Japan Geopolymer Market Size, Share, Trends and Forecast by Application, End-Use Industry, and Region, 2026-2034

Japan Geopolymer Market Overview:

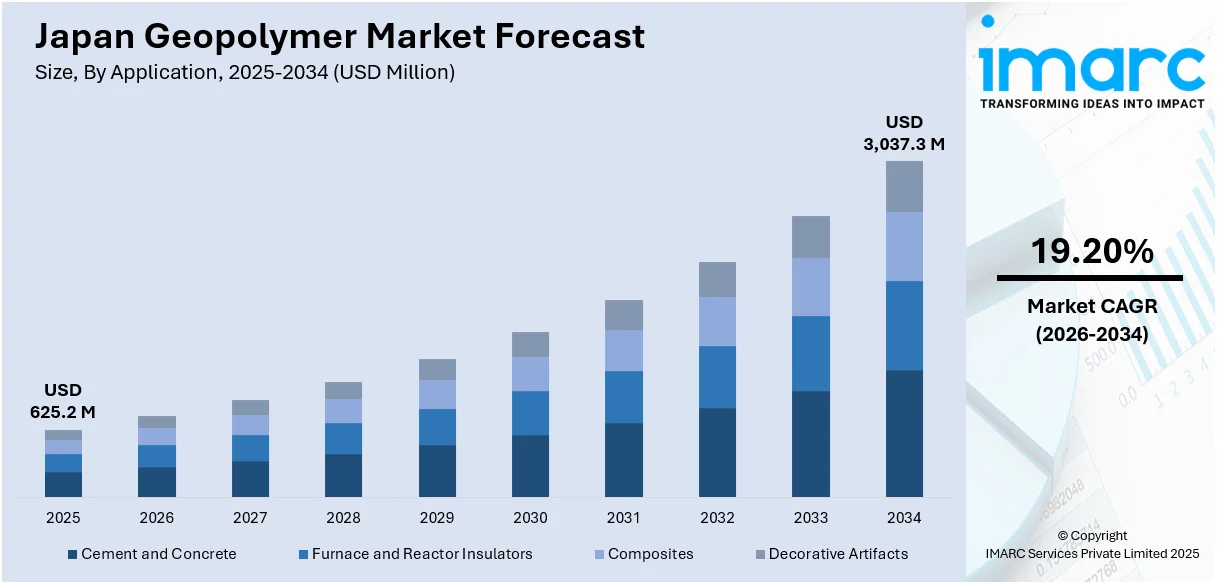

The Japan geopolymer market size reached USD 625.2 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 3,037.3 Million by 2034, exhibiting a growth rate (CAGR) of 19.20% during 2026-2034. The market is driven by the growing emphasis on sustainability and interest in minimizing carbon emissions, continuous infrastructure renewal activities, particularly in transportation and urban development, and increasing generation of industrial waste, such as fly ash from thermal power generation and blast furnace slag from steel production.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 625.2 Million |

| Market Forecast in 2034 | USD 3,037.3 Million |

| Market Growth Rate 2026-2034 | 19.20% |

Japan Geopolymer Market Trends:

Increasing Emphasis on Sustainable Construction Materials

Japan's emphasis on sustainability and its interest in minimizing carbon emissions is making a major impact on the urgency for green options in building construction, with geopolymer finding increasing usage as an ecofriendly alternative to ordinary Portland cement. In contrast to the production of conventional cement as a large emitter of CO₂, geopolymer synthesis comes with considerably reduced carbon emission since it incorporates industrial waste materials such as fly ash and slag. This transition is consistent with Japan's environmental policies to become carbon-neutral by 2050. The Japanese construction sector is facing mounting regulatory pressure to implement sustainable practices, and developers are actively looking for materials that meet green building certifications. Geopolymers offer a twofold benefit with minimizing industrial waste and enabling low-carbon infrastructure development. Furthermore, increasing public and governmental consciousness about the environmental impact of construction materials is encouraging the use of geopolymer-based concrete in public work and private developments. According to the IMARC Group, the Japan construction market size is expected to reach USD 937.4 Billion by 2033.

To get more information on this market Request Sample

Rapid Infrastructure Modernization and Seismic Resilience Needs

Japan's continuous infrastructure renewal activities, particularly in transportation and urban development, are bolstering the market growth. The nation continuously replaces aging infrastructure to enhance safety and efficiency, particularly given its seismic propensity. Geopolymers have better mechanical characteristics, excellent thermal stability, and greater chemical resistance than traditional cement, which makes them suitable for strong and resistant building. Consistent with Japan's seismic history, materials that withstand extreme conditions to preserve structural integrity are in particular demand. The capacity of geopolymer concrete to resist temperatures and mechanical forces without appreciable degradation makes it an attractive material for key infrastructures like tunnels, bridges, dams, and transportation hubs. Moreover, the government is investing in smart city construction projects, thereby driving the need for effective yet sustainable construction materials. In 2024, the Ministry of Land, Infrastructure, Transport and Tourism (MLIT) announced a list of regions chosen for the 2024 Smart City Implementation Support Project.

Innovation in Industrial Waste Management and Circular Economy Initiatives

Japan's strong industrial economy generates a huge amount of waste, such as fly ash from thermal power generation and blast furnace slag from steel production. There is a high emphasis on shifting towards a circular economy through government policies, promoting recycling of industrial by-products into high-value products. Geopolymers, being synthesized from such materials, present an effective route to dispose of waste in an environment friendly manner. The incorporation of geopolymer manufacturing into waste management practices facilitates industries in achieving landfill independence and zero-waste goals. There is cooperation from Japanese manufacturers to work with institutions of higher education and environmental bureaus to bring scalability and the performance of geopolymer technology to a superior level. Investigative efforts aim to enhance formula consistency and provide standardized applications in various sectors as well. In FY2024/3, the quantity of industrial waste generated by Daicel’s business sites and the domestic Group companies increased by 6%. As industries seek to minimize operational waste and meet environmental standards, the environmental and economic advantages of using geopolymer become all the more compelling. Such a convergence between industrial by-product utilization and green material innovation is a key driver of growth for the market in Japan.

Japan Geopolymer Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on application and end-use industry.

Application Insights:

- Cement and Concrete

- Furnace and Reactor Insulators

- Composites

- Decorative Artifacts

The report has provided a detailed breakup and analysis of the market based on the application. This includes cement and concrete, furnace and reactor insulators, composites, and decorative artifacts.

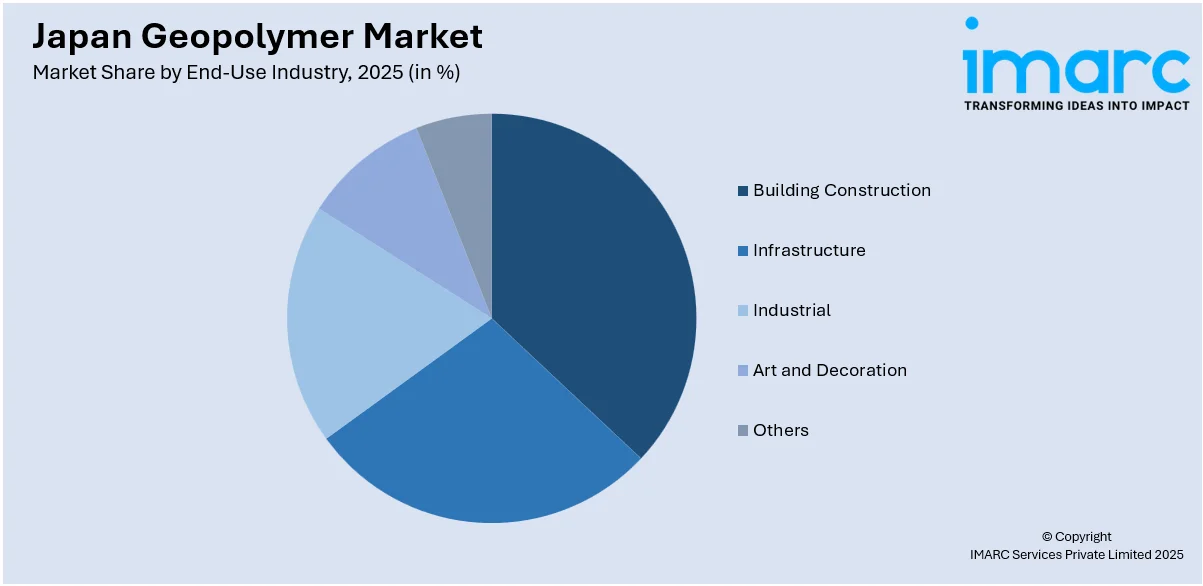

End-Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- Building Construction

- Infrastructure

- Industrial

- Art and Decoration

- Others

A detailed breakup and analysis of the market based on the end-use industry have also been provided in the report. This includes building construction, infrastructure, industrial, art and decoration, and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto region, Kansai/Kinki region, Central/ Chubu region, Kyushu-Okinawa region, Tohoku region, Chugoku region, Hokkaido region, and Shikoku region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Geopolymer Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Cement and Concrete, Furnace and Reactor Insulators, Composites, Decorative Artifacts |

| End-Use Industries Covered | Building Construction, Infrastructure, Industrial, Art and Decoration, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan geopolymer market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan geopolymer market on the basis of application?

- What is the breakup of the Japan geopolymer market on the basis of end-use industry?

- What are the various stages in the value chain of the Japan geopolymer market?

- What are the key driving factors and challenges in the Japan geopolymer market?

- What is the structure of the Japan geopolymer market and who are the key players?

- What is the degree of competition in the Japan geopolymer market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan geopolymer market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan geopolymer market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan geopolymer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)