Japan Glass Market Size, Share, Trends and Forecast by Product Type, End Use Industry, and Region, 2026-2034

Japan Glass Market Overview:

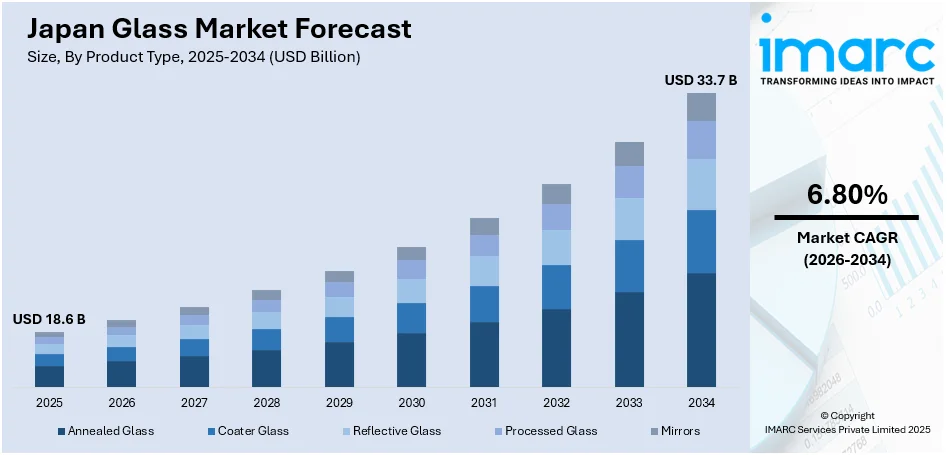

The Japan glass market size reached USD 18.6 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 33.7 Billion by 2034, exhibiting a growth rate (CAGR) of 6.80% during 2026-2034. Environmental-friendly formulations, high-tech nanotechnology, and multi-use convenience are the central trends driving the market. Green products with biodegradable components and packaging for refills respond to green concerns, while nanotechnology boosts cleaning power and protection of the surfaces. Moreover, flexible cleaners ease application on diverse surfaces, responding to contemporary living styles. These innovations together spur robust growth and consumer acceptance, further solidifying Japan's reputation as a technological and quality leader in the glass cleaning industry, favorably influencing the Japan glass market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 18.6 Billion |

| Market Forecast in 2034 | USD 33.7 Billion |

| Market Growth Rate 2026-2034 | 6.80% |

Japan Glass Market Trends:

Rise of Green Glass Cleaning Solutions

The glass cleaning industry in Japan is increasingly led by the use of sustainable and environmentally friendly formulations. Products formulated with biodegradable ingredients and refillable containers are becoming highly popular as consumers become more green-oriented. This trend follows a larger cultural shift toward minimizing waste and limiting chemical exposure to ecosystems. These types of formulations tend to shun aggressive solvents and focus on plant-based ingredients to maintain safety for consumers and the environment. Sustainability is also applied to packaging innovations that aim to minimize plastic use through reusable or zero-waste formats. These innovations align closely with the sentiments of the Japanese consumer today, supporting greater acceptance and demand. Moreover, these eco-friendly glass cleaners support the healthy trend of Japan glass growth by addressing environmental demands without sacrificing cleaning efficiency, ultimately supporting broader market adoption and green chemistry innovation. According to the sources, in November 2023, AGI Japan invested ₹200 crore for minority stake in Hyderabad's Standard Glass in order to enhance its expansion and upgrade glass manufacturing technology in the India-Japan market partnership.

To get more information on this market Request Sample

Advanced Nanotechnology Improving Glass Cleaner Performance

The use of nanotechnology in glass cleaners represents a major development in the Japanese market. Through the utilization of materials at the nanoscale, these cleaners provide enhanced dirt and grease removal with added surface benefits of hydrophobicity and anti-fogging. The properties allow for improved glass clarity for longer durations, lowering the frequency of cleaning and enhancing user convenience. The nanomaterials form miniature protective shields that repel water, oils, and particulate matter, improving surface durability and visual clarity. The technology fills the needs for domestic and automotive glass cleaning, and it responds to growing consumer demands for superior product performance. According to the reports, in October 2023, NSG Group showcased new-age automotive glass technologies at JAPAN MOBILITY SHOW 2023 in Tokyo, which included variable transmission, antifouling, and panoramic light-control glass, with highlights of future mobility solutions. Moreover, the use of nanotechnology reflects the industry's drive for scientific advancement, further driving Japan glass market growth by providing improved functionality and backing the premiumization trend on various glass-cleaning applications.

Convenience and Multi-Purpose Glass Cleaning Products

Concurrently, there is a growing preference among Japanese consumers for convenience and multifunctionality in glass cleaning products. This emerging trend has led to the development of multi-purpose cleaners capable of effectively cleaning a variety of surfaces, including windows, mirrors, digital screens, and car windshields. These products obviate the necessity for using several specialized cleaners, making household maintenance easy and saving time. Packaging innovations also promote convenience, with ergonomically shaped spray bottles, pre-moistened wipes, and convenient formats ideal for use while on the move. These innovations address busy lifestyles and the increasing urban population that prioritizes efficiency and ease of use. Product appeal and market growth are driven by the emphasis on multi-functionality and user-friendly designs. By keeping pace with changing consumer interests in functionality and efficiency, these products account for the consistent Japan glass growth, affirming the market's sensitivity to modern lifestyle needs.

Japan Glass Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product type and end use industry.

Product Type Insights:

- Annealed Glass

- Coater Glass

- Reflective Glass

- Processed Glass

- Mirrors

The report has provided a detailed breakup and analysis of the market based on the product type. This includes annealed glass, coater glass, reflective glass, processed glass, and mirrors.

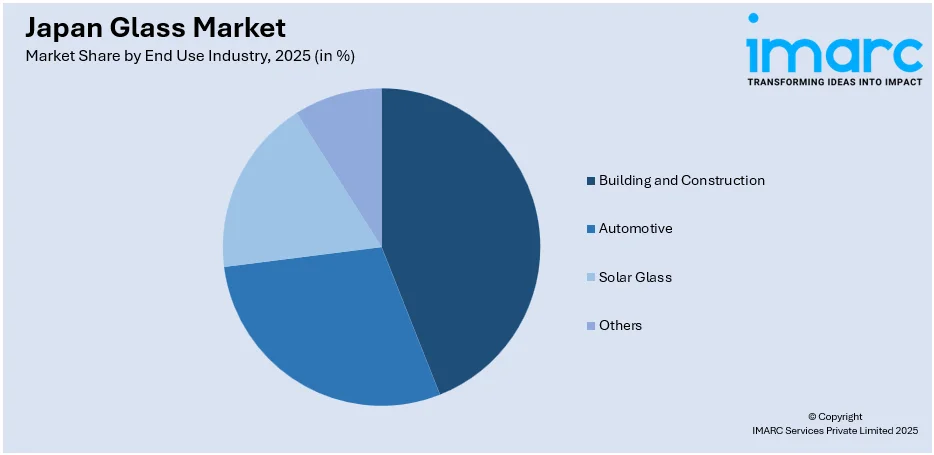

End Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- Building and Construction

- Automotive

- Solar Glass

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes building and construction, automotive, solar glass, and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Glass Market News:

- In October 2024, WG Tech debuted new glass-based Mini LED products at FINETECH JAPAN, such as a 65-inch ultra-thin TV, enhancing Japan glass market innovation with cutting-edge TGV technology, environmental materials, and high-performance applications in displays and semiconductors, meeting Japan's increasing need for innovative, eco-friendly glass solutions.

Japan Glass Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Annealed Glass, Coater Glass, Reflective Glass, Processed Glass, Mirrors |

| End Use Industries Covered | Building and Construction, Automotive, Solar Glass, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan glass market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan glass market on the basis of product type?

- What is the breakup of the Japan glass market on the basis of end use industry?

- What is the breakup of the Japan glass market on the basis of region?

- What are the various stages in the value chain of the Japan glass market?

- What are the key driving factors and challenges in the Japan glass?

- What is the structure of the Japan glass market and who are the key players?

- What is the degree of competition in the Japan glass market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan glass market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan glass market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan glass industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)