Japan Flexible Paper Packaging Market Size, Share, Trends and Forecast by Packaging Type, Application, and Region, 2026-2034

Japan Flexible Paper Packaging Market Summary:

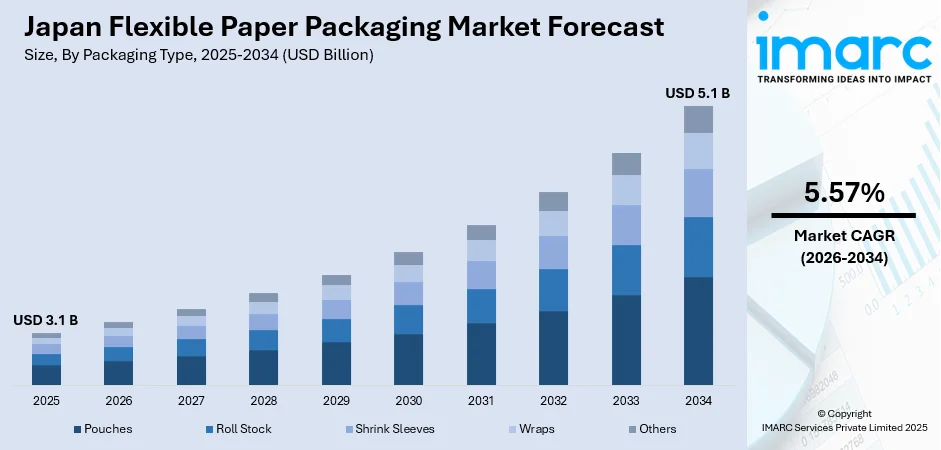

The Japan flexible paper packaging market size was valued at USD 3.1 Billion in 2025 and is projected to reach USD 5.1 Billion by 2034, growing at a compound annual growth rate of 5.57% from 2026-2034.

The Japan flexible paper packaging market is witnessing robust growth driven by increasing environmental consciousness and stringent government regulations promoting sustainable packaging alternatives. The market benefits from technological innovations enhancing paper-based barrier properties, growing demand from the food and beverage sector, and the shift away from single-use plastics toward recyclable and biodegradable packaging solutions.

Key Takeaways and Insights:

- By Packaging Type: Pouches dominates the market with a share of 46% in 2025, driven by consumer preference for convenient, resealable, and lightweight packaging formats that extend product shelf life while minimizing material usage.

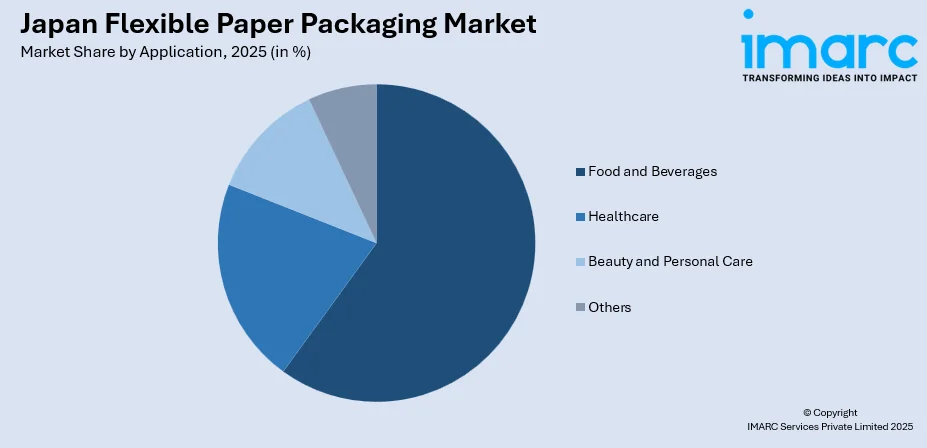

- By Application: Food and beverages lead the market with a share of 60% in 2025, reflecting the extensive adoption of paper-based flexible packaging for ready-to-eat meals, snacks, beverages, and convenience food products across Japanese retail channels.

- Key Players: The Japan flexible paper packaging market exhibits a competitive landscape characterized by established domestic manufacturers and multinational corporations focusing on sustainable innovation, barrier technology advancement, and strategic partnerships to strengthen market positioning.

To get more information on this market Request Sample

The Japan flexible paper packaging market continues to evolve with intensifying focus on circular economy principles and plastic waste reduction initiatives. Notably, in October 2025, Harima Chemicals Group, a major Japanese coatings company, announced the launch of water‑based barrier coating agents with up to 85% biomass content. These coatings are designed to give paper superior resistance to water, oil, heat, and moisture, allowing paper to replace plastic‑based laminated packaging even for food contact applications. Japanese manufacturers are pioneering innovations in paper-based barrier coatings and recyclable laminate structures that meet stringent food safety requirements while maintaining environmental sustainability. The Containers and Packaging Recycling Law has accelerated the transition toward eco-friendly packaging solutions, prompting brands across multiple sectors to redesign their packaging strategies. Consumer awareness of environmental impact is increasingly influencing purchasing decisions, creating competitive advantages for brands that adopt sustainable paper-based flexible packaging alternatives.

Japan Flexible Paper Packaging Market Trends:

Accelerating Transition Toward Recyclable and Biodegradable Materials

Japanese manufacturers are intensifying efforts to develop fully recyclable and biodegradable flexible paper packaging solutions in response to regulatory mandates and consumer expectations. In June 2025, researchers in Japan unveiled a new transparent, biodegradable paperboard produced entirely from cellulose. It offers the mechanical strength required for packaging while remaining recyclable like traditional paper. Advanced material science innovations are enabling the creation of paper-based substrates with enhanced moisture and grease resistance that can replace traditional plastic laminates while maintaining recyclability through conventional paper recycling streams.

Integration of Smart Packaging Technologies

The incorporation of digital technologies into flexible paper packaging is gaining momentum across Japan, with manufacturers implementing QR codes, NFC tags, and temperature indicators to enhance consumer engagement and product traceability. In June 2025, TOPPAN Digital announced it would showcase NFC/RFID‑enabled smart‑packaging at AIPIA & AWA 2025, reflecting rising interest in embedding digital ID and authentication tags into eco‑friendly packages. These smart packaging solutions align with Japan's tech-savvy consumer culture and provide valuable product information while supporting brand authentication and supply chain transparency.

Rising Demand for Portion-Controlled and Single-Serve Formats

The growing proportion of single-person households in Japan is driving demand for smaller, portion-controlled flexible paper packaging formats that reduce food waste and enhance convenience. According to reports, roughly 34.0% of all households in Japan, or about 18.5 million households, are single‑person households. Manufacturers are developing innovative stand-up pouches and resealable paper-based sachets tailored to the needs of urban consumers seeking ready-to-eat and on-the-go food options.

Market Outlook 2026-2034:

The Japan flexible paper packaging market is positioned for sustained expansion through the forecast period, supported by regulatory momentum toward sustainable packaging, continuous technological innovation, and evolving consumer preferences for eco-friendly products. The market is expected to benefit from investments in recycling infrastructure, development of advanced barrier technologies, and growing adoption across diverse end-use sectors. The market generated a revenue of USD 3.1 Billion in 2025 and is projected to reach a revenue of USD 5.1 Billion by 2034, growing at a compound annual growth rate of 5.57% from 2026-2034.

Japan Flexible Paper Packaging Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Packaging Type | Pouches | 46% |

| Application | Food and Beverages | 60% |

Packaging Type Insights:

- Pouches

- Roll Stock

- Shrink Sleeves

- Wraps

- Others

The pouches dominate with a market share of 46% of the total Japan flexible paper packaging market in 2025.

The dominance of pouches in the Japanese flexible paper packaging market reflects their exceptional versatility and alignment with contemporary consumer lifestyles. Stand-up pouches, flat pouches, and retort pouches manufactured from paper-based substrates offer superior functionality including resealability, portion control, and extended shelf-life capabilities. Japanese consumers particularly value these packaging formats for their convenience and space-efficient storage characteristics that suit compact urban living environments. In October 2024, Mitsui Chemicals, Inc., together with TOPPAN Inc. and RM Tohcello Co., Ltd., announced they had developed a recycled flexible‑film pouch made from horizontally recycled printed BOPP packaging waste (with ink removed, repolymerized, and reformed) and began offering sample pouches.

The pouches segment continues to benefit from technological advancements enabling paper-based materials to achieve barrier properties previously exclusive to plastic laminates. Manufacturers are developing innovative paper pouch designs incorporating biodegradable coatings and mono-material structures that facilitate recycling while maintaining product protection standards essential for food safety. The growing emphasis on sustainable packaging across retail and food service channels reinforces pouch adoption as brands seek environmentally responsible alternatives.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Food and Beverages

- Healthcare

- Beauty and Personal Care

- Others

The food and beverages lead with a share of 60% of the total Japan flexible paper packaging market in 2025.

The food and beverages sector commands the largest share of the Japanese flexible paper packaging market, driven by the nation's robust convenience food culture and extensive ready-to-eat product offerings. Japan's high concentration of convenience stores and the prevalence of single-person households create sustained demand for individually packaged food items requiring effective barrier protection and aesthetic appeal. Paper-based flexible packaging solutions meet these requirements while addressing growing consumer preferences for sustainable materials. In May 2025, Oji Holdings Corporation announced a collaboration with Nihon Tetra Pak K.K. and Gold Pack to launch Japan’s first system to recycle used aseptic carton packages into corrugated paper containers, a move aimed at supporting circular economy practices across the food and beverage sector and reducing reliance on virgin packaging materials.

The segment's leadership is reinforced by stringent food safety regulations that paper-based packaging increasingly satisfies through advanced barrier technologies. Japanese food manufacturers are transitioning toward paper-based flexible formats for snacks, confectionery, dried goods, and beverage products to align with corporate sustainability commitments and consumer expectations. The development of grease-resistant and moisture-barrier paper coatings has expanded application possibilities across diverse food categories previously dependent on plastic packaging.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto region, encompassing Tokyo and surrounding prefectures, represents the largest market for flexible paper packaging in Japan. This economically dominant region benefits from concentrated food and beverage manufacturing, dense urban retail networks, and a strong emphasis on eco-friendly packaging innovation driven by regulatory compliance and environmentally conscious consumers.

The Kansai/Kinki region, centered around Osaka, Kyoto, and Kobe, holds a significant market share driven by its diverse manufacturing base and pharmaceutical industry presence. The region is recognized for high-performance barrier films serving healthcare applications and innovative packaging solutions that meet rigorous quality standards required by its prominent consumer goods sector.

The Central/Chubu region, anchored by Nagoya, demonstrates steady market growth supported by its strong industrial base and strategic logistics positioning. The region's automotive and electronics industries drive demand for industrial flexible paper packaging, while urbanization continues to fuel consumption of food and beverage packaging solutions across retail channels.

The Kyushu-Okinawa region exhibits strong growth potential driven by its prominent agricultural sector and food processing industries. The region specializes in bio-based and sustainable packaging for fresh produce exports, including tropical fruits from Okinawa, supporting its position as a key supplier of quality agricultural products requiring environmentally friendly packaging.

The Tohoku region prioritizes disaster-resistant and durable flexible paper packaging solutions, reflecting its preparedness-focused outlook developed following natural disasters. The region has emerged as an innovator in developing robust emergency food packaging that ensures product safety and extended shelf stability, addressing both everyday consumer needs and disaster preparedness requirements.

The Chugoku region demonstrates moderate market activity supported by its manufacturing industries and port facilities enabling export-oriented packaging demand. The region's strategic coastal location facilitates trade activities requiring specialized packaging solutions, while local food processing operations contribute to steady consumption of flexible paper packaging formats.

The Hokkaido region presents unique market characteristics driven by its renowned agricultural and dairy industries requiring specialized packaging for fresh and processed food products. The region emphasizes sustainable packaging solutions that preserve product freshness during extended transportation to mainland markets while supporting its reputation for premium quality food offerings.

The Shikoku region prioritizes environmentally friendly packaging for traditional and handcrafted products reflecting its cultural heritage preservation focus. Local manufacturers specialize in paper-based and biodegradable packaging solutions for regional specialties including green tea and traditional foods, targeting niche markets that value sustainability alongside authentic Japanese craftsmanship.

Market Dynamics:

Growth Drivers:

Why is the Japan Flexible Paper Packaging Market Growing?

Stringent Environmental Regulations and Sustainability Mandates

Japanese government policies, including the Containers and Packaging Recycling Law and Plastic Resource Circulation Act, are creating a favorable regulatory environment for flexible paper packaging adoption. These mandates compel manufacturers and brands to transition from plastic-based packaging toward recyclable and biodegradable alternatives, directly stimulating demand for paper-based flexible solutions. In November 2025, Toppan Holdings announced development of a new “paper‑heavy” jar container in which the container’s weight is over 50% paper, reducing plastic usage by over 90% compared with conventional plastic jars. Corporate sustainability commitments aligned with national environmental targets further accelerate the shift toward eco-friendly packaging across all industry sectors.

Technological Advancements in Barrier Properties and Material Science

Continuous innovation in paper coating technologies and barrier films is expanding the functional capabilities of flexible paper packaging. Japanese manufacturers are developing fluorine-free grease-resistant coatings, water-based barrier solutions, and advanced laminate structures that enable paper substrates to match the protective performance of conventional plastic packaging. In June 2024, Dai Nippon Printing Co., Ltd. (DNP) announced that its “high‑barrier paper mono‑material sheet” achieved over 85% repulpability, combining strong barrier performance against oxygen and moisture with recyclability via conventional paper recycling streams. These technological breakthroughs are opening new application possibilities while maintaining recyclability, making paper-based options viable across previously inaccessible product categories.

Evolving Consumer Preferences Toward Sustainable Products

Japanese consumers are increasingly prioritizing environmental sustainability in their purchasing decisions, favoring products packaged in eco-friendly materials over conventional plastic alternatives. This shift in consumer behavior creates competitive advantages for brands adopting flexible paper packaging and influences product development strategies across the food and beverage, personal care, and healthcare sectors. The growing awareness of plastic pollution and environmental degradation motivates consumers to support brands that demonstrate commitment to sustainable packaging practices.

Market Restraints:

What Challenges the Japan Flexible Paper Packaging Market is Facing?

Technical Limitations in Barrier Performance

Despite significant advancements, paper-based flexible packaging still faces challenges in achieving barrier properties comparable to multi-layer plastic laminates for certain applications. Moisture sensitivity, oxygen permeability, and grease resistance limitations restrict adoption in product categories requiring extended shelf life or stringent protection, necessitating continued research and development investment.

Higher Production Costs Compared to Conventional Alternatives

Advanced paper-based flexible packaging solutions often involve higher manufacturing costs than traditional plastic packaging due to specialized coating technologies and material processing requirements. These cost differentials may constrain adoption among price-sensitive market segments and require manufacturers to balance sustainability objectives with commercial viability considerations.

Recycling Infrastructure and Multi-Material Complexity

While paper-based packaging is generally more recyclable than plastic alternatives, composite structures combining paper with barrier coatings or laminated layers may complicate recycling processes. Ensuring compatibility with existing paper recycling streams requires careful material selection and design considerations, presenting technical challenges for manufacturers seeking to optimize both performance and end-of-life recyclability.

Competitive Landscape:

The Japan flexible paper packaging market features a competitive landscape characterized by established domestic manufacturers with strong technological capabilities competing alongside multinational packaging corporations. Key players are differentiating through investments in sustainable material innovation, advanced barrier technologies, and digital printing capabilities that enable customization and short-run production. Strategic partnerships between packaging converters and raw material suppliers are accelerating the development of next-generation paper-based solutions that meet evolving regulatory requirements and consumer expectations for environmental responsibility.

Recent Developments:

- In October 2025 Oji Holdings Corporation, in collaboration with Taisei Lamick Group, launched paper-based sachets for sauces and dressings on select Japan Airlines flights. These eco-friendly sachets offer high barrier protection while reducing plastic use, marking a step forward in sustainable food packaging in Japan.

Japan Flexible Paper Packaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Packaging Types Covered | Pouches, Roll Stock, Shrink Sleeves, Wraps, Others |

| Applications Covered | Food and Beverages, Healthcare, Beauty and Personal Care, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan flexible paper packaging market size was valued at USD 3.1 Billion in 2025.

The Japan flexible paper packaging market is expected to grow at a compound annual growth rate of 5.57% from 2026-2034 to reach USD 5.1 Billion by 2034.

Pouches dominated the Japan flexible paper packaging market with a share of 46%, driven by consumer preference for resealable, convenient and lightweight packaging formats that align with urban lifestyles and sustainability goals.

Key factors driving the Japan flexible paper packaging market include stringent environmental regulations promoting sustainable packaging, technological advancements in barrier properties, evolving consumer preferences toward eco-friendly products, and the growing food and beverage industry demand for recyclable packaging solutions.

Major challenges include technical limitations in achieving barrier performance comparable to plastic laminates, higher production costs for advanced paper-based solutions, recycling complexity for multi-material structures, and competition from established plastic packaging alternatives.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)