Japan Generic Injectables Market Size, Share, Trends and Forecast by Therapeutic Area, Container, Distribution Channel, and Region, 2026-2034

Japan Generic Injectables Market Overview:

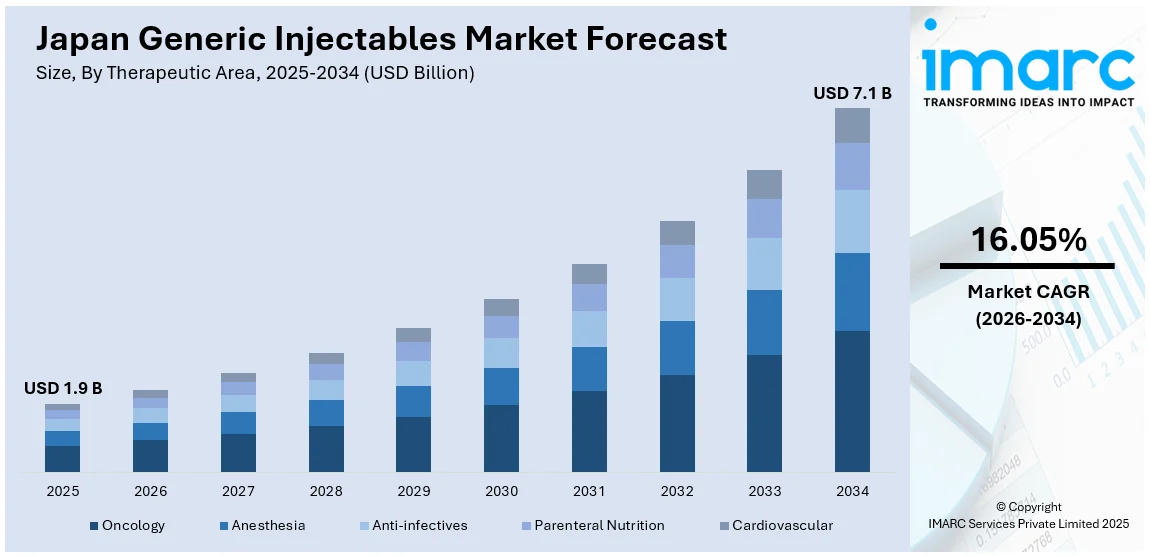

The Japan generic injectables market size reached USD 1.9 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 7.1 Billion by 2034, exhibiting a growth rate (CAGR) of 16.05% during 2026-2034. Patent expirations in high-value injectables, favorable NHI reimbursement updates, expanded domestic parenteral portfolios, cost-driven procurement reforms, improved clinical acceptance, PMDA-backed regulatory confidence, electronic prescribing prompts, pharmacovigilance efforts, and increased hospital adoption across oncology, nephrology, and emergency care are some of the factors positively impacting the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1.9 Billion |

| Market Forecast in 2034 | USD 7.1 Billion |

| Market Growth Rate 2026-2034 | 16.05% |

Japan Generic Injectables Market Trends:

Patent Expirations Across High-Value Injectable Drug Classes

Japan’s pharmaceutical sector has entered a cycle of frequent patent expirations, particularly across high-value injectable drugs used in oncology, autoimmune diseases, and metabolic disorders. As these patent cliffs occur, generic manufacturers are seizing the opportunity to enter the injectable space, where price margins remain more favorable than oral generics. The National Health Insurance (NHI) system supports this shift by updating reimbursement rates and actively favoring cost-effective alternatives. This regulatory environment has directly influenced the Japan generic injectables market share, particularly in high-cost hospital-based therapies, giving generics significant access to formulary placement and clinical adoption. Major hospitals and regional centers are adjusting procurement practices to align with revised pricing models, resulting in procurement cycles that favor reliable and price-competitive generics. As per a recent 2024 study, regulatory reforms in Japan post-2021 have led to a notable increase in industry-wide investment in sterile manufacturing technologies, with over 40% of surveyed companies reporting active upgrades to meet revised GMP standards. Domestic companies, such as Nichi-Iko and Sawai, are leveraging these opportunities with expanded parenteral portfolios and increased capacity. With originator prices consistently revised downward and generics gaining parity in therapeutic trust, the landscape for injectable generics is strengthening. Notably, on February 21, 2025, Chuikyo formally approved the pricing rules for Japan’s FY2025 drug price revision, which will come into effect in April. The revision includes tighter price reduction mechanisms for off-patent drugs, revised repricing criteria, and further incentives for stable supply, all of which directly influence generic injectable pricing and reimbursement. These changes are expected to reshape market dynamics for injectable generics in Japan by reinforcing pricing pressure while supporting supply continuity for high-priority formulations. Institutional buyers are further placing increasing emphasis on supply assurance and post-marketing monitoring, which Japanese manufacturers have integrated into their production and logistics workflows, thereby creating a positive market outlook.

To get more information on this market Request Sample

Physician and Patient Acceptance Driven by Institutional Trust and Quality Assurance

In Japan, conservative prescribing patterns have historically slowed generic uptake, particularly in injectables. As per a recent 2024 report, injectables accounted for only 6.8% of Japan’s generic drug volume but made up 26.4% of its market value, underscoring their high-cost concentration. Additionally, 80% of injectable generics were produced by just 10 companies, with only 9.4% of facilities meeting full GMP compliance under updated standards. However, institutional trust has grown in tandem with stringent regulatory oversight by the Pharmaceuticals and Medical Devices Agency (PMDA). Domestic manufacturers have focused on quality consistency, transparent manufacturing audits, and strong pharmacovigilance programs, which have reassured healthcare providers. This behavioral shift is contributing to the overall Japan generic injectables market growth, as it has led to broader adoption of generic injectables in high-dependency areas such as oncology, nephrology, and emergency care, where clinical outcomes and supply reliability are critical. Prescribers now receive electronic prompts for cost-effective alternatives, and patient education programs are reinforcing the equivalency of approved generics. These changes are particularly relevant in therapeutic classes requiring long-term injectable therapy cycles, where cost savings accumulate quickly. Dispensing incentives and formulary-level changes have started to normalize generic use even in community-level care settings. The long-term Japan generic injectables market outlook reflects a favorable shift, driven by supportive policy, steady demand from hospitals, and a measurable change in clinical preference patterns, especially for injectable generics with reliable clinical histories and robust manufacturing standards.

Japan Generic Injectables Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on therapeutic area, container, and distribution channel.

Therapeutic Area Insights:

- Oncology

- Anesthesia

- Anti-infectives

- Parenteral Nutrition

- Cardiovascular

The report has provided a detailed breakup and analysis of the market based on the therapeutic area. This includes oncology, anesthesia, anti-infectives, parenteral nutrition, and cardiovascular.

Container Insights:

- Vials

- Ampoules

- Premix

- Prefilled Syringes

The report has provided a detailed breakup and analysis of the market based on the container. This includes vials, ampoules, premix, and prefilled syringes.

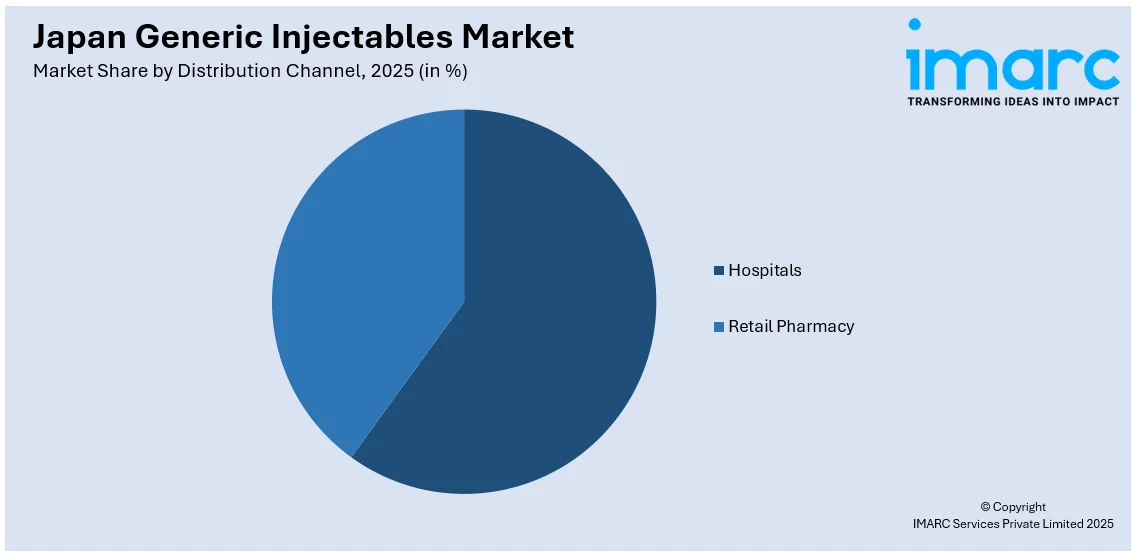

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Hospitals

- Retail Pharmacy

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes hospitals and retail pharmacy.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Generic Injectables Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Therapeutic Areas Covered | Oncology, Anesthesia, Anti-infectives, Parenteral Nutrition, Cardiovascular |

| Containers Covered | Vials, Ampoules, Premix, Prefilled Syringes |

| Distribution Channels Covered | Hospitals, Retail Pharmacy |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan generic injectables market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan generic injectables market on the basis of therapeutic area?

- What is the breakup of the Japan generic injectables market on the basis of container?

- What is the breakup of the Japan generic injectables market on the basis of distribution channel?

- What is the breakup of the Japan generic injectables market on the basis of region?

- What are the various stages in the value chain of the Japan generic injectables market?

- What are the key driving factors and challenges in the Japan generic injectables market?

- What is the structure of the Japan generic injectables market and who are the key players?

- What is the degree of competition in the Japan generic injectables market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan generic injectables market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan generic injectables market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan generic injectables industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)