Japan Glycolic Acid Market Report by Source (Synthetic, Natural), Purity Level (99% Purity, 70% Purity, 60% Purity, 30% Purity, and Others), Application (Personal Care and Cosmetics, Household, Textile, Food Processing, Pharmaceuticals, and Others), and Region 2026-2034

Japan Glycolic Acid Market Size:

The Japan glycolic acid market size reached USD 23.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 39.5 Million by 2034, exhibiting a growth rate (CAGR) of 6.12% during 2026-2034. The market is driven by the growing product usage in the skincare sector and the expanding geriatric population in Japan, owing to its renowned skin-rejuvenating and anti-aging properties. It is also witnessing increasing interest in other industries, including pharmaceuticals and manufacturing.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 23.1 Million |

| Market Forecast in 2034 | USD 39.5 Million |

| Market Growth Rate (2026-2034) | 6.12% |

Access the full market insights report Request Sample

Japan Glycolic Acid Market Analysis:

- Major Market Drivers: In Japan, there is a strong emphasis on youthfulness, skincare and beauty-related innovations, which are the key market drivers for glycolic acid. Besides this, the growing environmental consciousness among consumers is propelling the demand for bio-based chemicals and products that are organically derived, which is acting as another significant growth-inducing factor.

- Key Market Trends: The growing utilization of glycolic acid in the skincare sector is the primary market trend. Moreover, glycolic acid is increasingly being used in the pharmaceutical industry and to clean electronic equipment machinery, which are also key trends.

- Challenges and Opportunities: The high cost of raw materials required for high-purity glycolic acid and intense competition between international and domestic manufacturers are among the key challenges. Moreover, global trade tensions and macroeconomic headwinds are also ever-present risks. Key opportunities include the rapidly expanding skincare sector and Japan’s reputation globally for high-quality beauty products and innovations. The growing number of applications of glycolic acid in other industries, including pharmaceutical, is also expected to broaden market potential.

Japan Glycolic Acid Market Trends:

Growing Product Usage in the Skincare Sector

The elevating demand for glycolic acid in the cosmetics and personal care sectors is a key trend. This acid is widely utilized as a neutralizing agent, especially in hair straightening and hair care products, such as shampoos, creams, conditioners, etc., at levels of 0.5-10%. The personal care market in Japan is well-established, with over 3,000 companies operating in the market. Glycolic acid is also renowned for its exfoliating properties to help remove dead skin cells to ensure bright and smooth skin. As such, it is extensively utilized in skin brightening and anti-aging products in Japan.

Expanding Geriatric Population

Glycolic acid is used in products in high demand among ageing populations to address concerns such as wrinkles, fine lines, uneven skin tone, etc. It helps maintain skin firmness and elasticity. Japan has among the lowest birth rates across the globe, and 29.1% of the population was aged 65 and above as of September 2023. More than one in 10 Japanese people are aged 8- or older, making Japan the world’s oldest population. Therefore, old age-related skincare products are in high demand in Japan, and this invariably involves the usage of glycolic acid.

Increasing Product Usage for Cleaning Electronic Components and Heavy Machinery

Glycolic acid is renowned for its ability to remove mineral deposits, rust, and other contaminants from electronic components and heavy machinery without negatively impacting the underlying material. 70% technical grade variant of the acid offers exceptional performance and properties for several metal finishing and cleaning applications. It is safe to use on sensitive metals, such as aluminum and copper, making it a preferable alternative to strong acids or inorganic options, including hydrochloric acid or phosphoric acid. This has propelled its usage in the numerous industry verticals, including the paints and coatings sector, where it is in high demand for dissolving oils and grime to prepare metal surfaces for further processing. Glycolic acid’s usage in heavy machinery in Japan is particularly relevant since Japan is among the largest manufacturers of heavy machinery and equipment in the world, with the output value of the machinery segment accounting for about half of the country’s overall manufacturing industry.

Emerging Usage in Pharmaceutical Industry

In line with glycolic acid’s uses in skincare products, it has been adopted in dermatological applications to treat skin conditions such as acne, psoriasis, keratosis pilaris, and numerous other skin-related conditions that involve promoting the shedding of dead skin cells to facilitate the natural regeneration process. Glycolic acid is also being adopted in biodegradable materials for inner-body implanted sustained-release medicine systems, implantable repair equipment, biological absorbable surgical sutures, artificial bones, etc.

Government Regulations Favoring Sustainable Chemicals Over Synthetic Compounds

Glycolic acid is primarily derived from sugar cane, fruits, and milk, which are natural sources. This is beneficial for its demand, as the Japanese government is encouraging the usage of organic and natural compounds over synthetic variants as part of its commitment to achieve carbon neutrality by 2050. The government’s Clean Energy Strategy stipulates a 46% reduction in greenhouse gas emissions by 2030 and decarbonization across sectors. These trends reflect well for the market outlook for glycolic acid, which is also seeing increasing interest in the development of purely bio-based variants.

Japan Glycolic Acid Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on source, purity level, and application.

Source Insights:

To get detailed segment analysis of this market Request Sample

- Synthetic

- Natural

The report has provided a detailed breakup and analysis of the market based on the source. This includes synthetic and natural.

Purity Level Insights:

- 99% Purity

- 70% Purity

- 60% Purity

- 30% Purity

- Others

A detailed breakup and analysis of the market based on the purity level have also been provided in the report. This includes 99% purity, 70% purity, 60% purity, 30% purity, and others.

Application Insights:

- Personal Care and Cosmetics

- Household

- Textile

- Food Processing

- Pharmaceuticals

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes personal care and cosmetics, household, textile, food processing, pharmaceuticals, and others.

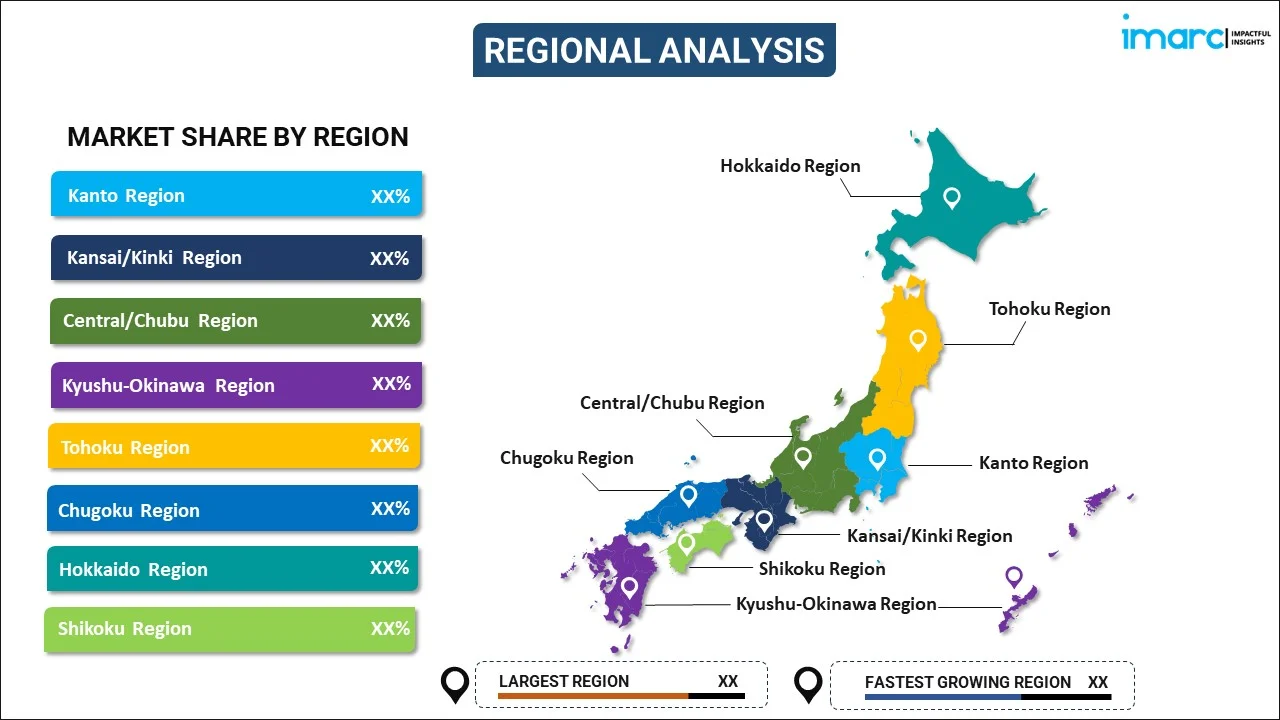

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Glycolic Acid Market News:

- July 2023: Japan reported that its population declined for the first time in all 47 prefectures for the first time, marking the steepest fall in the country's population since 1968, which was when the data began being collated. As per the data, in 2022, the population of Japanese citizens fell by about 800,000 people (-0.65%) to 122.4 million from the previous year. This marked the 14th straight year that Japan registered a drop in population. An aging population would invariably lead to growing demand for anti-aging creams and beauty products, which have glycolic acid as an ingredient.

Japan Glycolic Acid Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Synthetic, Natural |

| Purity Levels Covered | 99% Purity, 70% Purity, 60% Purity, 30% Purity, Others |

| Applications Covered | Personal Care and Cosmetics, Household, Textile, Food Processing, Pharmaceuticals, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan glycolic acid market performed so far, and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Japan glycolic acid market?

- What is the breakup of the Japan glycolic acid market on the basis of source?

- What is the breakup of the Japan glycolic acid market on the basis of purity level?

- What is the breakup of the Japan glycolic acid market on the basis of application?

- What are the various stages in the value chain of the Japan glycolic acid market?

- What are the key driving factors and challenges in the Japan glycolic acid market?

- What is the structure of the Japan glycolic acid market, and who are the key players?

- What is the degree of competition in the Japan glycolic acid market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan glycolic acid market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan glycolic acid market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan glycolic acid industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)