Japan Helicopter Services Market Size, Share, Trends and Forecast by Type, Application, End User, and Region, 2026-2034

Japan Helicopter Services Market Overview:

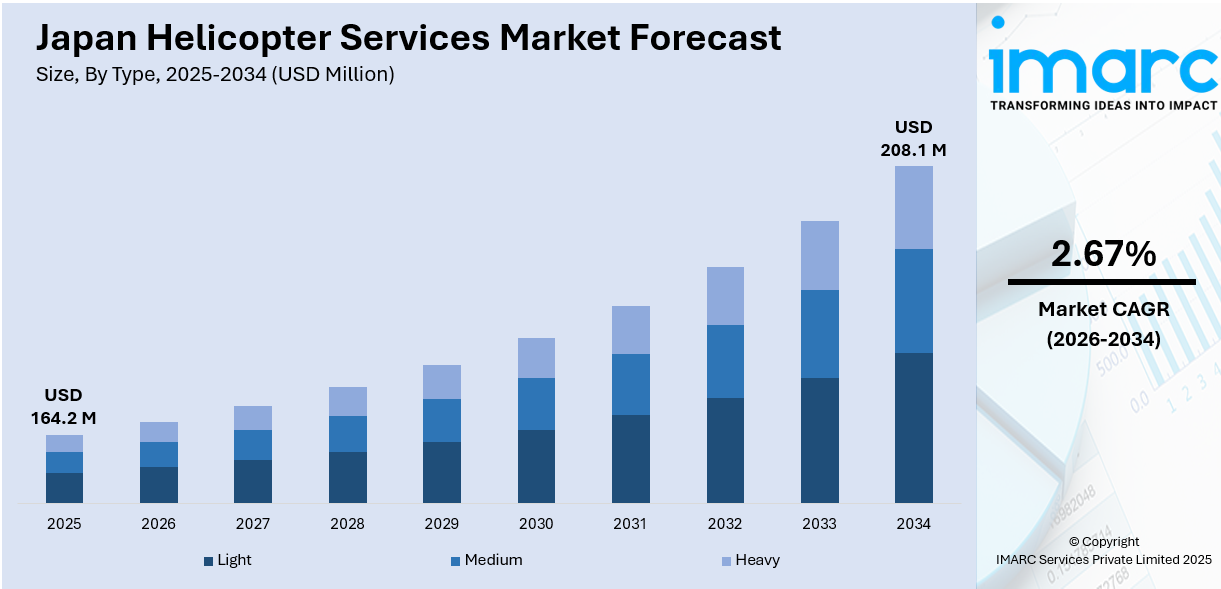

The Japan helicopter services market size reached USD 164.2 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 208.1 Million by 2034, exhibiting a growth rate (CAGR) of 2.67% during 2026-2034. The rising demand for urban air mobility (UAM) in the country is impelling the market growth. Apart from this, changes in the tourism sector are increasing, as tourists are choosing extraordinary aerial tours. Moreover, ongoing advancements in helicopter technology are playing a crucial role in expanding the Japan helicopter services market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 164.2 Million |

| Market Forecast in 2034 | USD 208.1 Million |

| Market Growth Rate 2026-2034 | 2.67% |

Japan Helicopter Services Market Trends:

Growing Need for Urban Air Mobility (UAM)

Japan helicopter services sector is growing with the rising demand for urban air mobility (UAM). Urban centers are developing very fast, and helicopter services are being considered a workable solution to manage traffic and the increasing need for quick modes of transportation. The Japanese government and private sector are making every effort to create infrastructure support for air taxis and other airborne services. Japan is also heavily investing in technology advancements, including electric vertical takeoff and landing (eVTOL) aircraft, which are driving the growth of urban air mobility. With increasingly booming populations in major cities like Tokyo and Osaka, the need for helicopters to offer fast, on-demand transportation is increasing, thus remaining a major driver of the market. This transition to UAM is generating a boom in helicopter demand in Japan, especially for short-distance flights and cargo transportation. In 2025, ANA Holdings (ANA HD) and Joby Aviation, Inc., a firm working on electric air taxis for commercial passenger transport, today revealed a major enhancement of their partnership to introduce electric air taxi service in Japan. Under revised agreements, the two firms aim to create a joint venture and intend to introduce over 100 Joby aircraft within a new air taxi framework throughout Japan. Beginning in Tokyo, ANA HD and Joby aim to implement a staged rollout over the next few years. Joby’s electric vertical takeoff and landing (eVTOL) aircraft rises like a helicopter and then shifts to forward flight like a plane, producing minimal noise and zero operating emissions. These features render it perfect for use in crowded city environments.

To get more information on this market Request Sample

Changes in Tourism Industry

The sector is reaping the rewards of the increasing tourism sector, as tourists are choosing extraordinary aerial tours. Helicopter flights are fast turning into a highly sought-after means of experiencing the scenic vistas of the country, especially in the tourist areas, such as Hokkaido and the Japanese Alps. Tourism is also being encouraged by the government, targeting foreign tourists, thereby supporting the Japan helicopter services market growth. Helicopter facilities are being incorporated into high-end travel packages, and tourists can now see the serenity of Japan from up above. Helicopters are also facilitating better access to difficult-to-reach places, which remain inaccessible by other conventional modes of transport. Increased demand for sightseeing helicopter tours, along with the rise in adventure tourism, is driving the market. Moreover, the growth in luxury tourism is stimulating higher demand for helicopter services as components of upscale travel packages, further fueling market expansion. IMARC Group predicts that the Japan luxury travel market is expected to attain USD 84.6 Million by 2033.

Technology Advances in Helicopters

The ongoing advancements in helicopter technology are playing a crucial role in driving the market in Japan. Helicopter manufacturers are continuously working on developing more efficient, quieter, and safer helicopters, which is increasing the appeal of helicopter services. New designs focus on refining fuel efficiency, lowering environmental impact, and improving overall performance, making helicopter travel more cost-effective and sustainable. Interest in the development of hybrid and electric aircraft is increasing in Japan, with research institutions and companies working together to commercialize these technologies. These advancements are not just lowering operating expenses but are also making helicopter services safer and more reliable. Consequently, private individuals and corporations alike are more inclined to invest in helicopter transport. The use of such technologies is widening the applications of helicopters, from passenger transport to cargo services, thus increasing the general market in Japan. Moreover, the use of helicopters in public and government sectors in Japan is accelerating. For instance, in 2025, the Tokyo Fire Department in Japan granted Airbus Helicopters a contract for an Airbus H225 after a bidding process. This new helicopter will take the place of an older aircraft in the organization's fleet upgrade plan. This purchase strengthens the agency’s dedication to sustaining high operational readiness for essential missions such as aerial firefighting, search and rescue, emergency medical services, and disaster response.

Japan Helicopter Services Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type, application, and end user.

Type Insights:

- Light

- Medium

- Heavy

The report has provided a detailed breakup and analysis of the market based on the type. This includes light, medium, and heavy.

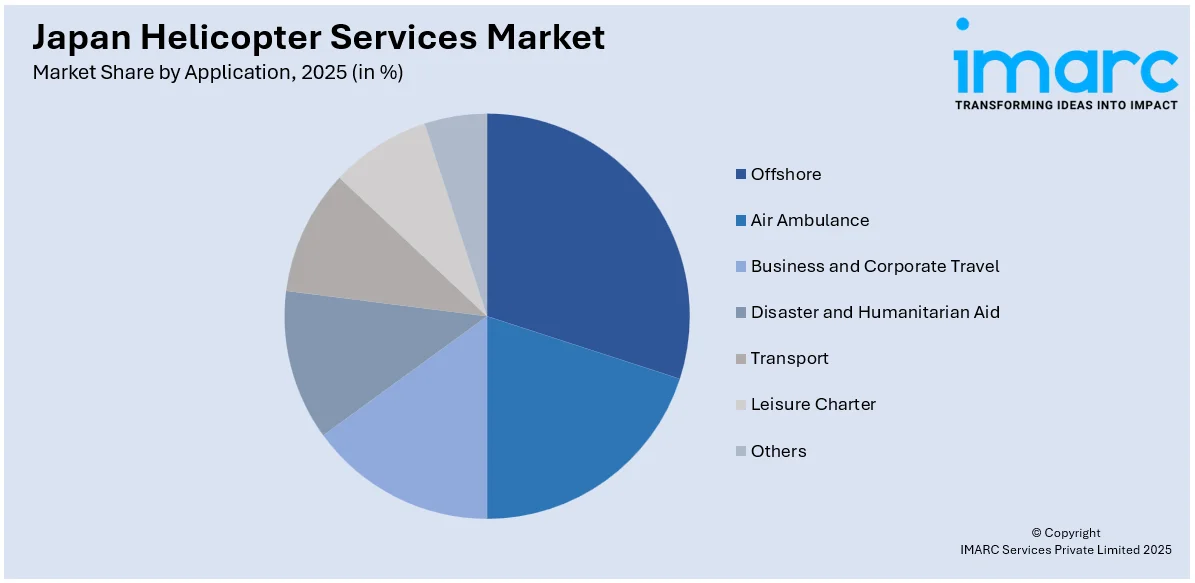

Application Insights:

Access the comprehensive market breakdown Request Sample

- Offshore

- Air Ambulance

- Business and Corporate Travel

- Disaster and Humanitarian Aid

- Transport

- Leisure Charter

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes offshore, air ambulance, business and corporate travel, disaster and humanitarian aid, transport, leisure charter, and others.

End User Insights:

- Civil

- Commercial

- Military

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes civil, commercial, and military.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Helicopter Services Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Light, Medium, Heavy |

| Applications Covered | Offshore, Air Ambulance, Business and Corporate Travel, Disaster and Humanitarian Aid, Transport, Leisure Charter, Others |

| End Users Covered | Civil, Commercial, Military |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan helicopter services market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan helicopter services market on the basis of type?

- What is the breakup of the Japan helicopter services market on the basis of application?

- What is the breakup of the Japan helicopter services market on the basis of end user?

- What is the breakup of the Japan helicopter services market on the basis of region?

- What are the various stages in the value chain of the Japan helicopter services market?

- What are the key driving factors and challenges in the Japan helicopter services market?

- What is the structure of the Japan helicopter services market and who are the key players?

- What is the degree of competition in the Japan helicopter services market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan helicopter services market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan helicopter services market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan helicopter services industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)