Japan Generator Market Size, Share, Trends and Forecast by Fuel Type, Power Rating, Sales Channel, Design, Application, End User, and Region, 2026-2034

Japan Generator Market Overview:

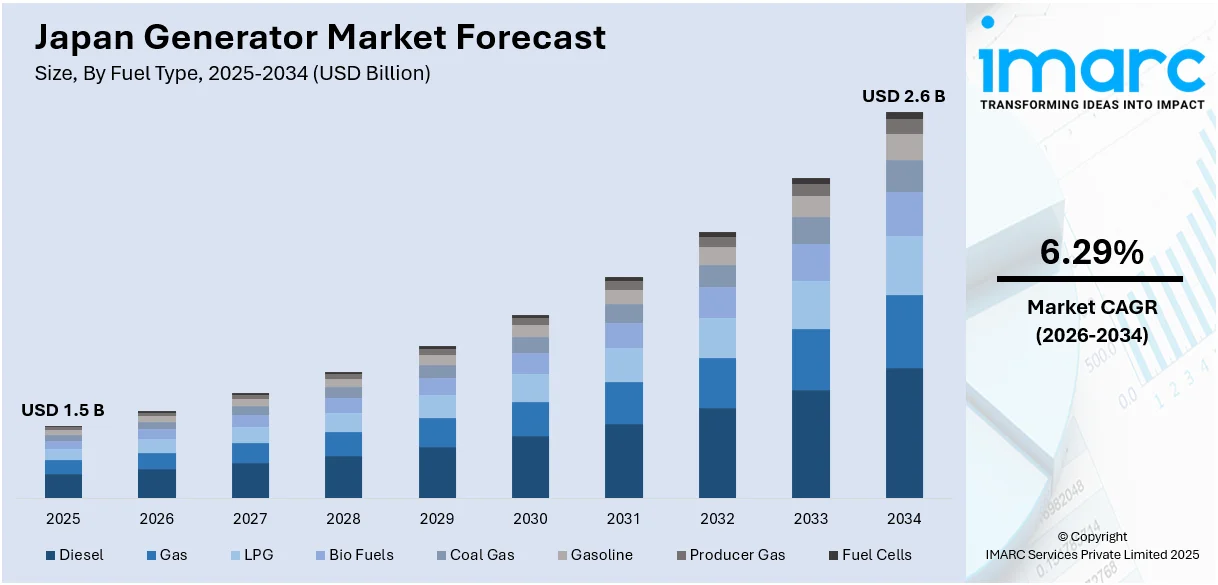

The Japan generator market size reached USD 1.5 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 2.6 Billion by 2034, exhibiting a growth rate (CAGR) of 6.29% during 2026-2034. Rising demand from disaster preparedness, strict emission laws, and energy efficiency needs are supporting the market growth. Moreover, frequent power outages, increasing data centers, and growing telecom and industrial sectors are propelling the market growth. Furthermore, renewable energy integration, aging power infrastructure, urban development, government incentives, technological upgrades, and expanding construction activities are some of the factors boosting the Japan generator market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1.5 Billion |

| Market Forecast in 2034 | USD 2.6 Billion |

| Market Growth Rate 2026-2034 | 6.29% |

Japan Generator Market Trends:

Stringent Regulations on Emissions and Energy Efficiency

Japan has some of the strictest environmental regulations in the world, especially when it comes to emissions and energy use. These rules push generator manufacturers to focus on making products that are cleaner and more efficient. The government sets high standards for fuel consumption, noise levels, and carbon emissions, making it necessary for companies to use advanced technology. This is particularly important in urban areas where pollution and noise can affect public health and the environment. As a result, many manufacturers are investing in research and development to create low-emission diesel and gas generators. The demand for energy-efficient models is also increasing among businesses and households looking to reduce energy costs and comply with regulations. Additionally, Japan’s focus on meeting global climate goals encourages the shift towards eco-friendly energy solutions, including hybrid and inverter generators. These factors make environmental regulations not just a challenge but also a major driver of innovation and market growth in Japan's generator industry.

To get more information on this market Request Sample

Natural Disasters and Having a Backup Power Source

Japan is highly exposed to natural disasters like earthquakes, typhoons, tsunamis, and volcanic eruptions. These can significantly affect the power supply, and thus backup generators are not a luxury but a necessity. Ever since catastrophic disasters such as the 2011 earthquake and tsunami, there has been a dramatic increase in the level of awareness and demand for high-quality emergency power solutions. Generators are becoming a key part of home disaster preparedness plans, organization disaster plans, healthcare facility emergency plans, and government building disaster plans. The fear of sudden loss of power drives consumers to purchase generators that can provide power to essential devices and services during an emergency. In remote rural areas where power might take longer to restore, generators become a critical lifeline. Schools, shelters, and community centers have backup power systems that are installed in them to ensure safety and continuity. With the constant threat of disasters, there is continuous demand for both portable and fixed generators across Japan, a key driver of market growth. In March 2024, Japan’s Ministry of Economy, Trade and Industry (METI) announced a nationwide initiative to upgrade emergency power infrastructure in disaster-prone regions, including subsidies for residential and community backup generators—a move that is expected to further accelerate market expansion.

Infrastructure Development and Urban Expansion

Japan is constantly improving its infrastructure, including roads, bridges, railroads, and public structures. All of them require a steady supply of power, especially in areas where grid power is nonexistent or unreliable. Generators are extremely crucial in providing temporary power to construction sites and development locations. As cities expand and urban areas are reclaimed, the use of generators in powering equipment, lighting, and safety equipment is inevitable. Large infrastructure projects also involve tunneling, heavy machinery, and 24/7 operations that cannot afford power interruptions. In such cases, diesel or gas generators serve as the main source of electricity. Moreover, government-led initiatives to rebuild aging infrastructure further boost the demand for generators. With an increasing focus on smart cities and advanced public transportation, power reliability during development stages is critical. Generator firms also benefit from long-term tenders and contracts for such projects. This constant infrastructural construction across Japan yields consistent market growth and presents frequent opportunities for the application of generators in public and private sector construction projects, which is further driving the Japan generator market growth.

Japan Generator Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on fuel type, power rating, sales channel, design, application, and end user.

Fuel Type Insights:

- Diesel

- Gas

- LPG

- Bio Fuels

- Coal Gas

- Gasoline

- Producer Gas

- Fuel Cells

The report has provided a detailed breakup and analysis of the market based on the fuel type. This includes diesel, gas, LPG, bio fuels, coal gas, gasoline, producer gas, and fuel cells.

Power Rating Insights:

- Up To 50 Kw

- 51–280 Kw

- 281–500 Kw

- 501–2,000 Kw

- 2,001–3,500 Kw

- Above 3,500 Kw

A detailed breakup and analysis of the market based on the power rating have also been provided in the report. This includes up to 50 Kw, 51–280 Kw, 281–500 Kw, 501–2,000 Kw, 2,001–3,500 Kw, and above 3,500 Kw.

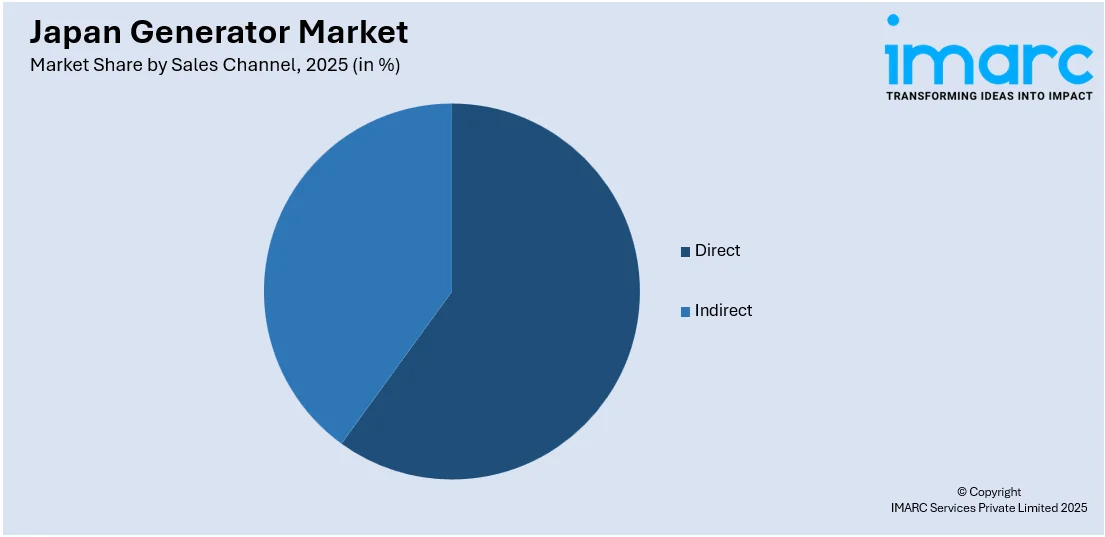

Sales Channel Insights:

Access the comprehensive market breakdown Request Sample

- Direct

- Indirect

A detailed breakup and analysis of the market based on the sales channel have also been provided in the report. This includes direct and indirect.

Design Insights:

- Stationary

- Portable

The report has provided a detailed breakup and analysis of the market based on the design. This includes stationary and portable.

Application Insights:

- Standby

- Prime and Continuous

- Peak Shaving

The report has provided a detailed breakup and analysis of the market based on the application. This includes standby, prime and continuous, and peak shaving.

End User Insights:

- Utilities/Power Generation

- Oil and Gas

- Chemicals and Petrochemicals

- Mining and Metals

- Manufacturing

- Marine

- Construction

- Others

- Residential

- Commercial

- Healthcare

- IT and Telecommunications

- Data Centers

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes utilities/power generation (oil and gas, chemicals and petrochemicals, mining and metals, manufacturing, marine, construction, and others), residential, and commercial (healthcare, IT and telecommunications, data centers, and others).

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Generator Market News:

- In 2025, JERA and France's EDF consolidated their Japan power trading activities under the Singapore-based joint venture, JERA Global Markets, aiming to enhance efficiency and governance in Japan's power market.

- In 2024, JERA commenced operations of a 2.34 GW gas-fired power plant in Chiba. Featuring GE and Toshiba turbines, the plant achieves 64% efficiency and reduces CO₂ emissions by 16%, addressing Japan's summer power demands.

Japan Generator Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fuel Types Covered | Diesel, Gas, LPG, Bio Fuels, Coal Gas, Gasoline, Producer Gas, Fuel Cells |

| Power Ratings Covered | Up To 50 Kw, 51–280 Kw, 281–500 Kw, 501–2,000 Kw, 2,001–3,500 Kw, Above 3,500 Kw |

| Sales Channels Covered | Direct, Indirect |

| Designs Covered | Stationary, Portable |

| Applications Covered | Standby, Prime and Continuous, Peak Shaving |

| End Users Covered |

|

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan generator market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan generator market on the basis of fuel type?

- What is the breakup of the Japan generator market on the basis of power rating?

- What is the breakup of the Japan generator market on the basis of sales channel?

- What is the breakup of the Japan generator market on the basis of design?

- What is the breakup of the Japan generator market on the basis of application?

- What is the breakup of the Japan generator market on the basis of end user?

- What is the breakup of the Japan generator market on the basis of region?

- What are the various stages in the value chain of the Japan generator market?

- What are the key driving factors and challenges in the Japan generator market?

- What is the structure of the Japan generator market and who are the key players?

- What is the degree of competition in the Japan generator market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan generator market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan generator market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan generator industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)