Japan Fitness Supplements Market Size, Share, Trends and Forecast by Type, Distribution Channel, and Region, 2025-2033

Japan Fitness Supplements Market Overview:

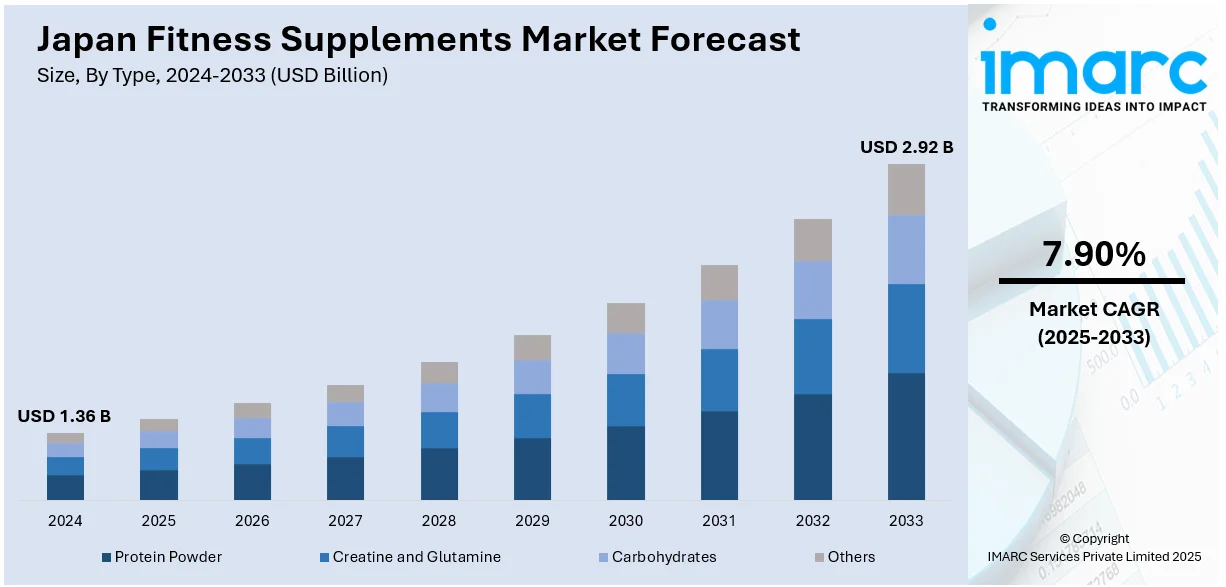

The Japan fitness supplements market size reached USD 1.36 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.92 Billion by 2033, exhibiting a growth rate (CAGR) of 7.90% during 2025-2033. The increased realization of the need to be healthy is positively influencing the market in Japan. Moreover, gym culture and fitness trends are becoming popular in the country, catalyzing the demand for health supplements. This trend, along with the heightened emergence of online shopping platforms is expanding the Japan fitness supplements market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.36 Billion |

| Market Forecast in 2033 | USD 2.92 Billion |

| Market Growth Rate 2025-2033 | 7.90% |

Japan Fitness Supplements Market Trends:

Health Consciousness Among Consumers

As Japanese culture focuses on balance and overall wellness, there is a considerable realization among the masses about the need to be healthy, which is positively influencing the fitness supplements sector in the country. People are embracing healthy living and are keen on enhancing their physical well-being. This has been reflected in the increase in the number of fitness enthusiasts, gym members, and people placing emphasis on overall wellness. As more individuals become aware about the importance of regular exercise and nutrition, they are looking for fitness supplements as an additive to their workout regimen. The Japanese people are becoming informed about aspects like equilibrium nutrition, muscle recuperation, and performance improvement, which can be offered through supplements. In addition, the geriatric population is searching for means to retain muscle and joint health, thereby propelling the growth of the market. In 2024, as per government data, Japan’s elderly population reached the record high of 36.25 million citizens, with 65 or older age group occupying one-third of Japan’s population. This growing aged population in the country is driving the popularity of different supplements intended to aid in fitness objectives, with more consumers integrating them into their day-to-day diets.

Increased Fitness Trends and Gym Culture Popularity

Gym culture and fitness trends are increasingly becoming popular in Japan, catalyzing the demand for fitness supplements. With the rising penetration of fitness clubs and gyms in the country, an increasing number of people are becoming involved in regular exercise and strength training. Individuals are now more involved in all sorts of workout routines like weight training, CrossFit, and cardio, which rely on having more nutritional supplementation to improve performance and recovery. Personal trainers, athletes, and fitness influencers are also helping to promote the use of supplements by suggesting certain products for improving training results. With increasing numbers of people concentrating on particular fitness objectives like muscle building, improving endurance, or shedding weight, supplements designed to address these requirements, including protein powders, amino acids, and pre-workout, are becoming popular in the market. In 2024, Japanese active nutrition brand VALX unveiled its protein-based products and EAA9 supplements in the e-commerce sector of Hong Kong.

Emergence of E-commerce and Online Accessibility

The increasing number of online shopping platforms is contributing to the Japan fitness supplements market growth. Customers are buying fitness supplements from online retailers, which are driven by convenience, affordability, and variety. The speedy development of online shopping channels provides customers with opportunities to try international brands and specialized supplements that might not be easily found in offline stores. Additionally, e-commerce platforms often present detailed product depictions, customer reviews, and comparisons, which are empowering consumers to make informed purchasing decisions. With the adoption of online shopping, the demand for fitness supplements is rising, as consumers seek products tailored to their specific health and fitness needs. The convenience of access to different supplement products and the fact that these can be ordered and received directly at home are driving the market, particularly in urban settings where online shopping behavior is extremely high. The IMARC Group predicts that the Japan e-commerce market will reach USD 692.8 Billion by 2033.

Japan Fitness Supplements Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and distribution channel.

Type Insights:

- Protein Powder

- Creatine and Glutamine

- Carbohydrates

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes protein powder, creatine and glutamine, carbohydrates, and others.

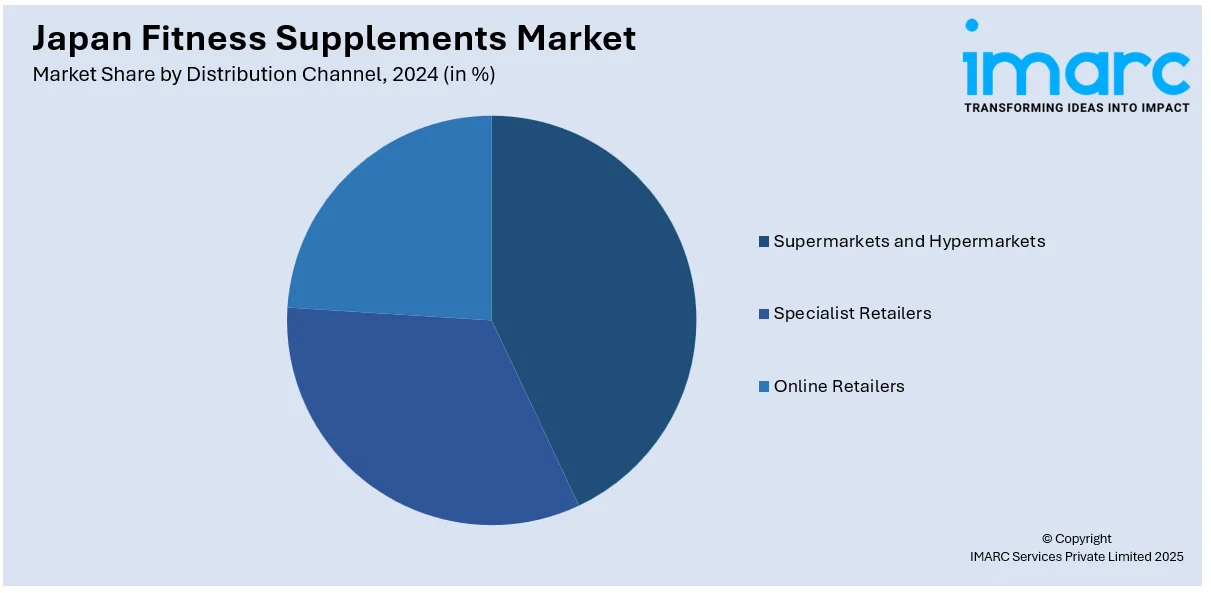

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Specialist Retailers

- Online Retailers

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, specialist retailers, and online retailers.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Fitness Supplements Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Protein Powder, Creatine and Glutamine, Carbohydrates, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialist Retailers, Online Retailers |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan fitness supplements market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan fitness supplements market on the basis of type?

- What is the breakup of the Japan fitness supplements market on the basis of distribution channel?

- What is the breakup of the Japan fitness supplements market on the basis of region?

- What are the various stages in the value chain of the Japan fitness supplements market?

- What are the key driving factors and challenges in the Japan fitness supplements market?

- What is the structure of the Japan fitness supplements market and who are the key players?

- What is the degree of competition in the Japan fitness supplements market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan fitness supplements market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan fitness supplements market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan fitness supplements industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)