Japan Gear Market Size, Share, Trends and Forecast by Gear Type, End Use Industry, and Region, 2026-2034

Japan Gear Market Summary:

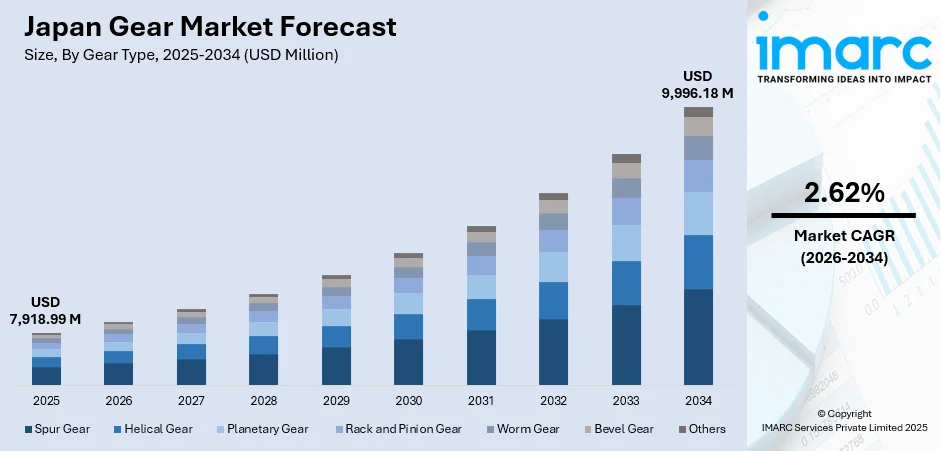

The Japan gear market size was valued at USD 7,918.99 Million in 2025 and is projected to reach USD 9,996.18 Million by 2034, growing at a compound annual growth rate of 2.62% from 2026-2034.

The market is driven by rapid advancements in manufacturing automation, increasing adoption of electric and hybrid vehicles requiring precision transmission components, and expanding renewable energy infrastructure demanding durable gear systems. Japan's strong industrial base and focus on technological innovation continue to propel demand for high-performance gears across automotive, robotics, and power generation sectors, significantly contributing to Japan gear market share.

Key Takeaways and Insights:

- By Gear Type: Spur gear dominates the market with a share of 32% in 2025, driven by its widespread applicability across diverse industrial applications, cost-effectiveness in mass production, and superior performance in parallel shaft configurations requiring efficient power transmission with minimal complexity.

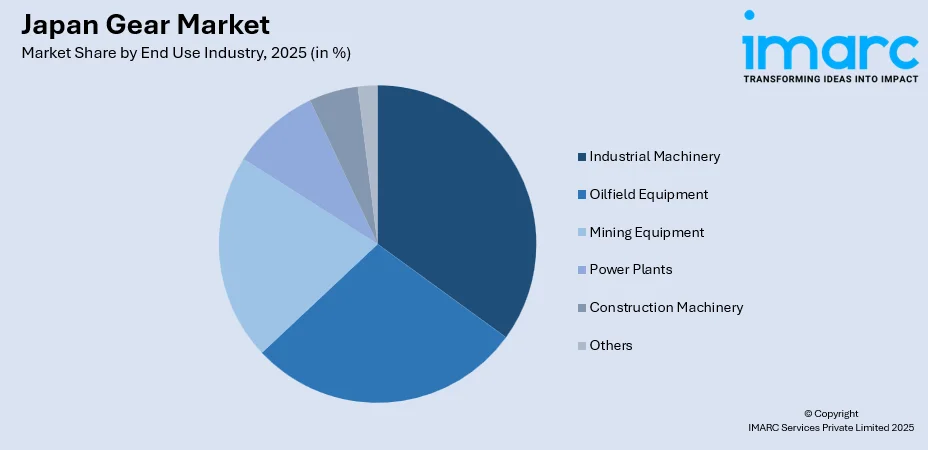

- By End Use Industry: Industrial machinery leads the market with a share of 35% in 2025, owing to Japan's robust manufacturing ecosystem, high demand for precision equipment in automated production facilities, and continuous modernization of factory operations requiring reliable gear systems.

- By Region: Kanto region dominates the market with a share of 31% in 2025, driven by the concentration of major manufacturing facilities in Tokyo and surrounding prefectures, extensive automotive production clusters, and presence of leading industrial equipment manufacturers in this economic heartland.

- Key Players: The Japan gear market exhibits a well-established competitive landscape characterized by technologically advanced domestic manufacturers competing alongside specialized precision engineering firms, with market participants focusing on innovation, quality enhancement, and expansion of application-specific product portfolios.

To get more information on this market Request Sample

The Japan gear market is primarily driven by the country's leadership in advanced manufacturing and industrial automation technologies. The ongoing transformation toward smart factories and Industry 4.0 implementation has substantially increased demand for high-precision gear systems capable of supporting complex robotic operations and automated production lines. In February 2024, Nidec Machine Tool developed the world’s first high accuracy polishing method for mass-producing internal gears, enhancing durability, transmission efficiency, and NVH performance for EV and robotic applications. Additionally, the automotive sector's accelerating transition toward electric and hybrid vehicles necessitates innovative gear solutions that optimize power transmission efficiency while minimizing weight and friction. Japan's commitment to renewable energy development, particularly wind power installations and modernized transportation infrastructure, further stimulates demand for specialized gears designed to withstand demanding operational conditions. The nation's emphasis on technological excellence and manufacturing precision positions the gear industry for sustained expansion.

Japan Gear Market Trends:

Integration of Smart Manufacturing Technologies

The market is experiencing significant transformation through the adoption of intelligent manufacturing systems and digital technologies. Manufacturers are increasingly implementing advanced production methodologies that incorporate real-time monitoring, automated quality control, and predictive maintenance capabilities. This technological evolution enables the production of gears with enhanced precision and consistency while optimizing operational efficiency. The integration of artificial intelligence (AI) and machine learning (ML) algorithms into manufacturing processes allows for continuous improvement in gear design and production techniques. In January 2025, Japan’s ARUM Inc. reported that its AI software ARUMCODE cut machining-program creation time from 16 hours completed in 15 minutes, with about 150 companies already adopting the technology. Moreover, Japanese manufacturers are leveraging these technologies to develop customized gear solutions that meet evolving industrial requirements while maintaining the highest quality standards that the nation's manufacturing sector is renowned for globally.

Lightweight Material Innovation for Enhanced Performance

Japanese gear manufacturers are intensifying research and development efforts focused on advanced materials that offer superior strength-to-weight ratios. The shift toward lightweight gear components is being driven by applications in electric vehicles, aerospace, and precision robotics where weight reduction directly translates to improved energy efficiency and performance. As per sources, a Waseda University–led team developed ultra-high molecular weight polyethylene gears that were 89% lighter than metal versions and reduced robotic energy consumption by about 3%. Furthermore, engineers are exploring innovative alloys, composite materials, and advanced heat treatment processes to create gears that deliver exceptional durability while minimizing mass. This trend aligns with broader sustainability objectives and supports the development of more efficient mechanical systems. The pursuit of material innovation positions Japanese manufacturers at the forefront of next-generation gear technology development.

Expansion of Precision Gear Applications in Robotics

Japan's leadership in robotics and automation is creating expanding opportunities for precision gear manufacturers serving this dynamic sector. The growing deployment of industrial robots, collaborative robots, and service robots across manufacturing, healthcare, and logistics applications demands increasingly sophisticated gear systems. These applications require gears capable of delivering exceptional accuracy, minimal backlash, and reliable performance under continuous operation. As per sources, in December 2025, Laifual Drive advanced its harmonic drive solutions, delivering zero-backlash, high-torque, and ultra-compact gear systems for robotics, aerospace, and medical applications, enhancing precision and reliability globally. Moreover, Japanese manufacturers are developing specialized planetary gear systems and harmonic drive technologies optimized for robotic applications. The convergence of robotics advancement and precision gear engineering reinforces Japan's position as a global hub for automation technology innovation.

Market Outlook 2026-2034:

The Japan gear market is projected to demonstrate steady revenue growth throughout the forecast period, supported by continued industrial modernization and technological advancement across key end-use sectors. Expanding applications in electric vehicle production, renewable energy infrastructure, and advanced manufacturing automation are expected to sustain demand for precision gear systems. Japanese manufacturers' commitment to innovation and quality excellence positions the market for sustained expansion, with revenue generation benefiting from both domestic consumption and export opportunities. The market's trajectory reflects Japan's enduring strength in precision engineering and manufacturing capabilities. The market generated a revenue of USD 7,918.99 Million in 2025 and is projected to reach a revenue of USD 9,996.18 Million by 2034, growing at a compound annual growth rate of 2.62% from 2026-2034.

Japan Gear Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Gear Type | Spur Gear | 32% |

| End Use Industry | Industrial Machinery | 35% |

| Region | Kanto Region | 31% |

Gear Type Insights:

- Spur Gear

- Helical Gear

- Planetary Gear

- Rack and Pinion Gear

- Worm Gear

- Bevel Gear

- Others

Spur gear dominates with a market share of 32% of the total Japan gear market in 2025.

Spur gears maintain their dominant position in the Japanese market owing to their fundamental design simplicity and exceptional versatility across numerous industrial applications. These gears offer efficient power transmission for parallel shaft configurations and are particularly valued in applications requiring straightforward installation and maintenance. The cost-effectiveness of spur gear production makes them attractive for high-volume manufacturing requirements across automotive, industrial machinery, and consumer electronics sectors.

Japanese manufacturers have refined spur gear production to achieve exceptional precision levels that meet the demanding quality standards of domestic industries. In October 2024, Nachi-Fujikoshi launched the high-performance GSGT260 gear grinding machine, enabling high-precision, low-noise machining of EV reduction and industrial machinery gears while saving space and energy. Moreover, the widespread adoption of spur gears in general-purpose machinery, conveyor systems, and material handling equipment ensures continued strong demand. Their reliable performance characteristics and compatibility with standard manufacturing processes reinforce their position as the preferred gear type for numerous conventional power transmission applications throughout Japan's industrial landscape.

End Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- Oilfield Equipment

- Mining Equipment

- Industrial Machinery

- Power Plants

- Construction Machinery

- Others

Industrial machinery leads with a share of 35% of the total Japan gear market in 2025.

Industrial machinery dominates gear consumption in Japan, reflecting the nation's extensive manufacturing infrastructure and continuous investment in production equipment modernization. Japanese industrial machinery manufacturers require precision gears for diverse applications including machine tools, packaging equipment, material handling systems, and processing machinery. The emphasis on automation and productivity enhancement drives demand for high-quality gear components that ensure reliable equipment operation.

Japan's industrial machinery sector benefits from strong domestic demand and substantial export activity, creating sustained requirements for gear systems meeting international quality standards. The ongoing transition toward smart manufacturing and connected production systems necessitates gears capable of supporting precise positioning, synchronized operations, and extended service life. Manufacturers serving this segment continue investing in advanced production technologies to deliver gear solutions meeting evolving industrial machinery requirements across diverse manufacturing applications. According to sources, in 2024, Toyo Advanced Technologies unveiled the THG-35C horizontal internal grinder and TGG-26-2W-HS gear grinde, featuring automation, labor-saving, and high-precision machining.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

Kanto region dominates with a market share of 31% of the total Japan gear market in 2025.

Kanto region maintains market leadership driven by its concentration of major manufacturing facilities, automotive production plants, and industrial equipment manufacturers. The Tokyo metropolitan area and surrounding prefectures host headquarters and primary production facilities of numerous leading gear manufacturers and their principal customers. This geographic concentration facilitates efficient supply chain relationships and supports rapid product development collaboration between gear suppliers and equipment manufacturers.

The region's robust transportation infrastructure, skilled workforce availability, and research institution presence create favorable conditions for gear industry development. Major automotive manufacturers located in the Kanto region generate substantial demand for transmission components and precision gears supporting vehicle production. The concentration of electronics, robotics, and general machinery manufacturing further reinforces the region's dominant position in Japan gear market, with manufacturers benefiting from proximity to key customers and supporting industries.

Market Dynamics:

Growth Drivers:

Why is the Japan Gear Market Growing?

Accelerating Automotive Electrification and Hybrid Vehicle Adoption

Japan's automotive industry transition toward electric and hybrid powertrains represents a significant growth catalyst for the gear market. Electric vehicles require specialized reduction gears that optimize electric motor performance while ensuring smooth, efficient power transmission to wheels. Hybrid vehicles demand complex gear systems capable of seamlessly integrating electric and mechanical powertrains. Japanese automakers' aggressive investment in electrification technologies creates expanding opportunities for gear manufacturers developing lightweight, high-efficiency components. As per sources, Nissan announced its “The Arc” plan, aiming to launch 34 EV models by fiscal 2030, with EVs comprising 40% of its global lineup by fiscal 2026. Furthermore, the technical requirements of electric drivetrains, including minimized friction losses and compact packaging, drive innovation in gear design and materials. This automotive transformation establishes sustained demand growth for precision gears supporting the nation's carbon neutrality objectives.

Industrial Automation and Smart Factory Implementation

The widespread adoption of Industry 4.0 technologies across Japanese manufacturing facilities generates strong demand for precision gear systems. Smart factory implementations require sophisticated automation equipment incorporating high-quality gears that enable precise motion control and reliable continuous operation. The integration of robotics, automated guided vehicles, and flexible manufacturing systems necessitates gear components meeting demanding performance specifications. According to sources, in June 2025, Japan’s METI launched the Robotics & Regional Initiative Networking Group (RING Project) to accelerate robot adoption in SMEs, addressing workforce shortages and promoting regional manufacturing productivity. Furthermore, Japanese manufacturers' emphasis on production efficiency and quality improvement drives investment in advanced automation equipment utilizing precision gears. The ongoing modernization of existing manufacturing facilities and construction of new automated production lines ensures sustained gear demand growth. This industrial transformation reinforces the essential role of precision gears in enabling next-generation manufacturing capabilities.

Renewable Energy Infrastructure Development

Japan's commitment to expanding renewable energy capacity, particularly wind power installations, creates growing demand for specialized gear systems. Wind turbines require large, durable gearboxes designed to withstand variable loads and harsh environmental conditions while maintaining reliable operation. In April 2025, GE Vernova’s onshore wind turbines began operations at Japan’s largest Abukuma wind farm (147 MW), supporting Fukushima’s reconstruction and advancing the nation’s renewable energy requirements. Moreover, the nation's energy diversification objectives support continued investment in renewable generation capacity requiring precision gear components. Additionally, modernization of power transmission infrastructure and development of energy storage systems create supplementary demand for industrial gears. Japanese manufacturers are developing corrosion-resistant gears with extended service life characteristics suitable for demanding renewable energy applications. This sector's expansion represents a significant growth avenue for gear suppliers serving Japan's evolving energy infrastructure requirements.

Market Restraints:

What Challenges the Japan Gear Market is Facing?

High Production Costs and Pricing Pressure

Japanese gear manufacturers face challenges related to elevated production costs stemming from expensive raw materials, energy costs, and skilled labor requirements. The precision manufacturing processes necessary for high-quality gear production demand substantial capital investment and ongoing operational expenditures. Pricing pressure from international competitors offering lower-cost alternatives creates margin compression for domestic manufacturers. These cost dynamics potentially limit market expansion and necessitate continuous productivity improvement efforts.

Skilled Workforce Availability Constraints

The gear manufacturing industry requires specialized technical expertise that is increasingly difficult to source within Japan's aging workforce demographics. Experienced engineers and skilled production workers possessing precision manufacturing knowledge are approaching retirement, creating knowledge transfer challenges. Training new workers to achieve required competency levels demands significant time and investment. This workforce constraint potentially limits production capacity expansion and technological advancement pace.

Global Supply Chain Vulnerabilities

Japanese gear manufacturers depend on global supply chains for raw materials, specialized components, and manufacturing equipment that create operational vulnerabilities. Disruptions in international material supplies, logistics constraints, and currency fluctuations impact production planning and cost management. Geopolitical tensions and trade policy uncertainties introduce additional supply chain risks requiring mitigation strategies. These vulnerabilities necessitate diversification efforts and inventory management adjustments.

Competitive Landscape:

The Japan gear market features a mature competitive environment characterized by established domestic manufacturers with deep technical expertise competing alongside specialized precision engineering firms. Market participants differentiate through technological innovation, product quality, application-specific customization capabilities, and customer service excellence. Leading manufacturers invest substantially in research and development to advance gear design, materials science, and production technologies. The competitive landscape reflects Japanese manufacturing traditions emphasizing quality, reliability, and continuous improvement. Strategic partnerships between gear manufacturers and end-use equipment producers facilitate collaborative product development addressing evolving application requirements. Market participants increasingly focus on developing solutions for emerging applications in electric vehicles, robotics, and renewable energy while maintaining strength in traditional industrial markets.

Recent Developments:

-

In November 2024, Nidec Machine Tool unveiled the ZI25A internal gear grinding machine at JIMTOF 2024. The high-precision grinder accommodates larger gears for automotive drive units, robot joints, and industrial machinery, enhancing efficiency, accuracy, and service life, supporting Japan’s industrial machinery sector and its growing demand for advanced gear production technologies.

Japan Gear Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Gear Types Covered | Spur Gear, Helical Gear, Planetary Gear, Rack and Pinion Gear, Worm Gear, Bevel Gear, Others |

| End User Industries Covered | Oilfield Equipment, Mining Equipment, Industrial Machinery, Power Plants, Construction Machinery, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan gear market size was valued at USD 7,918.99 Million in 2025.

The Japan gear market is expected to grow at a compound annual growth rate of 2.62% from 2026-2034 to reach USD 9,996.18 Million by 2034.

Spur gear held the largest market share owing to its widespread applicability across industrial applications, cost-effectiveness in manufacturing, superior performance in parallel shaft configurations, and compatibility with diverse machinery requirements throughout Japan's industrial sectors.

Key factors driving the Japan gear market include accelerating automotive electrification requiring precision transmission components, expanding industrial automation adoption, renewable energy infrastructure development, technological innovation in manufacturing processes, and growing robotics applications.

Major challenges include high production costs and pricing pressure from international competitors, skilled workforce availability constraints amid demographic shifts, global supply chain vulnerabilities affecting raw material access, and increasing technical complexity requirements for emerging applications.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)