Japan Floating Solar Farms Market Size, Share, Trends and Forecast by Location, Capacity, Size, Connectivity, Application, and Region, 2026-2034

Japan Floating Solar Farms Market Summary:

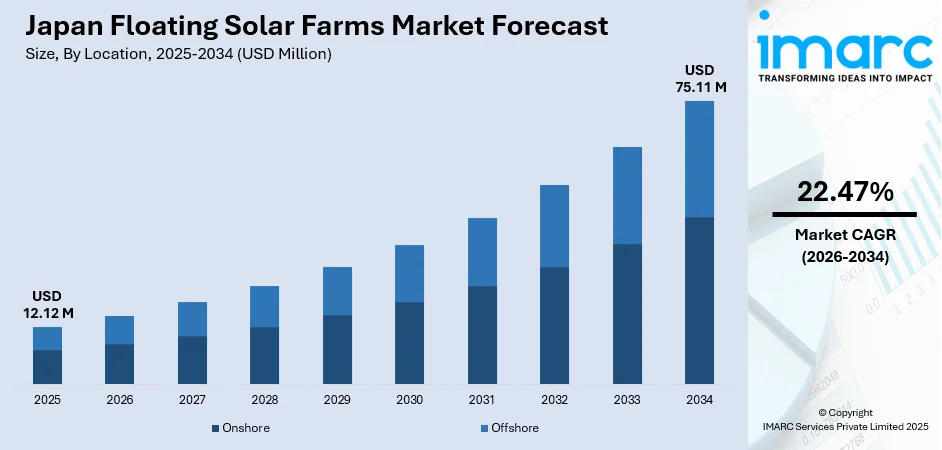

The Japan floating solar farms market size was valued at USD 12.12 Million in 2025 and is projected to reach USD 75.11 Million by 2034, growing at a compound annual growth rate of 22.47% from 2026-2034.

The market is primarily driven by Japan's acute land scarcity and the government's strategic push toward renewable energy diversification following the Fukushima nuclear disaster. The country's unique geographical constraints, with over three-quarters of its terrain being mountainous, have positioned floating photovoltaic systems as an optimal solution for expanding solar capacity. Government initiatives under the Strategic Energy Plan, combined with feed-in tariff mechanisms and carbon neutrality targets, continue to incentivize investment in innovative floating solar installations. Additionally, the natural cooling effect of water enhances panel efficiency while simultaneously reducing water evaporation from reservoirs, further strengthening the Japan floating solar farms market share.

Key Takeaways and Insights:

- By Location: Onshore installations dominate the market with a share of 93.7% in 2025, driven by the abundance of agricultural reservoirs, freshwater dams, and irrigation ponds across Japan's prefectures that provide stable anchoring conditions and easier maintenance access.

- By Capacity: The above 5 MW segment leads the market with a 55.4% share in 2025, reflecting the preference for utility-scale projects that maximize energy output and operational efficiency on larger water bodies.

- By Size: Utility scale segment represents the largest category with 68.7% market share in 2025, owing to government incentives favoring large-scale renewable installations connected to major grid infrastructure.

- By Connectivity: On-grid installations hold a dominant 88.2% share in 2025, supported by established feed-in tariff mechanisms and power purchase agreements with regional utilities.

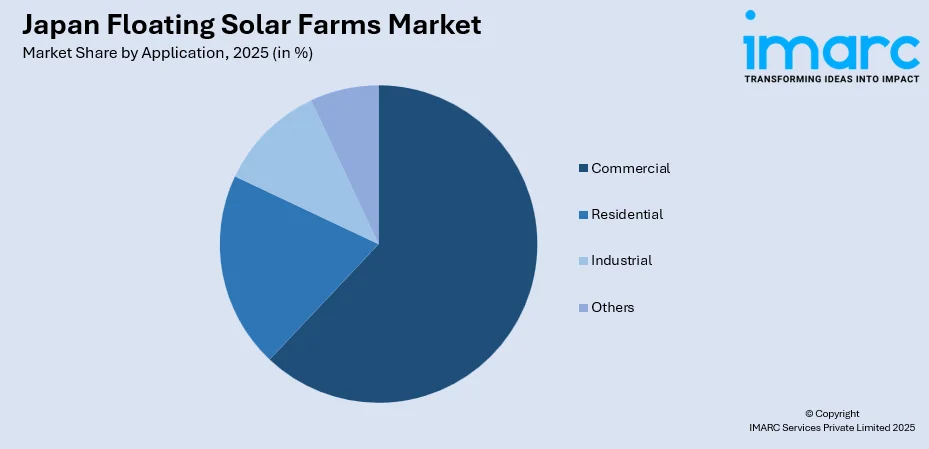

- By Application: Commercial segment accounts for the largest share of 62.1% in 2025, driven by corporate sustainability commitments, power purchase agreements, and industrial energy optimization strategies.

- By Region: Kanto Region leads with a 32.8% market share in 2025, benefiting from proximity to Tokyo's energy demand centers and landmark installations like the Yamakura Dam project in Chiba Prefecture.

- Key Players: The Japan floating solar farms market exhibits a moderately consolidated competitive structure, with established domestic technology firms and international floating platform specialists collaborating on project development, installation, and long-term maintenance services.

To get more information on this market Request Sample

Japan has established itself as a global pioneer in floating photovoltaic technology, hosting over 50 of the world's 100 largest floating solar installations. The country's extensive network of agricultural reservoirs, flood-control dams, and irrigation ponds provides an estimated technical potential for significant capacity expansion without competing with valuable terrestrial land resources. Technological advancements in high-density polyethylene floating platforms have enhanced system durability against typhoon conditions, with modern installations engineered to withstand wind speeds exceeding 200 kilometers per hour. For instance, Ciel & Terre maintains a commanding 70% share of Japan's floating solar platform market, having equipped more than 130 installations representing approximately 180 MW of power output through partnerships with major Japanese corporations. The integration of smart monitoring systems and predictive maintenance capabilities is further optimizing operational performance across installations nationwide.

Japan Floating Solar Farms Market Trends:

Expansion of Offshore Floating Solar Technology

Japanese companies are pioneering the development of offshore floating solar systems to overcome limitations of inland water bodies. This emerging segment addresses challenges related to wave dynamics, saltwater corrosion, and tidal variations through specialized mooring systems and marine-grade materials. In April 2024, Sumitomo Mitsui Construction installed floating solar power generation facilities in Tokyo Bay under the Tokyo Metropolitan Government's eSG Project, marking a significant milestone in demonstrating sea-based solar viability for densely populated coastal urban areas.

Integration of Advanced Energy Storage Solutions

Floating solar installations are increasingly being paired with battery energy storage systems to address solar intermittency and enhance grid stability. For instance, in June 2025, Saft, a TotalEnergies subsidiary, was chosen by Asian renewable energy developer Gurīn Energy to provide a battery energy storage system for a large-scale storage project currently under development in Fukushima, Japan. This trend enables a consistent power supply regardless of weather conditions and supports Japan's broader renewable integration goals. The Tokyo Bay demonstration project incorporates land-based battery storage with mobile battery transportation capabilities, allowing generated renewable energy to power electric mobility vehicles and watercraft while establishing models for local energy consumption frameworks.

Hybrid Hydro-Solar System Development

The convergence of floating solar with existing hydroelectric infrastructure represents a growing trend in Japan's renewable energy landscape. Utilizing reservoirs associated with hydropower dams maximizes land efficiency while leveraging existing grid connections and water management systems. This hybrid approach optimizes capital expenditure by sharing transmission infrastructure and allows complementary generation profiles, with solar peak output during daytime hours supplementing hydroelectric capacity while water storage provides backup during low-solar periods. For instance, in October 2025, Japan’s Ministry of Land, Infrastructure, Transport and Tourism (MLIT) appointed a consortium led by TEPCO Renewable Power as the preferred developer and operator of a new hydropower project at the Yunishigawa Dam in Nikko City, Tochigi Prefecture. The ministry finalized the decision on October 27, 2025, followed by the company’s confirmation the next day.

Market Outlook 2026-2034:

The Japan floating solar farms market is positioned for robust expansion as the country intensifies efforts to achieve carbon neutrality by 2050 under the Seventh Strategic Energy Plan framework. Continued government support through feed-in premium mechanisms, combined with increasing corporate demand for renewable energy procurement, will sustain investment momentum. Technological innovations in platform design, anchoring systems, and panel efficiency are expected to reduce levelized costs while expanding viable installation sites. The market generated a revenue of USD 12.12 Million in 2025 and is projected to reach a revenue of USD 75.11 Million by 2034, growing at a compound annual growth rate of 22.47% from 2026-2034.

Japan Floating Solar Farms Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Location | Onshore | 93.7% |

| Capacity | Above 5 MW | 55.4% |

| Size | Utility Scale | 68.7% |

| Connectivity | On-Grid | 88.2% |

| Application | Commercial | 62.1% |

| Region | Kanto Region | 32.8% |

Location Insights:

- Onshore

- Offshore

The onshore segment dominates with a market share of 93.7% of the total Japan floating solar farms market in 2025.

Onshore floating solar installations on freshwater bodies including reservoirs, agricultural ponds, and dams constitute the overwhelming majority of Japan's floating photovoltaic capacity. These installations benefit from stable water conditions, established regulatory frameworks, and proximity to existing grid infrastructure. The country hosts over 50 of the world's 100 largest floating solar facilities, predominantly situated on inland water bodies. Hyogo Prefecture alone contains nearly 40,000 lakes and ponds suitable for floating solar deployment, demonstrating the extensive potential for continued onshore expansion.

Agricultural reservoirs represent particularly attractive sites due to dual benefits of renewable energy generation and reduced water evaporation that supports irrigation efficiency. The modular structure of today’s floating solar platforms allows for quick installation while avoiding any long-term impact on surrounding land. Additionally, the natural cooling provided by the water surface helps photovoltaic panels operate more efficiently than many ground-mounted systems, supporting higher overall performance and energy output. Partnerships between technology providers and local water management cooperatives continue facilitating project development across rural prefectures nationwide.

Capacity Insights:

- Up to 1 MW

- 1 MW – 5 MW

- Above 5 MW

The above 5 MW segment leads the market with a share of 55.4% of the total Japan floating solar farms market in 2025.

Large-scale floating solar installations exceeding 5 MW capacity dominate market revenue, driven by economies of scale in procurement, installation, and grid integration. Utility-scale projects leverage substantial water surface areas to maximize generation potential while achieving favorable power purchase agreement terms with regional utilities. The landmark Yamakura Dam installation in Chiba Prefecture, featuring 13.7 MW capacity across 50,904 solar modules spanning 180,000 square meters, exemplifies the technical feasibility and commercial viability of mega-scale floating deployments.

Project developers increasingly favor above 5 MW installations to optimize infrastructure investments and operational efficiencies. Larger installations justify specialized engineering for typhoon-resistant anchoring systems and enable comprehensive monitoring infrastructure deployment. The presence of established engineering contractors with multi-project experience has reduced execution risks while standardized platform designs facilitate efficient component manufacturing and assembly processes.

Size Insights:

- Utility Scale

- Community

The utility scale segment holds the largest share with 68.7% of the total Japan floating solar farms market in 2025.

Utility-scale floating solar farms designed for grid-level power generation represent the predominant market segment, benefiting from government feed-in tariff programs and corporate power purchase agreements. These installations typically exceed community-scale deployments in capacity and are connected to regional transmission networks operated by major utilities, including Tokyo Electric Power Company. The strategic focus on utility-scale development aligns with Japan's ambitious renewable energy targets under the Seventh Strategic Energy Plan.

Investment in utility-scale floating solar continues attracting participation from major infrastructure developers, financial institutions, and international renewable energy specialists. Project financing structures have matured with the availability of long-term power purchase agreements providing revenue certainty. The integration of floating solar with existing hydroelectric dam infrastructure further enhances utility-scale project economics by leveraging established transmission connections and water management expertise.

Connectivity Insights:

- On-Grid

- Off-Grid

The on-grid segment exhibits clear dominance with an 88.2% share of the total Japan floating solar farms market in 2025.

Grid-connected floating solar installations constitute the vast majority of deployed capacity, supported by Japan's established feed-in tariff and feed-in premium mechanisms that guarantee electricity purchase at predetermined rates. On-grid projects benefit from streamlined interconnection procedures with regional transmission system operators and access to wholesale electricity markets. The regulatory framework incentivizes grid-connected renewable installations as part of national decarbonization strategies.

Transmission infrastructure development in reservoir-adjacent areas has facilitated on-grid floating solar expansion, with substations collecting generated current for integration into high-voltage distribution networks. The Yamakura Dam installation connects to Tokyo Electric Power Company's 154-kilovolt grid lines through three dedicated substations, demonstrating scalable integration approaches. Continued grid modernization investments under Japan's energy transformation policies will further support on-grid floating solar deployment.

Application Insights:

Access the Comprehensive Market Breakdown Request Sample

- Residential

- Commercial

- Industrial

- Others

The commercial segment accounts for the highest revenue with a 62.1% share of the total Japan floating solar farms market in 2025.

Commercial applications dominate the Japan floating solar farms market, driven by corporate sustainability mandates, power purchase agreement structures, and cost optimization strategies among business enterprises. Large corporations are increasingly signing long-term renewable energy procurement contracts to meet environmental, social, and governance commitments while hedging against electricity price volatility. In May 2024, Google announced two solar power purchase agreements in Japan with Clean Energy Connect and Shizen Energy, adding 60 megawatts of combined capacity to support data center operations.

Commercial sector demand is further supported by government incentives for corporate renewable energy adoption and growing investor focus on carbon disclosure requirements. Companies across technology, manufacturing, and retail sectors are actively pursuing floating solar procurement to demonstrate climate leadership and achieve science-based emission reduction targets. The commercial segment benefits from professional energy management capabilities that optimize floating solar integration with facility load profiles.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto Region leads the market with a share of 32.8% of the total Japan floating solar farms market in 2025.

The Kanto Region maintains market leadership driven by proximity to Tokyo's substantial electricity demand, advanced grid infrastructure, and the presence of landmark installations including the Yamakura Dam floating solar project in Chiba Prefecture. The region's dense population and limited land availability create strong economic incentives for water-based solar deployment, while established industrial and commercial electricity consumers provide ready markets for generated power.

Tokyo Metropolitan Government initiatives including the Tokyo Bay eSG Project are pioneering offshore floating solar demonstrations, positioning the Kanto Region at the forefront of next-generation floating photovoltaic technology development. The region benefits from concentrated engineering expertise, financial services infrastructure, and policy support that facilitate project development and investment flows. Continued urbanization and corporate sustainability commitments are expected to sustain Kanto's market leadership throughout the forecast period.

Market Dynamics:

Growth Drivers:

Why is the Japan Floating Solar Farms Market Growing?

Acute Land Scarcity and Geographic Constraints

Japan's unique geographical profile, with over three-quarters of its terrain being mountainous and heavily forested, creates significant constraints for conventional ground-mounted solar installations. The densely populated archipelago faces continuous competition for limited flat land among residential, agricultural, industrial, and conservation uses. Floating solar technology addresses this fundamental constraint by utilizing underutilized water surfaces including agricultural reservoirs, flood-control dams, and irrigation ponds that do not compete with terrestrial land requirements. Japan has a large network of freshwater bodies that offer strong potential for floating solar projects. Regions such as Hyogo Prefecture feature an abundance of lakes and ponds, giving developers ample opportunities to install floating systems. These widespread water surfaces provide suitable, stable environments for deployment, helping support the country’s broader renewable energy expansion.

Government Policy Support and Renewable Energy Targets

Japan's comprehensive policy framework supporting renewable energy expansion provides strong tailwinds for the floating solar market growth. The Seventh Strategic Energy Plan targets 40-50% renewable electricity by 2040, positioning solar energy as a cornerstone of the national decarbonization strategy. Feed-in tariff and feed-in premium mechanisms guarantee electricity purchase prices for qualified installations, reducing investment risk and enabling project financing. The government's target to increase installed solar capacity from 79 gigawatts in 2022 to 108 gigawatts by 2030 creates substantial opportunities for innovative deployment approaches, including floating photovoltaic systems that maximize generation potential without land consumption.

Enhanced Performance Through Water Cooling Effects

Floating solar installations benefit from natural cooling effects that enhance panel efficiency compared to ground-mounted or rooftop systems. Water beneath the panels absorbs heat and prevents overheating that would otherwise reduce energy conversion efficiency, particularly during hot summer months when electricity demand peaks. Research indicates floating panels can generate up to 20% more energy than equivalent land-based installations due to this cooling advantage. Additionally, the shade provided by floating arrays reduces water evaporation from reservoirs, delivering dual environmental benefits for agricultural irrigation systems. These technical advantages strengthen the economic case for floating solar deployment and support continued market expansion.

Market Restraints:

What Challenges the Japan Floating Solar Farms Market is Facing?

Typhoon and Extreme Weather Vulnerability

Japan's exposure to frequent typhoons presents significant operational risks for floating solar installations. Extreme wind speeds, heavy rainfall, and wave action can damage panel arrays, mooring systems, and electrical connections, requiring enhanced engineering specifications that increase capital costs. Post-incident repairs present logistical challenges due to water-based access requirements and specialized equipment needs.

Higher Installation and Maintenance Costs

Floating solar projects entail higher upfront costs compared to conventional ground-mounted installations due to specialized platform components, corrosion-resistant materials, and complex anchoring systems. Anchoring infrastructure alone can account for up to 15% of total project costs depending on water depth and bottom conditions. Ongoing maintenance activities require watercraft access and trained personnel, increasing operational expenditures throughout project lifecycles.

Grid Integration and Infrastructure Limitations

Connecting floating solar installations to existing transmission networks presents technical and regulatory challenges, particularly for projects on remote water bodies. Submarine cabling requirements increase costs while interregional transmission capacity constraints limit power export opportunities. Grid curtailment during periods of excess renewable generation reduces effective utilization rates, affecting project economics and investor returns.

Competitive Landscape:

The Japan floating solar farms market exhibits a moderately consolidated competitive structure characterized by collaboration between domestic technology conglomerates and specialized international floating platform providers. Leading participants encompass the entire project value chain from component manufacturing and system design through installation, grid connection, and long-term operation and maintenance services. Established Japanese electronics and construction firms bring local market expertise, regulatory relationships, and grid integration capabilities, while European floating platform specialists contribute proven technology systems and global deployment experience. Strategic partnerships and joint ventures have emerged as the dominant market entry model, enabling knowledge transfer and risk sharing across complex floating installations.

Recent Developments:

- July 2024: Sumitomo Mitsui Construction Co., Ltd. installed floating solar power generation facilities in Tokyo Bay under the Tokyo Metropolitan Government's eSG Project for sustainable urban development. The demonstration project examines mooring systems, power generation performance, and salt damage effects to develop low-cost offshore floating solar solutions.

- May 2024: Tokyu Land Corporation, SolarDuck, and Kyocera Communication Systems Corporation completed the installation of Japan's first offshore floating solar photovoltaic power plant in the Tokyo Bay Area. The demonstration will test power generation with offshore floating facilities, land-based battery storage, and storage battery transportation for powering electric mobility vehicles and watercraft.

Japan Floating Solar Farms Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Locations Covered | Onshore, Offshore |

| Capacities Covered | Up to 1MW, 1MW – 5MW, Above 5MW |

| Sizes Covered | Utility Scale, Community |

| Connectivities Covered | On Grid, Off Grid |

| Applications Covered | Residential, Commercial, Industrial, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central /Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan floating solar farms market size was valued at USD 12.12 Million in 2025.

The Japan floating solar farms market is expected to grow at a compound annual growth rate of 22.47% from 2026-2034 to reach USD 75.11 Million by 2034.

Onshore installations dominated with a 93.7% share in 2025, driven by Japan's extensive network of agricultural reservoirs, irrigation ponds, and flood-control dams that provide stable deployment conditions and established regulatory frameworks.

Key factors driving the Japan floating solar farms market include acute land scarcity constraining ground-mounted installations, government renewable energy targets and feed-in tariff mechanisms, enhanced panel efficiency through water cooling effects, and corporate sustainability commitments driving power purchase agreements.

Major challenges include typhoon and extreme weather vulnerability requiring enhanced engineering specifications, higher installation and maintenance costs compared to ground-mounted systems, complex anchoring requirements, and grid integration constraints in remote water body locations.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)