Japan Gearbox Market Size, Share, Trends and Forecast by Type, Gear Type, End User, and Region, 2026-2034

Japan Gearbox Market Overview:

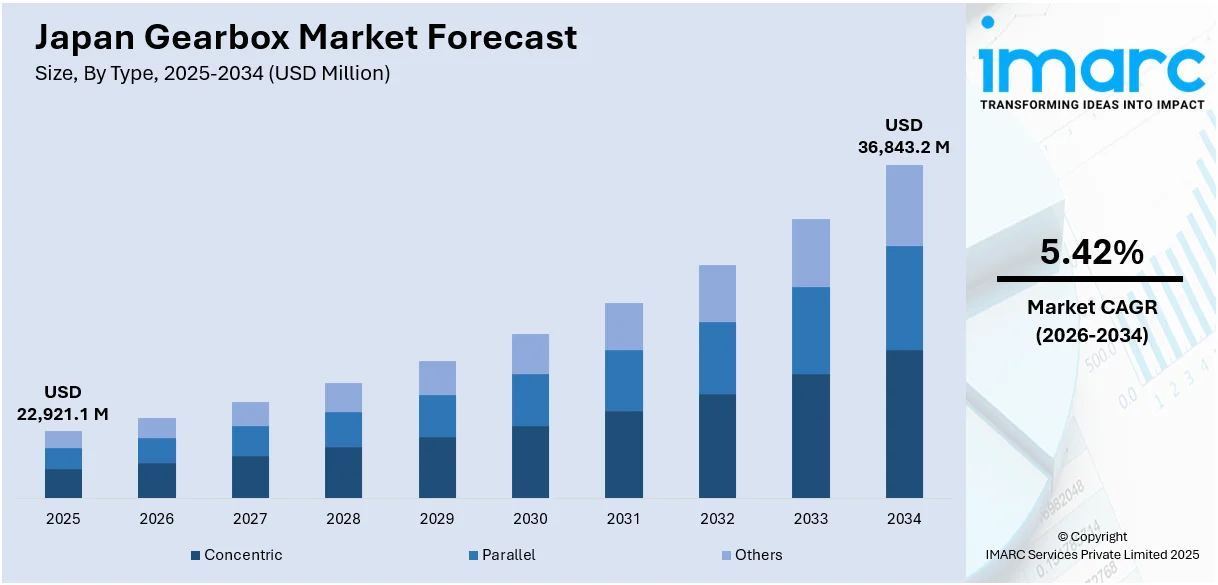

The Japan gearbox market size reached USD 22,921.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 36,843.2 Million by 2034, exhibiting a growth rate (CAGR) of 5.42% during 2026-2034. The steady expansion of the automotive industry, rising demand for electric and hybrid vehicles, and strong push for industrial automation are creating a positive market outlook. Moreover, increasing reliance on robotics in manufacturing, aging workforce leading to labor shortages, steady investment in renewable energy projects like wind power, and growing exports of high-precision machinery are accelerating the market growth. Furthermore, technological improvements in compact and efficient gearboxes, rising need for predictive maintenance solutions, advancement in material science for longer gearbox life, and supportive government policies for smart manufacturing are fueling the Japan gearbox market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 22,921.1 Million |

| Market Forecast in 2034 | USD 36,843.2 Million |

| Market Growth Rate 2026-2034 | 5.42% |

Japan Gearbox Market Trends:

Expansion of the Automotive Industry

One of the main drivers of the gearbox market in Japan is the continued growth and evolution of the automotive industry. Japan is home to some of the world’s leading automobile manufacturers, including Toyota, Honda, Nissan, and SubaruAs these companies increase production, particularly in the electric and hybrid vehicle segments, the demand for gearboxes continues to rise. Although electric vehicles (EVs) typically use simpler transmission systems compared to internal combustion engine vehicles, they still rely on specialized gear systems to enhance torque and efficiency. In hybrid vehicles, gearboxes play a key role in balancing power from the engine and electric motor. Additionally, as the automotive industry shifts toward more advanced driver-assistance systems (ADAS) and autonomous features, the mechanical components, including gearboxes, must also adapt. There is an increasing need for lighter, quieter, and more durable gear units. Japanese manufacturers are investing in new materials and technologies to meet these standards. The domestic market is also supported by growing exports, with Japanese vehicles being shipped worldwide.

To get more information on this market Request Sample

Growth in Industrial Automation

Industrial automation is another major driver of the gearbox market in Japan. With a shrinking and aging population, Japanese companies are turning more to automated machinery and robots to maintain productivity and efficiency. Industrial robots, conveyors, packaging machines, and CNC machines are highly dependent on gearboxes as fundamental parts. They help manage torque, speed, and direction in very precise applications. Japan is the global leader in terms of automation, and local firms have been replacing their production lines with more efficient and power-saving equipment all the time. Such replacements mostly involve the installation of high-performance gear sets. Further, applications of gearboxes that are small but fit into tight spaces have increased, especially in such industries as electronics and precision manufacturing. Automation is also being carried forward to small and medium enterprises (SMEs), which were earlier lagging in the introduction of new technologies. With the support of government subsidies, along with technology grants, an increasing number of SMEs are now adopting intelligent manufacturing systems, which is further driving the Japan gearbox market growth.

Aging Population Driving Automation

The aging population in Japan is having a tremendous impact on the labor supply, especially for manually intensive sectors such as manufacturing and logistics. In 2024, there were up t0 20.76 million people in Japan aged 75 or above, who accounted for 16.8% of the population. Among them, there were 12.9 million in their 80s and above, who accounted for 10.4%. This highlights the increasing proportion of the ultra-elderly within Japan's aging population, prompting companies nationwide to adopt automation to address labor shortages. This phenomenon is driving the demand for gearboxes directly, as they are key mechanical components in automated systems and robots. With fewer young laborers entering the industrial workforce, manufacturers must ensure continued and efficient production through machines. Gearboxes help to supply the precise motion and force required by many automated tasks, from simple material handling to complex robotic movements. The trend is particularly strong in sectors like automotive, electronics, and food processing, where high output and consistent quality are most important. The government of Japan also facilitates this trend by providing policy and grant incentives to promote the adoption of technology by manufacturers. As a result, increasingly more companies are reconfiguring their production lines to have automation-friendly layouts, raising the demand for compact, robust, and low-maintenance gearbox systems.

Japan Gearbox Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type, gear type, and end user.

Type Insights:

- Concentric

- Parallel

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes concentric, parallel, and others.

Gear Type Insights:

- Spur Gear

- Worm Gear

- Bevel Gear

- Helical Gear

- Others

A detailed breakup and analysis of the market based on the gear type have also been provided in the report. This includes spur gear, worm gear, bevel gear, helical gear, and others.

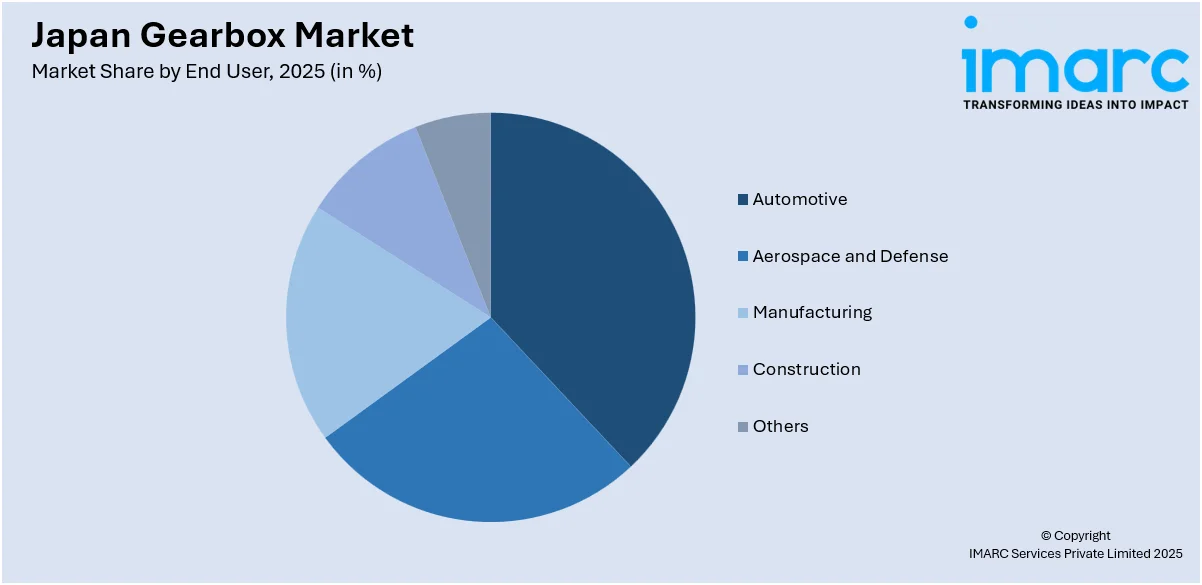

End User Insights:

Access the comprehensive market breakdown Request Sample

- Automotive

- Aerospace and Defense

- Manufacturing

- Construction

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes automotive, aerospace and defense, manufacturing, construction, and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Gearbox Market News:

- In 2023, JATCO introduced the CVT XS JF023E, a new continuously variable transmission model, enhancing fuel efficiency and performance for compact vehicles. This launch reinforces JATCO's position as a leading CVT supplier in Japan.

Japan Gearbox Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Concentric, Parallel, Others |

| Gear Types Covered | Spur Gear, Worm Gear, Bevel Gear, Helical Gear, Others |

| End Users Covered | Automotive, Aerospace and Defense, Manufacturing, Construction, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan gearbox market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan gearbox market on the basis of type?

- What is the breakup of the Japan gearbox market on the basis of gear type?

- What is the breakup of the Japan gearbox market on the basis of end user?

- What is the breakup of the Japan gearbox market on the basis of region?

- What are the various stages in the value chain of the Japan gearbox market?

- What are the key driving factors and challenges in the Japan gearbox market?

- What is the structure of the Japan gearbox market and who are the key players?

- What is the degree of competition in the Japan gearbox market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan gearbox market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan gearbox market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan gearbox industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)