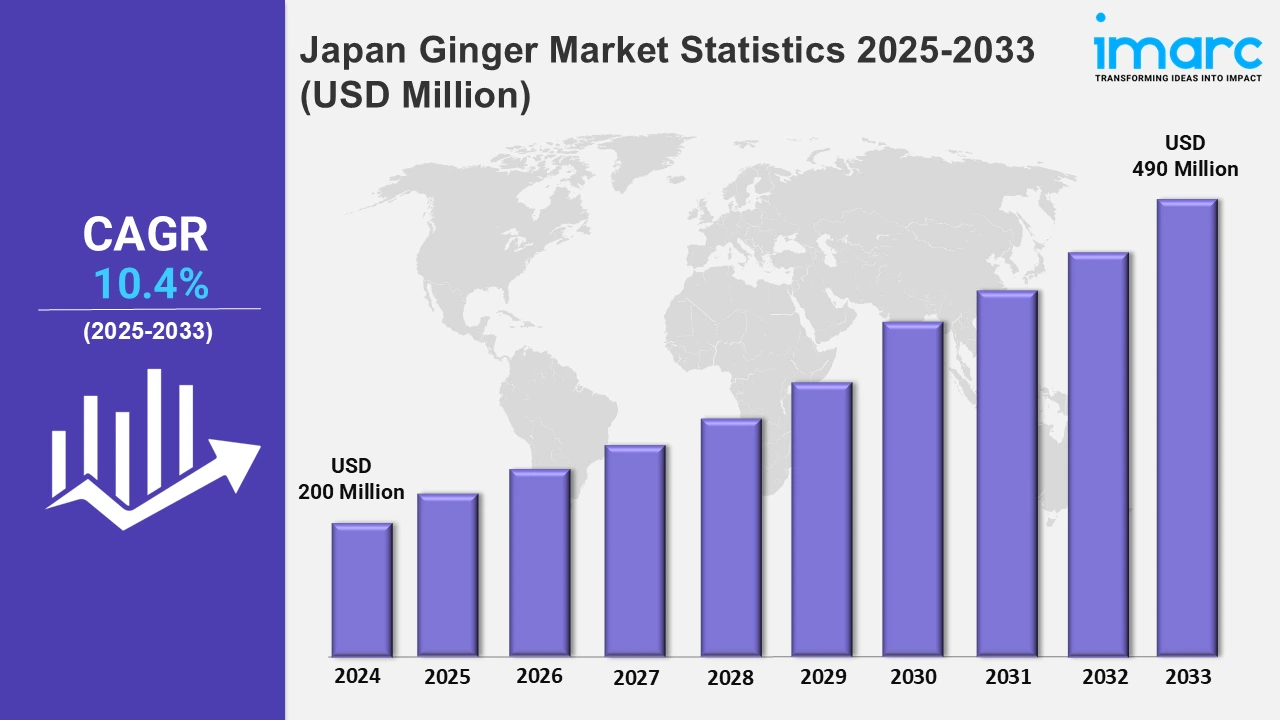

Japan Ginger Market Expected to Reach USD 490 Million by 2033 - IMARC Group

Japan Ginger Market Statistics, Outlook and Regional Analysis 2025-2033

The Japan ginger market size was valued at USD 200 Million in 2024, and it is expected to reach USD 490 Million by 2033, exhibiting a growth rate (CAGR) of 10.4% from 2025 to 2033.

To get more information on this market, Request Sample

Traditional Japanese tastes, such as ginger and citrus peel, are increasingly popular in modern cuisine. This shows a commitment to blending authenticity and innovation in culinary experiences. For example, in November 2024, Burger King Japan introduced the KYOTO Whopper, which combines a ginger sauce with vegetables, meat, and rice. It emphasizes on the classic tastes of roasted chili and citrus peel.

Moreover, the emergence of functional foods in Japan has highlighted unique options such as caffeinated ginger-infused meals. The combination of robust tastes and useful benefits appeals to changing consumer lives, meeting the demand for exciting late-night meal alternatives among a burgeoning gaming community. For instance, in September 2024, Nissin launched caffeinated noodles and rice in Japan, including ginger keema curry rice, to attract the country's booming gamer population of nearly 50 million. These unique flavors blend utility with powerful flavor for late-night hunger. Furthermore, Japan's farmers are improving agricultural practices to increase productivity and fulfill the rising demand for premium-quality ginger in both home and export markets. This is consistent with initiatives to enhance sustainable farming methods and meets government aims for reducing chemical input in agriculture. Additionally, the Japan ginger industry has enormous revenue prospects, driven by customer preference for organic and fresh produce over processed alternatives, resulting in greater flavor and health benefits. Coca-Cola, Unilever, and Nestlé are among the prominent food and beverage businesses that have used Japan-sourced ginger in new product lines, including health teas, ginger-based drinks, and culinary spices.

Japan Ginger Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include the Kanto region, Kinki region, Central/ Chubu region, Kyushu-Okinawa region, Tohoku region, Chugoku region, Hokkaido region, and Shikoku region. The growing awareness of the health benefits of ginger in various regions of Japan is propelling the market.

Kanto Region Ginger Market Trends:

Ginger is becoming increasingly popular in ready-to-eat foods in Kanto. Companies like FamilyMart launched ginger-infused bento boxes, providing a simple and tasty choice for busy shoppers. This innovation is consistent with urban lifestyles in Kanto's highly populated districts, where quick meal options are prevalent. The use of ginger indicates increased health awareness and a preference for more flavorful meals.

Kinki Region Ginger Market Trends:

To maintain high-quality standards, local growers in the Kinki region rely on traditional ginger production methods. Companies such as Wakayama-based Nakano BC have developed ginger liqueurs that combine regional ginger with sake, appealing to consumers seeking authentic and locally manufactured drinks. By emphasizing regional individuality, Kinki ginger producers guarantee that their products stand out in the competitive domestic market, garnering popularity among people who appreciate premium and artisanal offers.

Central/Chubu Region Ginger Market Trends:

In the Central/Chubu region, producers are experimenting with ginger-infused confectioneries. Shizuoka's Imuraya Group introduced ginger-flavored yokan (sweet bean jelly), blending traditional sweets with a fiery bite of ginger, drawing both local and foreign customers. This strategy combines legacy with originality, appealing to people looking for distinctive and high-quality snacks. Such improvements serve to portray ginger as a versatile ingredient with applications beyond its conventional culinary usage.

Kyushu-Okinawa Region Ginger Market Trends:

The Kyushu-Okinawa region focuses on ginger-based health supplements. Kariyushi Herb Research Co. produced ginger capsules for digestive health, capitalizing on the region's reputation for longevity and wellness goods. With the rising consumer interest in preventative health, these supplements meet current dietary demands while complementing Kyushu-Okinawa's reputation as a natural and functional food hub.

Tohoku Region Ginger Market Trends:

Ginger is used to warm dishes in the Tohoku region that are appropriate for the cooler environment. Hachinohe Shuzo, situated in Aomori, launched ginger-infused miso soup packets to provide customers with easy and heat-generating meal alternatives throughout the harsh winter months. This regional innovation improves meal functionality by fulfilling customer demands for warmth and nutrition while capitalizing on the growing need for quick and health-conscious food options.

Chugoku Region Ginger Market Trends:

Ginger is commonly used in the Chugoku region to preserve seafood. Companies in Hiroshima developed ginger-marinated oysters, which combine local shellfish with ginger's preservation properties, increasing shelf life and flavor. These products are aimed at both domestic and foreign markets, cementing the region's reputation as a pioneer in seafood innovation and encouraging sustainable consumption.

Hokkaido Region Ginger Market Trends:

In the Hokkaido region, ginger is used in dairy products. Local dairies created ginger-flavored yogurt, which combined yogurt's smoothness with ginger's spiciness, appealing to consumers seeking new taste experiences. This invention builds on Hokkaido's excellent reputation for high-quality dairy, utilizing its established market position to provide new and health-conscious tastes to customers locally and nationally.

Shikoku Region Ginger Market Trends:

Ginger is a significant component in Shikoku's handcrafted soy sauces. Yamaroku Shoyu in Kagawa created ginger-infused soy sauce, a unique condiment that enriches traditional foods and caters to premium markets both locally and internationally. This is consistent with Shikoku's emphasis on maintaining and updating traditional food items, demonstrating the possibility for regional specialties to satisfy changing consumer preferences.

Top Companies Leading in the Japan Ginger Industry

Some of the leading Japan ginger market companies have been included in the report. In September 2023, Kirin, a Japanese beverage company, introduced Kirin Tokusei Ginger Ale Sour RTD beverages in the country. This product launch represents the company's attempts to broaden its beverage options and meet consumer preferences. Moreover, in September 2024, Nissin launched caffeinated noodles and rice in Japan.

Japan Ginger Market Segmentation Coverage

- Based on the product type, the market has been classified into fresh ginger, dried ginger, preserved ginger, ginger oil, and others. Fresh ginger is necessary in cooking. Dried ginger has a longer shelf life and medicinal value. Preserved ginger enriches sushi and desserts. Ginger oil is beneficial in aromatherapy and skincare.

- Based on the application, the market has been categorized into the food industry, pharmaceuticals industry, cosmetics industry, and others. The food industry fuels the need for ginger in Japanese cuisine and drinks. The pharmaceuticals sector uses its therapeutic characteristics to improve digestive health and reduce inflammation. The cosmetics industry adopts ginger in skincare due to its antioxidant and rejuvenating properties.

- Based on the distribution channel, the market has been divided into traditional retail, modern retail stores, and others. Traditional retail, including local markets, promotes fresh ginger sales and accommodates regional tastes. Modern retail establishments, such as supermarkets and online platforms, provide convenience and a wide range of ginger items, including processed forms.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 200 Million |

| Market Forecast in 2033 | USD 490 Million |

| Market Growth Rate 2025-2033 | 10.4% |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Fresh Ginger, Dried Ginger, Preserved Ginger, Ginger Oil, Others |

| Applications Covered | Food Industry, Pharmaceuticals Industry, Cosmetics Industry, Others |

| Distribution Channels Covered | Traditional Retail, Modern Retail Stores, Others |

| Regions Covered | Kanto Region, Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Ginger Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)