Japan Functional Food for Elderly Market Size, Share, Trends and Forecast by Product Type, Form, Health Benefit, Distribution Channel, and Region, 2026-2034

Japan Functional Food for Elderly Market Overview:

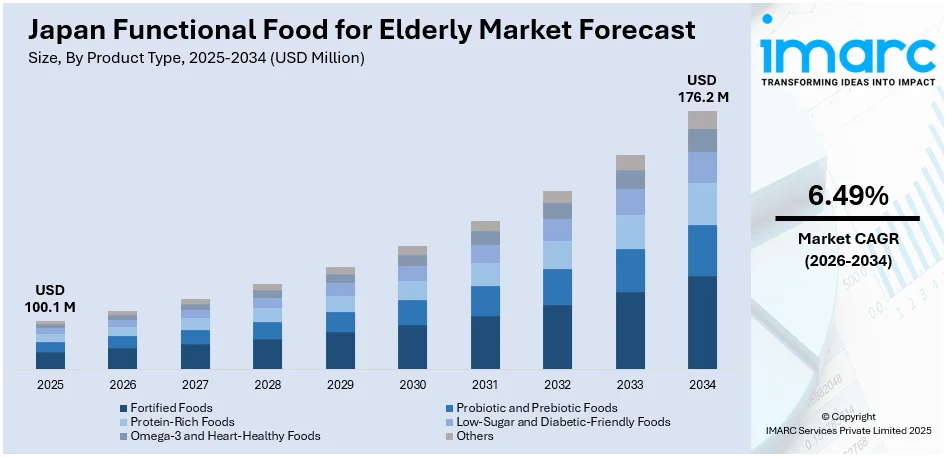

The Japan functional food for elderly market size reached USD 100.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 176.2 Million by 2034, exhibiting a growth rate (CAGR) of 6.49% during 2026-2034. The market is fueled by the rising health awareness, and increased demand for preventive health solutions among the older individuals who are looking for foods that ensure cognitive well-being, bone density, and immune protection. This trend is fostered by a culturally embedded belief in food as the basis of well-being and a desire for natural solutions in preference to drugs. Government backing for health-enhancing food innovation and consumer confidence in evidence-based products also have a profound impact on the Japan functional food for elderly market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 100.1 Million |

| Market Forecast in 2034 | USD 176.2 Million |

| Market Growth Rate 2026-2034 | 6.49% |

Japan Functional Food for Elderly Market Trends:

Personalized Nutrition for the Aging Population

Japan's aging population is fueling a large-scale movement toward personalized nutrition in functional foods. With the advancements in genetic testing and artificial intelligence, there is an enhanced capability to design diet solutions for people with specific health requirements. For the elderly, it translates to functional foods specifically designed for addressing age-related disorders like cognitive dysfunction, joint health, and gastrointestinal disorders. Businesses are increasingly providing products that address these needs so that seniors get the best nutrition possible. This is part of a wider movement towards customized healthcare, in which nutrition is central to disease prevention and control. By matching functional food products with the individualized health profiles of the elderly, companies can cater to the increasing need for personalized dietary solutions, thus improving the quality of life for the elderly in Japan.

To get more information on this market Request Sample

Emergence of Plant-Based Functional Foods

There is a clear shift toward plant-based functional foods among Japan's elderly due to health, environmental, and ethical factors. These foods, high in fiber, antioxidants, and essential vitamins and minerals, are becoming popular for their heart health, weight control, and general well-being potential. Soy, seaweed, and other grains are being added to functional foods, combining traditional Japanese food sources with new nutritional knowledge. This trend encourages healthier aging and aligns with international trends towards sustainable and ethical consumption. Greater accessibility and diversity of plant-based functional foods on the market are enabling the elderly to make healthy dietary decisions that support their long-term health and well-being.This trend demonstrates an expanding appreciation of the value of plant-based diets in supporting the general health and well-being of Japan's aging population. Recently, a new Plant-Based Food Certification System has been formally introduced in Japan by the Plant Based Lifestyle Lab (P-LAB) with the goal of raising consumer awareness and facilitating simpler product selection in the expanding plant-based industry.The certification program officially began on March 1st, 2025, and the plan was formally revealed at a press conference in Tokyo on March 25th. The market for plant-based products is anticipated to grow in Japan and around the world as awareness about sustainability and health issues continues to grow. Consumers still struggle to determine whether items support plant-based ideals, though. This gap is intended to be filled by P-LAB's new system.

Clean-Label and Sustainable Functional Foods

The Japanese consumers, including the older adults, are increasingly opting for clean-label functional foods that reflect openness and limited processing. The foods, without artificial preservatives and additives, are viewed as safer and more health oriented. The demand for these foods is also driven by the need for environmental sustainability, and the consequence is a demand for products with environmentally friendly packaging and sustainably sourced ingredients. Producers are taking action by creating functional foods that satisfy health requirements and also respect ethical and ecological principles. This represents an overall philosophy of health and wellness where consumers want products that both benefit the individual's well-being and the well-being of the planet, creating a healthier and more sustainable market for the elderly in Japan. This movement toward clean-label and sustainable products reinforces the significance of ethical factors in Japan's elderly population's dietary decisions, which further fuels the Japan functional food for elderly market growth.

Japan Functional Food for Elderly Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product type, form, health benefit, and distribution channel.

Product Type Insights:

- Fortified Foods

- Probiotic and Prebiotic Foods

- Protein-Rich Foods

- Low-Sugar and Diabetic-Friendly Foods

- Omega-3 and Heart-Healthy Foods

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes fortified foods, probiotic and prebiotic foods, protein-rich foods, low-sugar and diabetic-friendly foods, omega-3 and heart-healthy foods, others.

Form Insights:

- Solid Foods

- Liquid Foods

- Powders and Supplements

A detailed breakup and analysis of the market based on the form has also been provided in the report. This includes solid foods, liquid foods, and powders and supplements.

Health Benefit Insights:

- Bone and Joint Health

- Digestive Health

- Cardiovascular Health

- Immune Support

- Cognitive Health

- Others

A detailed breakup and analysis of the market based on the health benefit has also been provided in the report. This includes bone and joint health, digestive health, cardiovascular health, immune support, cognitive health, others.

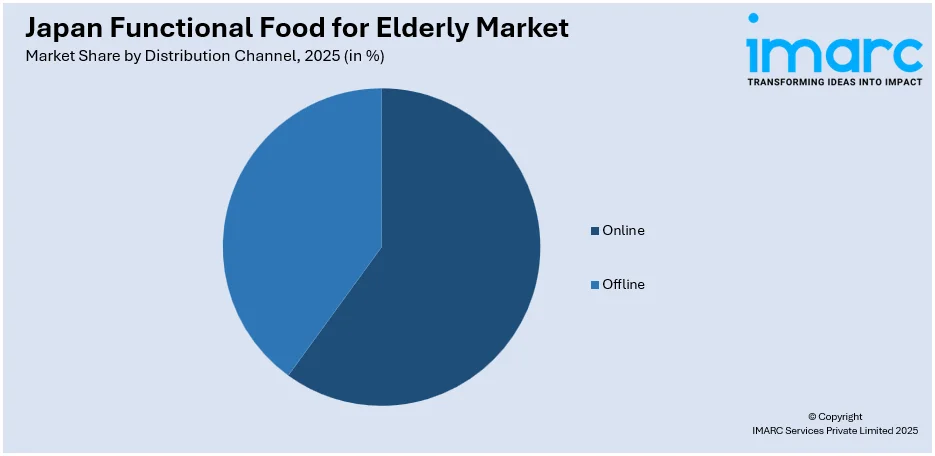

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Online

- Offline

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes online and offline.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central /Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central /Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Functional Food for Elderly Market News:

- Launched in May 2024, the plant-based company NEXT MEATs for elderly, asserted that it has several benefits over other plant-based products, such as improved texture and flavor. Restaurant chefs have also found success with the flavorless meat substitute, which they can prepare anyway they like.

Japan Functional Food for Elderly Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Fortified Foods, Probiotic and Prebiotic Foods, Protein-Rich Foods, Low-Sugar and Diabetic-Friendly Foods, Omega-3 and Heart-Healthy Foods, Others |

| Forms Covered | Solid Foods, Liquid Foods, Powders and Supplements |

| Health Benefits Covered | Bone and Joint Health, Digestive Health, Cardiovascular Health, Immune Support, Cognitive Health, Others |

| Distribution Channels Covered | Online, Offline |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central /Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan functional food for elderly market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan functional food for elderly market on the basis of product type?

- What is the breakup of the Japan functional food for elderly market on the basis of form?

- What is the breakup of the Japan functional food for elderly market on the basis of health benefit?

- What is the breakup of the Japan functional food for elderly market on the basis of distribution channel?

- What is the breakup of the Japan functional food for elderly market on the basis of region?

- What are the various stages in the value chain of the Japan functional food for elderly market?

- What are the key driving factors and challenges in the Japan functional food for elderly market?

- What is the structure of the Japan functional food for elderly market and who are the key players?

- What is the degree of competition in the Japan functional food for elderly market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan functional food for elderly market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan functional food for elderly market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan functional food for elderly industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)