Japan Fire Fighting Chemicals Market Size, Share, Trends and Forecast by Type, Chemicals, Application, and Region, 2026-2034

Japan Fire Fighting Chemicals Market Overview:

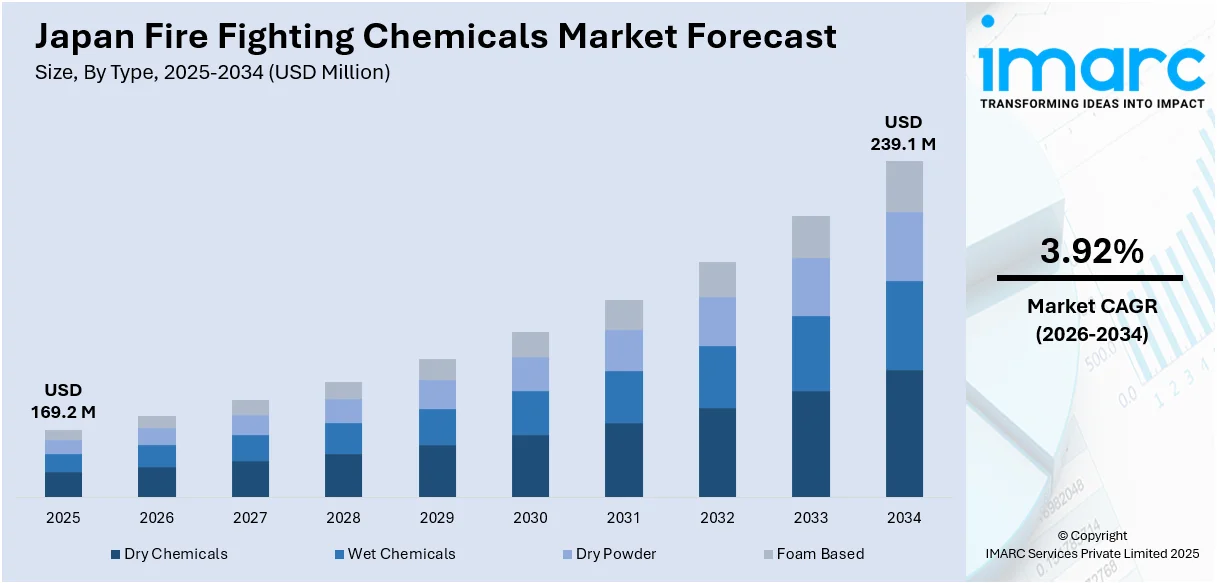

The Japan fire fighting chemicals market size reached USD 169.2 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 239.1 Million by 2034, exhibiting a growth rate (CAGR) of 3.92% during 2026-2034. The fire fighting chemicals market in Japan is expanding due to climate-driven wildfire threats and a strong public preparedness culture, with the rising demand from both emergency agencies and households for fast-acting, versatile suppression tools that support large-scale operations and localized safety initiatives.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 169.2 Million |

| Market Forecast in 2034 | USD 239.1 Million |

| Market Growth Rate 2026-2034 | 3.92% |

Japan Fire Fighting Chemicals Market Trends:

Climate-Driven Demand for Wildfire Management

Japan's increasing susceptibility to climate changes is heightening wildfire threats, particularly in wooded and hilly areas. Rising temperatures, extended dry spells, and unpredictable rainfall are heightening the occurrence and intensity of wildfires, leading to more rigorous containment measures. In January 2025, a wildfire ignited in the mountains located between Kofu City and Fuefuki City in Yamanashi Prefecture and was uncontrolled for several days. The reply included helicopters and Self-Defense Forces, emphasizing the increasing necessity for coordinated, extensive suppression operations. Yamanashi, which has faced several wildfires in recent years, illustrates how some prefectures are increasingly stressed during Japan’s busiest fire season. In response to these threats, officials are funding rapid-response chemical agents suitable for use on the ground and in the air. The growing range of wildfire management is resulting in heightened demand for fire retardants and foam chemicals capable of covering large areas and controlling fires more effectively. These changes are encouraging local governments and disaster response organizations to uphold chemical stocks as a component of seasonal readiness plans. Fire fighting chemicals are emerging as an essential resource in climate resilience strategies, with purchasing choices shaped by the requirements for swift deployment, performance in various conditions, and suitability for aerial delivery methods.

To get more information on this market Request Sample

Public Awareness and Preparedness Campaigns

Japan’s long-standing exposure to natural disasters is cultivating a nationwide emphasis on emergency readiness, increasingly reflected in public fire safety initiatives. This preparedness culture is catalyzing the demand for chemical-based fire suppression tools across homes, public institutions, and community spaces. Awareness campaigns, local training programs, and visible government-led drills are promoting practical use of fire extinguishers, portable chemical canisters, and personal safety kits. A clear demonstration of this occurred in January 2025 during the Tokyo Fire Department’s annual Dezomeshiki New Year’s ceremony. The event gathered 2,900 personnel and 150 vehicles to conduct disaster response simulations, including drills for earthquakes, fires, and chemical hazards. This public-facing showcase combined traditional firefighting techniques with modern emergency tools and served to reinforce communal responsibility and preparedness. Held in the aftermath of the 2024 Noto Peninsula earthquake, the ceremony emphasized readiness and cooperation amid ongoing recovery from the 2024 Noto Peninsula earthquake. Such events build public familiarity with emergency systems and increase trust in chemical-based fire response solutions. As a result, there is growing uptake of safety equipment at the household and municipal level, boosting the market for small-volume fire fighting chemicals. The message of self-reliance and rapid response, consistently reinforced through community engagement, is expanding the user base beyond industry and government buyers, anchoring personal safety as a core growth channel for fire suppression products in Japan.

Japan Fire Fighting Chemicals Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on type, chemicals, and application.

Type Insights:

- Dry Chemicals

- Wet Chemicals

- Dry Powder

- Foam Based

The report has provided a detailed breakup and analysis of the market based on the type. This includes dry chemicals, wet chemicals, dry powder, and foam based.

Chemicals Insights:

- Monoammonium Phosphate

- Halon

- Carbon Dioxide

- Potassium Bicarbonate

- Potassium Citrate

- Sodium Chloride

- Others

A detailed breakup and analysis of the market based on the chemicals have also been provided in the report. This includes monoammonium phosphate, halon, carbon dioxide, potassium bicarbonate, potassium citrate, sodium chloride, and others.

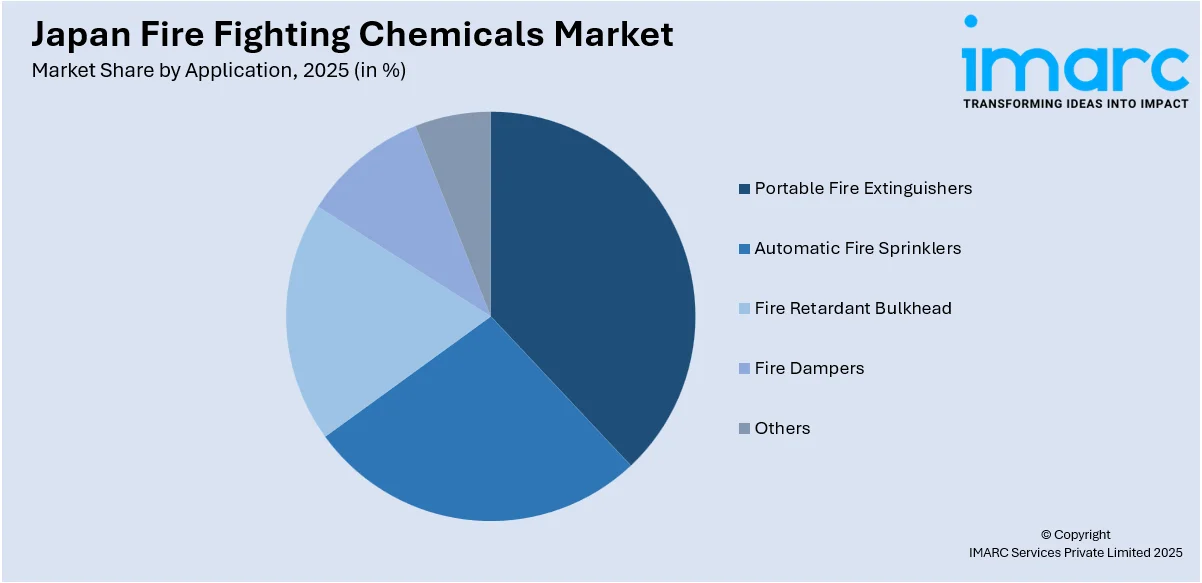

Application Insights:

Access the comprehensive market breakdown Request Sample

- Portable Fire Extinguishers

- Automatic Fire Sprinklers

- Fire Retardant Bulkhead

- Fire Dampers

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes portable fire extinguishers, automatic fire sprinklers, fire retardant bulkhead, fire dampers, and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Fire Fighting Chemicals Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Dry Chemicals, Wet Chemicals, Dry Powder, Foam Based |

| Chemicals Covered | Monoammonium Phosphate, Halon, Carbon Dioxide, Potassium Bicarbonate, Potassium Citrate, Sodium Chloride, Others |

| Applications Covered | Portable Fire Extinguishers, Automatic Fire Sprinklers, Fire Retardant Bulkhead, Fire Dampers, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan fire fighting chemicals market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan fire fighting chemicals market on the basis of type?

- What is the breakup of the Japan fire fighting chemicals market on the basis of chemicals?

- What is the breakup of the Japan fire fighting chemicals market on the basis of application?

- What is the breakup of the Japan fire fighting chemicals market on the basis of region?

- What are the various stages in the value chain of the Japan fire fighting chemicals market?

- What are the key driving factors and challenges in the Japan fire fighting chemicals market?

- What is the structure of the Japan fire fighting chemicals market and who are the key players?

- What is the degree of competition in the Japan fire fighting chemicals market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan fire fighting chemicals market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan fire fighting chemicals market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan fire fighting chemicals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)