Japan Functional Food Market Size, Share, Trends and Forecast by Product Type, Ingredient, Distribution Channel, Application, and Region, 2026-2034

Japan Functional Food Market Overview:

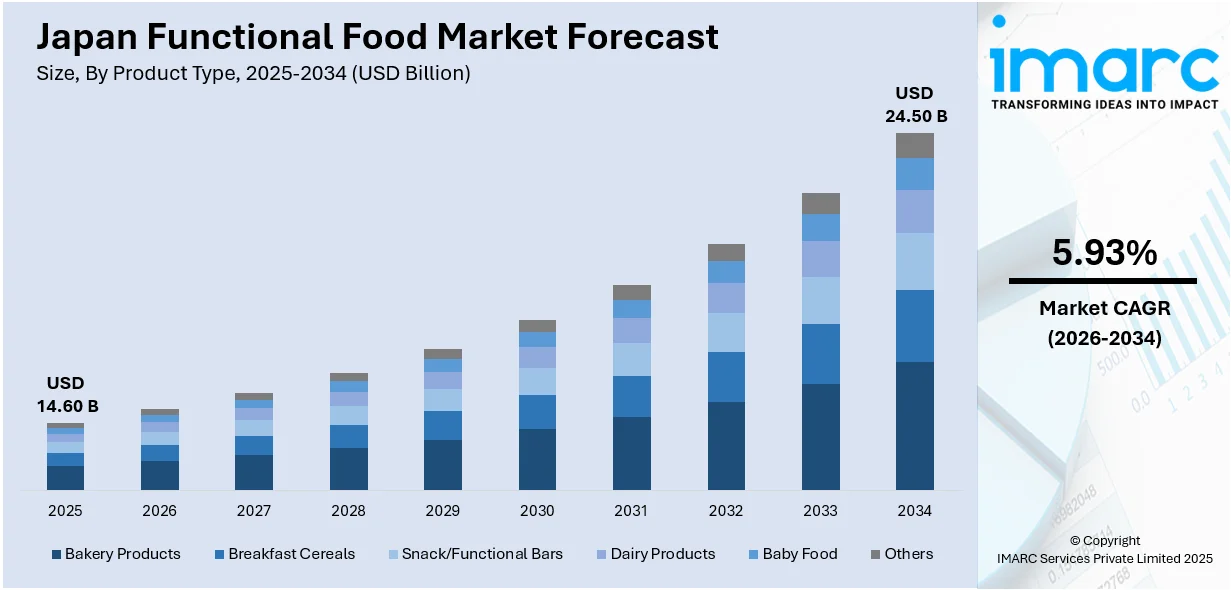

The Japan functional food market size reached USD 14.60 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 24.50 Billion by 2034, exhibiting a growth rate (CAGR) of 5.93% during 2026-2034. The market is driven by rising health consciousness, an aging population seeking preventive care, and government-backed FFC/FOSHU certifications enabling science-based health claims. Augmenting demand for immune-enhancing and gut-health products is accelerating, supported by innovations in probiotics and fermented foods. Convenience and wellness trends among younger consumers are further expanding the Japan functional food market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 14.60 Billion |

| Market Forecast in 2034 | USD 24.50 Billion |

| Market Growth Rate 2026-2034 | 5.93% |

Japan Functional Food Market Trends:

Rising Demand for Immune-Enhancing Functional Foods

The market is experiencing significant growth in immune-enhancing products, driven by accelerating health awareness post-pandemic. Consumers are increasingly seeking foods fortified with vitamins, probiotics, and bioactive compounds such as beta-glucans to enhance immunity. A systematic review and meta-analysis of 70 studies published from 1996 to 2024 concluded that bioactive β-glucans, mainly rooted in Saccharomyces cerevisiae, confirmed the quality of health parameters (notably lysozyme, phagocytic activity, and IgM) and growth (for example, the specific growth rate of g = 2.71) in finfish and shellfish, predominantly fresh-water species. Mortality rates showed a significant decrease (g = -5.75); the best outcomes were seen in the short-period type of feeding, lasting from 3 to 8 weeks. These results are in accordance with Japan's progress in immune-enhancing aquafeeds, which point to the country's advances in the development of biofunctional food products, drawing relevance to the functional food market, where natural additives like β-glucans are increasingly valued for their health-promoting benefits in both human and animal nutrition. As a result, key players are innovating with fermented ingredients, such as lactobacillus-rich yogurts and koji-based products, aligning with traditional Japanese dietary preferences. Additionally, the aging population is a major contributor to this trend, as older adults prioritize preventive healthcare. Government initiatives promoting "Foods with Function Claims" (FFC) are also favoring Japan functional food market growth by allowing scientifically backed health claims on packaging. As a result, companies are investing in R&D to develop clinically validated immune-enhancing foods, positioning Japan as a leader in this functional food segment.

To get more information on this market Request Sample

Expansion of Gut Health and Probiotic Functional Foods

Gut health is a dominant trend in Japan’s functional food market, with probiotics and prebiotics gaining traction due to their digestive and metabolic benefits. Fermented foods including miso, natto, and kefir have long been staples, but modern consumers now seek convenient formats such as probiotic-enriched snacks, drinks, and supplements. A research study published showed that 31% of the 392 Japanese adults surveyed using fortified foods and/or dietary supplements and that up to 20.6% of their vitamin B6 intake came from supplemental sources. Those using these products had significantly better intakes of thiamine, riboflavin, vitamin C, and calcium, increasing the likelihood of nutrient adequacy without excessive intake other than 2% of users hitting the upper limit for vitamin B6. These findings support the appetite for Japan's functional food industry that targets micronutrient deficiencies through customized supplementation. Major brands are incorporating next-generation probiotics, including bifidobacteria and lactobacillus strains into functional beverages and ready-to-eat meals. The FOSHU (Food for Specified Health Uses) certification system further enhances consumer trust in these products. Thus, this is further creating a positive Japan functional food market outlook. Additionally, younger demographics are embracing gut-friendly foods for beauty and mental health benefits, expanding the market beyond traditional elderly consumers. With rising scientific validation and innovative product launches, gut health functional foods are poised for sustained growth in Japan.

Japan Functional Food Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on product type, ingredient, distribution channel, and application.

Product Type Insights:

- Bakery Products

- Breakfast Cereals

- Snack/Functional Bars

- Dairy Products

- Baby Food

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes bakery products, breakfast cereals, snack/functional bars, dairy products, baby food, and others.

Ingredient Insights:

- Probiotics

- Minerals

- Proteins and Amino Acids

- Prebiotics and Dietary Fiber

- Vitamins

- Others

A detailed breakup and analysis of the market based on the ingredient have also been provided in the report. This includes probiotics, minerals, proteins and amino acids, prebiotics and dietary fiber, vitamins, and others.

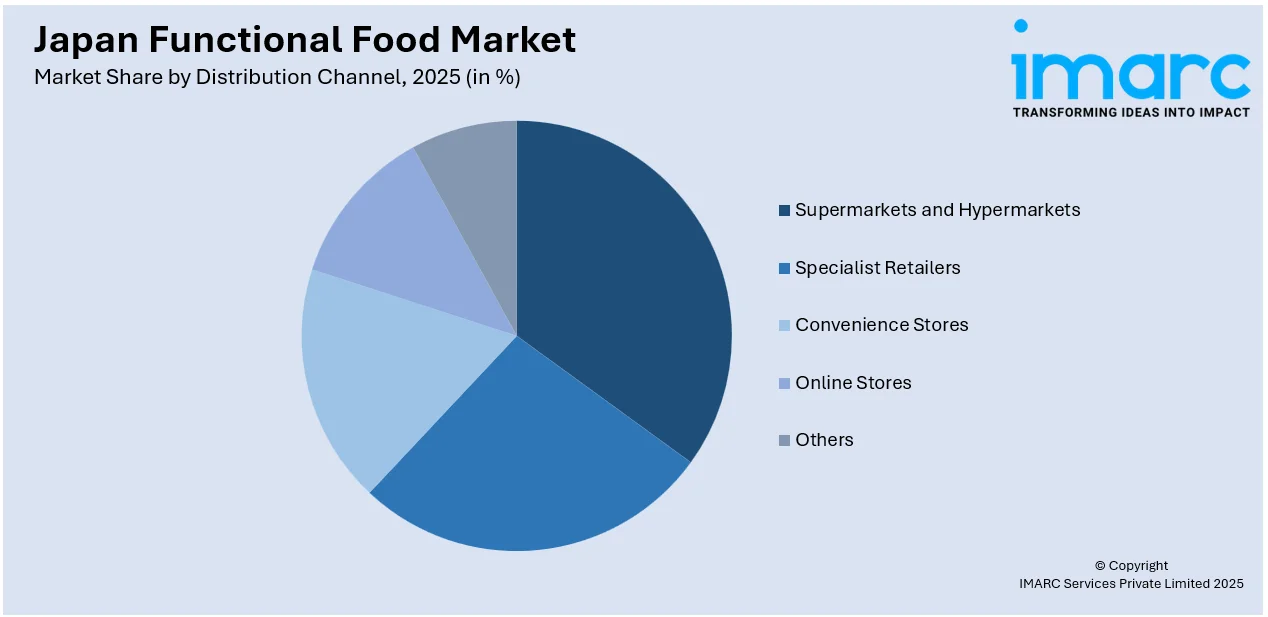

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Specialist Retailers

- Convenience Stores

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, specialist retailers, convenience stores, online stores, and others.

Application Insights:

- Sports Nutrition

- Weight Management

- Clinical Nutrition

- Cardio Health

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes sports nutrition, weight management, clinical nutrition, cardio health, and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Functional Food Market News:

- July 26, 2024: Meiji ventured into functional chocolates with the launch of a new line of FOS (fructooligosaccharides)-sweetened, low-calorie, gut-friendly chocolates. These items have been in stores since mid-July, and they are registered under the Foods with Function Claims by Japan’s Consumer Affairs Agency. Targeting health-oriented consumers focused on gut health, this introduction marks a strategic step forward for Japan's growing functional food market by offering the enjoyment of food without compromising science-backed benefits.

Japan Functional Food Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Bakery Products, Breakfast Cereals, Snack/Functional Bars, Dairy Products, Baby Food, Others |

| Ingredients Covered | Probiotics, Minerals, Proteins and Amino Acids, Prebiotics and Dietary Fiber, Vitamins, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialist Retailers, Convenience Stores, Online Stores, Others |

| Applications Covered | Sports Nutrition, Weight Management, Clinical Nutrition, Cardio Health, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan functional food market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan functional food market on the basis of product type?

- What is the breakup of the Japan functional food market on the basis of ingredient?

- What is the breakup of the Japan functional food market on the basis of distribution channel?

- What is the breakup of the Japan functional food market on the basis of application?

- What is the breakup of the Japan functional food market on the basis of region?

- What are the various stages in the value chain of the Japan functional food market?

- What are the key driving factors and challenges in the Japan functional food market?

- What is the structure of the Japan functional food market and who are the key players?

- What is the degree of competition in the Japan functional food market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan functional food market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan functional food market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan functional food industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)