Japan Ferroalloys Market Size, Share, Trends and Forecast by Product, Application, and Region, 2025-2033

Japan Ferroalloys Market Overview:

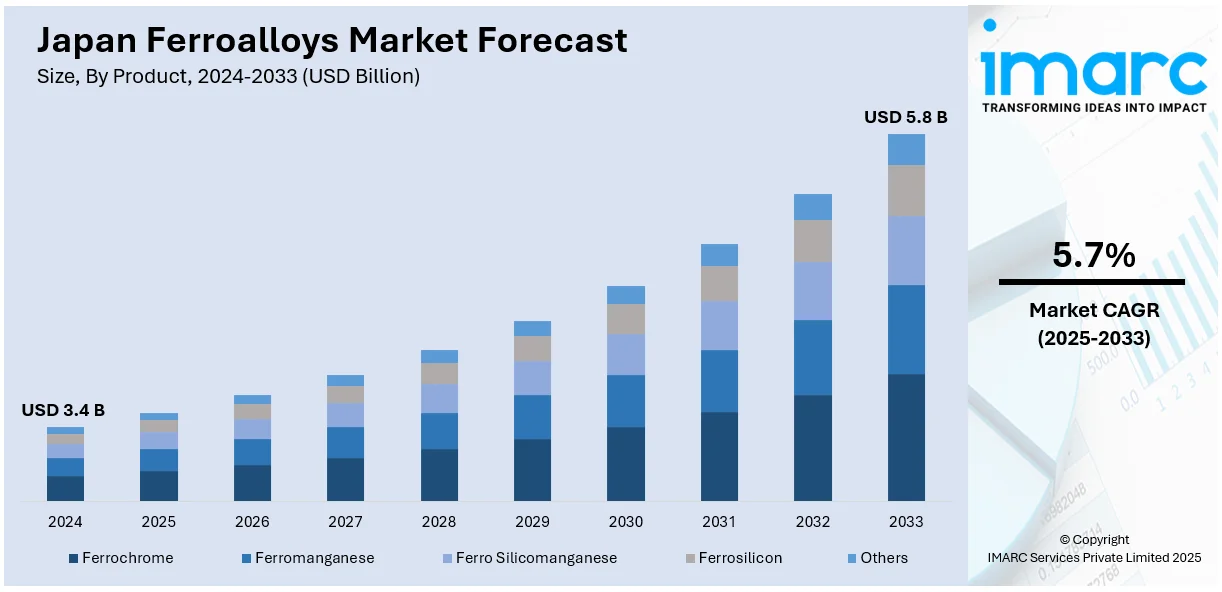

The Japan ferroalloys market size reached USD 3.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.8 Billion by 2033, exhibiting a growth rate (CAGR) of 5.7% during 2025-2033. The market is driven by the growing demand from the steel manufacturing sector and heightened focus on the employment of sophisticated manufacturing methods that enable the production of special alloys with specific properties.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.4 Billion |

| Market Forecast in 2033 | USD 5.8 Billion |

| Market Growth Rate 2025-2033 | 5.7% |

Japan Ferroalloys Market Trends:

Robust Demand from Steel and Automotive Industries

Japan’s ferroalloys market is heavily driven by the escalating demand from the steel manufacturing sector, particularly in the context of the automotive and construction industries. Ferroalloys serve as crucial additives in steel, enhancing strength, corrosion resistance, and malleability. As Japan is the base country for prominent automotive players, there is a steady demand for quality steel. The Japanese automobile industry not only plays a vital role in the domestic economy but also generates substantial export demand for advanced high-strength steels, which are often dependent on ferroalloys like ferromanganese, ferrochrome, and ferrosilicon. Furthermore, the growing use of lightweight and fuel-efficient materials in electric vehicles (EVs) is driving the demand for alloy compositions. These are mainly manganese- and silicon-based ferroalloys, which contribute to the performance of steel components employed in vehicle frames and safety equipment. The IMARC Group predicts that the Japan EV market size is expected to exhibit a growth rate (CAGR) of 36.0% during 2025-2033.

Technological Advancements and Specialty Alloy Development

Japan's focus on technological innovation is bolstering the market growth. The nation's metallurgical research centers and industrial stakeholders are coming up with sophisticated manufacturing methods that enable the production of special alloys with specific properties. These developments are vital for high-end usage in aerospace, electronics, and nuclear power applications that need ultra-high-performance materials. The growing emphasis on specialty ferroalloys, including rare earth element-containing or especially compositional-balanced ones, is broadening the market's reach beyond traditional steelmaking. High-technology processing techniques such as vacuum arc remelting (VAR) and powder metallurgy are making it possible to manufacture ferroalloys with enhanced purity and microstructure, which are being served to highly regulated markets. Moreover, the application of artificial intelligence (AI) and machine learning (ML) to process control systems is enhancing yield, lowering energy usage, and reducing waste in ferroalloy production. The Japan AI market size is projected to reach USD 35.2 Billion by 2033, as per the predictions of the IMARC Group.

Sustainability Goals and Recycling Initiatives

Sustainability of the environment and conservation of resources are contributing to the market growth. Stringent government policies on environmental issues and plans to achieve long-term carbon neutrality are motivating industries to opt for cleaner production techniques and recycle more. The manufacturing of ferroalloys is energy consuming and generally goes with high carbon output. As a result, producers are spending on power-saving technologies and evaluating alternatives like biomass-based reductants and hydrogen. Concurrently, there is an increase in the focus on ferrous and non-ferrous scrap recycling to decrease reliance on virgin raw materials such as chromite and manganese ore, which frequently have to be imported. Japan's well-developed scrap recycling system, backed by sophisticated segregation and melting technologies, enables effective recovery of alloying components from industrial and post-consumer residue. This recycling model is essential in steel production in the country. In 2024, Tokyo Steel unveiled its new Near Zero brand of environmentally friendly steel. Its production lowered carbon emissions from 0.4 tons of CO2 per ton of steel to 0.1 tons.

Japan Ferroalloys Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product and application.

Product Insights:

- Ferrochrome

- Ferromanganese

- Ferro Silicomanganese

- Ferrosilicon

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes ferrochrome, ferromanganese, ferro silicomanganese, ferrosilicon, and others.

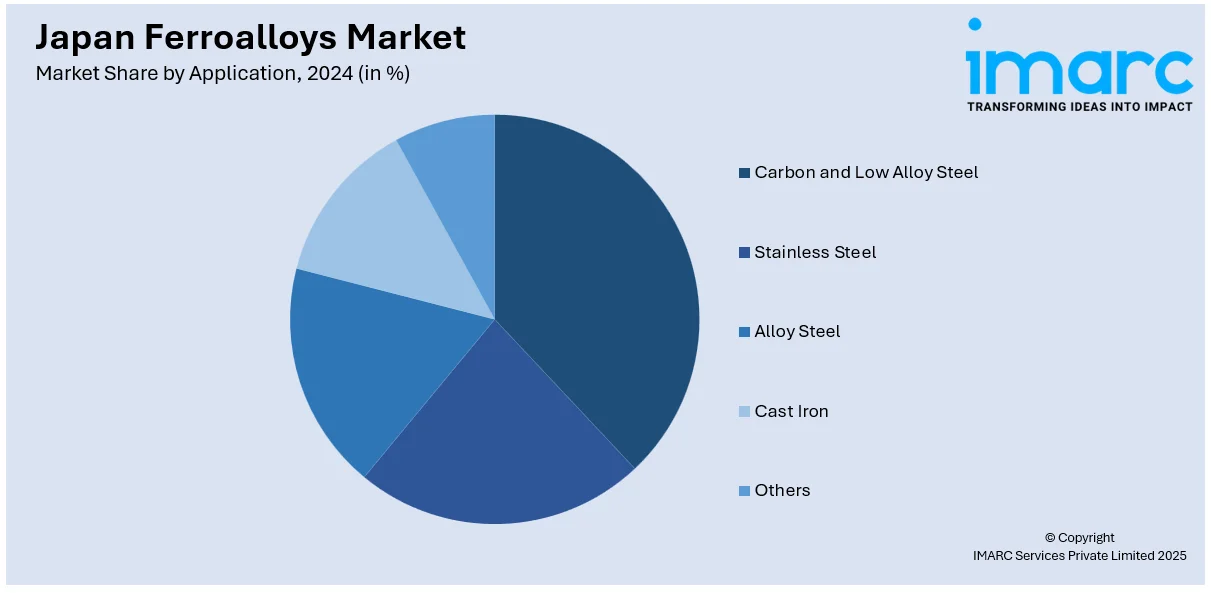

Application Insights:

- Carbon and Low Alloy Steel

- Stainless Steel

- Alloy Steel

- Cast Iron

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes carbon and low alloy steel, stainless steel, alloy steel, cast iron, and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, And Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Ferroalloys Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Ferrochrome, Ferromanganese, Ferro Silicomanganese, Ferrosilicon, Others |

| Applications Covered | Carbon and Low Alloy Steel, Stainless Steel, Alloy Steel, Cast Iron, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan ferroalloys market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan ferroalloys market on the basis of product?

- What is the breakup of the Japan ferroalloys market on the basis of application?

- What is the breakup of the Japan ferroalloys market on the basis of region?

- What are the various stages in the value chain of the Japan ferroalloys market?

- What are the key driving factors and challenges in the Japan ferroalloys market?

- What is the structure of the Japan ferroalloys market and who are the key players?

- What is the degree of competition in the Japan ferroalloys market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan ferroalloys market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan ferroalloys market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan ferroalloys industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)