Japan Gut Health Supplements Market Size, Share, Trends and Forecast by Product Type, Form, Sales Channel, and Region, 2026-2034

Japan Gut Health Supplements Market Summary:

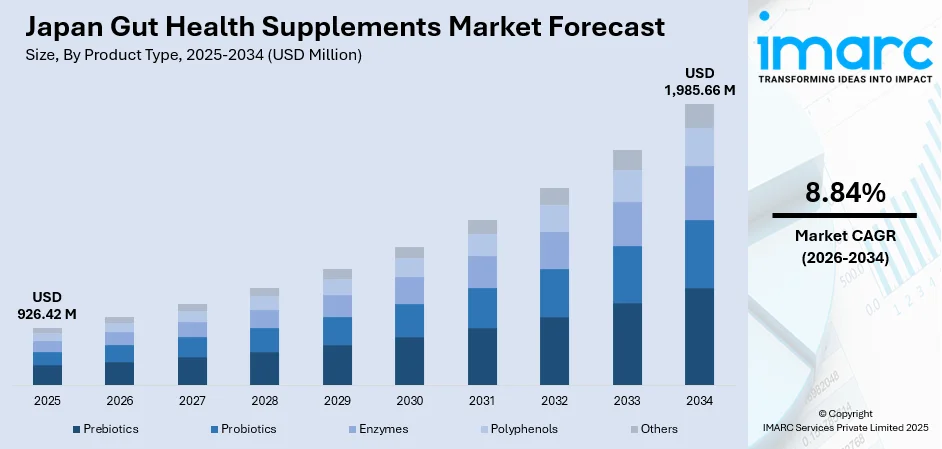

The Japan gut health supplements market size was valued at USD 926.42 Million in 2025 and is projected to reach USD 1,985.66 Million by 2034, growing at a compound annual growth rate of 8.84% from 2026-2034.

The Japan gut health supplements market is experiencing robust expansion driven by increasing consumer awareness of gut-brain axis connections, the nation's rapidly aging population seeking preventive healthcare solutions, and cultural preferences for scientifically-validated functional foods. Advancements in personalized nutrition, including AI-driven microbiome testing and tailored supplement formulations, are accelerating demand as Japanese consumers increasingly embrace precision health solutions. The expansion of e-commerce platforms and robust regulatory frameworks supporting Foods with Function Claims (FFC) are further augmenting the Japan gut health supplements market share.

Key Takeaways and Insights:

- By Product Type: Probiotics dominate the market with a share of 79% in 2025, driven by extensive clinical research supporting digestive health benefits and strong consumer trust in established probiotic strains.

- By Form: Capsules lead the market with a share of 38% in 2025, owing to superior convenience, precise dosage control, and enhanced shelf stability preferred by health-conscious consumers.

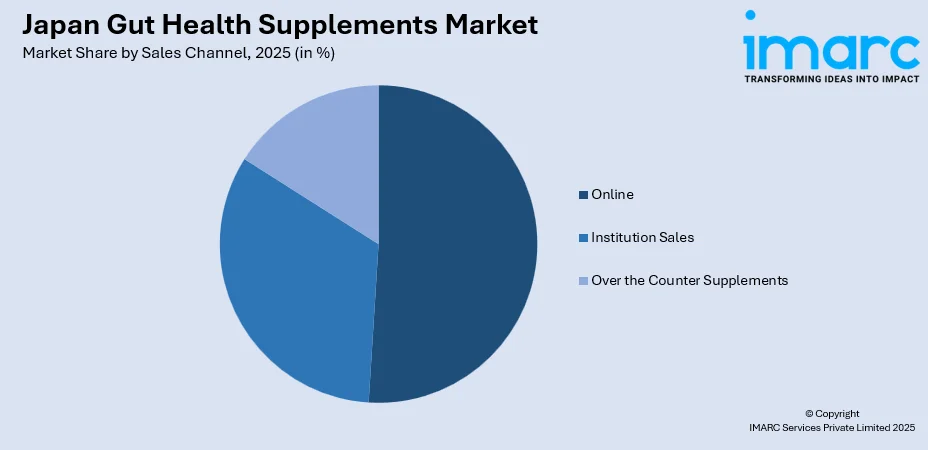

- By Sales Channel: Online represents the largest segment with a market share of 51% in 2025, supported by subscription-based models and comprehensive product information accessibility.

- Key Players: The Japan gut health supplements market exhibits moderate competitive intensity, with established domestic manufacturers competing alongside international entrants. Companies leverage extensive research capabilities and established distribution networks to maintain market positioning.

To get more information on this market Request Sample

Japan's gut health supplements market benefits from the nation's deep-rooted culture of functional foods and preventive healthcare, with consumers demonstrating strong preference for products backed by rigorous scientific validation. The market landscape is characterized by continuous product innovation, including multi-strain probiotic formulations and synbiotic combinations targeting specific health outcomes such as digestive wellness, immune support, and metabolic balance. The integration of traditional Japanese fermented food wisdom with modern microbiome science creates unique product differentiation opportunities for manufacturers. Consumer trust in clinically validated ingredients drives purchasing decisions, with particular emphasis on strain-specific research demonstrating measurable health benefits. This sophisticated consumer base expects comprehensive product information, including bacterial strain origins, manufacturing processes, and documented efficacy data. The cultural appreciation for quality and authenticity positions Japan as a discerning market where innovation must align with substantiated health claims.

Japan Gut Health Supplements Market Trends:

Rising Adoption of Personalized Microbiome-Based Nutrition

Personalized nutrition is transforming the Japan gut health supplements market, driven by advancements in microbiome testing and AI-driven health insights. Consumers increasingly seek tailored supplement regimens based on their unique gut bacteria profiles, with companies offering at-home gut microbiome test kits providing customized supplement recommendations. This trend aligns with Japan's tech-savvy population, which values data-driven health solutions integrating cutting-edge technology with preventive wellness approaches for optimized digestive health outcomes.

Expansion of Gut-Brain Axis Formulations

Japanese consumers are increasingly recognizing connections between gut health and mental wellness, driving demand for formulations targeting stress, anxiety, and sleep improvement. Products addressing the gut-brain axis are gaining significant traction among working professionals experiencing urban lifestyle pressures and seeking holistic wellness solutions. This growing awareness has prompted manufacturers to develop probiotic strains specifically researched for cognitive and emotional benefits. The trend reflects broader shifts toward preventive mental health approaches, with consumers seeking natural supplementation alternatives supporting both digestive function and psychological wellbeing simultaneously.

Growing Demand for Clean Label and Transparent Products

Japanese consumers are increasingly demanding clear labeling on CFU counts, origin of bacterial strains, and absence of synthetic additives in gut health supplements. The clean label movement emphasizes transparency, traceability, and sustainability throughout the product lifecycle. Manufacturers are responding by providing comprehensive ingredient disclosure, detailed strain documentation, and environmentally conscious packaging solutions. This trend reflects heightened consumer expectations for product authenticity and quality assurance, driving brands to prioritize honest communication and ethical sourcing practices.

Market Outlook 2026-2034:

The Japan gut health supplements market is positioned for sustained expansion as consumer awareness of digestive wellness continues rising alongside scientific validation of probiotic benefits. The convergence of traditional fermented food culture with modern microbiome research creates unique growth opportunities for innovative product development targeting diverse health objectives. E-commerce channel expansion and subscription-based purchasing models will continue driving market accessibility across urban and rural demographics. Personalized nutrition approaches leveraging gut microbiome testing are expected to gain significant traction among tech-savvy consumers seeking customized supplementation regimens. The aging population's focus on preventive healthcare will sustain demand for digestive wellness solutions supporting healthy longevity. Additionally, manufacturers are anticipated to introduce advanced formulations addressing gut-brain axis connections, immune function enhancement, and metabolic health optimization, further broadening the market's consumer appeal and application scope. The market generated a revenue of USD 926.42 Million in 2025 and is projected to reach a revenue of USD 1,985.66 Million by 2034, growing at a compound annual growth rate of 8.84% from 2026-2034.

Japan Gut Health Supplements Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Probiotics | 79% |

| Form | Capsules | 38% |

| Sales Channel | Online | 51% |

Product Type Insights:

- Prebiotics

- Probiotics

- Enzymes

- Polyphenols

- Others

The probiotics segment dominates with a market share of 79% of the total Japan gut health supplements market in 2025.

Probiotics maintain overwhelming dominance in Japan's gut health supplements market owing to decades of scientific research validating digestive and immune health benefits. Japanese consumers demonstrate strong preference for clinically-validated strains with documented colony-forming unit counts, reflecting the nation's emphasis on scientific substantiation. The Japan probiotics market is expected to reach USD 7,178.7 Million by 2033, exhibiting a growth rate (CAGR) of 6.72% during 2025-2033, driven by women representing 44% of end-user value share and increasing adoption among aging populations.

Manufacturers are innovating with shelf-stable, high-potency formulations to meet growing demand for convenient probiotic supplementation among health-conscious Japanese consumers. Multi-strain probiotic products combining Lactobacillus and Bifidobacterium species are gaining popularity for their synergistic effects on gut flora balance and enhanced digestive wellness benefits. Japan's FOSHU regulatory framework ensures product safety and efficacy, providing consumers confidence in probiotic supplement quality while supporting informed purchasing decisions based on scientifically-validated health claims.

Form Insights:

- Tablet

- Capsules

- Liquid

- Powder Premixes

- Gummies/Chewable

- Lozenges

- Liquid and Gels

The capsules segment leads with a share of 38% of the total Japan gut health supplements market in 2025.

Capsules maintain market leadership in Japan's gut health supplements sector owing to superior portability, extended shelf stability, and ease of consumption preferred by health-conscious consumers. Soft gel encapsulation provides enhanced protection for probiotic microorganisms from environmental stresses including moisture and light, ensuring higher stability and viability of bacterial strains throughout the product lifecycle. Japanese consumers particularly value the precise dosage control and convenience offered by capsule formulations for daily supplementation routines.

The capsules segment benefits from strong consumer preference for solid dosage forms that facilitate convenient consumption during busy professional schedules. Manufacturers continue innovating with delayed-release capsule technologies ensuring probiotic viability through gastric transit for optimal intestinal delivery. The format appeals particularly to working professionals and elderly populations seeking straightforward supplementation without preparation requirements. Capsules also enable effective combination of multiple probiotic strains and synbiotic formulations within single convenient dosage units.

Sales Channel Insights:

Access the comprehensive market breakdown Request Sample

- Institution Sales

- Over the Counter Supplements

- Drug Stores and Pharmacies

- Hypermarkets/Supermarkets

- Convenience Stores

- Health and Wellness Stores

- Specialty Stores

- Departmental Stores

- Online

- Company Websites

- 3rd Party/Mass Merchandiser

The online segment exhibits clear dominance with a 51% share of the total Japan gut health supplements market in 2025.

Online channels have transformed gut health supplement distribution in Japan, with e-commerce platforms providing consumers extensive product variety and comprehensive information accessibility. Major platforms have optimized their offerings specifically for the health supplement category, enabling both domestic and international brands to reach broader audiences. Subscription-based purchasing models ensure consistent supplement supply while enhancing brand loyalty among health-conscious consumers seeking convenient replenishment options.

Despite online dominance, physical retail maintains significance with pharmacies and drugstores serving as trusted touchpoints, particularly for elderly consumers valuing personal consultation and professional guidance. This suggests continued importance of omnichannel distribution strategies combining digital convenience with in-store expertise. Companies increasingly integrate digital health platforms with supplement recommendations, enhancing consumer engagement through personalized health management applications that bridge online purchasing with tailored wellness advice.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto Region witnesses high demand for gut health supplements due to Tokyo's concentration of health-conscious urban professionals, advanced healthcare infrastructure, and dense network of retail and e-commerce distribution channels. The region's high population density and disposable income levels support premium supplement adoption.

The Kansai/Kinki Region represents a significant market anchored by Osaka and Kyoto metropolitan areas, with strong consumer preference for scientifically validated gut health products. The region benefits from established pharmaceutical manufacturing presence and increasing young population focus on preventive health.

The Central/Chubu Region, centered on Nagoya, demonstrates steady gut health supplements adoption supported by manufacturing sector workforce seeking convenient health maintenance solutions. The region reflects established wellness consciousness among working professionals.

The Kyushu-Okinawa Region exhibits the fastest growth trajectory among Japanese regions. Okinawa's renowned longevity culture and traditional fermented food heritage create unique positioning for gut health supplement adoption and market expansion.

The Tohoku Region demonstrates accelerating growth driven by aging demographics seeking digestive wellness solutions. Sendai serves as the regional hub, with expanding health awareness supporting increased probiotic supplement adoption across the area.

The Chugoku Region presents steady market development supported by Hiroshima's urban consumer base and expanding retail infrastructure. Healthcare accessibility improvements and rising preventive health consciousness drive incremental supplement adoption among middle-aged populations.

Hokkaido Region's market development benefits from the region's aging population demographics and growing interest in natural health solutions. The region's dairy industry heritage supports consumer familiarity with probiotic products, facilitating supplement market penetration.

The Shikoku Region represents an emerging market opportunity with gradually increasing health supplement awareness among its predominantly elderly population. Limited retail density creates opportunities for e-commerce channel expansion and direct-to-consumer supplement distribution models.

Market Dynamics:

Growth Drivers:

Why is the Japan Gut Health Supplements Market Growing?

Rapidly Aging Population Driving Preventive Healthcare Demand

Japan's unprecedented demographic shift toward an aging society is significantly driving gut health supplement demand as elderly individuals prioritize digestive wellness for healthy aging. According to Japan's Ministry of Internal Affairs and Communications, approximately 29.3% of the Japanese population was aged 65 and older as of September 2024, representing the highest proportion globally. This demographic increasingly seeks supplements addressing age-related digestive concerns including nutrient absorption, constipation, and immune function decline. Elderly consumers particularly favor easy-to-consume formats including capsules, powders, and liquids, stimulating continuous product innovation. Japan's advanced healthcare awareness and cultural emphasis on quality of life in old age create sustained demand for scientifically-validated gut health solutions supporting longevity.

Robust Regulatory Framework Supporting Consumer Confidence

Japan's comprehensive regulatory systems including Foods for Specified Health Uses (FOSHU) and Foods with Function Claims (FFC) provide strong frameworks ensuring product safety and efficacy, building consumer confidence in gut health supplements. The Consumer Affairs Agency's notification-based FFC system enables manufacturers to communicate scientifically-substantiated health claims, streamlining market entry while maintaining quality standards. This regulatory clarity attracts both domestic innovation and international brand entry, expanding product availability. Japanese consumers demonstrate strong preference for products carrying official health claim certifications, driving manufacturer compliance and investment in clinical research substantiating gut health benefits.

E-commerce Expansion Enhancing Market Accessibility

The rapid expansion of e-commerce platforms is fundamentally reshaping gut health supplement distribution in Japan, providing consumers wider product variety and enhanced accessibility. Major platforms have optimized offerings specifically for the health supplement category, enabling targeted marketing and personalized customer experiences. Subscription-based purchasing models ensure consistent supplement supply while enhancing brand loyalty. The integration of digital health platforms with supplement recommendations through AI-driven analytics creates personalized purchasing experiences aligned with individual health goals. This digital transformation enables both domestic manufacturers and international brands to efficiently reach Japan's health-conscious consumer base.

Market Restraints:

What Challenges the Japan Gut Health Supplements Market is Facing?

High Price Points Limiting Mass Market Penetration

Premium pricing of gut health supplements, particularly those with specialized probiotic strains or advanced formulations, restricts adoption among price-sensitive consumer segments. The average price premium for probiotic supplements over conventional supplements, though declining, continues limiting accessibility for mid-income households seeking affordable preventive healthcare solutions.

Consumer Confusion Regarding Product Differentiation

The proliferation of gut health supplement products with varying probiotic strains, CFU counts, and health claims creates consumer confusion regarding product selection and efficacy expectations. Distinguishing between FOSHU-approved products, FFC-labeled supplements, and conventional offerings requires substantial consumer education, potentially delaying purchase decisions among less-informed buyers.

Raw Material Cost Volatility and Supply Chain Challenges

Fluctuations in raw material prices and logistical challenges impact production costs and supply consistency for gut health supplement manufacturers. Ensuring stable sourcing of specialized probiotic strains and maintaining cold chain integrity for live cultures presents operational complexities that influence product pricing and availability across distribution channels.

Competitive Landscape:

The Japan gut health supplements market exhibits moderate competitive intensity characterized by established domestic manufacturers maintaining significant market presence alongside international entrants seeking category penetration. The competitive environment emphasizes research-driven product development, with companies investing substantially in clinical trials validating strain-specific health benefits. Distribution network strength across pharmacies, health food stores, and e-commerce platforms represents a critical competitive differentiator. Manufacturers increasingly pursue multi-strain formulations and synbiotic combinations addressing diverse consumer health objectives. Strategic partnerships between ingredient suppliers and finished product manufacturers accelerate innovation cycles while regulatory compliance capabilities determine market entry success.

Recent Developments:

- May 2025: Probi partnered with Nomura Dairy Products to launch Japan's first fermented carrot juice beverage enriched with LP299V probiotic strain under the "My Flora" brand, marking a significant milestone in plant-based probiotic product development for digestive health.

- April 2025: Morinaga Milk Industry released a synbiotic yogurt containing Bifidobacterium longum BB-536 plus lactulose, demonstrating benefits for digestion, mental health, stress resilience, and work performance.

Japan Gut Health Supplements Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Prebiotics, Probiotics, Enzymes, Polyphenols, Others |

| Forms Covered | Tablet, Capsules, Liquid, Powder Premixes, Gummies/Chewable, Lozenges, Liquid and Gels |

| Sales Channels Covered |

|

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan gut health supplements market size was valued at USD 926.42 Million in 2025.

The Japan gut health supplements market is expected to grow at a compound annual growth rate of 8.84% from 2026-2034 to reach USD 1,985.66 Million by 2034.

Probiotics dominated the Japan gut health supplements market with a 79% share in 2025, driven by extensive clinical research validating digestive and immune health benefits and strong consumer trust in established probiotic strains supported by Japan's functional food regulatory framework.

Key factors driving the Japan gut health supplements market include the rapidly aging population seeking preventive healthcare solutions, robust regulatory frameworks supporting consumer confidence, expanding e-commerce distribution channels, increasing gut-brain axis awareness, and continuous product innovation.

Major challenges include premium pricing limiting mass market penetration, consumer confusion regarding product differentiation among numerous offerings, raw material cost volatility, supply chain complexities for specialized probiotic strains, and intensive competition requiring substantial research investment for differentiation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)