is the degree of competition in the Japan fermented food and beverage market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan fermented food and beverage market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan fermented food and beverage market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan fermented food and beverage industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)