Japan Foundry Equipment Market Size, Share, Trends and Forecast by Equipment Type, Foundry Process, Application, and Region, 2026-2034

Japan Foundry Equipment Market Summary:

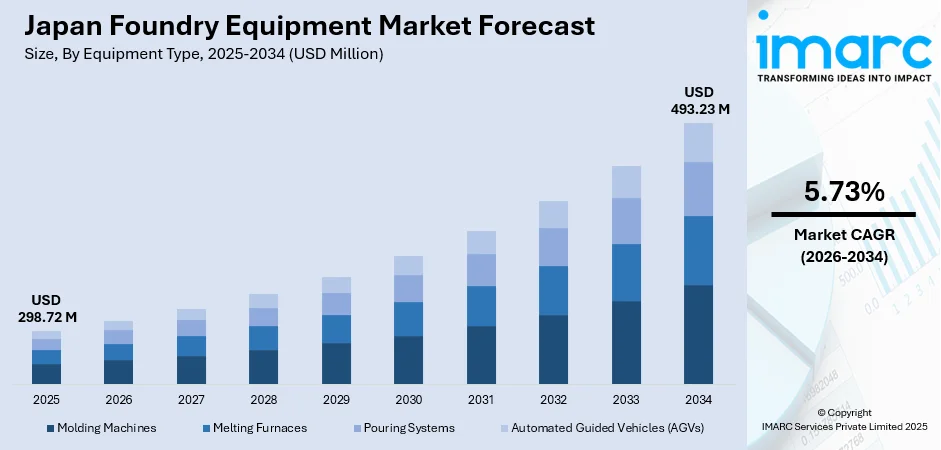

The Japan foundry equipment market size was valued at USD 298.72 Million in 2025 and is projected to reach USD 493.23 Million by 2034, growing at a compound annual growth rate of 5.73% from 2026-2034.

The market is driven by robust automotive industry demand requiring precision casting components, increasing adoption of automation and intelligent manufacturing systems, and government initiatives supporting industrial modernization and environmental sustainability. The transition to electric vehicle (EV) production is driving the demand for lightweight casting equipment, while technological advancements in molding machines and energy-efficient systems are enhancing production capabilities, supporting the Japan foundry equipment market share.

Key Takeaways and Insights:

- By Equipment Type: Molding machines dominate the market with a share of 41% in 2025, driven by increasing automation adoption, integration of machine vision systems for defect detection, and demand for high-precision casting capabilities in automotive and industrial applications.

- By Foundry Process: Green sand casting leads the market with a share of 48% in 2025, owing to its cost-effectiveness, versatility across diverse metal types, and suitability for high-volume automotive component production requiring consistent quality standards.

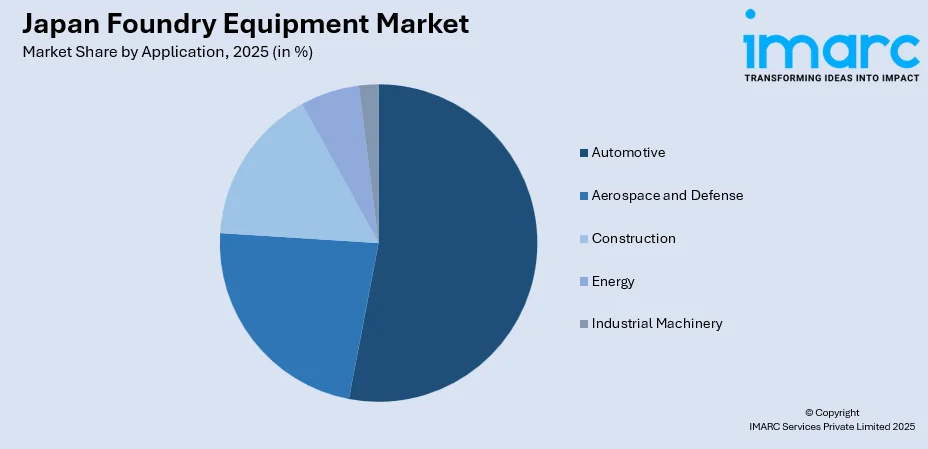

- By Application: Automotive represents the largest segment with a market share of 53% in 2025, fueled by robust vehicle production, transition to electric powertrains requiring lightweight casting components, and concentration of major manufacturers in the Chubu region.

- By Region: Central/Chubu region lead the market with 34% share 2025, attributed to concentration of automotive manufacturing clusters centered around Toyota and major aerospace facilities producing approximately 50% of Japan's aircraft parts.

- Key Players: The Japan foundry equipment market exhibits moderate competitive intensity, with domestic precision engineering specialists competing alongside international equipment manufacturers across automation levels and process technologies.

To get more information on this market Request Sample

Japanese foundries are undergoing significant transformation driven by automotive industry evolution and digital manufacturing adoption. The integration of automated systems with machine vision capabilities is reducing scrap rates while improving production consistency. Sinto introduced advanced sand molding machines with automatic mold alignment and defect detection, achieving over 220 installations in Japan, South Korea, and India within the first year of release. The automotive sector's transition to electric vehicles is reshaping equipment demand. Government support through the Green Innovation Fund and subsidies for battery production facilities is accelerating investments in energy-efficient foundry equipment. The market benefits from Japan's expertise in precision engineering and strong supply chain integration, particularly in the Chubu region where automotive and aerospace manufacturing converge.

Japan Foundry Equipment Market Trends:

Automation and Smart Manufacturing Integration

Japanese foundries are rapidly adopting automated equipment integrated with predictive maintenance systems and real-time process optimization capabilities. This transformation addresses labor shortages while improving casting quality and production efficiency. The integration of machine vision systems enables automatic defect detection, significantly reducing scrap rates and manual inspection requirements. These intelligent systems collect operational data for continuous process improvement, supporting manufacturers in maintaining competitive advantages through enhanced productivity and consistent quality standards. In 2025, NISSEI PLASTIC INDUSTRIAL CO., LTD., (Nagano, Japan) under the leadership of President Hozumi Yoda, along with its affiliate NEGRI BOSSI announced its plans to showcase six new-generation injection moulding machines and smart factory-ready technologies, aimed at minimizing environmental impact.

Electric Vehicle (EV) Production Driving Lightweight Casting Technologies

The automotive industry's transition to EVS is fundamentally reshaping foundry equipment requirements, with emphasis shifting to lightweight materials and integrated casting solutions. Manufacturers are investing in advanced molding technologies capable of producing large, single-piece structural components that reduce vehicle weight and improve manufacturing efficiency. Toyota announced giga casting technology at its Myochi plant in June 2023, implementing large-scale casting systems that produce major structural components in single pieces. The innovation reduces mold change lead time from 24 hours to just 20 minutes while improving structural integrity. This trend is accelerating equipment demand for high-pressure die casting machines and aluminum casting systems as electric vehicle production is projected to reach 20% to 30% of Japan's domestic vehicle sales by 2030.

Environmental Sustainability and Energy Efficiency Focus

Japanese foundries are prioritizing investments in energy-efficient equipment to comply with stringent environmental regulations and achieve carbon neutrality targets. The government's commitment to reducing emissions by 2050 is driving adoption of cleaner casting technologies and recyclable materials. Mitsubishi Materials Corporation launched eco-friendly casting alloys and processes in June 2024 designed to reduce carbon footprint and improve recycling efficiency across manufacturing operations. Government support through the Green Innovation Fund provides financial backing for research and development in power-saving technologies, enhancing Japan's competitive position in sustainable manufacturing. METI has created a Green Innovation Fund amounting to 2 trillion yen under the FY2020 Tertiary Supplementary Budget and has chosen the New Energy and Industrial Technology Development Organization (NEDO) to manage it. This regulatory and policy environment is compelling foundries to modernize equipment fleets with systems featuring lower energy consumption, reduced emissions, and compatibility with circular economy principles.

Market Outlook 2026-2034:

The Japan foundry equipment market is positioned for sustained expansion driven by automotive industry transformation and manufacturing modernization initiatives. The market generated a revenue of USD 298.72 Million in 2025 and is projected to reach a revenue of USD 493.23 Million by 2034, growing at a compound annual growth rate of 5.73% from 2026-2034. Market expansion will benefit from Japan's precision engineering expertise and strong supplier networks, with revenues expected to accelerate as environmental regulations mandate energy-efficient equipment upgrades across foundry operations.

Japan Foundry Equipment Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Equipment Type | Molding Machines | 41% |

| Foundry Process | Green Sand Casting | 48% |

| Application | Automotive | 53% |

| Region | Central/Chubu Region | 34% |

Equipment Type Insights:

- Molding Machines

- Melting Furnaces

- Pouring Systems

- Automated Guided Vehicles (AGVs)

Molding machines dominate with a market share of 41% of the total Japan foundry equipment market in 2025.

Molding machines represent the dominant equipment category driven by widespread automation adoption across Japanese foundries seeking productivity improvements and quality consistency. The segment encompasses automated matchplate molding systems, flaskless molding equipment, and high-pressure molding machines equipped with advanced control systems. Japanese manufacturers are integrating machine vision capabilities for automatic defect detection, reducing scrap rates while minimizing manual inspection requirements. These intelligent systems collect operational data enabling predictive maintenance and process optimization, supporting foundries in maintaining competitive advantages through enhanced efficiency and reduced downtime.

The automotive industry's evolution is reshaping molding machine specifications, with increasing demand for equipment capable of handling lightweight alloys and producing complex geometries required for electric vehicle components. Manufacturers are investing in high-speed automated molding lines that integrate seamlessly with existing production workflows while offering flexibility for diverse casting requirements. In 2025, UBE Machinery Corporation, Limited., the primary entity of the UBE Group's machinery division, has finalized the design and development of the largest electric injection molding machine globally, boasting a clamping force of 5,500 metric tons, and will begin its sales. To satisfy the increasing need for bigger plastic products, UBE Machinery has broadened its range by introducing two additional models in the ultra-large electric injection molding machines, the 5,500-metric-ton and 5,000-metric-ton models.

Foundry Process Insights:

- Green Sand Casting

- Investment Casting

- Die Casting

- Permanent Mold Casting

- Centrifugal Casting

Green sand casting leads with a share of 48% of the total Japan foundry equipment market in 2025.

Green sand casting maintains market leadership due to its cost-effectiveness, versatility across diverse metal types, and suitability for high-volume production requirements prevalent in automotive manufacturing. Japanese foundries serving automotive applications rely heavily on green sand casting for engine components, transmission housings, and structural parts requiring consistent quality standards. In 2025, VRX Silica signed non-binding offtake agreements to supply 440,000 tons of certified foundry sand annually, including with Japan's Yamakawa Sangyo Co. Ltd., supporting the foundry sector serving key automotive and marine industries.

The process benefits from continuous technological improvements including automated sand preparation systems, enhanced temperature control capabilities, and integration with digital monitoring equipment enabling real-time quality assessment. Japanese manufacturers are investing in advanced sand recycling systems that reduce waste while maintaining optimal moisture content and compaction properties essential for dimensional accuracy. The automotive industry's transition to electric vehicles is sustaining green sand casting demand as manufacturers require cost-efficient production methods for motor housings, battery enclosures, and structural components.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Automotive

- Aerospace and Defense

- Construction

- Energy

- Industrial Machinery

Automotive exhibits a clear dominance with a 53% share of the total Japan foundry equipment market in 2025.

The automotive sector dominates foundry equipment demand driven by Japan's position as the fourth-largest automotive market globally, Japanese automotive manufacturers produced approximately 9.6 million vehicle units in 2022. The industry's evolution toward electric powertrains is fundamentally reshaping equipment requirements, with manufacturers investing in systems capable of producing lightweight components essential for vehicle efficiency. In 2025, Shibaura Machine hosted the 19th Shibaura Group Solution Fair 2025 at its headquarters and factory in Numazu, Shizuoka Prefecture, from June 4 to 6. The event drew in around 4,000 attendees throughout the span of three days. A key feature was the company’s virtual reality (VR) showcase of the DC12000GS, a die casting machine boasting one of Japan's largest clamping forces at 12,000 tons. The machine is engineered to facilitate giga-casting, a method where sizable vehicle components are shaped as single aluminum pieces.

Electric vehicles are projected to increase their share of Japan's domestic vehicle sales. This transition is accelerating investments in aluminum die casting equipment and integrated molding systems capable of handling the complex geometries required for battery housings, motor components, and lightweight structural elements. Japanese manufacturers are emphasizing precision casting capabilities meeting stringent automotive quality standards, with foundry equipment suppliers developing specialized solutions addressing thermal management requirements, weight reduction objectives, and production flexibility needed across conventional and electric vehicle platforms.

Regional Insights:

- Central/Chubu Region

- Kanto Region

- Kansai/Kinki Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

Central/Chubu Region accounts for the highest revenue with approximately 34% market share in 2024.

The Central/Chubu Region dominates the foundry equipment market through its unparalleled concentration of automotive and aerospace manufacturing facilities centered around Nagoya and Aichi Prefecture. The region accounts for majority of Japan's aircraft parts production and hosts major automotive manufacturers and extensive tier supplier networks requiring continuous foundry equipment investments. The region's automotive industry contributes significantly to local economic output, while government initiatives supporting industrial modernization through the Chubu Bureau of Economy, Trade and Industry provide financial incentives for equipment upgrades and digital transformation projects.

The region benefits from exceptional transportation infrastructure including Chubu Centrair International Airport and shinkansen connectivity facilitating rapid access to Tokyo and Osaka markets. Manufacturing clusters encompassing Gifu, Shizuoka, and Mie prefectures create dense supplier networks supporting just-in-time production systems requiring reliable foundry equipment performance. The concentration of precision engineering expertise and research institutions accelerates technology adoption across casting operations. Government support through infrastructure development initiatives and manufacturing innovation programs sustains equipment investment momentum, while the region's established workforce skills in automotive and aerospace manufacturing enable rapid implementation of advanced casting technologies. This ecosystem positions the Chubu region for continued market leadership as electric vehicle production scaling drives next-generation equipment procurement across automotive supply chains.

Market Dynamics:

Growth Drivers:

Why is the Japan Foundry Equipment Market Growing?

Automotive Industry Transformation and Electric Vehicle Adoption

Japan's automotive sector ranks fourth globally in production volume, contributing 2.9% to national GDP and 13.9% to manufacturing GDP. The industry's transition to electric powertrains is fundamentally reshaping foundry equipment demand as manufacturers require advanced casting systems capable of producing lightweight components essential for vehicle efficiency and range performance. Key market players are announcing giga casting technology, implementing systems that produce major structural components in single pieces while reducing mold change lead time from 24 hours to just 20 minutes. Moreover, Japan plans to provide additional subsidies for electric-vehicle battery manufacturing, committing up to $2.4 billion for initiatives involving Toyota Motor (7203.T) and other leading firms, as it aims to bolster its battery supply chain.

Manufacturing Automation and Industry 4.0 Integration

Japanese foundries are rapidly adopting automated equipment integrated with predictive maintenance systems and real-time process optimization capabilities to address labor shortages while improving production efficiency and casting quality consistency. The aging workforce and rising labor costs are compelling manufacturers to invest in intelligent systems that reduce manual intervention requirements while enhancing operational reliability. These intelligent systems collect operational data enabling continuous process improvement through analysis of temperature profiles, pressure variations, and cycle times. Government initiatives supporting digital transformation provide collaborative support for advancing digitalization across regional manufacturers. The Japanese government is promoting increased digitalization to address the challenges of Japan's aging demographic, while also improving the nation’s competitiveness and economic stability. To achieve a Society 5.0, the government is initiating major projects, including the rollout of the Ouranos Ecosystem and is enacting several strategies to draw in foreign businesses.

Government Support and Environmental Regulations

Japan's commitment to achieving carbon neutrality by 2050 is driving substantial investments in energy-efficient foundry equipment meeting stringent environmental compliance requirements. The Green Innovation Fund supports research and development in power-saving technologies while providing financial backing for manufacturers implementing cleaner production processes and recyclable material systems. Government subsidies and tax incentives for energy-saving equipment investments reduce capital barriers while accelerating modernization timelines, with programs offering tax credits and special depreciation benefits for manufacturers adopting certified energy-efficient machinery. This regulatory and policy environment positions Japanese foundries competitively in sustainable manufacturing while supporting domestic equipment manufacturers developing specialized solutions meeting environmental performance standards. Moreover, the opening of various metal recycling centers in the country is supporting the growth of the market. In 2025, Tokyo Subway Corporation., Metro Sharyo Co., Ltd., Honda Trading Corporation, Nippon Sougou Recycle Co., Ltd., Nikkeikin Aluminium Core Technology Co., Ltd., alongside Suminoe Industries Co., Ltd. have collaboratively accomplished the horizontal recycling of aluminum sourced from Hanzomon Line Series 8000 vehicles to Series 18000 vehicles.

Market Restraints:

What Challenges the Japan Foundry Equipment Market is Facing?

Aging Workforce and Skilled Labor Shortages

Japan faces significant challenges with an aging population and declining workforce availability in manufacturing sectors, particularly impacting labor-intensive foundry operations. The shortage of skilled technicians capable of operating sophisticated casting equipment and performing precision maintenance creates operational constraints and increases training costs for manufacturers. Regional areas outside major metropolitan centers experience particularly acute labor shortages, affecting foundry productivity and limiting expansion capabilities despite equipment availability.

High Capital Investment Requirements and Equipment Costs

Advanced automated foundry equipment requires substantial capital investments that pose financial barriers for small and medium-sized enterprises despite government subsidy programs. The integration of intelligent manufacturing systems with predictive maintenance capabilities and machine vision technologies demands significant upfront expenditure alongside ongoing software licensing and technical support costs. Rising equipment costs driven by sophisticated automation components and precision engineering requirements constrain procurement decisions, particularly for foundries serving niche market segments with limited volume justification for expensive automated systems.

Complex Regulatory Compliance and Environmental Standards

Stringent environmental regulations including the Act on Rationalising Energy Use and compliance with Japanese Industrial Standards impose significant administrative burdens and technical requirements on foundry operators. Manufacturers must invest in documentation systems, periodic reporting mechanisms, and environmental monitoring equipment to demonstrate regulatory compliance. The complexity of coordinating multiple regulatory frameworks across energy efficiency, emissions control, and waste management creates operational overhead that diverts resources from core production activities and equipment optimization initiatives.

Competitive Landscape:

The Japan foundry equipment market exhibits moderate competitive intensity characterized by established domestic manufacturers leveraging precision engineering expertise alongside international suppliers offering specialized automated systems. Japanese companies maintain strong positions through integrated service capabilities, rapid technical support networks, and deep understanding of local automotive and industrial manufacturing requirements. Competition centers on automation sophistication, energy efficiency performance, and integration capabilities with existing production systems. Domestic manufacturers emphasize customization flexibility and long-term service relationships, while international suppliers compete through advanced digital technologies and global best practices implementation. The market structure supports both specialized niche equipment providers focusing on specific casting processes and comprehensive solution suppliers offering integrated production lines. Technological differentiation increasingly focuses on intelligent systems incorporating predictive maintenance, machine learning optimization, and seamless connectivity with enterprise resource planning platforms supporting Industry 4.0 manufacturing environments.

Recent Developments:

- In October 2025, Messe Frankfurt Japan Ltd will introduce its new Foundry Tech and Expo in collaboration with the Japan Foundry Society, Inc., taking place from September 9th to 11th, 2026, at Tokyo Big Sight South Hall 4. Taking place alongside Thermotec 2026, Japan's sole exhibition focused on industrial furnaces and associated technology, Foundry Tech and Expo 2026 will showcase 80 exhibitors presenting products and services across various applications.

- In July 2025, Rapidus Corporation, a producer of cutting-edge logic semiconductors, revealed that prototyping has begun for its 2nm gate-all-around (GAA) transistor design at Rapidus’ Innovative Integration for Manufacturing (IIM-1) facility. The prototype wafers began to acquire their electrical properties. Rapidus' latest IIM-1 foundry marks a major improvement compared to the conventional foundry model.

Japan Foundry Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Equipment Types Covered | Molding Machines, Melting Furnaces, Pouring Systems, Automated Guided Vehicles (AGVs) |

| Foundry Processes Covered | Green Sand Casting, Investment Casting, Die Casting, Permanent Mold Casting, Centrifugal Casting |

| Applications Covered | Automotive, Aerospace and Defense, Construction, Energy, Industrial Machinery |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan foundry equipment market size was valued at USD 298.72 Million in 2025.

The Japan foundry equipment market is expected to grow at a compound annual growth rate of 5.73% from 2026-2034 to reach USD 493.23 Million by 2034.

Molding machines dominated the market with approximately 41% revenue share in 2025, driven by widespread automation adoption across Japanese foundries seeking productivity improvements and quality consistency through advanced control systems and machine vision integration.

Key factors driving the Japan foundry equipment market include automotive industry transformation and electric vehicle adoption, manufacturing automation and Industry 4.0 integration, and government support with environmental regulations driving sustainable equipment investments. The electric vehicle transition is accelerating demand for advanced casting systems, while labor shortages are compelling automation adoption across foundry operations.

Major challenges include aging workforce and skilled labor shortages affecting foundry operations, high capital investment requirements creating financial barriers for small and medium-sized enterprises, and complex regulatory compliance with stringent environmental standards requiring substantial administrative resources and technical monitoring systems.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)