Japan Glass Cleaner Market Size, Share, Trends and Forecast by Form, Distribution Channel, End User, and Region, 2026-2034

Japan Glass Cleaner Market Summary:

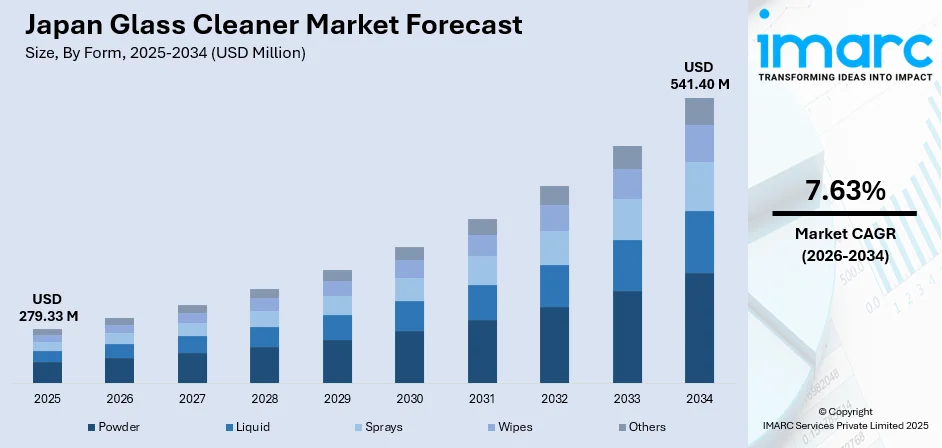

The Japan glass cleaner market size was valued at USD 279.33 Million in 2025 and is projected to reach USD 541.40 Million by 2034, growing at a compound annual growth rate of 7.63% from 2026-2034.

The Japan glass cleaner market is experiencing steady expansion driven by growing consumer emphasis on household hygiene, urbanization, and increasing demand for eco-friendly cleaning solutions. The integration of advanced formulations, including biodegradable and non-toxic ingredients, reflects evolving preferences among environmentally conscious consumers. Additionally, compact urban living spaces and busy lifestyles are fueling demand for convenient, efficient, and multipurpose glass cleaning products across residential and commercial applications.

Key Takeaways and Insights:

- By Form: Liquid dominates the market with a share of 54.2% in 2025, owing to its versatility, effective streak-free cleaning performance, and widespread availability across diverse retail channels throughout Japan.

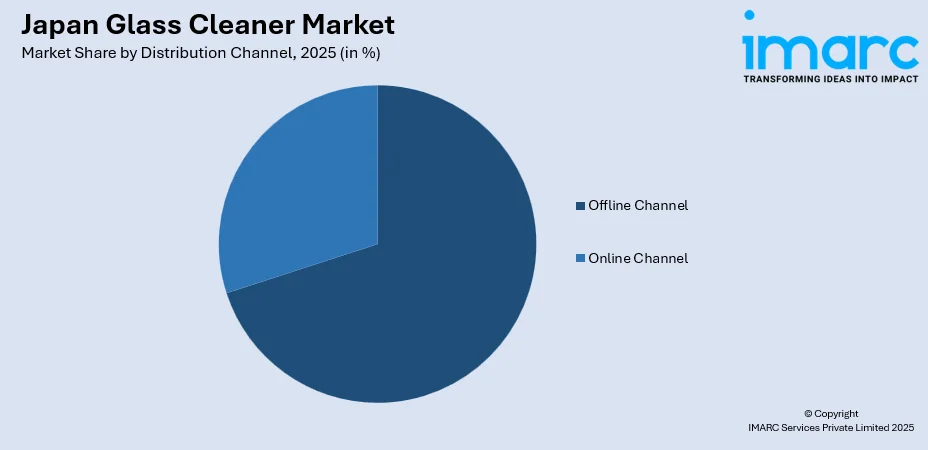

- By Distribution Channel: Offline Channel leads the market with a share of 68.8% in 2025, supported by the extensive network of supermarkets, hypermarkets, and convenience stores enabling immediate product accessibility across urban and rural areas.

- By End User: Residential represents the largest segment with a market share of 65.3% in 2025, driven by Japan's cultural emphasis on cleanliness and rising household demand for effective, convenient glass cleaning solutions.

- By Region: Kanto Region holds the largest share at 34.2% in 2025, propelled by high population density, significant commercial activity, and substantial consumer spending in the Tokyo metropolitan area.

- Key Players: The Japan glass cleaner market exhibits moderate competitive intensity, with established domestic manufacturers competing alongside multinational consumer goods corporations. Market leaders focus on product innovation, sustainable formulations, and extensive distribution networks to strengthen their Japan glass cleaner market share.

To get more information on this market Request Sample

The Japan glass cleaner market continues to evolve as consumer preferences shift toward environmentally sustainable and high-performance cleaning solutions. Manufacturers are responding by introducing plant-based formulations, biodegradable packaging, and concentrated products that reduce environmental impact while maintaining cleaning efficacy. In January 2025, the Japan Environment Association (JEA) launched the “Eco Mark Cleaning Materials” certification, promoting widespread adoption of eco‑certified cleaning products across commercial cleaning and maintenance services. The emphasis on convenience is driving innovation in spray mechanisms, pre-moistened wipes, and ergonomic packaging designs suited for compact urban apartments. Furthermore, the integration of smart cleaning technologies, including electrostatic-enhanced microfiber applications and automated window cleaning devices, is gaining traction among tech-savvy consumers and aging populations seeking minimal-effort solutions. The commercial segment also demonstrates consistent demand from hotels, offices, shopping complexes, and healthcare facilities requiring professional-grade glass maintenance products.

Japan Glass Cleaner Market Trends:

Rising Demand for Eco-Friendly and Non-Toxic Formulations

Japanese consumers are increasingly prioritizing environmentally sustainable cleaning products, driving demand for glass cleaners formulated with plant-based ingredients, biodegradable surfactants, and refillable packaging options. In 2025, Ministry of Economy, Trade and Industry (METI) announced new packaging certification standards, covering household cleaning products, cosmetics, and detergents, that mandate increased recycled material content and recyclability for containers and packaging. This shift reflects heightened environmental consciousness and cultural values emphasizing harmony with nature, prompting manufacturers to develop non-toxic formulations certified with eco-labels that minimize ecological impact.

Integration of Smart Cleaning Technologies

The adoption of technology-enabled cleaning solutions is gaining momentum, particularly among urban households and aging populations seeking convenience. For instance, in April 2025, LIXIL Corporation became the exclusive domestic distributor in Japan for HOBOT, a leading automatic window‑cleaning robot, signalling broadening consumer access to automated window‑cleaning devices. Automated window cleaners, electrostatic-enhanced sprays, and IoT-compatible cleaning devices are reshaping home maintenance routines, supporting Japan glass cleaner market growth through innovation-driven product differentiation and enhanced user experiences.

Compact and Multifunctional Product Designs

Urban living constraints in Japan are driving demand for space-efficient and multipurpose glass cleaning products. For example, in August 2025, shall we clean, operated by Wind Creative Co., Ltd., launched refill pouches for its Multi‑Cleaner and Hard‑Cleaner lines, offering compact, easy‑store packaging that supports re‑use of containers. Concentrated formulations, compact packaging, and multi-surface cleaners that address windows, mirrors, and glass furniture simultaneously appeal to consumers in smaller apartments seeking efficient storage solutions without compromising cleaning performance.

Market Outlook 2026-2034:

The Japan glass cleaner market outlook remains positive as urbanization, sustainability preferences, and technological innovation continue shaping consumer demand. Growth prospects are supported by expanding commercial infrastructure, rising hygiene awareness, and continuous product development targeting diverse consumer segments from residential households to professional cleaning services. The market generated a revenue of USD 279.33 Million in 2025 and is projected to reach a revenue of USD 541.40 Million by 2034, growing at a compound annual growth rate of 7.63% from 2026-2034.

Japan Glass Cleaner Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Form | Liquid | 54.2% |

| Distribution Channel | Offline Channel | 68.8% |

| End User | Residential | 65.3% |

| Region | Kanto Region | 34.2% |

Form Insights:

- Powder

- Liquid

- Sprays

- Wipes

- Others

The liquid dominates with a market share of 54.2% of the total Japan glass cleaner market in 2025.

Liquid glass cleaners maintain their leading position due to their versatility and superior cleaning performance across diverse glass surfaces including windows, mirrors, and glass partitions. For example, Kao Corporation, a major Japanese household‑care manufacturer, recently committed under its Kirei Lifestyle Plan to transition many of its products to refillable or recycled‑plastic packaging, reducing reliance on conventional bottles. Their effective streak-free formulations, combined with easy application through spray mechanisms, make them the preferred choice for both residential consumers and commercial users throughout Japan. The availability of various packaging sizes further supports widespread adoption.

The segment benefits from continuous product innovation with manufacturers introducing eco-friendly plant-based formulations and concentrated versions that reduce plastic waste while maintaining cleaning efficacy. Consumer preference for quick-drying solutions that deliver spotless finishes on glass facades, automotive windows, and household surfaces continues to reinforce liquid products as the dominant form in the Japan glass cleaner market.

Distribution Channel Insights:

Access the Comprehensive Market Breakdown Request Sample

- Online Channel

- Offline Channel

The offline channel leads with a share of 68.8% of the total Japan glass cleaner market in 2025.

Offline distribution channels maintain dominance through an extensive network of supermarkets, hypermarkets, drugstores, and convenience stores that offer immediate product availability and physical inspection opportunities. Japanese consumers traditionally prefer purchasing cleaning products through established retail channels, benefiting from product comparisons, promotional offers, and trusted shopping experiences. The dense network of convenience stores across urban and suburban areas ensures accessibility.

Commercial buyers including hotels, property managers, and cleaning service providers rely heavily on offline channels for bulk procurement and direct supplier relationships. While e-commerce adoption continues growing, traditional retail maintains its stronghold due to ingrained shopping habits, expert product guidance from store staff, and the immediate availability that meets urgent cleaning requirements for both residential and commercial customers.

End User Insights:

- Residential

- Commercial

The residential dominates with a market share of 65.3% of the total Japan glass cleaner market in 2025.

Residential demand remains robust driven by Japan's deep-rooted cultural emphasis on household cleanliness and orderly living environments. Even as recently, a survey by Duskin found that about 51.8% of households in Japan still carry out the traditional year‑end “Ōsōji,” a big cleaning ritual at year’s end, underscoring how ingrained the habit of thorough home maintenance remains. Japanese households prioritize maintaining immaculate windows, mirrors, and glass surfaces as part of regular home maintenance routines, including traditional year-end cleaning practices. The growing number of urban apartments with extensive glass features further supports consistent product consumption throughout the year.

Rising disposable incomes and evolving lifestyle preferences have shifted consumer demand toward premium, eco-friendly glass cleaners with specialized features. Households increasingly seek products formulated with natural ingredients, pleasant fragrances, and user-friendly packaging that accommodate compact living spaces. The aging population also drives demand for convenient, easy-to-use glass cleaning solutions that minimize physical effort during household maintenance activities.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto Region exhibits a clear dominance with a 34.2% share of the total Japan glass cleaner market in 2025.

The Kanto region commands market leadership as Japan's most densely populated and economically developed area, encompassing Tokyo and surrounding prefectures including Yokohama, Kawasaki, and Saitama. High population density, substantial commercial infrastructure, and elevated consumer spending power drive consistent demand for glass cleaning products across residential apartments, commercial offices, retail establishments, and hospitality venues.

The region's concentration of high-rise buildings, modern architectural developments with extensive glass facades, and sophisticated retail distribution networks ensures robust product accessibility and consumption. Additionally, the presence of major corporate headquarters, hotels, and shopping complexes generates significant commercial demand for professional-grade glass maintenance solutions, reinforcing Kanto's dominant position in the Japan glass cleaner market.

Market Dynamics:

Growth Drivers:

Why is the Japan Glass Cleaner Market Growing?

Increasing Urbanization and Modern Architectural Developments

Japan's ongoing urbanization continues driving demand for glass cleaning products as cities expand with modern residential towers, commercial complexes, and retail establishments featuring extensive glass facades and interiors. Under the 5th Comprehensive National Development Plan, the government is promoting high‑density, multi‑storey housing and redevelopment of urban land to improve living standards and accommodate population shifts, a policy that has encouraged construction of glass‑intensive residential and commercial buildings across metropolitan areas. High-rise apartments, office buildings, shopping malls, and hospitality venues require efficient glass maintenance solutions for windows, partitions, and decorative surfaces. Urban dwellers in compact living spaces seek streak-free, quick-drying products suitable for various glass applications. The proliferation of glass-intensive architecture across metropolitan areas including Tokyo, Osaka, and Nagoya generates sustained consumption of specialized cleaning formulations designed for diverse surface requirements.

Growing Environmental Consciousness and Demand for Sustainable Products

Environmental awareness among Japanese consumers is driving substantial demand for eco-friendly glass cleaners formulated with biodegradable ingredients and sustainable packaging. In 2024, Lion Corporation expanded its “eco Lion” line of household cleaning products, featuring plant-based surfactants, non-toxic formulations, and refillable packaging to reduce environmental impact. This shift aligns with broader cultural values emphasizing harmony with nature and responsible consumption. Manufacturers are responding by developing green cleaning solutions certified with recognized eco-labels while maintaining effective cleaning performance. Government sustainability initiatives and growing awareness of chemical safety further reinforce consumer preferences for environmentally responsible glass cleaning products.

Aging Population and Demand for Convenient Cleaning Solutions

Japan's aging demographic structure is influencing glass cleaner product development and consumption patterns. Elderly consumers and caregivers seek user-friendly cleaning solutions requiring minimal physical effort while delivering effective results. This demographic shift drives demand for ergonomically designed spray bottles, pre-moistened wipes, and automated cleaning devices that simplify household maintenance tasks. Manufacturers are developing lightweight packaging, easy-grip containers, and concentrated formulations that reduce handling requirements. The preference for convenient, efficient cleaning products among aging populations supports steady market growth as household maintenance needs evolve to accommodate changing physical capabilities and lifestyle requirements.

Market Restraints:

What Challenges the Japan Glass Cleaner Market is Facing?

Competition from Alternative Cleaning Methods

Traditional cleaning methods using natural agents such as vinegar and baking soda, along with reusable microfiber cloths, present alternatives that reduce reliance on commercial glass cleaners. Environmentally conscious consumers exploring DIY cleaning solutions and zero-waste lifestyles may limit demand for packaged products, challenging manufacturers to differentiate offerings through enhanced performance and convenience features.

Price Sensitivity and Premium Product Costs

The development of eco-friendly formulations with premium natural ingredients and sustainable packaging often results in higher product costs compared to conventional cleaners. Price-sensitive consumers may hesitate to purchase premium options, particularly during economic uncertainty. Balancing sustainability features with affordable pricing remains a challenge for manufacturers seeking broader market penetration.

Regulatory Compliance and Ingredient Restrictions

Stringent regulations governing chemical ingredients in household cleaning products require manufacturers to continuously reformulate products to meet evolving safety and environmental standards. Compliance with labeling requirements, ingredient restrictions, and eco-certification processes adds complexity and costs to product development, potentially limiting innovation pace and market introduction of new formulations.

Competitive Landscape:

The Japan glass cleaner market demonstrates moderate competitive intensity characterized by established domestic manufacturers competing alongside multinational consumer goods corporations. Leading players focus on product differentiation through innovative formulations, sustainable ingredients, and convenient packaging designs that address evolving consumer preferences. Strategic investments in research and development enable continuous improvement of cleaning efficacy, eco-friendly credentials, and user experience. Distribution partnerships with major retail chains ensure widespread product availability across offline and online channels. Companies are increasingly emphasizing brand positioning around environmental responsibility, leveraging eco-certifications and transparent ingredient sourcing to build consumer trust. Private label products from major retailers also contribute to competitive dynamics, offering cost-effective alternatives in the value segment.

Recent Developments:

- In April 2025 – Japan: LIXIL Corporation became the official domestic agent for HOBOT’s window‑cleaning robots, shifting from reseller to distributor to meet growing smart‑home demand, integrating automation into its portfolio of windows, doors, and building materials.

Japan Glass Cleaner Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Forms Covered | Powder, Liquid, Sprays, Wipes, Others |

| Distribution Channels Covered | Online Channel, Offline Channel |

| End Users Covered | Residential, Commercial |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan glass cleaner market size was valued at USD 279.33 Million in 2025.

The Japan glass cleaner market is expected to grow at a compound annual growth rate of 7.63% from 2026-2034 to reach USD 541.40 Million by 2034.

Liquid form holds the largest market share at 54.2%, driven by its versatility, effective streak-free cleaning performance, and widespread availability across diverse retail channels in Japan.

Key factors driving the Japan glass cleaner market include increasing urbanization, growing environmental consciousness, rising demand for eco-friendly formulations, Japan's aging population seeking convenient cleaning solutions, and expanding commercial infrastructure requiring professional glass maintenance products.

Major challenges include competition from alternative cleaning methods and DIY solutions, price sensitivity limiting premium product adoption, stringent regulatory compliance requirements for chemical ingredients, and the need to balance sustainable formulations with cost-effective pricing.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)