Japan Fiber Cement Market Size, Share, Trends and Forecast by Raw Material, Construction Type, End Use, and Region, 2026-2034

Japan Fiber Cement Market Summary:

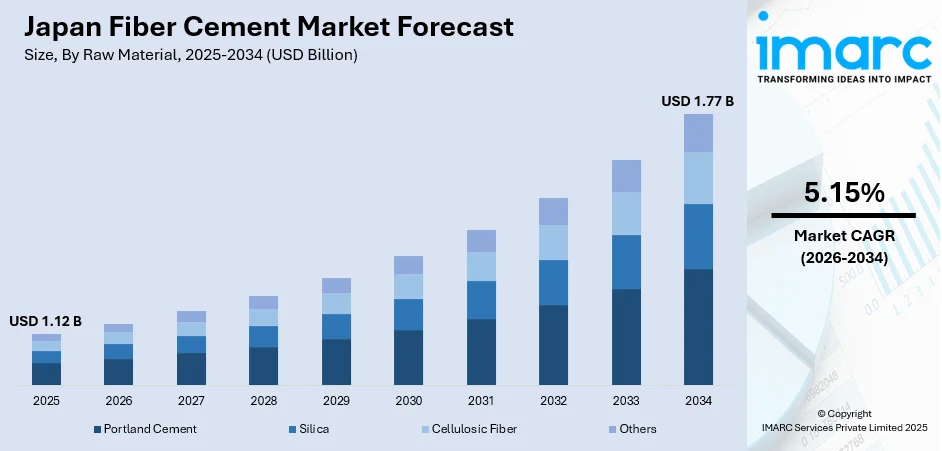

The Japan fiber cement market size was valued at USD 1.12 Billion in 2025 and is projected to reach USD 1.77 Billion by 2034, growing at a compound annual growth rate of 5.15% from 2026-2034.

The market is experiencing robust growth driven by Japan's stringent building safety standards and heightened demand for fire-resistant, earthquake-resilient construction materials. The country's position along the Pacific Ring of Fire necessitates durable cladding solutions that can withstand seismic forces while meeting evolving energy efficiency mandates. Continued urban redevelopment initiatives across metropolitan areas, coupled with the expansion of prefabricated and modular housing sectors seeking lightweight installation solutions, further reinforce Japan fiber cement market share across residential and commercial building applications.

Key Takeaways and Insights:

- By Raw Material: Portland cement dominates the market with a share of 55.7% in 2025, driven by its structural reliability, established supply chain networks, and compatibility with cellulose fiber reinforcement for dimensional stability.

- By Construction Type: Siding leads the market with a share of 45.2% in 2025, owing to superior durability, fire resistance, and low maintenance requirements compared to traditional wood and vinyl alternatives.

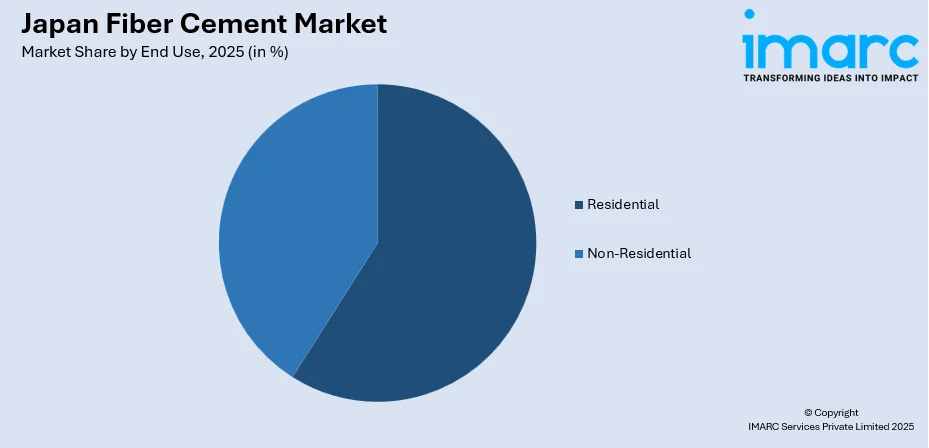

- By End Use: Residential holds the largest share at 59.8% in 2025, reflecting sustained demand for durable exterior cladding in single-family homes and apartment complexes across urban centers.

- By Region: Kanto Region dominates the market with 34.2% share in 2025, supported by concentrated construction activity in Tokyo and surrounding metropolitan areas, megaproject developments, and early adoption of advanced building standards.

- Key Players: The Japan fiber cement market exhibits moderate competitive intensity, with established domestic manufacturers competing alongside international building material corporations across premium architectural and standard residential segments.

To get more information on this market Request Sample

Japan's fiber cement sector benefits from the country's comprehensive approach to construction safety and sustainability. The government's National Resilience Plan channels substantial investment into seismic retrofitting and disaster-resistant infrastructure, creating sustained demand for materials meeting rigorous JIS standards. In February 2025, Sumitomo Corporation signed a memorandum of understanding with Fortera Corporation to explore constructing a low-carbon cement production facility in Japan, targeting pilot production by fiscal year 2026 and demonstrating industry commitment to reducing manufacturing emissions while maintaining structural performance standards.

Japan Fiber Cement Market Trends:

Growing Emphasis on Fire-Resistant Cladding Solutions

The increasing frequency of natural disasters and heightened building safety awareness have accelerated adoption of non-combustible exterior materials across Japan. Fiber cement products, characterized by inherent fire resistance and dimensional stability under thermal stress, have gained significant traction for siding and partition applications. Builders and property developers increasingly specify these materials over traditional alternatives due to superior longevity and reduced maintenance requirements. In November 2024, Nippon Electric Glass unveiled its rebranded alkali-resistant glass fiber product line as WizARG, representing enhanced performance capabilities for fiber cement reinforcement in architectural and civil engineering applications across the domestic market.

Acceleration of Sustainable Construction Practices

Japan's construction sector continues transitioning toward environmentally responsible building materials aligned with national carbon reduction objectives. Fiber cement's composition utilizing cement, cellulose fibers, and natural aggregates offers a favorable environmental profile compared to petroleum-based cladding alternatives. The CASBEE certification program and government mandates targeting Zero Energy House standards by 2030 are driving specification of materials supporting energy efficiency goals. In December 2024, Lixil Corporation commenced mass production of Revia, an advanced eco-friendly construction material incorporating recycled plastic and wood waste, demonstrating broader industry momentum toward circular economy principles in building material manufacturing.

Prefabricated Housing Driving Lightweight Material Demand

Japan's prefabricated and modular housing boom is creating substantial demand for lightweight, easy-to-install cladding products that streamline factory-based construction processes. The sector continues emphasizing disaster resilience and thermal insulation performance while addressing persistent labor shortages through off-site manufacturing efficiency. Leading homebuilders are integrating fiber cement panels into standardized building systems, leveraging their consistent dimensional properties and compatibility with mechanical installation systems.

Market Outlook 2026-2034:

The Japan fiber cement market is positioned for sustained expansion, supported by robust infrastructure investment programs and evolving construction practices prioritizing material durability and sustainability. Urban redevelopment projects across Tokyo, Osaka, and regional metropolitan centers continue driving demand for high-performance cladding solutions meeting stringent seismic and fire safety standards. The market generated a revenue of USD 1.12 Billion in 2025 and is projected to reach a revenue of USD 1.77 Billion by 2034, growing at a compound annual growth rate of 5.15% from 2026-2034. Government initiatives promoting disaster-resilient construction and green building certification programs are expected to further accelerate specification of fiber cement products across residential, commercial, and institutional building segments.

Japan Fiber Cement Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Raw Material | Portland Cement | 55.7% |

| Construction Type | Siding | 45.2% |

| End Use | Residential | 59.8% |

| Region | Kanto Region | 34.2% |

Raw Material Insights:

- Portland Cement

- Silica

- Cellulosic Fiber

- Others

Portland cement dominates with a market share of 55.7% of the total Japan fiber cement market in 2025.

Portland cement remains the foundational raw material for fiber cement manufacturing due to its proven structural reliability, consistent availability through established supply networks, and superior compatibility with cellulosic fibers used for reinforcement. The material's formulation supports dimensional stability, weather resistance, and extended service life, making it suitable for both new construction and building refurbishment applications across Japan's varied climatic regions. Japanese cement manufacturers are advancing sustainability initiatives while maintaining product quality standards essential for fiber cement production.

Construction Type Insights:

- Siding

- Roofing

- Molding and Trim

- Others

Siding leads the market with a share of 45.2% of the total Japan fiber cement market in 2025.

Fiber cement siding has established itself as the preferred exterior cladding solution across Japan's residential and commercial construction sectors. The material offers superior durability, fire resistance, and low maintenance requirements compared to traditional wood, vinyl, and metal alternatives. Its ability to replicate the appearance of natural materials such as wood, stone, and brick while providing enhanced weather protection has broadened its appeal among architects and homeowners seeking both aesthetic versatility and long-term performance. The siding segment continues to benefit from product innovation focused on expanded design options and simplified installation methods.

End Use Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Non-Residential

Residential accounts for the largest segment with a 59.8% share of the total Japan fiber cement market in 2025.

The residential sector drives Japan fiber cement demand through sustained requirements for durable, fire-resistant exterior cladding in single-family homes, apartments, and condominium developments. Urban population concentration in metropolitan areas like Tokyo and Osaka sustains new construction activity, while aging housing stock across suburban and rural regions generates steady renovation demand. Fiber cement's combination of aesthetic versatility, weather resistance, and low maintenance aligns with homeowner preferences for long-lasting building materials. Japan's residential construction sector is adapting to evolving regulatory requirements and sustainability goals.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

Kanto Region holds the largest share at 34.2% of the total Japan fiber cement market in 2025.

The Kanto Region, encompassing Tokyo and surrounding prefectures, leads Japan fiber cement consumption through concentrated construction activity driven by megaproject developments, high-rise residential construction, and urban redevelopment initiatives. The region's early adoption of advanced building standards, including Building Information Modeling and net-zero building codes, positions it as a national trendsetter for construction material specifications. Dense population centers sustain consistent demand for fire-resistant and seismically resilient cladding solutions.

Major infrastructure and development projects continue to support fiber cement demand across the Kanto Region. Tokyo's urban landscape is being transformed by large-scale redevelopment initiatives. Government investment in seismic retrofitting of expressways and municipal facilities further extends demand for durable building materials, while private-sector focus on high-performance residential and commercial construction sustains procurement of premium fiber cement cladding products.

Market Dynamics:

Growth Drivers:

Why is the Japan Fiber Cement Market Growing?

Stringent Seismic Safety Standards and Disaster Resilience Requirements

Japan's location along the Pacific Ring of Fire generates consistent demand for construction materials capable of withstanding significant seismic forces while maintaining structural integrity. Building codes mandate compliance with rigorous earthquake resistance standards, with regulations updated following major seismic events to incorporate lessons learned and technological advances. Fiber cement products contribute to overall building resilience through lightweight characteristics reducing structural load and dimensional stability preventing facade failure during ground movement. The National Resilience Plan channels multi-year investment into seismic retrofitting programs across public infrastructure and residential buildings, creating sustained demand for compliant cladding materials.

Expanding Green Building Certification and Energy Efficiency Mandates

Government initiatives promoting sustainable construction practices are accelerating adoption of environmentally responsible building materials aligned with national carbon reduction objectives. The Comprehensive Assessment System for Built Environment Efficiency certification program evaluates building environmental performance, incentivizing specification of materials contributing to energy efficiency and reduced lifecycle environmental impact. Fiber cement's favorable characteristics including thermal mass properties, recyclability potential, and absence of volatile organic compounds position it advantageously within green building frameworks. In January 2025 end, Mitsubishi UBE Cement Corporation invested USD 5 Million in MCi Carbon's mineral carbonation technology for carbon capture and utilization, demonstrating industry commitment to reducing cement production emissions while advancing sustainability objectives across Japan's construction materials sector.

Urban Redevelopment and Aging Housing Stock Renovation

Japan's concentrated urban populations and aging housing infrastructure generate substantial demand for renovation and redevelopment projects requiring high-performance exterior materials. Properties constructed before contemporary building codes require facade upgrades to meet current seismic, fire, and energy efficiency standards. Major metropolitan areas including Tokyo, Osaka, and Nagoya are experiencing intensive redevelopment programs transforming aging commercial districts and residential neighborhoods. The Torch Tower development in Tokyo, set to become Japan's tallest skyscraper upon completion in 2028, exemplifies the scale and ambition of current urban construction activity driving demand for advanced building materials. Municipal renovation subsidy programs incentivize property owners to upgrade seismic resistance and thermal performance, creating incremental demand for fiber cement cladding solutions across existing building stock.

Market Restraints:

What Challenges the Japan Fiber Cement Market is Facing?

Labor Shortages Constraining Installation Capacity

Japan's construction industry faces persistent workforce challenges as demographic aging reduces available skilled labor while regulatory changes limit overtime hours. Contractors struggle to maintain installation capacity for specialized cladding applications requiring trained personnel, creating project delays and cost pressures across residential and commercial sectors. The impending retirement of veteran construction workers intensifies competition for qualified installers capable of meeting quality standards.

Rising Raw Material and Production Costs

Escalating input costs for cement, cellulose fibers, and energy continue pressuring manufacturer margins while complicating pricing strategies across the fiber cement sector. Global supply chain volatility and domestic energy price fluctuations create uncertainty in production economics, with cost increases potentially limiting adoption among price-sensitive residential construction segments seeking affordable exterior finishing solutions.

Competition from Alternative Cladding Materials

Fiber cement faces increasing competition from alternative exterior materials including metal panels, engineered wood products, and advanced composite systems offering differentiated performance characteristics. Technological improvements in competing materials combined with aggressive marketing from alternative product manufacturers create substitution pressure, particularly in commercial applications where architectural flexibility and installation speed influence specification decisions.

Competitive Landscape:

The Japan fiber cement market features a structured competitive environment with established domestic manufacturers competing alongside international building material corporations for market position across residential and commercial segments. Competition centers on product innovation addressing fire resistance, moisture stability, dimensional consistency, and installation efficiency requirements. Domestic manufacturers leverage strong integration with Japan's residential construction channels and comprehensive architectural design offerings, while international participants contribute premium panel solutions emphasizing color stability and surface finishing quality. Companies invest in expanded product portfolios, enhanced technical support services, and sustainability credentials to differentiate offerings and capture specification preference among architects, contractors, and property developers. Strategic partnerships between material suppliers and homebuilders support standardized product integration within prefabricated construction systems, creating competitive advantages for manufacturers demonstrating reliable quality and supply chain performance.

Japan Fiber Cement Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Raw Materials Covered | Portland Cement, Silica, Cellulosic Fiber, Others |

| Construction Types Covered | Siding, Roofing, Molding and Trim, Others |

| End Uses Covered | Residential, Non-Residential |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan fiber cement market size was valued at USD 1.12 Billion in 2025.

The Japan fiber cement market is expected to grow at a compound annual growth rate of 5.15% from 2026-2034 to reach USD 1.77 Billion by 2034.

Portland cement, holding the largest revenue share of 55.7%, remains pivotal for Japan's fiber cement production due to its structural reliability, established supply networks, and superior compatibility with cellulosic fiber reinforcement for dimensional stability.

Key factors driving the Japan fiber cement market include stringent seismic and fire safety building regulations, urban redevelopment and infrastructure modernization initiatives, expanding residential renovation activity, and growing preference for sustainable building materials.

Major challenges include skilled labor shortages in the construction sector, rising material and energy costs affecting production economics, and demographic decline reducing new residential construction demand in peripheral regions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)