Japan Heat Transfer Fluids Market Size, Share, Trends and Forecast by Type, End User, and Region, 2026-2034

Japan Heat Transfer Fluids Market Summary:

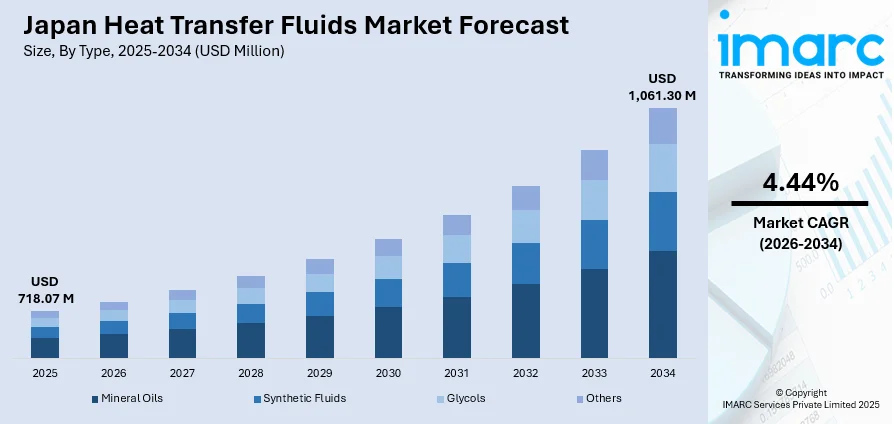

The Japan heat transfer fluids market size was valued at USD 718.07 Million in 2025 and is projected to reach USD 1,061.30 Million by 2034, growing at a compound annual growth rate of 4.44% from 2026-2034.

The Japan heat transfer fluids market is experiencing steady growth as industries adopt advanced thermal management solutions to enhance process efficiency and operational safety. Rising demand from chemical processing, HVAC systems, renewable energy projects, and automotive manufacturing supports wider product usage. Increasing focus on energy optimization, equipment longevity, and temperature stability is encouraging the shift toward high-performance synthetic and bio-based heat transfer fluids, strengthening market expansion across industrial and commercial applications.

Key Takeaways and Insights:

- By Type: Mineral oils dominate the market with a share of 41% in 2025, owing to their cost-effectiveness, established global supply chain, excellent compatibility with existing industrial equipment, and reliable thermal stability across diverse operating temperatures.

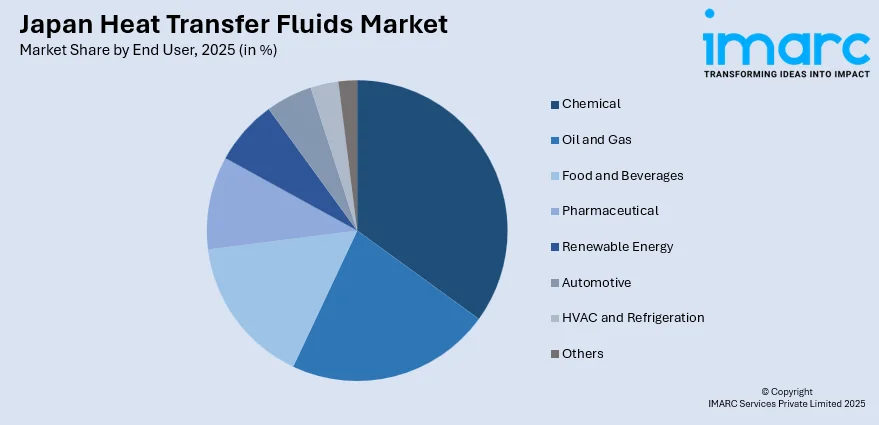

- By End User: Chemical leads the market with a share of 24% in 2025, driven by extensive requirements for precise temperature control in distillation, polymerization, and chemical synthesis processes across Japan's robust chemical and petrochemical industries.

- Key Players: The Japan heat transfer fluids market exhibits moderate competitive intensity, featuring established multinational chemical corporations alongside specialized regional manufacturers competing through product innovation, strategic partnerships, and expansion of production capacities to meet growing industrial demand across key application sectors.

To get more information on this market Request Sample

The Japan heat transfer fluids market is expanding steadily as industries focus on improving thermal efficiency, operational reliability, and energy performance. The Japan HVAC market size reached USD 20,914.41 Million in 2024 and is projected to reach USD 80,716.89 Million by 2033, which further strengthens demand for high-quality thermal management solutions. Adoption is rising across chemicals, HVAC, automotive, and renewable energy, supported by increasing use in concentrated solar power, electronics cooling, and advanced manufacturing. Companies are shifting toward high-performance fluids that offer improved stability, lower maintenance needs, and enhanced safety in high-temperature environments. The market is also benefiting from growing decarbonisation efforts, as heat transfer fluids enable efficient thermal control in heat pumps, district heating, and sustainable industrial systems. Additionally, evolving quality standards and a shift toward synthetic and bio-based formulations are influencing product innovation. Overall, the market is positioned for stable long-term growth driven by modernisation of industrial infrastructure and continuous innovation in thermal technologies.

Japan Heat Transfer Fluids Market Trends:

Energy Efficiency Focus

Growing emphasis on energy-efficient operations is accelerating the adoption of advanced heat transfer fluids in Japan, as industries prioritise improved thermal stability, lower energy consumption, and higher operational reliability. Manufacturers are increasingly upgrading legacy systems with modern formulations that maintain consistent performance under demanding temperature conditions, reduce maintenance needs, and support long-term cost optimisation. This trend is reshaping industrial thermal management strategies across multiple sectors. Moreover, Japan's commitment to sustainability and achieving carbon neutrality by 2050 is driving manufacturers to create environmentally friendly, high-performance fluids. Japan is advancing its energy sector sustainability by aiming for a 38% share of renewable energy by 2030 and achieving carbon neutrality by 2050. Initiatives include policies for green transition technologies and addressing challenges posed by climate change, highlighting the need for coordinated global efforts to tackle the crisis.

Industrial Manufacturing Growth

Increasing activity in chemical processing, pharmaceuticals, and electronics manufacturing is boosting the requirement for precision-driven heat transfer solutions. These industries depend on fluids that enable accurate temperature control, minimise contamination risks, and support continuous high-quality production. As Japan intensifies its focus on advanced manufacturing, companies are integrating superior fluid technologies to optimise operational stability, meet strict product quality standards, and enhance competitiveness across complex industrial environments.

Renewable Energy Expansion

The expanding renewable energy sector is strengthening demand for specialised heat transfer fluids that enhance heat retention and maintain stable output in thermal energy systems, supported by the fact that the Japan renewable energy market size reached 256.9 TWh in 2025 and is expected to reach 356.2 TWh by 2034. Concentrated solar power facilities and advanced heat storage projects are adopting high-performance formulations that withstand temperature variations, extend equipment life, and support efficient power generation. This trend aligns with Japan’s transition toward cleaner energy sources and growing investment in long-term sustainable infrastructure.

Market Outlook 2026-2034:

The Japan heat transfer fluids market is expected to witness steady growth as industries prioritize higher energy efficiency, better thermal stability, and improved operational reliability across heating and cooling systems. Expanding industrial manufacturing, coupled with rising adoption of renewable energy technologies, is creating sustained demand for advanced fluid formulations. Growing emphasis on process optimisation in sectors such as chemicals, electronics, and food processing continues to strengthen market prospects, supporting long-term usage of high-performance heat transfer solutions. The market generated a revenue of USD 718.07 Million in 2025 and is projected to reach a revenue of USD 1,061.30 Million by 2034, growing at a compound annual growth rate of 4.44% from 2026-2034.

Japan Heat Transfer Fluids Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Mineral Oils | 41% |

| End User | Chemical | 24% |

Type Insights:

- Mineral Oils

- Synthetic Fluids

- Glycols

- Others

The mineral oils dominate with a market share of 41% of the total Japan heat transfer fluids market in 2025.

Mineral oils hold the largest share of the Japan heat transfer fluids market due to their affordability, wide availability, and suitability for moderate temperature applications. Industries prefer these fluids for stable performance in general heating and cooling operations, making them a cost-effective choice for large-scale systems. Their compatibility with existing equipment and low maintenance needs further support sustained demand, especially in conventional industrial environments transitioning gradually toward more advanced formulations.

Mineral oils continue to be widely used in established industrial sectors that prioritise operational reliability and manageable operating costs. Their strong thermal stability in controlled temperature ranges makes them ideal for applications such as chemical processing, HVAC systems, and food-grade heating units. Although synthetic fluids are gaining traction, mineral oils remain essential where high-temperature performance is not a primary requirement, ensuring consistent adoption across diverse processing facilities.

End User Insights:

Access the Comprehensive Market Breakdown Request Sample

- Chemical

- Oil and Gas

- Food and Beverages

- Pharmaceutical

- Renewable Energy

- Automotive

- HVAC and Refrigeration

- Others

The chemical leads with a share of 24% of the total Japan heat transfer fluids market in 2025.

The chemical industry leads the Japan heat transfer fluids market as manufacturers require precise temperature control to maintain product quality and support complex processing operations. Heat transfer fluids are crucial for reaction stability, controlled heating and cooling cycles, and safe handling of sensitive materials. Their role in improving process efficiency and preventing thermal degradation strengthens their importance across both bulk and specialty chemical production units.

Growing investment in advanced chemical manufacturing is further increasing the need for high-performance heat transfer solutions. Facilities are adopting fluids that provide greater system efficiency, improved oxidation resistance, and longer service life to support continuous production. As processes become more automated and energy conscious, chemical plants are prioritising fluids that enhance operational reliability and minimise downtime, reinforcing the segment’s leading position in the market.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

Kanto Region continues to generate strong demand for heat transfer fluids, supported by its dense concentration of manufacturing units, advanced electronics facilities, and expanding HVAC installations. Growing adoption of energy-efficient technologies further contributes to consistent product utilisation across industrial and commercial applications.

Kansai/Kinki Region shows stable consumption driven by its diverse industrial base, including chemicals, machinery, and automotive production. Increasing investment in energy optimisation and modern thermal systems supports broader usage of heat transfer fluids across both established manufacturing clusters and emerging processing facilities.

Central/Chubu Region maintains steady demand as automotive, precision manufacturing, and machinery industries expand their production capabilities. Adoption of advanced thermal management solutions is rising across large-scale factories and component suppliers that require efficient heating and cooling to support continuous and high-precision operations.

Kyushu-Okinawa Region records growing utilisation of heat transfer fluids due to its expanding manufacturing presence, renewable energy activities, and industrial infrastructure upgrades. Increased focus on efficient thermal systems in chemicals, electronics, and power applications supports broader adoption across various processing facilities.

Tohoku Region demonstrates consistent demand as food processing, electronics, and renewable energy developments expand across the area. Modernisation of industrial plants and adoption of energy-efficient technologies continue to support a gradual rise in heat transfer fluid consumption.

Chugoku Region supports steady market activity driven by chemicals, heavy industries, and equipment manufacturing. Rising focus on improving operational efficiency and adopting advanced thermal systems is encouraging greater usage of heat transfer fluids across production environments.

Hokkaido Region shows growing demand as energy projects, food manufacturing activities, and cold climate industries require effective heat management solutions. Expansion of district heating systems and industrial upgrades further supports increased utilisation of heat transfer fluids.

Shikoku Region maintains moderate but stable demand, driven by chemicals, paper manufacturing, and small to mid-scale industrial operations. Ongoing improvements in processing efficiency and temperature control systems contribute to consistent use of heat transfer fluids across essential industries.

Market Dynamics:

Growth Drivers:

Why is the Japan Heat Transfer Fluids Market Growing?

Expansion of District Heating and Cooling Networks

Japan is witnessing steady growth in urban heating and cooling infrastructure, which is driving higher consumption of durable heat transfer fluids capable of supporting efficient thermal circulation. Utilities are adopting fluids that minimise heat losses, improve system responsiveness, and enhance long term energy savings. This trend is supported by government emphasis on sustainable urban development, encouraging operators to deploy advanced formulations that offer better stability, low viscosity, and extended operational lifespans for reliable year-round performance. In May 2025, JR East and Tokyu Fudosan Holdings launched the JR Funabashi Ichiba-cho Development Project, transforming a 45,400 square meter former housing site in Funabashi City. The plan includes over 1,000 residential units and commercial facilities, emphasizing sustainability through renewable energy, community spaces, and enhanced urban green areas, with construction set for 2025-2028.

Rising Demand for Advanced Temperature Control Solutions

Growing reliance on precision manufacturing is increasing the need for highly efficient heat transfer fluids that maintain stable thermal conditions across complex processes. Industries such as electronics, specialty chemicals, and automotive are prioritising fluids that provide consistent performance, protect sensitive components, and enable tighter process control. As production lines become more automated and sensitive to temperature variation, demand for high-purity, thermally stable, and contamination-resistant fluids continues to strengthen across Japan.

Strong Investments in Industrial Automation and Modernisation

The continued push toward smart manufacturing is boosting the adoption of synthetic and glycol-based heat transfer fluids designed to function reliably in high-load and continuous duty environments. The Japan industrial automation components market size reached USD 13.70 Billion in 2024 and is projected to reach USD 28.90 Billion by 2033, reinforcing demand for high-performance thermal solutions. As industries modernise production setups, they require fluids with superior oxidation resistance, minimal degradation, and lower maintenance needs, enabling extended service intervals, reduced downtime, and improved system efficiency in technologically advanced facilities.

Market Restraints:

What Challenges the Japan Heat Transfer Fluids Market is Facing?

High Initial System Upgrade Costs

High initial investment requirements remain a major restraint, as industries face substantial expenses for upgrading thermal systems, integrating advanced heat transfer technologies, and ensuring compatibility with existing infrastructure. These costs are particularly challenging for small and mid-sized enterprises, limiting their ability to adopt high-performance fluids. The financial burden of installation, system redesign, and specialised workforce training slows market penetration and delays modernization efforts across multiple industrial segments.

Regulatory and Compliance Complexities

Evolving regulatory standards related to chemical handling, workplace safety, and environmental compliance create persistent barriers for manufacturers using heat transfer fluids. Frequent updates in documentation, quality auditing, and system validation processes increase operational workload and extend project timelines. Companies must regularly reformulate or adjust processes to align with changing requirements, which raises cost pressures. These complexities restrict rapid adoption, especially in tightly regulated industries such as pharmaceuticals, power generation, and food processing.

Supply Chain and Raw Material Vulnerabilities

Supply chain challenges continue to affect market stability, driven by fluctuations in raw material availability, extended lead times, and reliance on specialised global suppliers. Variability in procurement, coupled with transportation inefficiencies, disrupts production planning and increases cost volatility for end users. Inconsistent supply also impacts quality assurance and inventory reliability, forcing companies to maintain buffer stocks. These uncertainties hinder steady market growth and create operational risks for industries with continuous and high-temperature processes.

Competitive Landscape:

The Japan heat transfer fluids market features a competitive environment shaped by continuous product innovation, performance differentiation, and strong focus on industrial efficiency. Companies compete by enhancing thermal stability, safety profiles, and fluid lifespan to meet the needs of electronics, chemicals, automotive, and renewable energy applications. The market is also influenced by rising customer preference for high-purity formulations and environmentally safer alternatives, prompting players to expand R&D capabilities and upgrade manufacturing processes. Strategic partnerships with end-use industries further support product customisation and strengthen long-term market positioning across Japan.

Japan Heat Transfer Fluids Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Mineral Oils, Synthetic Fluids, Glycols, Others |

| End Users Covered | Chemical, Oil and Gas, Food and Beverages, Pharmaceutical, Renewable Energy, Automotive, HVAC and Refrigeration, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan heat transfer fluids market size was valued at USD 718.07 Million in 2025.

The Japan heat transfer fluids market is expected to grow at a compound annual growth rate of 4.44% from 2026-2034 to reach USD 1,061.30 Million by 2034.

Mineral oils held the largest share in the Japan heat transfer fluids market, supported by their cost-effectiveness, wide industrial applicability, and stable performance across moderate temperature ranges, making them a preferred choice for several manufacturing and processing operations.

Key factors driving the Japan heat transfer fluids market include rising demand for energy-efficient thermal systems, growing industrial modernization, increased adoption in HVAC, chemicals, and renewable energy, and stronger preference for high-performance formulations that enhance operational reliability.

Major challenges include stringent regulatory requirements for fluid composition, concerns around thermal degradation at high temperatures, higher costs of advanced synthetic formulations, and increasing pressure for sustainable and low-emission alternatives across industrial thermal management applications.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)