Japan Health Insurance Market Report by Provider (Private Providers, Public Providers), Type (Life-Time Coverage, Term Insurance), Plan Type (Medical Insurance, Critical Illness Insurance, Family Floater Health Insurance, and Others), Demographic (Minor, Adults, Senior Citizen), Provider Type (Preferred Provider Organizations (PPOs), Point of Service (POS), Health Maintenance Organizations (HMOs), and Exclusive Provider Organizations (EPOs)), and Region 2025-2033

Japan Health Insurance Market Size:

The Japan health insurance market size reached USD 148.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 296.3 Billion by 2033, exhibiting a growth rate (CAGR) of 8% during 2025-2033. Burgeoning aging population, rising healthcare costs, availability of universal healthcare system, the growing prevalence of chronic diseases, advancements in medical technology, expansion of telemedicine, escalating corporate insurance adoption, and the increasing number of foreign residents requiring health coverage are some of the factors driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 148.6 Billion |

| Market Forecast in 2033 | USD 296.3 Billion |

| Market Growth Rate (2025-2033) | 8% |

Japan Health Insurance Market Analysis:

- Major Market Drivers: An aging population in Japan has considerably boosted the need for healthcare services, such as senior care, which is one of the primary factors driving the market growth. This is further supported by government initiatives and the availability of universal health coverage. Moreover, increased awareness about lifestyle diseases and preventive healthcare are driving the demand for health services, which is further fueling the Japan health insurance market growth. The market is also driven by the advancement in technology, such as telemedicine and electronic health records (EHR), which enable better access to services with utmost convenience. Apart from this, Japan's economic reliability has burgeoned the investments into healthcare infrastructure, which is further providing a thrust to the market growth.

- Key Market Trends: The increasing convergence of digital platforms for healthcare services is one of the key market trends. Insurers are leveraging telemedicine, mobile apps, and digital records to simplify service delivery, which is further fostering the market growth. Moreover, the growing use of data analytics to enable more personalized insurance policies, including a custom coverage plan for an individual based on their health data, is facilitating the market growth. In line with this, the burgeoning per capita income has boosted the demand for quicker and more comprehensive services through private health insurance, which is further accelerating the market growth.

- Geographical Trends: Tokyo leads the health insurance market in Japan as it is home to umpteen primary care clinics and a high population density. It is also backed by a sizeable share of the nation, which has further surged the need for health insurance services. Additionally, Tokyo has several corporate headquarters, which is further driving the Japan health insurance market share. Moreover, as the economic and political capital of Japan, Tokyo has one of highest ratios pf private health insurance service coverage in the country, which is further accelerating the market growth.

- Competitive Landscape: The competitive landscape of the market has been examined in the report, along with the detailed profiles of the major players operating in the industry.

- Challenges and Opportunities: The rapidly aging population has put significant pressure on healthcare costs, which represents one of the primary factors hindering the market growth. The slow birth rate, further states that fewer people are working and paying premiums, which is another factor restraining the market growth. However, the operational efficiency and cost saving can be achieved with technological advancements, such as artificial intelligence (AI) in diagnostics and, telehealth, which is offering a lucrative opportunity for the market growth. Apart from this, the availability of personalized preventative healthcare and the growing demand for private healthcare services are propelling the market growth.

Japan Health Insurance Market Trends:

Aging Population

One of the primary drivers boosting the Japan health insurance market dynamic is the aging population. An age structure of over 28% individuals aged 65 or older, ushers an ageing dynamic to the country that stands as one of the most rapidly aging society in the world, which is further demonstrating a growing need for healthcare services. As per the industry reports, national figures indicate that about 125 million people of the country's population is over 65 years old. In addition, the elderly population faces a higher prevalence of chronic conditions such as heart disease, dementia, and diabetes, placing further financial pressure on both the healthcare system and insurance providers. In response, major health insurers are developing services tailored to meet the needs of this growing elderly demographic, which is driving further market expansion.

Government’s Universal Healthcare System

The essential factor for the market growth is the availability of universal healthcare system, which allows virtually all citizens and residents access to medical services. Founded in 1961, it is financed by the public health insurance program funded through National Health Insurance (NHI) and Employees' Health Insurance (EHI). Additionally, this system structure enables relatively low co-payment for care, which is further creating a positive Japan health insurance market outlook. Moreover, the growing demand for health insurance, the inflating consumer per capita income, and government efforts are stimulating the market growth.

Rising Healthcare Costs

The rising cost of healthcare in Japan is a crucial driver of the health insurance market. Factors contributing to these increasing costs include the aging population, the growing prevalence of chronic diseases, and the advancement of medical technologies. As healthcare becomes more expensive, individuals and families are more likely to seek comprehensive insurance coverage to protect against high medical bills. Businesses also look for ways to manage employee healthcare expenses, turning to group insurance plans. The government, faced with rising costs in its universal healthcare system, has introduced cost-control measures such as price reductions for medical services and pharmaceuticals.

Japan Health Insurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on provider, type, plan type, demographics, and provider type.

Breakup by Provider:

- Private Providers

- Public Providers

The report has provided a detailed breakup and analysis of the market based on the provider. This includes private and public providers.

The public providers segment is driven by Japan’s universal healthcare system, which ensures that all citizens and long-term residents are covered under either the National Health Insurance (NHI) or Employees' Health Insurance (EHI). These government-backed programs provide a broad foundation for the healthcare system, aiming to deliver affordable healthcare to the population while managing costs through strict price controls on medical services and pharmaceuticals. An aging population is a major factor increasing demand within this segment, as the elderly require more frequent and specialized medical care. The prevalence of chronic diseases, such as hypertension, diabetes, and cancer, further drives the need for comprehensive public health insurance coverage.

As per the Japan health insurance market forecast, the private providers segment is driven by a growing demand for supplemental coverage and personalized healthcare services. While the universal healthcare system offers comprehensive basic coverage, many individuals seek private insurance to cover services not included in the public plan, such as advanced medical treatments, private hospital rooms, and specialized care. The rising healthcare costs and out-of-pocket expenses are encouraging more people to turn to private providers for financial protection beyond what public insurance covers. Moreover, Japan’s aging population significantly impacts the private segment, as elderly individuals often require long-term care, home nursing, and rehabilitation services, many of which are not fully covered under public insurance.

Breakup by Type:

- Life-Time Coverage

- Term Insurance

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes life-time coverage and term insurance.

The life-time coverage segment is driven by Japan's aging population, increased life expectancy, and a strong cultural preference for financial security. In a country with one of the longest life expectancies, people seek comprehensive, lifelong health protection to cover medical expenses well into old age. The fear of outliving savings or facing unexpected medical costs in later life encourages individuals to invest in lifetime health insurance. Additionally, Japan’s robust universal healthcare system covers basic medical needs but leaves gaps, such as advanced treatments or specialized care, that lifetime insurance can fill.

The term insurance segment in Japan is driven primarily by the need for affordable and short-term health protection, particularly among younger and middle-aged demographics. Unlike lifetime insurance, term policies offer coverage for a specific period, making them less expensive and more appealing to those who seek temporary financial protection. As corporate employment is prevalent in Japan, many workers are covered by employer-provided health plans, reducing the need for lifetime coverage and increasing demand for term insurance. Economic factors, including job insecurity and fluctuating incomes, also contribute to the popularity of term policies, as individuals may be hesitant to commit to long-term premiums. Additionally, term insurance is favored by people with specific financial goals, such as covering healthcare costs during child-rearing years or while paying off a mortgage.

Breakup by Plan Type:

- Medical Insurance

- Critical Illness Insurance

- Family Floater Health Insurance

- Others

The report has provided a detailed breakup and analysis of the market based on the plan type. This includes medical insurance, critical illness insurance, family floater health insurance, and others.

As per the Japan health insurance market research report, the medical insurance segment is driven by aging population and the rising incidence of chronic diseases, such as diabetes and hypertension, which require long-term treatment and regular medical care. Increasing healthcare costs, due to advanced medical procedures and expensive hospital stays, also push individuals to seek comprehensive coverage. The government's universal healthcare system covers a portion of medical expenses, but gaps in coverage encourage consumers to purchase additional private medical insurance. Another key driver is Japan’s emphasis on preventive care, with many insurance plans now offering wellness programs to mitigate future medical expenses.

The critical illness insurance segment is driven by the increasing prevalence of life-threatening conditions such as cancer, stroke, and heart disease in Japan, especially among its aging population. These illnesses often require prolonged treatment and recovery periods, leading to significant financial burdens for individuals and families. As treatment costs for such conditions rise, especially with advancements in medical technology, consumers are turning to critical illness insurance to protect against the high out-of-pocket expenses that are often not fully covered by standard medical insurance or government healthcare.

The family floater health insurance segment is driven by the increasing need for comprehensive and cost-effective health coverage for entire families in Japan. With rising healthcare costs, many households prefer a single policy that covers multiple family members, providing financial security and convenience. The aging population plays a significant role, as families seek insurance that covers both children and elderly parents under one plan, simplifying the management of healthcare needs across generations. Japan’s universal healthcare system provides a baseline of coverage, but families often look for private insurance to fill the gaps, particularly for treatments not fully covered by public insurance, such as specialized care or advanced treatments.

The other segments in Japan's health insurance market, such as senior citizen plans, dental insurance, and maternity coverage, are driven by specific demographic needs and lifestyle factors. Senior citizen plans are primarily driven by the rapidly aging population, which requires specialized insurance products that focus on geriatric care, including long-term care and support for chronic conditions. Dental insurance is gaining traction due to increasing awareness about oral health's impact on overall well-being and the high out-of-pocket costs associated with dental treatments not fully covered by public healthcare.

Breakup by Demographics:

- Minor

- Adults

- Senior Citizen

A detailed breakup and analysis of the market based on the demographics have also been provided in the report. This includes minor, adults, and senior citizens.

The minor segment is driven by the increasing focus on preventive healthcare, vaccination programs, and parental demand for comprehensive health coverage. Parents seek insurance plans that cover childhood illnesses, accidents, and regular check-ups. Government support through Japan's universal healthcare system ensures minors receive coverage for necessary medical care, while parents often supplement this with private insurance for additional services like dental and specialist visits. The rise in awareness of mental health and developmental disorders among children has also spurred demand for policies that address early diagnosis and treatment.

The adult segment is driven by the growing need for comprehensive health coverage due to increasing work-related stress, lifestyle diseases, and the high costs of medical care. In Japan, many adults are enrolled in employer-sponsored health insurance plans, which provide coverage for routine medical care, hospitalization, and preventive services. The rise in non-communicable diseases like diabetes, hypertension, and heart disease among working adults has heightened the demand for policies that cover chronic disease management and regular check-ups. Additionally, the adoption of wellness programs by corporations encourages adults to maintain their health, reducing long-term healthcare costs.

The senior citizen segment is driven by Japan’s rapidly aging population, making this the largest and most significant segment in the health insurance market. Seniors typically require more frequent healthcare services due to age-related diseases like dementia, arthritis, and cardiovascular conditions. Long-term care services, including nursing homes and in-home care, are also crucial, with insurance policies catering to these needs. Government programs like the National Health Insurance and Long-term Care Insurance provide basic coverage, but many seniors opt for private insurance to cover gaps, such as additional medical procedures and medications.

Breakup by Provider Type:

- Preferred Provider Organizations (PPOs)

- Point of Service (POS)

- Health Maintenance Organizations (HMOs)

- Exclusive Provider Organizations (EPOs)

The report has provided a detailed breakup and analysis of the market based on the provider type. This includes preferred provider organizations (PPOs), point of service (POS), health maintenance organizations (HMOs), and exclusive provider and organizations (EPOs).

The preferred provider organizations (PPOs) segment is driven by the demand for flexibility in choosing healthcare providers. PPOs offer greater freedom for patients to select doctors and hospitals without requiring referrals from primary care physicians. In Japan, the growing preference for personalized healthcare and the desire for access to specialized services outside of traditional networks push the adoption of PPOs. Additionally, corporate demand for flexible insurance plans that cater to diverse employee needs has contributed to the growth of this segment.

The point of service (POS) segment is driven by the hybrid model it offers, combining features of both HMOs and PPOs. POS plans appeal to those seeking managed care while maintaining the flexibility to seek out-of-network services with referrals. The segment benefits from the government’s push for efficient healthcare utilization and the need for a structured system to manage costs. In Japan, as chronic diseases rise, the integrated approach of POS plans ensures that patients have coordinated care, encouraging preventative healthcare measures while providing access to specialists when needed.

The health maintenance organizations (HMOs) segment is driven by the focus on cost control and preventive care. HMOs in Japan are attractive for their emphasis on keeping healthcare costs low by requiring members to choose a primary care provider and obtain referrals for specialist services. This managed care approach aligns with the government’s objectives to reduce unnecessary medical expenses and optimize the healthcare system. The rise in chronic disease management and the need for affordable insurance solutions drive the demand for HMOs, as they promote regular checkups and preventive treatments.

The exclusive provider organizations (EPOs) segment is driven by the demand for cost-effective, streamlined healthcare options. EPOs restrict patients to a select network of providers but do not require referrals for specialists, offering a middle ground between flexibility and cost savings. In Japan, corporate interest in affordable group insurance plans and the increasing adoption of telemedicine have bolstered this segment. As healthcare costs rise, employers and individuals prefer EPOs for their ability to provide comprehensive coverage while keeping premiums low, especially in metropolitan areas where provider networks are well-established.

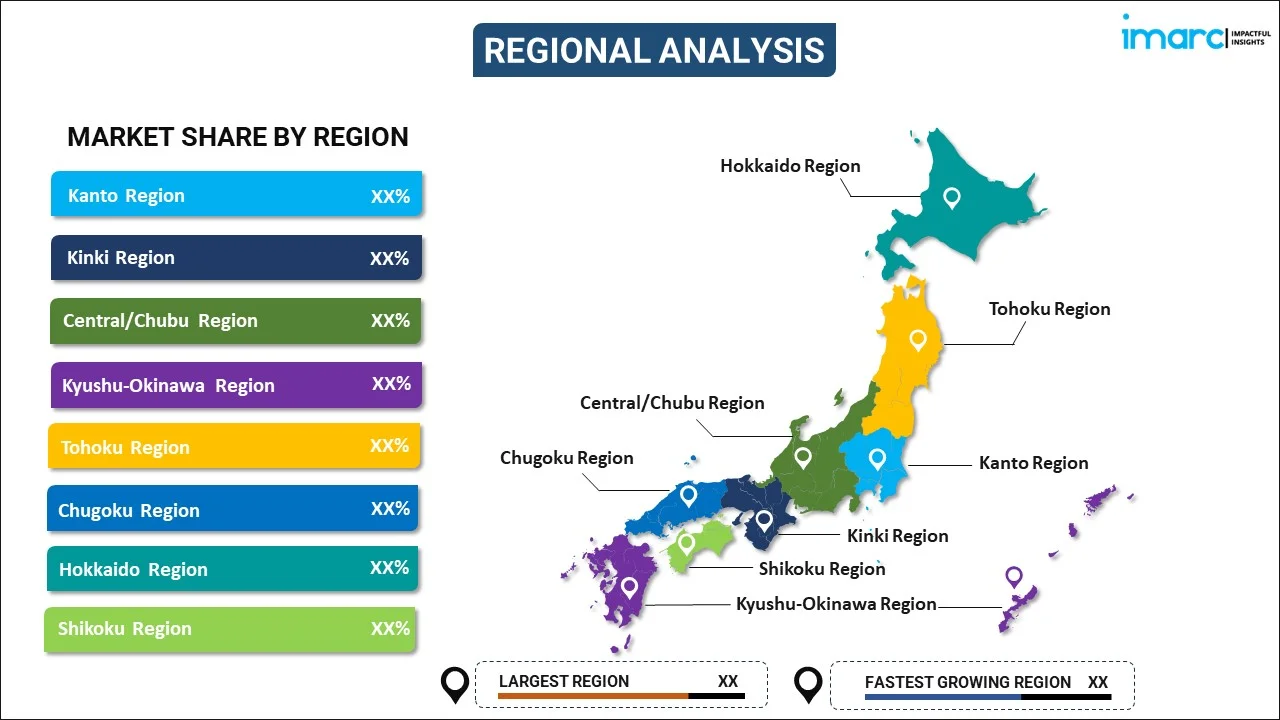

Breakup by Region:

- Kanto Region

- Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

The Kanto region's market is driven by its dense urban population, particularly in Tokyo, Japan's capital and largest city. The high concentration of businesses and expatriates in this area creates strong demand for both corporate and individual health insurance plans. Additionally, the region's aging population increases the need for comprehensive long-term care and specialized insurance products. With a highly developed healthcare infrastructure, the Kanto region is a hub for both public and private insurers, pushing market competition and innovation.

The Kinki region's market is driven by its economic powerhouses, including cities like Osaka and Kyoto, which house numerous corporations and industries. This leads to high demand for employer-sponsored health insurance plans. The region's aging population further fuels the need for long-term care coverage and chronic disease management. The local government’s initiatives to promote healthcare innovations, including telemedicine, also contribute to the growing need for specialized insurance products catering to both residents and businesses.

The Chubu region's market is driven by its diverse industrial base, including manufacturing and automotive industries, particularly in cities like Nagoya. The corporate sector demands group insurance packages for employees, while the region’s aging population heightens the need for long-term care and chronic disease coverage. The region’s proximity to both the Kanto and Kansai regions allows for a spillover of advanced healthcare services, further driving demand.

The Kyushu-Okinawa region's market is driven by a combination of an aging population and growing tourism, especially in Okinawa, which heightens the need for both local and expatriate health insurance. The region’s relatively rural landscape increases the demand for telemedicine and mobile healthcare solutions, making insurance policies that cover these services more attractive. Additionally, the government’s focus on promoting the region as a hub for medical research and tourism boosts private insurance offerings.

The Tohoku region's market is driven primarily by its aging and declining population, leading to an increased need for long-term care and healthcare services. With many remote areas, the region faces challenges in healthcare accessibility, which has driven the adoption of telemedicine and mobile healthcare services. Insurance products that offer coverage for these emerging services are in high demand. The region is also recovering from the 2011 earthquake and tsunami, with a focus on improving healthcare infrastructure, which further stimulates the need for comprehensive health insurance policies covering disaster-related healthcare services.

The Chugoku region's market is driven by its mix of industrial cities like Hiroshima and rural areas, creating diverse healthcare needs. The aging population significantly impacts demand for long-term care and chronic disease management insurance. Telemedicine has become increasingly important in this region due to the distance from urban healthcare facilities, driving demand for insurance coverage of remote care services. Additionally, Hiroshima’s history as a center for peace and medical research attracts both domestic and international patients, boosting the need for specialized health insurance plans.

The Hokkaido region's market is driven by its large rural population and challenging geography, which increases the reliance on telemedicine and mobile healthcare services. The region’s aging demographic further boosts demand for long-term care insurance. The harsh climate in Hokkaido also leads to a higher incidence of seasonal health issues, contributing to the demand for comprehensive health coverage. Additionally, Hokkaido's growing tourism industry, particularly during the winter months, creates a need for short-term insurance products for both domestic and international visitors.

The Shikoku region's market is driven by its aging population and rural healthcare challenges. With limited access to advanced medical facilities, there is a growing demand for insurance products that cover telemedicine and mobile healthcare services. The region’s agricultural economy also influences health insurance needs, as workers require coverage for both occupational health and chronic conditions. Additionally, Shikoku’s efforts to modernize its healthcare infrastructure, particularly in the area of elderly care, contribute to the increasing demand for long-term care insurance.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided.

- Top companies in Japan health insurance market are focusing on several strategic initiatives to adapt to evolving market demands. One major approach is the expansion of digital health services, such as telemedicine and mobile healthcare applications, which are increasingly popular due to their convenience and the country's aging population. Additionally, insurers are expanding their supplemental insurance offerings to cover gaps left by the government’s universal healthcare system, particularly for specialized treatments and long-term care. To address the rising healthcare costs, key players are enhancing corporate insurance packages, catering to businesses that seek cost-effective solutions for employee health benefits. They are also focusing on expatriate and international insurance plans to cater to the growing foreign workforce and medical tourists. Furthermore, umpteen insurers are involved in regulatory discussions to adapt policies that encourage innovation while maintaining cost efficiency.

Japan Health Insurance Market News:

- In 2023, Nippon Life Insurance Company announced a strategic partnership with H2O.ai to enhance its insurance business through advanced machine learning technologies. This collaboration aims to integrate H2O.ai’s AI-driven solutions to improve customer health management and streamline insurance processes. The implementation of these machine learning models is expected to transform how Nippon Life analyzes health data, predicts customer needs, and personalizes insurance offerings.

- In 2024, Dai-ichi Life Insurance Company made a significant move by announcing its investment in the Nippon Life Insurance Company’s insurance technology venture, known as Digital Life Holdings. This investment, amounting to approximately ¥10 billion (about $76 million), aims to enhance Dai-ichi Life's capabilities in digital insurance services. The collaboration focuses on leveraging advanced technologies to improve customer experiences, streamline operations, and drive innovation in the health insurance sector.

Japan Health Insurance Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Providers Covered | Private Providers, Public Providers |

| Types Covered | Life-Time Coverage, Term Insurance |

| Plan Types Covered | Medical Insurance, Critical Illness Insurance, Family Floater Health Insurance, Others |

| Demographics Covered | Minor, Adults, Senior Citizen |

| Provider Types Covered | Preferred Provider Organizations (PPOs), Point of Service (POS), Health Maintenance Organizations (HMOs), and Exclusive Provider Organizations (EPOs) |

| Regions Covered | Kanto Region, Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan health insurance market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the Japan health insurance market?

- What is the impact of each driver, restraint, and opportunity on the Japan health insurance market?

- What is the breakup of the market based on the provider?

- Which is the most attractive provider in the Japan health insurance market?

- What is the breakup of the market based on the type?

- Which is the most attractive type in the Japan health insurance market?

- What is the breakup of the market based on the plan type?

- Which is the most attractive plan type in the Japan health insurance market?

- What is the breakup of the market based on the demographics?

- Which is the most attractive demographics in the Japan health insurance market?

- What is the breakup of the market based on the provider type?

- Which is the most attractive provider type in the Japan health insurance market?

- What is the competitive structure of the market?

- Who are the key players/companies in the Japan health insurance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan health insurance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan health insurance market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan health insurance industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)