Japan Forklift Market Size, Share, Trends and Forecast by Class, Power Source, Load Capacity, Electric Battery, End User, and Region, 2026-2034

Japan Forklift Market Overview:

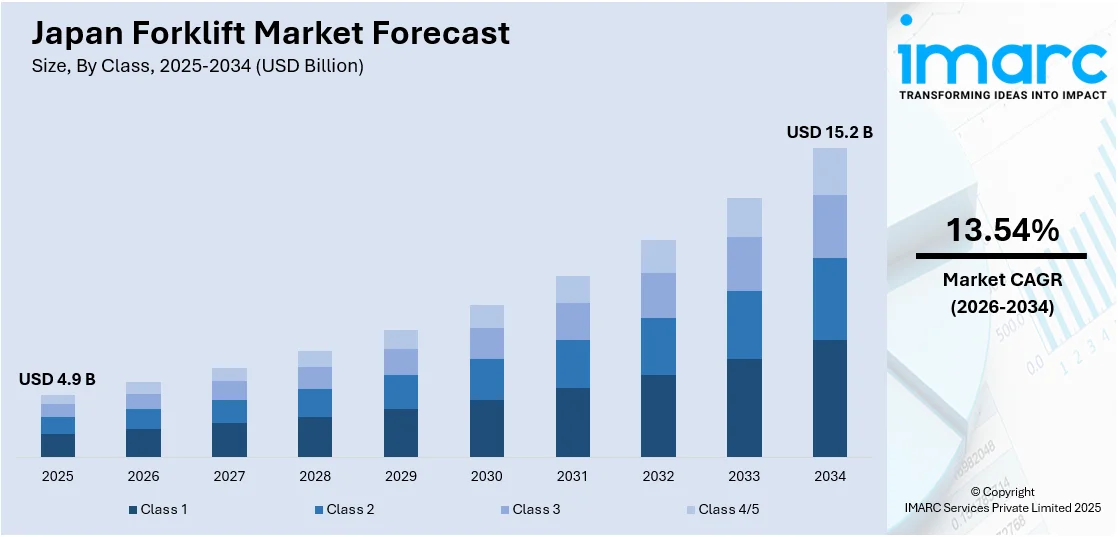

The Japan forklift market size reached USD 4.9 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 15.2 Billion by 2034, exhibiting a growth rate (CAGR) of 13.54% during 2026-2034. Automation in warehousing, growth in e-commerce, expansion of manufacturing sectors, labor shortages prompting equipment reliance, and stricter safety regulations are some of the factors contributing to Japan forklift market share. Demand for electric and compact forklifts is rising due to environmental concerns and space constraints in urban logistics and factory operations.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 4.9 Billion |

| Market Forecast in 2034 | USD 15.2 Billion |

| Market Growth Rate 2026-2034 | 13.54% |

Japan Forklift Market Trends:

Rise of AI-Driven Safety Enhancements

Forklift operations in Japan are increasingly integrating AI-based evaluation tools to improve workplace safety. New systems are leveraging dashcam footage to monitor operator behavior, identifying risky actions such as load handling while driving, improper reverse checks, and sudden directional changes. These platforms generate individualized safety assessments, allowing companies to provide focused training and reduce the risk of accidents. The shift reflects a broader emphasis on proactive risk management and data-informed safety protocols in industrial settings. By enabling real-time behavior analysis without the need for human supervision, such innovations are reshaping safety standards in warehousing and logistics. The move toward automation in safety oversight is becoming a critical component of operational efficiency and compliance in the country’s material handling sector. These factors are intensifying the Japan forklift market growth. For example, in July 2024, Toyota Material Handling Japan and Fujitsu introduced Japan's first AI-powered forklift safety evaluation service. The system analyzes dashcam footage to detect unsafe operations like simultaneous driving and load handling, inadequate checks during reverse, and abrupt turns. It generates safety scorecards for operators, aiding in targeted training.

To get more information on this market Request Sample

Automation Push in Material Handling

Japan is witnessing a growing shift toward fully automated solutions in warehouse and logistics operations. The focus is on enhancing efficiency and reducing dependence on manual labor by deploying AI-enabled forklifts capable of autonomously managing tasks such as product reception and truck loading. These systems are being integrated directly into existing logistics workflows without requiring major infrastructure changes, making adoption faster and more feasible. This shift aligns with broader efforts to address labor shortages and comply with tighter labor regulations. The use of advanced navigation technologies, including sensors and LiDAR, allows forklifts to operate safely and efficiently in dynamic environments. This evolution in material handling is expected to set new performance benchmarks for logistics centers across the country. For instance, Kao Corporation, in collaboration with Toyota Industries, implemented Japan's first fully automated truck loading system using AI-driven forklifts at its Toyohashi Plant. This initiative, operational since July 2024 and fully launched in October 2024, enhances logistics efficiency by automating processes from product reception to truck loading.

Japan Forklift Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on class, power source, load capacity, electric battery, and end user.

Class Insights:

- Class 1

- Class 2

- Class 3

- Class 4/5

The report has provided a detailed breakup and analysis of the market based on the class. This includes Class 1, Class 2, Class 3, and Class 4/5.

Power Source Insights:

- ICE

- Electric

A detailed breakup and analysis of the market based on the power source have also been provided in the report. This includes ICE and electric.

Load Capacity Insights:

- Below 5 Ton

- 5-15 Ton

- Above 16 Ton

The report has provided a detailed breakup and analysis of the market based on the load capacity. This includes below 5 ton, 5-15 ton, and above 16 ton.

Electric Battery Insights:

- Li-ion

- Lead Acid

A detailed breakup and analysis of the market based on the electric battery have also been provided in the report. This includes Li-ion and lead acid.

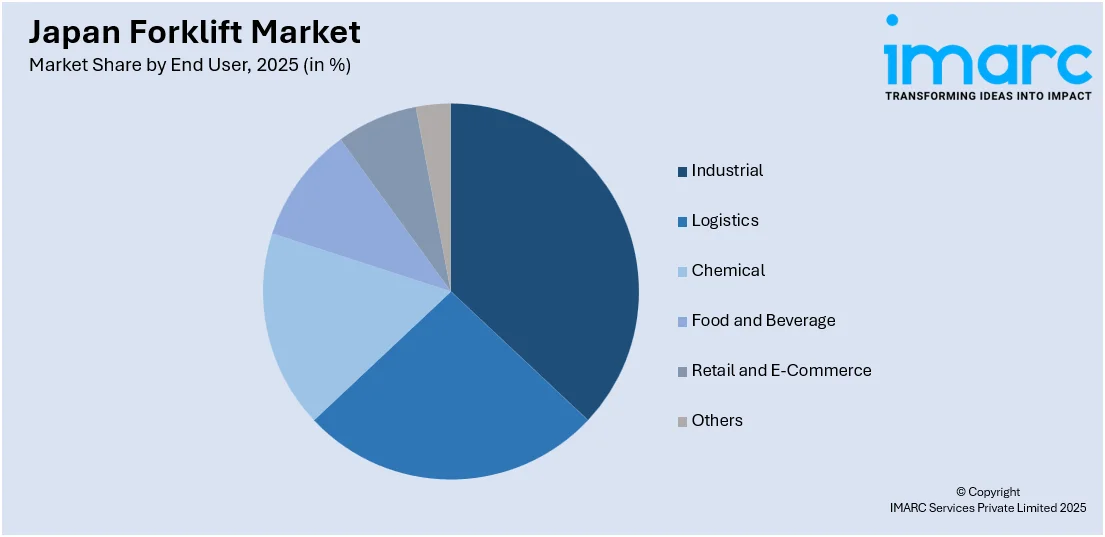

End User Insights:

Access the comprehensive market breakdown Request Sample

- Industrial

- Logistics

- Chemical

- Food and Beverage

- Retail and E-Commerce

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes industrial, logistics, chemical, food and beverage, retail and e-commerce, and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto region, Kansai/Kinki region, Central/Chubu region, Kyushu-Okinawa region, Tohoku region, Chugoku region, Hokkaido region, and Shikoku region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Forklift Market News:

- In September 2024, Mitsubishi Heavy Industries and Mitsubishi Logisnext showcased advanced autonomous forklift solutions at Logis-Tech Tokyo. Highlights included the ΣSynX automation platform, SynfoX-based unmanned forklifts, and lithium-ion battery models with AI-enabled safety features.

Japan Forklift Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Classes Covered | Class 1, Class 2, Class 3, Class 4/5 |

| Power Sources Covered | ICE, Electric |

| Load Capacities Covered | Below 5 Ton, 5-15 Ton, Above 16 Ton |

| Electric Batteries Covered | Li-ion, Lead Acid |

| End Users Covered | Industrial, Logistics, Chemical, Food and Beverage, Retail and E-Commerce, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan forklift market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan forklift market on the basis of class?

- What is the breakup of the Japan forklift market on the basis of power source?

- What is the breakup of the Japan forklift market on the basis of load capacity?

- What is the breakup of the Japan forklift market on the basis of electric battery?

- What is the breakup of the Japan forklift market on the basis of end user?

- What is the breakup of the Japan forklift market on the basis of region?

- What are the various stages in the value chain of the Japan forklift market?

- What are the key driving factors and challenges in the Japan forklift market?

- What is the structure of the Japan forklift market and who are the key players?

- What is the degree of competition in the Japan forklift market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan forklift market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan forklift market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan forklift industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)