Japan Functional Supplements Market Size, Share, Trends and Forecast by Product Type, Formulation Type, Health Benefit, Distribution Channel, and Region, 2026-2034

Japan Functional Supplements Market Overview:

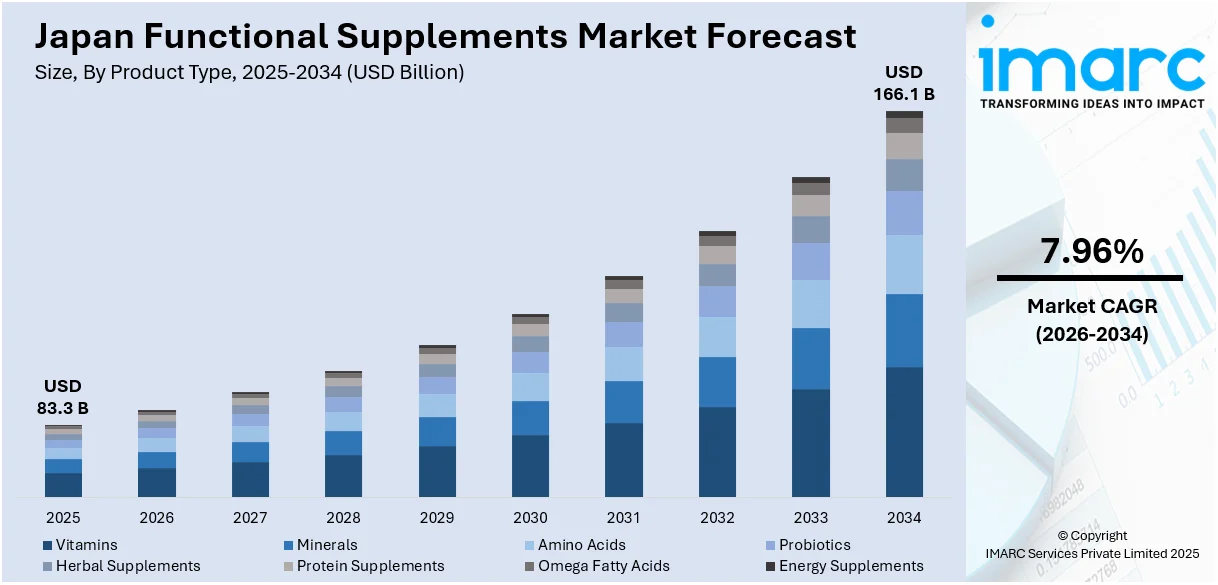

The Japan functional supplements market size reached USD 83.3 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 166.1 Billion by 2034, exhibiting a growth rate (CAGR) of 7.96% during 2026-2034. The market is driven by the rising aging population’s demand for health maintenance and disease prevention, especially for joint, cognitive, and cardiovascular health. Rising health awareness across all age groups is boosting demand for preventive supplements, while consumer preference for natural, safe, and high-quality ingredients is driving innovation in plant-based and clean-label products. Regulatory support like the Food with Function Claims system encourages science-backed supplements. Lastly, advances in personalized nutrition and technology enhance tailored formulations, boosting Japan functional supplements market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 83.3 Billion |

| Market Forecast in 2034 | USD 166.1 Billion |

| Market Growth Rate 2026-2034 | 7.96% |

Japan Functional Supplements Market Trends:

Increasing Demand for Natural and Plant-Based Ingredients

Japanese consumers are committed to natural, safe, and superior products, driving the development of the country's functional supplements market. This is an extremely strong preference, which has created a boom in demand for plant-based, organic, and clean-label supplements. Such traditional herbal ingredients as green tea, ginseng, and shiitake mushrooms are very popular due to their cultural acceptance for centuries and perceived health benefits. The move towards natural formulations is a broader global trend in wellness and national regulatory backing for non-synthetic, health-friendly ingredients. Brands are more concerned with research and development to produce a product that contains no artificial additives or allergens for those consumers who are not only health-aware but also ecologically conscious. The trend helps drive market growth through effective, benign answers to everyday wellness needs. The focus on natural ingredients is propelling innovation, enabling brands to satisfy changing consumer demands and uphold trust in a growingly competitive environment.

To get more information on this market Request Sample

Aging Population and Health Consciousness

As of September 2024, 36.25 million people in Japan, the country with the oldest population in the world, were 65 years of age or older, making up 29.3% of the country's entire population. This demographic shift is a major driver of growth in the functional supplements market, as seniors increasingly seek to maintain vitality and manage age-related concerns like joint health, cognitive function, and bone density. At the same time, younger generations are becoming more health-conscious, fueling demand for preventive solutions. Consumers of all ages now prioritize wellness and look for scientifically validated supplements. This has led to rising popularity of products with antioxidants, vitamins, minerals, and probiotics. The convergence of an aging society and a proactive wellness culture is accelerating innovation and diversification in supplement offerings. Brands are focusing on evidence-based ingredients and personalized health benefits to enhance quality of life and longevity, making Japan a key market for functional health solutions.

Technological Advances and Personalized Nutrition

Advancements in biotechnology and data analytics are driving the growth of personalized nutrition in Japan’s functional supplements market. Consumers now seek supplements tailored to their unique genetic makeup, lifestyle, and health conditions. Innovations in diagnostics, wearable devices, and AI-based health assessments make it possible to develop highly customized solutions. These targeted supplements enhance effectiveness, building consumer trust and satisfaction. Companies are adopting direct-to-consumer (D2C) models and digital platforms to deliver these personalized products more efficiently. In addition, novel delivery systems like microencapsulation and time-release capsules improve the absorption and efficacy of supplements, offering a more impactful user experience. This trend not only meets the demand for precision health but also supports Japan functional supplements market growth by offering differentiated, value-added products. As health awareness grows, personalized nutrition is becoming a key driver of innovation and competitiveness in Japan’s evolving supplement landscape, reflecting a shift toward more proactive and individualized wellness strategies.

Japan Functional Supplements Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product type, formulation type, health benefit, and distribution channel.

Product Type Insights:

- Vitamins

- Minerals

- Amino Acids

- Probiotics

- Herbal Supplements

- Protein Supplements

- Omega Fatty Acids

- Energy Supplements

The report has provided a detailed breakup and analysis of the market based on the product type. This includes vitamins, minerals, amino acids, probiotics, herbal supplements, protein supplements, omega fatty acids, and energy supplements.

Formulation Type Insights:

- Pills and Capsules

- Powders

- Liquids

- Gummies

- Bars

A detailed breakup and analysis of the market based on the formulation type have also been provided in the report. This includes pills and capsules, powders, liquids, gummies, and bars.

Health Benefit Insights:

- Weight Management

- Digestive Health

- Joint Health

- Immunity Boosting

- Energy Enhancement

- Heart Health

- Mental Wellbeing

- Bone Health

The report has provided a detailed breakup and analysis of the market based on the health benefit This includes weight management, digestive health, joint health, immunity boosting, energy enhancement, heart health, mental wellbeing, and bone health.

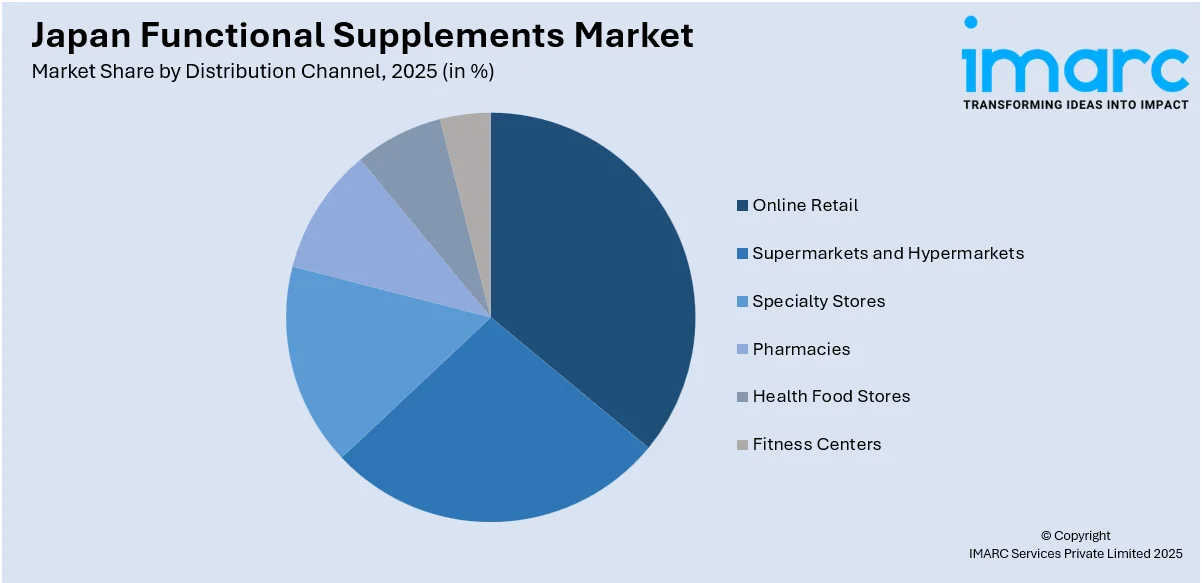

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Online Retail

- Supermarkets and Hypermarkets

- Specialty Stores

- Pharmacies

- Health Food Stores

- Fitness Centers

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online retail, supermarkets and hypermarkets, specialty stores, pharmacies, health food stores, and fitness centers.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Functional Supplements Market News:

- In April 2025, JBSL Japan, the pioneer of nattokinase manufacturing, celebrates its 50th anniversary on May 26-27 in Osaka. Founded in 1974, the company developed NSK-SD, a patented nattokinase ingredient for heart health, backed by 55 clinical studies. JBSL’s NSK-SD is uniquely vitamin K2-free, non-GMO, and globally recognized by EFSA and Health Canada, ensuring safety and efficacy. The celebration will unite global executives to honor its groundbreaking contributions to functional supplements.

- In November 2024, NXT USA’s joint health ingredient, TamaFlex, received Food with Function Claim (FFC) registration from Japan’s Consumer Affairs Agency, ensuring compliance with safety, efficacy, and quality standards. Developed with Japan-based partner Octroll, TamaFlex is backed by three double-blind clinical studies. This approval positions TamaFlex as a trusted, scientifically validated natural ingredient in Japan’s growing functional food market, meeting increasing demand for innovative health products.

Japan Functional Supplements Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Vitamins, Minerals, Amino Acids, Probiotics, Herbal Supplements, Protein Supplements, Omega Fatty Acids, Energy Supplements |

| Formulation Types Covered | Pills and Capsules, Powders, Liquids, Gummies, Bars |

| Health Benefits Covered | Weight Management, Digestive Health, Joint Health, Immunity Boosting, Energy Enhancement, Heart Health, Mental Wellbeing, Bone Health |

| Distribution Channels Covered | Online Retail, Supermarkets and Hypermarkets, Specialty Stores, Pharmacies, Health Food Stores, Fitness Centers |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan functional supplements market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan functional supplements market on the basis of product type?

- What is the breakup of the Japan functional supplements market on the basis of formulation type?

- What is the breakup of the Japan functional supplements market on the basis of health benefit?

- What is the breakup of the Japan functional supplements market on the basis of distribution channel?

- What is the breakup of the Japan functional supplements market on the basis of region?

- What are the various stages in the value chain of the Japan functional supplements market?

- What are the key driving factors and challenges in the Japan functional supplements market?

- What is the structure of the Japan functional supplements market and who are the key players?

- What is the degree of competition in the Japan functional supplements market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan functional supplements market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan functional supplements market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan functional supplements industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)