Japan Heat Reflective Roof Coatings Market Size, Share, Trends and Forecast by Type, Resin Type, Application, and Region, 2026-2034

Japan Heat Reflective Roof Coatings Market Summary:

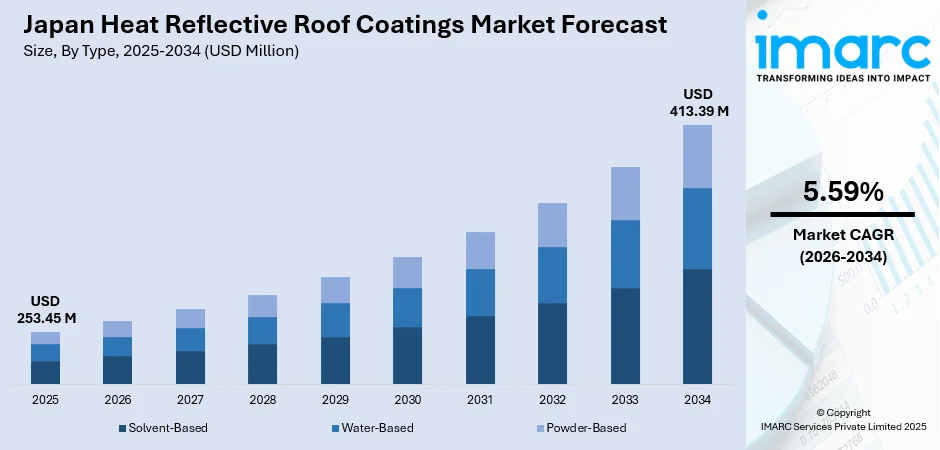

The Japan heat reflective roof coatings market size was valued at USD 253.45 Million in 2025 and is projected to reach USD 413.39 Million by 2034, growing at a compound annual growth rate of 5.59% from 2026-2034.

The Japan heat reflective roof coatings market is expanding rapidly due to intensifying urban heat island effects in densely populated metropolitan areas and heightened awareness regarding energy-efficient building solutions. Government-led initiatives promoting climate-resilient infrastructure and carbon neutrality targets are accelerating adoption across residential and commercial segments. Technological advancements in coating reflectivity and durability, combined with the growing demand for sustainable construction materials, continue to strengthen the Japan heat reflective roof coatings market share.

Key Takeaways and Insights:

-

By Type: Solvent-based dominates the market with a share of 52% in 2025, owing to its superior adhesion properties, exceptional durability under harsh weather conditions, and proven performance across industrial and commercial applications requiring long-lasting thermal protection.

-

By Resin Type: Epoxy leads the market with a share of 38% in 2025, driven by its outstanding chemical resistance, robust waterproofing capabilities, and excellent adhesion to various substrates, including metal, concrete, and asphalt roofing surfaces.

-

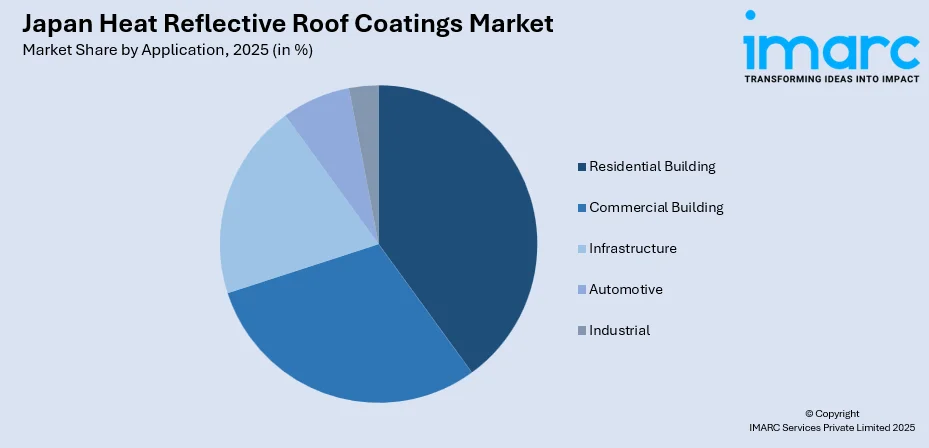

By Application: Residential building represents the largest segment with a market share of 29% in 2025, reflecting growing homeowner awareness regarding energy savings, government subsidies for home renovations, and increasing concerns about indoor comfort during Japan's increasingly hot summers.

-

Key Players: Key players are driving the Japan heat reflective roof coatings market by investing in advanced formulations with enhanced reflectivity and longevity. Their focus on developing eco-friendly, low volatile organic compound (VOC) products meeting stringent environmental regulations strengthens market positioning.

To get more information on this market Request Sample

The market benefits from Japan's strong technical expertise in specialty coating formulations and increasing integration of cool roof technologies with smart building systems. Rising summer temperatures and intensifying urban heat island effects across major metropolitan areas drive urgent demand for effective thermal management solutions. Japan experienced heightened climate-related health impacts in 2024, with individuals experiencing an average of 48.5 heatwave days. Commercial, industrial, and residential property owners are increasingly prioritizing coatings that offer long-term durability, lower cooling costs, and improved occupant comfort. Technological advancements in high-performance, eco-friendly formulations are expanding application potential across both new construction and refurbishment projects. As cities invest in heat island mitigation and climate resilience, heat reflective roof coatings continue to gain strategic importance, supporting sustained market expansion across Japan.

Japan Heat Reflective Roof Coatings Market Trends:

Rising Urban Heat Island Mitigation Initiatives

Japanese municipalities are increasingly implementing comprehensive urban heat island countermeasures that prominently feature heat reflective roof coatings. During the period from 15 to 21 July 2024, the Fire and Disaster Management Agency indicated that 9,078 individuals were admitted to hospitals due to heat stroke throughout Japan, underscoring the critical need for heat mitigation technologies. Municipal authorities increasingly promote reflective roofing as a cost-effective measure to reduce heat buildup in densely populated districts. These coatings help decrease energy consumption, enhance building comfort, and support broader climate resilience goals.

Integration of Nanotechnology and Advanced Materials

Coating manufacturers are incorporating nanotechnology-enhanced systems offering superior thermal insulation, ultraviolet resistance, and self-cleaning capabilities. These advanced formulations utilize ceramic particles and specialty pigments that reflect both visible and near-infrared light. Japanese startup SPACECOOL developed a radiative cooling membrane for the Gas Pavilion at Expo 2025 Osaka that cools surfaces without energy consumption and emits internal warmth into outer space via the atmosphere, showcasing the country's leadership in innovative cooling technologies.

Expansion of Retail Channels

Retail expansion is driving the market growth, as home improvement stores, specialty paint outlets, and large retail chains broaden product visibility and accessibility for consumers and contractors. As per IMARC Group, the Japan retail market size reached USD 1,779.7 Billion in 2024. Wider shelf presence encourages adoption by offering easy-to-understand performance comparisons, ready availability, and competitive pricing. Retailers also promote energy-saving solutions through in-store demonstrations and seasonal campaigns, increasing customer awareness. This expanded retail reach strengthens market penetration by making heat reflective coatings more approachable for residential users and small contractors.

Market Outlook 2026-2034:

The Japan heat reflective roof coatings market is positioned for sustained expansion driven by mandatory energy conservation standards for all newly built houses and continued government support for sustainable building practices. The market generated a revenue of USD 253.45 Million in 2025 and is projected to reach a revenue of USD 413.39 Million by 2034, growing at a compound annual growth rate of 5.59% from 2026-2034. Increasing frequency of extreme heat events, advancing coating technologies, and growing retrofit demand from aging building stock will continue to propel the market growth throughout the forecast period.

Japan Heat Reflective Roof Coatings Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Solvent-Based |

52% |

|

Resin Type |

Epoxy |

38% |

|

Application |

Residential Building |

29% |

Type Insights:

- Solvent-Based

- Water-Based

- Powder-Based

Solvent-based dominates with a market share of 52% of the total Japan heat reflective roof coatings market in 2025.

Solvent-based heat reflective roof coatings maintain market leadership due to their exceptional performance characteristics, including superior adhesion, weather resistance, and long-term durability. These coatings deliver consistent results across varying temperature conditions and demonstrate excellent penetration into substrate surfaces, creating stronger bonds that withstand Japan's humid climate and seasonal temperature fluctuations. Their ability to be applied via roller and spraying methods offers installation flexibility across diverse roofing configurations.

The segment's dominance is reinforced by established usage patterns in industrial and commercial applications where proven performance records influence purchasing decisions. Solvent-based coatings are widely adopted due to their compatibility with diverse roofing materials, such as metal, asphalt, and concrete. These coatings also deliver strong ultraviolet (UV) protection, reducing heat absorption and preventing surface degradation over time. Their proven track record, ease of application, and performance consistency reinforce their leadership in the market.

Resin Type Insights:

- Epoxy

- Polyester

- Silicon

- Acrylic

Epoxy leads with a share of 38% of the total Japan heat reflective roof coatings market in 2025.

Epoxy-based heat reflective roof coatings hold prominence due to their exceptional durability, chemical resistance, and strong adhesion to a wide range of substrates. Their robust protective layer makes them ideal for industrial facilities, warehouses, and commercial buildings exposed to pollutants, salt air, and temperature variations. Epoxy systems also offer superior mechanical strength, helping roofs withstand Japan’s frequent typhoons and heavy rainfall while maintaining reflective efficiency.

Moreover, epoxy coatings provide long service life with minimal maintenance, making them cost-effective for large-scale property owners and facility managers. Their ability to form seamless, impermeable surfaces enhances energy-saving performance by reducing heat absorption and improving indoor temperature stability. The rising focus on asset longevity, especially in aging urban infrastructure, further boosts adoption. With additional advantages, such as compatibility with topcoat systems and high-performance sealing, epoxy remains a preferred choice across multiple applications.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Residential Building

- Commercial Building

- Infrastructure

- Automotive

- Industrial

Residential building represents the leading segment with a 29% share of the total Japan heat reflective roof coatings market in 2025.

Residential building applications lead market demand as homeowners increasingly recognize heat reflective coatings as cost-effective solutions for reducing cooling energy consumption and improving indoor comfort. Rising summer temperatures across Japan drive urgent demand for effective thermal management solutions in housing.

Government incentive programs, specifically targeting residential energy efficiency improvements, accelerate adoption within this segment. Urbanization trends, residential building construction projects, and surging home renovation activities throughout Japan's major metropolitan areas support sustained demand growth. In September 2025, Hospitality giant Hilton reached an agreement with Japanese construction firm Mitsui Fudosan to create Waldorf Astoria-branded upscale rental residences at a mixed-use development in Tokyo. The residential segment benefits from increasing awareness campaigns educating consumers about long-term cost savings and environmental benefits associated with heat reflective roof coating installations.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto Region holds prominence due to its dense urban heat island conditions and extensive commercial and residential infrastructure requiring energy-efficient roofing upgrades. Tokyo’s strict sustainability programs, frequent building renovations, and high adoption of green construction materials drive consistent demand for reflective coatings.

The Kansai/Kinki Region shows steady demand supported by large metropolitan centers, such as Osaka and Kyoto, where rising temperatures and high cooling loads encourage adoption of heat-reflective solutions. The region’s strong manufacturing base and industrial facilities provide substantial opportunities for coating applications.

The Central/Chubu Region benefits from its strong automotive and industrial sectors, where large factory roofs require efficient thermal management. Increasing awareness about heat mitigation, combined with government-supported sustainability initiatives, is driving adoption across logistics warehouses and commercial structures. Urban centers like Nagoya experience growing renovation activities that boost the use of reflective coatings. Expanding distribution networks and contractor availability further support regional market expansion.

The Kyushu-Okinawa Region sees rising demand due to its hot, humid climate and prolonged summer heat, making reflective coatings essential for reducing indoor cooling requirements. Tourism-driven construction activities, including hotels and commercial establishments, contribute significantly to adoption. Local government programs promoting energy-efficient building materials enhance market penetration.

The Tohoku Region shows moderate demand, driven by increasing interest in reducing cooling loads during warmer months and improving building envelope performance. Public sector renovation projects and expanding awareness of energy savings support gradual market growth. Urban areas and industrial facilities increasingly adopt reflective coatings to meet sustainability goals and reduce electricity consumption in summer.

The Chugoku Region experiences steady uptake supported by industrial facilities and expanding commercial infrastructure. Rising temperatures in urban centers encourage the use of coatings to minimize heat absorption. Public building upgrades and regional energy-efficiency initiatives support market activity.

In the Hokkaido Region, interest is growing during warmer months as heatwaves become more frequent. Public buildings, warehouses, and selected commercial properties adopt reflective coatings to improve thermal comfort and reduce seasonal energy consumption. Government-led climate resilience programs and increasing focus on sustainable construction gradually support uptake.

The Shikoku Region exhibits niche but growing demand, driven by rising temperatures and increasing awareness about heat mitigation benefits among residential and commercial users. Smaller urban centers and local industries adopt reflective coatings to improve energy efficiency and prolong roof lifespan. Strengthening distribution channels and government promotion of sustainable materials further support market development across the region.

Market Dynamics:

Growth Drivers:

Why is the Japan Heat Reflective Roof Coatings Market Growing?

Rising Heat and Energy Efficiency Awareness

Increasing temperature and the intensifying heat island effect in major Japanese cities are key drivers of the market expansion. In August 2025, Japan recorded two new heat highs in a single day, with temperatures reaching 41.6 degrees Celsius (106.8 degrees Fahrenheit) and rising to 41.8C (107.2F), as reported by the nation's Meteorological Agency. High rooftop temperatures elevate indoor cooling demands, especially in dense metropolitan areas like Tokyo and Osaka, resulting in higher energy costs. Property owners, developers, and municipalities are increasingly seeking solutions to mitigate these effects. Heat reflective roof coatings reduce solar heat absorption, improving indoor comfort and lowering electricity consumption. Growing awareness about energy efficiency among building owners and residents, combined with national energy-saving policies, further fuels adoption. Both residential and commercial buildings are incorporating these coatings during new construction or renovation projects. As climate patterns shift, prolonged summer heat and frequent heatwaves enhance the perceived value of reflective coatings, encouraging widespread market penetration.

Government Regulations and Sustainability Initiatives

Government regulations and sustainability programs in Japan are significantly driving the adoption of heat reflective roof coatings. Stricter energy-efficiency standards, green building certifications, and tax incentives for eco-friendly construction encourage developers and homeowners to invest in reflective coatings. Municipal-level sustainability initiatives promote the installation of energy-saving materials, directly supporting the market growth. Regulatory emphasis on reducing electricity consumption and mitigating urban heat encourages property owners to select high-performance reflective coatings. These policies also incentivize the adoption of coatings integrated with energy-efficient technologies, such as solar-reflective pigments or insulating layers. Public sector projects, including schools, hospitals, and municipal buildings, frequently adopt these solutions to comply with guidelines. This policy-driven market support provides both financial and reputational benefits, ensuring a steady expansion of the heat reflective roof coatings sector. Over time, compliance-driven adoption continues to strengthen regional and national market penetration.

Urban Redevelopment and Infrastructure Expansion

Japan’s rapid urban redevelopment and growing infrastructure investment, including the Tokyo Outer Ring Road (Gaikan Expressway) expansion in 2024, are fueling the demand for heat reflective roof coatings. Large-scale renovation projects in metropolitan areas require modern, energy-efficient building envelopes to comply with updated construction codes and sustainability targets. Commercial complexes, industrial facilities, and public infrastructure upgrades increasingly integrate reflective coatings to improve thermal performance and reduce cooling energy requirements. Redevelopment of older office buildings and residential apartments presents opportunities for retrofit applications. The growing number of logistics centers, transport hubs, and mixed-use developments further drives demand. Contractors prefer factory-finished, high-performance coatings that streamline installation while maintaining quality standards. The combination of urban expansion, aging infrastructure replacement, and a focus on sustainable construction ensures that heat reflective coatings remain a critical component of building modernization projects. This structural and urban development trend provides a consistent and long-term growth pathway for the market.

Market Restraints:

What Challenges the Japan Heat Reflective Roof Coatings Market is Facing?

High Initial Installation Costs

Premium-quality heat reflective coatings require significant upfront investments that may deter budget-conscious consumers and building owners despite long-term energy savings potential. Professional application requirements and specialized surface preparation add further costs, creating adoption barriers particularly for smaller residential projects where payback periods extend beyond typical homeowner planning horizons.

Seasonal Performance Variability

Japan's distinct four-season climate presents performance challenges as coatings optimized for summer heat reflection may demonstrate different characteristics during cold winter months when heat retention becomes desirable. This seasonal variability complicates product selection and may limit appeal in regions experiencing significant temperature fluctuations throughout the year.

Competition from Alternative Cooling Solutions

Heat reflective roof coatings face competition from alternative energy-saving technologies, including rooftop greening systems, solar panel installations, and advanced insulation materials. Building owners evaluating comprehensive energy efficiency strategies may prioritize competing solutions offering different benefit profiles, limiting market penetration in certain segments.

Competitive Landscape:

The Japan heat reflective roof coatings market features established domestic manufacturers competing alongside international specialty coating companies. Market leaders differentiate through continuous product innovations, expanding distribution networks, and strategic partnerships with construction contractors. Companies invest significantly in research and development (R&D) activities to create advanced formulations meeting evolving environmental regulations and performance requirements. Competitive positioning increasingly emphasizes eco-friendly credentials, technical support services, and comprehensive warranty offerings that build contractor and end-user confidence in product performance. The growing focus on smart coating technologies further strengthens competition, encouraging players to integrate enhanced thermal and durability features. As urban heat island concerns intensify, firms aligning products with sustainability goals gain a stronger competitive edge.

Japan Heat Reflective Roof Coatings Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Solvent-Based, Water-Based, Powder-Based |

| Resin Types Covered | Epoxy, Polyester, Silicon, Acrylic |

| Applications Covered | Residential Building, Commercial Building, Infrastructure, Automotive, Industrial |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan heat reflective roof coatings market size was valued at USD 253.45 Million in 2025.

The Japan heat reflective roof coatings market is expected to grow at a compound annual growth rate of 5.59% from 2026-2034 to reach USD 413.39 Million by 2034.

Solvent-based dominated the market with a share of 52%, owing to superior adhesion properties, exceptional weather durability, and proven performance across industrial and commercial applications.

Key factors driving the Japan heat reflective roof coatings market include government subsidies for energy-efficient renovations, mandatory energy conservation standards, intensifying urban heat island effects, and rising consumer awareness regarding sustainable building solutions.

Major challenges include high initial installation costs deterring budget-conscious consumers, seasonal performance variability across Japan's distinct climate zones, competition from alternative cooling technologies, and limited consumer awareness in certain market segments regarding long-term cost-benefit advantages.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)